Crypto has shed a lot of weight over the last few months, and it is down to an $836.21B economy now. The Luna crash and the FTX bankruptcy aggravated the situation, draining investor confidence in crypto assets.

Is crypto dead?

In this article, we discuss the top reasons why the crypto price is falling. We analyze the factors that have contributed to the slowdown and whether the crypto market will recover any time soon. It is followed by some good bear market strategies and a list of assets that can perform well in the coming months. Let’s dive in.

Is Crypto Dead? An Overview

2021 was an incredible year for the crypto industry. The newfound interest in crypto that began with the pandemic gained pace last year, boosting the value of the market. Toward the last leg of 2021, leading cryptocurrencies hit their all-time highs to investors’ delight. A $100,000 BTC didn’t seem like a long shot then.

How things have changed in the last few months! The long-drawn-out crypto winter of 2022 began in late 2021 as most of the market underwent small downturns. Investors were not worried about the condition. This was nothing new in the market. It has seen many downturns over the years and has always got back on its feet with new vigor.

However, it was different this time. The market has slid down the charts over the months, leaving both the community and outsiders wondering if a recovery is possible. To give you a better perspective, BTC is 75.8% down from its all-time high of $68,789.63 scaled on 10 Nov 2021.

Five key factors have contributed to the bear market sentiments in 2022:

- Luna collapse: UST (TerraUSD) lost its peg in May 2022, sending the market into a frenzy. Investors were in a rush to cash out their crypto in the coming days and the global market cap plummeted, as a result. Even high-cap stable coins like USDT were not spared from the downturn.

- FTX fall: The FTX downfall is another tragedy that struck the market this year. In Nov 2022, FTX filed for bankruptcy, and CEO Sam Bankman-Fried resigned. The collapse of one of the world’s largest cryptocurrency exchanges tossed most of the market into a sea of red.

- Scams, hacks, and Ponzi schemes: The industry is in no dearth of scams and hacks this year, either. The money stolen in exploits is surging. Unless both service providers and users take initiative to improve cybersecurity, the industry will continue to lose investor support.

- Threats of regulation: Conflicting policies on cryptocurrencies hinder growth and innovation in the industry. The lack of clarity on regulations leaves exchanges and crypto financial service providers in a complicated situation. Additionally, it prevents users from investing their money in the market.

- Global macroeconomics: Persistent inflation, threats of a global recession, and the energy crisis caused by the Russia-Ukraine war have limited the flow of funds to the crypto market. With little savings in hand, investors choose to invest money in less volatile assets.

The persistent downturn suggests that the market is undergoing a series of price corrections. Unless projects shift their focus from hype to utility, recovery is not in sight for the market. To put it in other words, the market is on the path to a more mature phase where value-driven projects come to the forefront. Although the bumpy ride may continue for some time, it seems to be for the best.

Five Reasons Why Crypto Prices Have Fallen – A Closer Look

1. The Luna collapse

The Luna collapse will mark a major milestone in crypto history. It pushed the industry on a downward trajectory that continues. The crash wiped out around $60 billion from the market, much to the shock of the community.

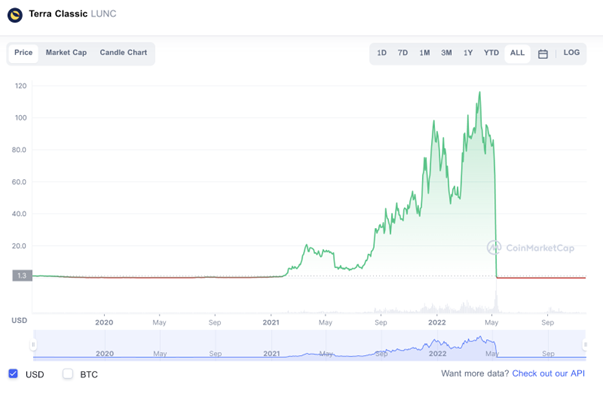

UST (TerraUSD) is an algorithmic stablecoin that is backed by its sister token, Luna. Unlike USDT or USDC stablecoins, UST is not backed by traditional assets in reserve. Luna, now LUNC, was the native token of the Terra blockchain. It was used to make payments in the network, maintain Terra’s stablecoin peg, validate network transactions, and participate in the platform’s governance.

LUNC all-time price history, 24 Nov 2022, CoinMarketCap

One of the biggest benefits of holding UST was that you could stake the stablecoin on Anchor Protocol, a decentralized money market built on the Terra blockchain. It promised an impressive 20% returns to users. Of course, the community piled in. But the returns were unsustainable, as one would assume. If it is too good to be true, it probably is. Many industry experts were worried about the source of the returns.

UST worth around $2B was unstaked from Anchor Protocol on 7 May 2022 and a large share of it was liquidated soon after. Lack of transparency in fund transfers sent both Luna and UST spiraling down in early May 2022. As the stablecoin started to depeg, the market went into a frenzy, taking most cryptocurrencies with it.

Stablecoins have long been considered safe havens in the crypto space. Regardless of where the market is heading, they help users store value and use crypto as a means of transaction. The high volatility prevents most cryptos from facilitating the seemingly simple use case. Most importantly, stablecoins made it easy to send payments across countries without going through a lot of hassle.

UST collapse changed the perspective, however. Stablecoins like USDT, which are meant to maintain a fixed value of around one dollar, had their credibility challenged. They struggled to make ends meet in the coming weeks, deteriorating investor confidence.

The crash took a toll on the entire cryptocurrency market, which was already on a slowdown. Many crypto projects came to a halt as their reserves were wiped out overnight. High-cap cryptocurrencies like BTC and ETH took the brunt, rapidly losing value.

2. The FTX bankruptcy

The fall of FTX is another tragedy that befell the industry this year. A report that throws light on the potential leverage and solvency concerns involving trading firm Alameda Research catalyzed the meltdown.

FTX was one of the world’s leading cryptocurrency exchanges. Helmed by Sam Bankman-Fried, the project gained a strong foothold in the industry in a short time. It is also known for its initiatives towards bringing crypto-friendly regulations in the US. According to the report, Alameda Research, a quantitative trading firm co-founded by Bankman-Fried, held a significant amount of FTT.

FTT is the native token of the FTX exchange. The report revealed that Alameda’s investment foundation was in FTT, instead of fiat currencies or other cryptocurrencies. As the word got around, all companies linked to Bankman-Fried were under suspicion.

FTT 1-month price history, 24 Nov 2022, source: CoinMarketCap

Although Bankman-Fried assured investors that the assets were stable and safe, he failed to win their confidence. He turned to venture capitalists for support to meet the fast-growing withdrawals, but FTT collapsed by 80% in two days. Although Binance announced plans to buy FTX (non-US), it later went back on the deal. The company filed for Chapter 11 bankruptcy protection on 11 Nov. 2022, after failing to meet user expectations. Bankman-Fried resigned from his position as the CEO of FTX on the same day.

The meltdown that began in early November has crippled all hopes of a late-year bull run. In the days that followed the collapse, the crypto market shrunk, losing billions and going below the $1 Trillion mark. The global crypto market stands at a feeble $836.21B at the time of writing. According to Binance CEO Changpeng “CZ” Zhao, the incident has set the industry back by a few years. Many experts believe that the aftermath could extend well into the future.

3. Global macroeconomics

Global economic trends tend to take a toll on the crypto industry from time to time. This year is no different. The persistent inflation, looming threats of a recession, and energy crisis caused by the Russia-Ukraine war are affecting the crypto market as well. They have exacerbated the post-pandemic wounds in the world’s largest economies, including the US, China, and the euro area.

Many central banks resorted to printing money to stimulate the economy in the aftermath of the pandemic. It has come to bite them back in 2022. The stimulative measures that went overboard have caused inflation across the world. For example, the latest UK inflation figures reveal that prices have surged 11.1% in the year to October, induced by rising fuel, energy, and food costs. It is the worst inflation to hit the country in 41 years.

According to a recent article on IMF.org, “the 2023 slowdown will be broad-based, with countries accounting for about one-third of the global economy poised to contract this year or next”. Tightening monetary and financial conditions will hinder the growth of the US economy, bringing it down to 1 percent next year. China, on the other hand, will be down to 4.4 percent. The declining property sector and continued lockdowns have injured the economy. The euro area will take the brunt of the slowdown, wounded by the war. As a result, the growth projection is down to 0.5 percent for the economy.

The case is similar in many developed and developing nations. Savings shrink as a result of the rising costs of food, housing, energy, and utilities. Investors have little money to channel to investments. Even if they do, crypto assets barely make the cut due to their highly volatile behavior this year.

4. Hacks and scams

Exploits continue to distress the crypto market, from hacks to scams and Ponzi schemes. A significant share of liquidations is triggered by these unfortunate events that alarm investors. They have also been one of the reasons why the crypto price is falling in 2022.

Most exploiters target DeFi platforms, which are known for their lack of regulations and clear policies. Even if the underlying protocol is not ill-intended, hackers find an easy way into them, extracting millions of dollars. A great way to tackle this is regular auditing. However, blockchain security companies are unable to meet the growing demands of the industry. Many platforms also manipulate audit reports to win investor confidence.

Centralized exchanges have learned the importance of security measures the hard way in the last years. To improve resiliency to crypto hacks, they usually implement strong security policies. However, that doesn’t guarantee the safety of investor funds, as proven by the FTX debacle. The misappropriation of funds by the management can come at a heavy cost for users. So, it is best advised to split crypto assets among self-custodial cold and hot wallets. A major share should go to cold wallets, as they’re disconnected from the internet.

While hacks and scams are a cause of concern, they can be mitigated to a great extent by due diligence from platforms and investors.

5. Looming threats of regulation

The crypto industry and regulators have rarely got along. As expected, it will take some time for regulators to understand the industry and what it has to offer. Crypto’s narrative of an alternative financial system has not impressed them yet. Both see the other as a threat.

Crypto platforms and users are concerned about the lack of initiatives to study the industry and its potential. Regulators, who see cryptocurrencies as a means to get away from the eyes of the law, have made little initiative to change the picture. While most countries are beginning to welcome cryptocurrencies into the economy, the growing number of ambiguous policies are hindering the growth of the industry.

The lack of clarity regarding the classification of crypto policies and what constitutes a legal payment system persists without proper policies. Mainstream adoption of cryptocurrencies and blockchain platforms remains a distant dream until unified international regulations are put into place.

Catastrophes like the FTX fall, LUNA collapse, and multiple hacks and scams prompt regulators to rethink their pro-crypto stance. It could lead to the implementation of more stringent policies in the coming months. Whether that will help or hinder the industry remains to be seen.

Will Crypto Recover – What Experts Say

While many industry experts have voiced their concern over the drawn-out crypto winter and the recent FTX fall, most believe that there is hope for recovery. For example, blockchain analysis firm Chainalysis noted in a recent Twitter thread that “this is not the first time crypto has faced significant turmoil related to the collapse of an exchange”.

After the Mt.Gox meltdown, the volume of on-chain transactions stagnated for roughly a year before picking up pace. Soon, it was more than double the previous level. There is no debate whether the crypto industry will recover or not. The only question is, when and how.

If the market streams funds to utility-rich cryptocurrencies backed by market-relevant projects, it wouldn’t take long. The ongoing crypto winter can be interpreted as a series of much-needed price corrections. Overvalued projects that solely rely on hype and rumors only tarnish the reputation of the industry.

Another exciting development catalyzed by the FTX fall would be regulations. Binance CEO CZ looked at the positive side of things, speaking at Indonesia Fintech Summit 2022: “I think basically we’ve been set back a few years now. Regulators rightfully will scrutinize this industry much, much harder, which is probably a good thing, to be honest”.

According to Ethereum founder Vitalik Buterin, the FTX collapse goes on to prove once again that the problem lies in people, not technology. He also reminded the community about the importance of decentralization.

Is Crypto Dead – Our Verdict

2022 has been unkind to the crypto industry. The fall of Luna, FTX, a series of exploits, global economic downturns, and lack of clarity about regulations have sent most cryptocurrencies into a downward spiral. That’s not something the industry can’t survive, however. History may rarely repeat, but it often rhymes.

With more stringent regulations in place and more caution from investors and platforms, the market will get back on its feet in the coming months. The cascade of price dumps is taking the market into a mature phase where utility takes precedence over hype.

How to Beat the Bear Market?

1. Buy the dips

The bear market is also an opportunity to stock up on assets at a cheap price. Make sure you analyze the underlying project in detail to find out the asset’s intrinsic value before hoarding it. Some cryptocurrencies may be going through a long-due price correction, while others are just following the larger market trends. The latter has a larger potential to bounce back.

2. Invest in utility-rich NFTs

NFTs are not immune to broader market downturns. But they have more inventive use cases than most cryptocurrencies in circulation today. They are used in gaming, fashion, sports, and climate action for better transparency.

For example, Silks Thoroughbred Racehorses are unique digital collectibles that represent real-world thoroughbred racehorses on the blockchain. Every time the real-world racehorse wins a race or breeds offspring, the underlying NFT accrues rewards for the holder. The derivative reward system makes them one of the best NFT collections this year. Make sure you hold a Silks Genesis Avatar that hasn’t used its 2022 Mint Pass to participate in the 2022 Silks Genesis Yearlings Sale.

Tamadoge Pet NFTs are also a good NFT investment this year, with the Tamadoge play-to-earn arcade ready to go live soon.

3. Invest in presales

Presales offer the cheapest way into promising long-term crypto projects. Ever wondered how much you could have earned had you bought ETH and BTC in their early stages? Listed below are two projects that are likely to explode in the coming months if the roadmaps unfold as planned.

- Dash 2 Trade (D2T)

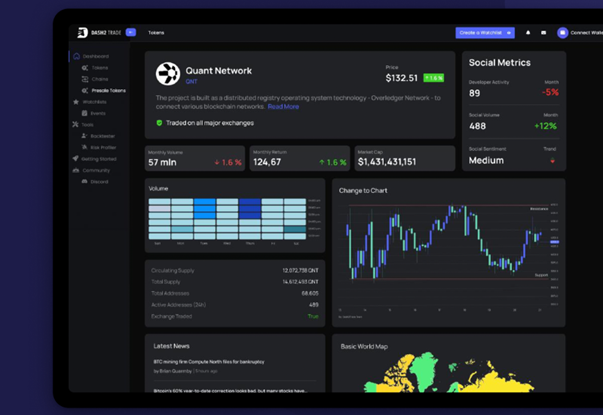

Dash 2 Trade is a crypto analytics and intelligence platform that has been drawing a lot of traction recently. The curated dashboard gives advanced crypto trading signals, predictions, and social analysis for focused decision-making. It helps users hone their portfolio using relevant data points that can improve their profitability.

Dash 2 Trade dashboard

The dashboard also features a custom-made scoring system for presales and ICOs, independent technical indicators, auto trading API, risk profiler, presale listing alerts, on-chain analytics, and social trading. D2T has the potential to climb 10X-15X by the first half of 2023. It is one of the best futuristic cryptocurrencies to invest in this year.

Buy Dash 2 Trade

- Calvaria (RIA)

Touted as the next Gods Unchained and Splinterlands, Calvaria is a battle card NFT game centered around the afterlife. The theme, which has rarely been explored in gaming or the popular media, has got the community hooked. The storyline, as detailed in the white paper, seems to justify its rich creative possibilities.

Another feature that caters to Calvaria’s fast-growing community is its lower entry barriers. The game is available in both free-to-play and play-to-earn modes. It is expected to go a long way in bringing traditional gamers aboard and sustaining engagement on the platform.

As one of the most-awaited games of 2023, Calvaria holds good growth potential. It is likely to book anywhere from 5X-10X returns for investors early next year.

Buy Calvaria

FAQ

- Is crypto dead?

No, crypto is not dead. It has been undergoing a series of price corrections since late 2021. Industry leaders and financial analysts believe that it takes the market to a more mature phase.

- Why is the crypto price falling?

Some key reasons for the crypto price dips are the recent FTX fall, LUNA collapse, global recession, market exploits, and regulatory threats.

- Will crypto recover? If yes, when?

The crypto market will recover in the coming months. A shift of focus from hype to utility, stringent security measures, and positive regulations will help the market get back on its feet.

- Should I buy cryptocurrencies now?

There is no reason to not invest in cryptocurrencies as long as you have done independent research about the underlying projects. When buying, look for credible undervalued assets, utility-rich NFTs, and promising presale tokens.