Decentralised exchange (DEX) platforms are becoming increasingly popular among crypto investors. Their attractiveness stems from the availability of users’ anonymity and the speed of executing trades. Besides this, a number of DEX platforms offer their own native tokens which power operations in their respective ecosystems. With a growing shift to decentralised financial solutions, more investors are keen on adding the best DEX coins to their portfolios for the near future.

This review examines the best DEX tokens and their performance in the market.

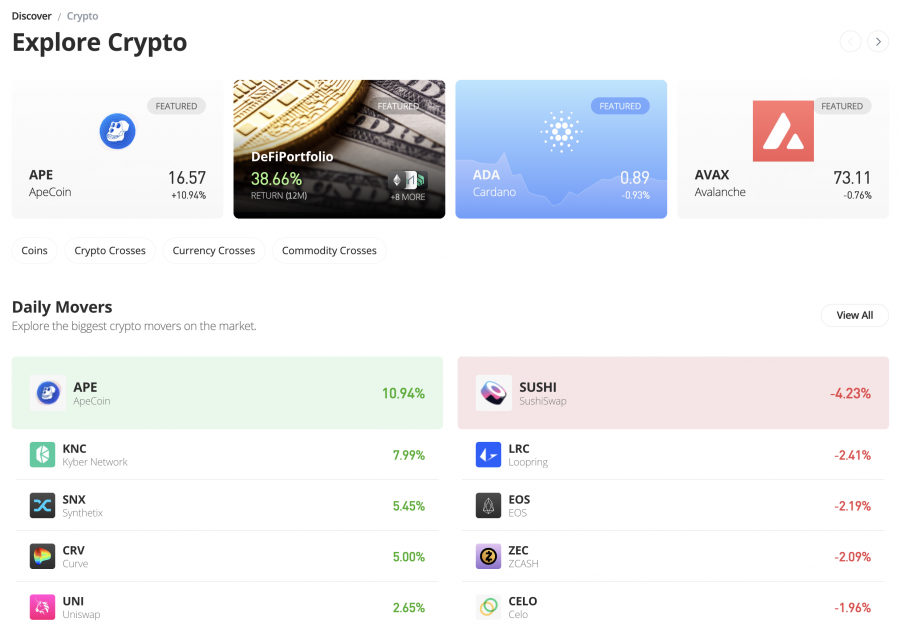

Best DEX Coins to Buy in 2022

This section assesses the best DEX coins that are making big moves in the market. We consider some new names along with some popular projects.

- DeFi Coin – Overall Best DEX Coin

- Lucky Block – New-Generation Gaming Platform with Huge Potential

- Yearn.finance – Top Yield Aggregator Platform

- UniSwap -Leading DEX Platform for Token Swaps

- SushiSwap – Promising DEX Crypto For Earning Passive Income

- PancakeSwap – Top DEX Crypto For BSC Network

- ThorChain – Top DEX Crypto For On-chain Liquidity

- Balancer – Non-custodial Portfolio Manager

- Cosmos – Best DEX Crypto For Blockchain Interoperability

- The Graph – Blockchain Indexing Protocol with DeFi Capability

A Closer Look at the Best DEX Tokens to Invest in

Our DEX coins list contains some of the most robust and promising projects operating in the new decentralised economy. However, before mapping a plan to invest in cryptocurrency, we recommend finding out their unique value propositions and how far they have come price-wise.

1. DeFi Coin – Overall Best DEX Coin to Buy in 2022

DeFi Coin takes the top spot on our best DEX coin list for a number of reasons. Launched in mid-2021, DeFi Coin is on a mission in bringing more people into the flourishing crypto market. As one of the best crypto IDOs it aims to do this by educating investors on the huge potential inherent in the DeFi space. Accordingly, the team behind the project are working on a number of crypto-related educational courses meant to onboard newbies into the new industry.

DeFi Coin takes the top spot on our best DEX coin list for a number of reasons. Launched in mid-2021, DeFi Coin is on a mission in bringing more people into the flourishing crypto market. As one of the best crypto IDOs it aims to do this by educating investors on the huge potential inherent in the DeFi space. Accordingly, the team behind the project are working on a number of crypto-related educational courses meant to onboard newbies into the new industry.

As per its current capacity, DeFi Coin is a community-driven fair launched project which operates under three core pillars of Reflection, liquidity provision (LP) Acquisition, and Manual Burn strategy.

These three fundamental guidelines are targeted at rewarding long-term holders of its native token, DEFC, and discouraging arbitrage traders who tend to impact the price performance of a protocol. To this end, all transactions are taxed 10% with the value generated split 50-50 to current DEFC owners and its liquidity pools, thus offering one of the best DeFi interest rates on the market.

DeFi Coin is also usable in providing liquidity to exchanges and allows investors to earn static rewards on their tokens. The DEFC is also set to play more roles in the protocol’s drive to incorporate digital collectables or non-fungible tokens (NFTs) in the near future. So time will tell if you’ll be able to buy NFTs with DEFC.

DeFi Coin also runs one of the best DeFi exchanges called DeFi Swap which allows users to swap, pool, and farm all ERC-20 tokens seamlessly and in an inexpensive manner. The DEX was recently launched in early May with the development causing the price performance of the DEFC token to spike by over 300% in a crypto bearish run.

In addition, the team are working on launching DeFi Swap V2 in the coming months with a DeFi Swap app in development. This app will come with earlier stated education content for users. Check out our Defi Coin price prediction to see how we view this coin’s future.

With so much to offer, the DeFi Coin team has pointed out that it is solely focused on delivering value and not lining investors’ pockets. This stance has seen the project’s Telegram channel surge in the last couple of weeks. If you are keen on adding this top DEX crypto to your portfolio, you can get started by following these quick steps:

- Visit the DeFi Swap Platform – Head over to the DeFi Swap trading interface to begin.

- Connect a Supported Wallet – Click on the ‘Connect Wallet’ icon and choose a supported crypto wallet of your choice.

- Buy BNB – Binance Coin is a principal player in the DeFi Swap ecosystem. You can easily buy some from Binance or other platforms and transfer it to your wallet.

- Buy DeFi Coin – Once BNB is in your wallet, select ‘BNB’ as the coin you want to swap and click on ‘DEFC’ as the one you want to swap to. Set your slippage ratio in the settings and click on ‘Swap’ to complete the process. Voila!

- You have DEFC now in your wallet, and you can earn passive income all year long.

2. Lucky Block – New-Generation Gaming Platform with Huge Potential

If you are seeking an alternative to the best DEX coins, we recommend Lucky Block. Also a Binance Smart Contract (BSC) network-based protocol, Lucky Block is a nascent and promising project.

If you are seeking an alternative to the best DEX coins, we recommend Lucky Block. Also a Binance Smart Contract (BSC) network-based protocol, Lucky Block is a nascent and promising project.

Lucky Block is on a mission to revolutionise the gaming industry by enabling a more transparent and fair framework which amplifies opportunities for users to earn.

Today, we consider it one of the best DeFi Coins available. The LBLOCK token powers the protocol’s operations and is used as a form of a ticket by users to engage in game draws. The platform’s unique reliance on the blockchain means every user can easily monitor the draws and payouts without the question of integrity coming into play.

Lucky Block has worked to increase the number of draws users can engage in, unlike the traditional system. To give back to its users, The platform recently launched free daily jackpot prize draws, allowing users to vote on the charities they want to support financially and get a part of the token rewards regardless of whether they win a draw.

To put things into perspective, LBLOCK has been one of the standout stars in the crypto space this year. Priced at $0.00015 at its presale stage, the digital token surged more than 4000% within a month to an all-time high (ATH) of $0.009617. This surge points to a huge potential currently locked in the protocol’s ecosystem.

Currently, LBLOCK is currently feeling the bearish waves and is trading at $0.0012, down 3.16% in the past day.

You can invest in LBLOCK by following these steps:

- Visit the PancakeSwap platform – Head over to PancakeSwap trading interface to begin.

- Connect a Supported Wallet – Click on the ‘Connect Wallet’ icon and choose a supported crypto wallet of your choice.

- Buy BNB – Binance Coin is a favoured token used in buying LBLOCK; however, you can make the purchase using USDT in your wallet. You can easily buy some from Binance or other platforms and transfer it to your wallet.

- Buy LBLOCK – Once BNB is in your wallet, select ‘BNB’ as the coin you want to swap and click on ‘LBLOCK’ as the one you want to swap to. Set your slippage ratio in the settings and click on ‘Swap’ to complete the process.

3. Yearn.Finance – Top Yield Aggregator Platform

Another top DEX crypto to keep an eye on is Yearn.finance’s token, YFI. Officially launched on the Ethereum network in early 2020, Yearn.finance has since expanded its services to other layer-1 smart contract networks. Its mode of operation is to serve as a bridge between borrowers and lenders by allowing them to engage in peer-to-peer (P2P) decentralised loans.

Yearn.finance also comes with yield-generation and aggregation tools, which allow investors to substantially increase their earning capacity by pooling resources across liquidity hubs.

Yearn.finance’s users can easily tap into the protocol’s attractive annual percent yields (APYs) to generate passive income. The fact that the protocol relies on P2P technology to function means borrowers do not need to worry about credit checks as long as they can provide the expected collaterals.

Price-wise, its native token, YFI, has been on a roller-coaster. The digital token surged to an ATH of $93,000 in the heat of the crypto bull run, largely due to its substantially limited amount of tokens in circulation.

This briefly made the YFI asset the most valuable in the crypto space. At press time, the ERC-20 token is facing a stiff bearish resistance. The DEX coin price is at $13,463, down 6.84% in the last 24 hours.

Cryptoassets are a highly volatile unregulated investment product.

4. UniSwap -Leading DEX Platform for Token Swaps

UniSwap is one of the best known DEX platforms and operates mostly on the Ethereum network. It’s also considered as one of the best utility tokens. Launched in late 2019, UniSwap heralded the boom of the DEX movement by allowing users to trade tokens without trading their personal details. This has made UniSwap one of the best DEX coins out there, with the platform launching three versions of its DEX trading platform for a more streamlined, seamless, and low-cost experience for users.

By function, UniSwap allows users to swap, exchange, and trade any ERC-20 tokens on its platform and also provides liquidity on the pools they prefer. As a reward, liquidity providers (LPs) are rewarded with the underlying asset’s tokens which can be exchanged on a 1:1 ratio once the user wants to withdraw their earnings.

UniSwap commands the largest share of the DEX market with over $2.5 billion of daily trades on its V3 platform. With even more substantial gains recorded on the Ethereum-based protocol.

At press time, UniSwap’s native token, UNI, is feeling the bearish brunt and is significantly down by 11.7%, with a price of $5.66.

Cryptoassets are a highly volatile unregulated investment product.

5. SushiSwap – Promising DEX Crypto For Earning Passive Income

SushiSwap is one of the DEX based coins that has become a mainstay in the flourishing decentralised economy. Based on Ethereum, SushiSwap is an automated market maker (AMM) and DEX platform that aims to offer users more unique ways of generating passive revenue.

Users are able to swap, earn, stack yields, lend, borrow, and leverage their digital assets on SushiSwap. The platform aims to become a better economical DEX than UniSwap. As a result, SushiSwap rewards SUSHI token stakers with 0.05% of all swaps, as governance rights. The platform runs on 14 chains, making it a multi-chain AMM protocol.

Price-wise, SUSHI has been on a bearish streak and is currently trading at $1.6, down 11.27% in the last 24 hours.

Cryptoassets are a highly volatile unregulated investment product.

6. PancakeSwap – Top DEX Crypto For BSC Network

Hosted on the Binance Smart Chain (BSC) network, PancakeSwap is a hybrid AMM and DEX platform that allows users to trade all BEP-20 tokens seamlessly. Also on tap is a lottery ticketing platform and a non-fungible token (NFT) program which allows users to buy digital collectables.

PancakeSwap allows users to earn through its farms and pools and also swap and provide liquidity to projects of their choice. PancakeSwap commands a sizable chunk of the DeFi trading sphere and currently processes a little over $1 billion in daily trades. The platform is powered by CAKE, which is used as a trading pair for several pools available on the platform.

CAKE is currently trading at $5.1, down 14.25% in the past day.

Cryptoassets are a highly volatile unregulated investment product.

7. ThorChain – Top DEX Crypto For On-chain Liquidity

ThorChain is another top DEX platform worth exploring. Founded by a team of decentralised developers, ThorChain is an autonomous and cross-chain liquidity network. The platform aims to enable crypto liquidity through a network of public ThorNodes and ecosystem products.

Currently, the platform allows users to swap and pool directly on several top-ranking DEX platforms and aggregators. ThorChain has a feature-rich ecosystem and enables the swapping of synthetics, composites, and self-paying loans. Principal to this is the ThorFi platform, which enables users to access no-liquidation-risk lending against layer-1 LP collaterals and several other services.

ThorChain has since integrated with the fast-rising smart contract network, Terra. The platform’s native token, RUNE, has struggled with the broader crypto market. At press time, RUNE is trading at $4.1, down 18.68% in the last 24 hours.

Cryptoassets are a highly volatile unregulated investment product.

8. Balancer – Non-custodial Portfolio Manager

Balancer is an automated portfolio manager and trading platform that allows users to invest their crypto assets and earn returns on them. Additionally, Balancer aggregates the best prices for users to place trades.

The platform borrows from the concept of an index fund by allowing users to obtain fees from traders who rebalance their portfolios using arbitrage trading strategies. As a result, users earn the platform’s utility token, BAL, as incentives and enjoy low-cost trading expenses. Additionally, Balancer functions as an AMM protocol which allows developers to build programmable liquidity pools.

BAL is currently flipping bullish. The digital asset trades at $11.28, up 3.14% in the last day.

Cryptoassets are a highly volatile unregulated investment product.

9. Cosmos – Best DEX Crypto For Blockchain Interoperability

Cosmos is a layer-1 smart contract protocol. Using a modular framework, the protocol aims to become the internet of blockchains wherein all protocols can transfer and receive data from each other.

As a highly scalable network, Cosmos runs on the now accepted proof-of-stake (PoS) consensus mechanism. The protocol aims to enable low-cost and energy-efficient transactions.

Cosmos’ mission is to solve the blockchain ecosystem’s hardest challenges. As a result, the protocol has become a mainstay for several top projects, like the Terra blockchain.

The protocol’s native token, ATOM, is currently following the market trend. The digital asset is down 15.8% in the past day with a price peg of $12.2.

Cryptoassets are a highly volatile unregulated investment product.

10. The Graph – Blockchain Indexing Protocol with DeFi Capability

The Graph’s token, GRT, is one of the most popular and low-cost DEX cryptos. Based on the Ethereum network, the blockchain serves as the indexing and information aggregation platform for all blockchain protocols. Essentially, it is the Google for Web3, as it enables developers to easily gather information about a blockchain.

Due to its growing relevance in the crypto space, The Graph has gained significant popularity and has launched on other smart contract-enabled platforms. Integrations on the platform have expanded the use cases for GRT, which is required for platform transaction processing.

At press time, GRT is trading at $0.23, down 10.1% in the last 24 hours.

Cryptoassets are a highly volatile unregulated investment product.

What are DEX Coins?

DEXs, short for decentralised exchanges, are a series of new-generation financial solutions that offer traditional financial services without the need for a bank. Users can save, borrow, lend, and generate passive income without stepping into a banking hall with this offering. Essentially, DEX coins are digital assets that are used in blockchain-facing protocols.

DEXs have thrived significantly due to their anonymity; users do not need to provide personal details before performing transactions. While it’s common to share personal details when an investor buys BTC with a credit card, buying DEX coins is more private. All users need to do is connect a blockchain wallet and fund them to interface with the protocol.

To power their operations, most DEXs utilise native tokens which perform a number of functions:

- paying for gas fees or transaction costs,

- governance tokens used for voting on proposals, and

- trading NFTs.

DEX coins are becoming attractive investment options for several users due to their lower per unit costs and their growth potential.

Are DEX Coins a Good Investment?

Several projects have become household names but investors are still not convinced on why these digital assets should be considered as long term investments. This is due to the volatile nature of digital assets, like the Ergo DEX coin which, at press time, has slipped 93.9% from its all-time high (ATH) of $44.06 to $2.4.

However, cryptocurrencies are known to rally after a bearish run. So, should you take the plunge? Here are a few reasons why you should invest in some of the best DEX coins now:

1. The New Financial Order

The conventional financial landscape is gradually losing steam due to high cost of transactions, low speed, and delineation of users. Decentralised exchanges solve all these problems and allow anyone to trade and earn from their digital asset holdings. Owing a DEX crypto is a viable means of tapping into this promising ecosystem.

2. DeFi Is Still in Its Infancy

Decentralised finance (DeFi) as we know it really kicked off in 2020. So far, the crypto sub-sector has recorded over $200 billion in total value locked (TVL). DEXs have played a principal role in the widespread adoption of this space and are still poised for more growth.

3. Room for Explosive Growth

Given that all DEX coins are predominantly cryptocurrencies, they are known for explosive uptrends in peak bullish seasons. Take, for instance, YFI, which launched in 2020 at a little above $100 and shot up to a remarkable value of $93,000 per token. No traditional financial asset has been able to make such a massive uptrend. Owning DEX coins and, in extension, crypto assets could be a viable means to hit your financial targets quickly.

DeFi Coin Crypto Price

DeFi Coin has largely followed in the same footsteps as several other digital assets. Given that Bitcoin controls the largest share of the nascent industry, every other digital token relies on its price-performance to break even.

The digital asset started trading at $0.57 in January 2022 before facing a nosedive. A series of sideways movements saw it dip to $0.23. However, this price peg could not serve as support; the digital asset dipped to $0.11. A rock-bottom bear run saw DEFC drop to $0.10.

This poor run of form was largely due to the silence of the development team regarding the protocol’s roadmap. The subsequent launch of the long-awaited DeFi Swap proved this assertion correct as DEFC surged 300% to an intraday high of $0.56. DEFC has since retraced some of its gains and is trading at $0.43, down 3.14% in the last 24 hours.

Where to Buy DEX Coins

If you are keen on buying DEX crypto, then you need to utilise a regulated and low-fee platform. A number of options arise when this topic emerges, but we recommend using the automated trading platform, eToro.

Launched in 2007, eToro operates more like a community of investors. As a result, traders can learn from one another. The platform covers over 63 digital assets, including some of the best DEX coins in the market. eToro’s most impressive element is its unique platform functionalities.

Fee-wise, eToro charges 2.46% for crypto trades and there are no deposit charges. However, withdrawals are charged at a base amount of $5.

eToro has a low minimum deposit of $10, for most investors, and a robust offering of payment methods. Users can easily fund their accounts using bank wire transfers, credit/debit cards, PayPal, Skrill, Neteller, and several others.

eToro’s most impressive element is its unique platform functionalities. The platform’s foremost functionality is CopyTrader. This feature allows new investors or laid-back traders to copy the trading strategies of professional investors. As a result, users can mimic the trading movements of an investor while increasing their profit and mitigating against potential losses.

Additionally, CopyPortfolio automatically rebalances and diversifies an investor’s portfolio. This feature extends to several top-performing industries and sectors.

eToro is a regulated platform with operational licenses from the UK’s Financial Conduct Authority (FCA), Financial Industry Regulatory Authority (FINRA), Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investment Commission (ASIC). The platform also secures users’ funds with two-factor authentication (2FA) as well as other bank-grade security measures.

Pros

- Highly secure and regulated platform

- CopyTrader support

- Low minimum deposit

Cons

- Charges inactivity fee

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Best DEX Crypto Wallet

Investing in DEX coins is one thing; protecting them from theft is another. Crypto wallets enable users to securely store their blockchain-based assets on the underlying network. There are hardware wallets, software wallets, and paper wallets.

- Hardware wallets: these are physical devices that store digital assets in an offline capacity. They are more secure but inconvenient for everyday transactions.

- Software wallets: software wallets, on the other hand, are online and mainly mobile app-based. Each software wallet provider employs the highest level of security to keep users’ funds safe. These wallets are more suited for everyday payments and are the most utilised of the three.

- Paper wallets : These are public and private keys printed on a piece of paper. They are considered very unsafe for use due to the propensity of damage or loss.

As we stated earlier, software wallets are the most suited for everyday users. The eToro Crypto Wallet and Crypto.com DeFi Wallet are some of the most popular.

The eToro Crypto Wallet comes highly recommended as it offers storage capacity for 120+ crypto assets as well as a backup recovery phrase service. This can come in handy if you lose your private key. The platform also allows for crypto price monitoring and direct purchase and sales of your digital assets. Additionally, eToro Crypto Wallet supports 500+ crypto-to-crypto trading pairs for advanced investors. The software wallet is also high secure with 2FA and other industry standards and is regulated exclusively by the Guernsey Financial Service Commission (GFSC).

The Crypto.com DeFi Wallet comes with a larger capacity and supports 600+ digital assets. The crypto wallet also allows for earning yields and swapping digital assets. The digital wallet runs on a non-custodial framework meaning users retain ownership of their coins and not the platform. Crypto.com DeFi Wallet is more suited for advanced users as all transactions are done on-chain.

Conclusion

Picking out the best DEX coins can be a chore, but our guide has pinpointed the best ones to add to your portfolio. However, DeFi Coin ranks as our number one DEX crypto. The digital asset’s high growth potential makes it a good investment option for value-driven investors.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney