- Cardano price slides lower after firm rejection against the trend line on the weekly chart.

- ADA is set to continue its bearish path.

- Expect to see the risk of a selloff in the last two weeks of 2022, bearing a 35% decline.

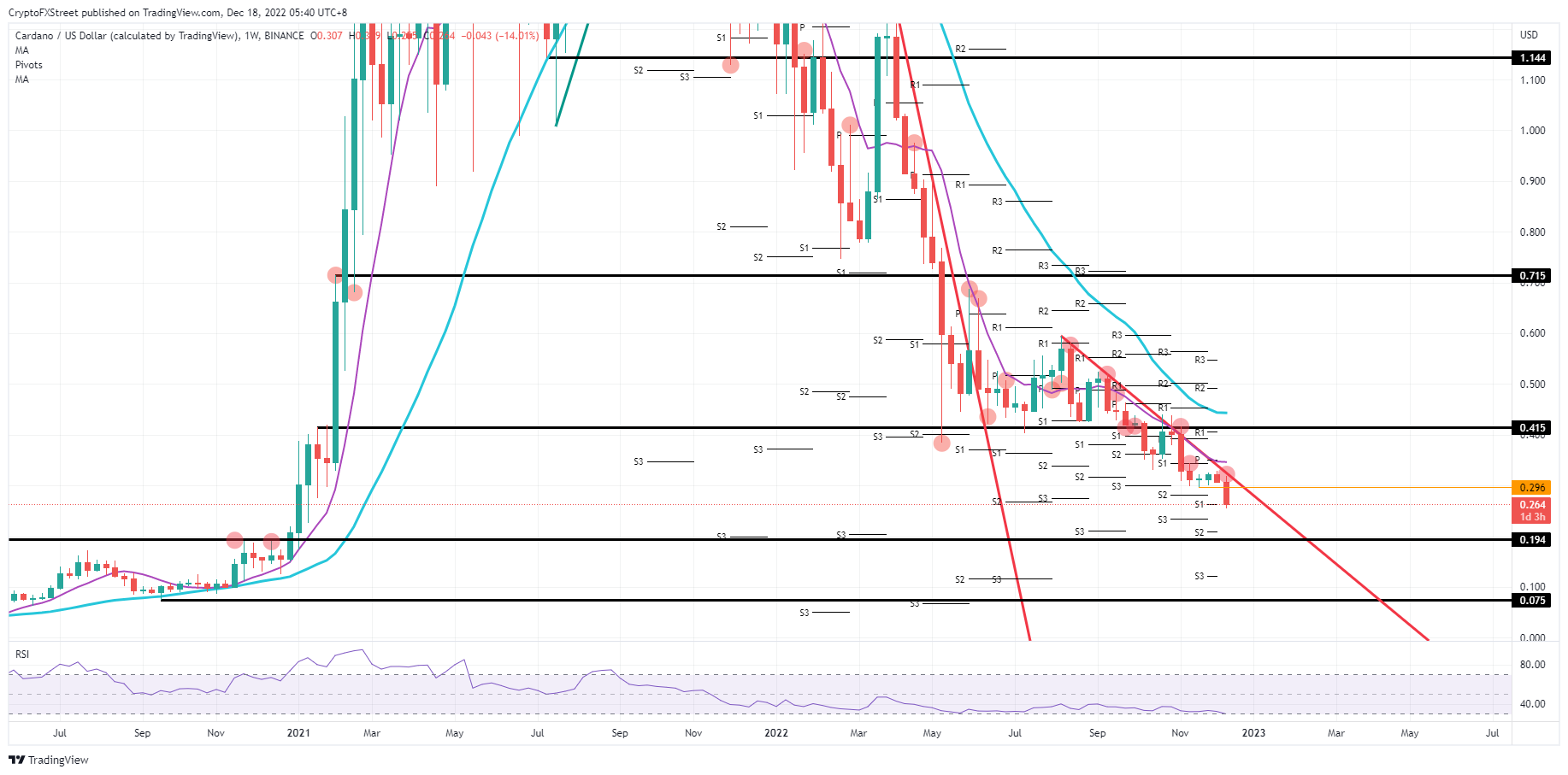

From a purely technical point of view, Cardano (ADA) price action is set to end the last two trading weeks of 2022 with massive losses. The several catalysts lined up this past week have yet to be attributed as expected and could see traders exit their positions for the last-minute Christmas rally. Central bank speakers Lagarde and Powell were quite firm in deflating the balloon of hopes for a goldilocks and soft landing scenario, meaning that ADA still has to get some revaluation to the downside in the coming weeks.

ADA price sees its balloon of hopes deflated

Cardano price did not reject well to the slew of data and speakers passed throughout this week. From a technical point of view, the bearish cycle is still not coming to an end, as ADA received a firm rejection from testing that red descending trend line after the euphoria of a lower US inflation print on Tuesday. A fade to the downside followed, which saw an acceleration by Friday.

ADA is thus not in good shape to withstand the current market turmoil, and the fact that it is trading away again from the bearish trend line, hopes for a breakout are evaporating. Traders will start to exit their positions built up after a Christmas rally. This will trigger more selloffs next week and revalue ADA near $0.194 in search of support.

ADA/USD weekly chart

However, Cardano price has been trading for most of 2022 alongside that descending trend line. That means interest has been there throughout the year to get in or participate should a breakout trade occur. Expect to see a downside being limited by traders buying the dip. This should put ADA back around $0.300 quite quickly, as a massive selloff is not materializing.