Dogecoin slips to the tenth spot on CoinMarketCap, having been leapfrogged by USDC today.

Although the difference in market cap between the two is relatively surmountable, at $213.4 million at the time of writing, the event still represents a continual bleed of significance for the controversial meme coin.

Despite attempts to revive interest in Dogecoin, the $1 price target that’s been heavily promoted by diehard supporters is looking increasingly far away.

With this in mind, is it now time to accept that DOGE has had its day?

DOGE attempts to recapture its former glory

When it comes to capturing the hearts and minds of investors, and not necessarily crypto investors, nothing comes close to Dogecoin. So much so, it has spawned countless copycats, all of which hope to garner just a fraction of its influence.

In many ways, it has advanced the crypto cause immensely by demonstrating that investing can be just “for the memes.”

At the same time, this “selling point” is its own downfall, in that some claim it’s farcical that a meme token, with no obvious use case, can generate the market cap that it has.

One such individual is financial advisor Ric Edelman, who blasted DOGE on the basis that its popularity is a hindrance to an industry striving for credibility and legitimacy.

“It was not serious. It has no legitimate use-case. It is not something that I think is doing the crypto community any good in its efforts to generate credibility and legitimacy in the financial marketplace, or approval by the SEC.”

In an attempt to evolve and recapture investor interest, the team behind Dogecoin has been making moves. First, there was formalizing the management structure at the Dogecoin Foundation, and this also involved bringing on board Ethereum co-founder Vitalik Buterin as an advisor.

With that comes talk of greater integration with Ethereum. Including a possible switch from Proof-of-Work to a more environmentally sustainable Proof-of-Stake model, as Ethereum is doing in ETH 2.0.

As well as that, driven by Mark Cuban, there’s also an attempt to repackage DOGE as a payment token.

But based on its slide in CoinMarketCap rankings, it would seem that investors remain unconvinced.

Dogecoin analysis

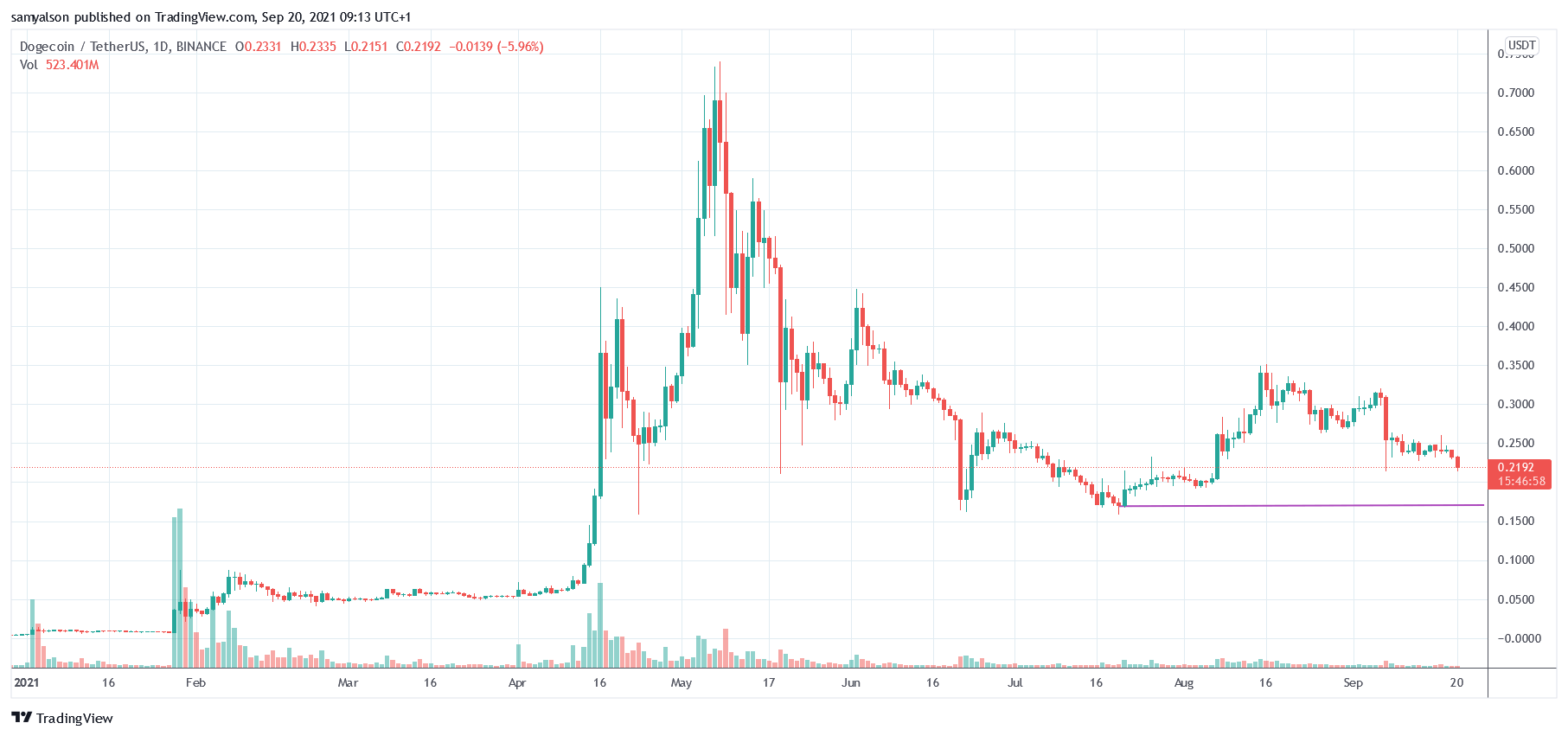

At its peak, in early May, Dogecoin hit an all-time high of $0.74, which represented an unbelievable YTD gain of 13,000%.

Its $95 billion market cap at the time made it more valuable than many real-world companies that serve millions of people. This was difficult to reconcile with the fact that its only use case was “for memes.”

While we have seen a revival of sorts in the past couple of weeks, $0.35 has proved to be a tough resistance level to overcome. A 30% drop on September 7 has led to tight-ranging movement ever since.

Strong support can be found at $0.17, and by all accounts, a possible re-test of that level in the coming days is do or die for DOGE.

Source: DOGEUSDT on TradingView.com

Source: DOGEUSDT on TradingView.com

Based on the rise of Solana, Avalanche, and Terra, it appears as though investors now favor serious projects.

While the Dogecoin Foundation is trying its hand by enhancing credibility, asking investors to take Dogecoin seriously is perhaps a step too far at this point.