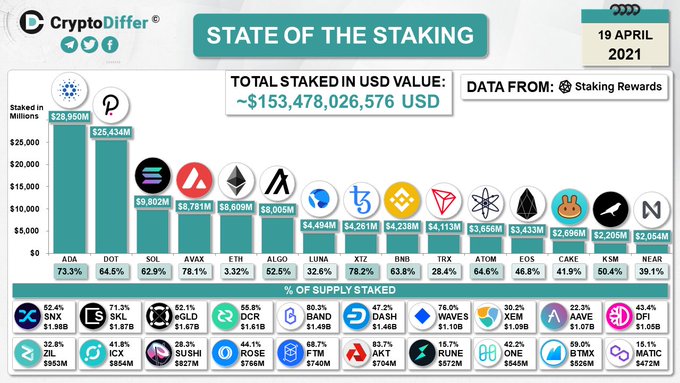

Data compiled by analytics tool CryptoDiffer shows Cardano (ADA) leads the pack when it comes to staking. Figures show users staked $28.95 billion on its platform. This manages to pip Polkadot (DOT), which comes in at $25.43 billion. Over a third of all staking in the crypto sphere is accounted for between the pair.

Source: @CryptoDiffer on Twitter.com

ICOs have come and gone, Ethereum DeFi is prohibitively expensive, and the non-fungible token (NFT) hype seems to be dying down. But staking is perhaps the primary rebuttal to arguments that crypto is a flash in the pan with no viable long-term future.

Staking is the “steady Eddy” of crypto

Proof of Stake (PoS) is an alternative consensus mechanism to Proof of Work (PoW). Instead of relying on energy-dependent mining to write blocks, PoS uses a deterministic algorithm to select nodes based on the number of tokens held.

Typically, the probability of selection is proportional to the number of tokens held, meaning the more tokens locked up in staking, the higher the node’s chances of writing the block and earning the reward.

Users who stake their tokens are compensated with staking rewards. This provides an easy way to earn passive income. It also strengthens the ecosystem by creating demand and taking tokens out of circulating supply.

Staking is a safer way to earn compared to trading and DeFi liquidity provision. The latter exposes users to impermanent loss when the token price changes compared to when deposited in the pool.

While staking rewards generally amount to less than other means, it still makes for an easy, consistent, and relatively low-risk way of earning using cryptocurrency.

Cardano tops the staking platforms, but fundamentals no longer matter

The Shelley phase brought staking to Cardano in July 2020. Since then, the number of active pools has tripled from its initial number of 700 pools at launch to over 2,300 at present.

Similarly, the total percentage of ADA staked is on an upwards trend, going from 69% in January to 73% today. Add to this the highest dollar amount staked on any platform, and it suggests users are confident that Cardano can deliver.

While this bodes well for its long-term future, Sunday’s flash crash saw Cardano suffer 26% losses to bottom at $1.04. A weak recovery today hit resistance at $1.32 leading to bears resuming control.

By contrast, Dogecoin, which is slated for its lack of fundamentals and infinite supply, not only regained its losses within four hours but went on to post 30% gains since then.