For the longest time, Ethereum has been the king of smart-contract blockchains.

As CryptoSlate sector data indicates, ETH’s market capitalization is an order of magnitude higher than that of the second-largest smart-contract crypto, Cardano (ADA). The difference between Ethereum and its peers is further pronounced when you look at metrics like active users, confirmed transactions, and transaction fees paid.

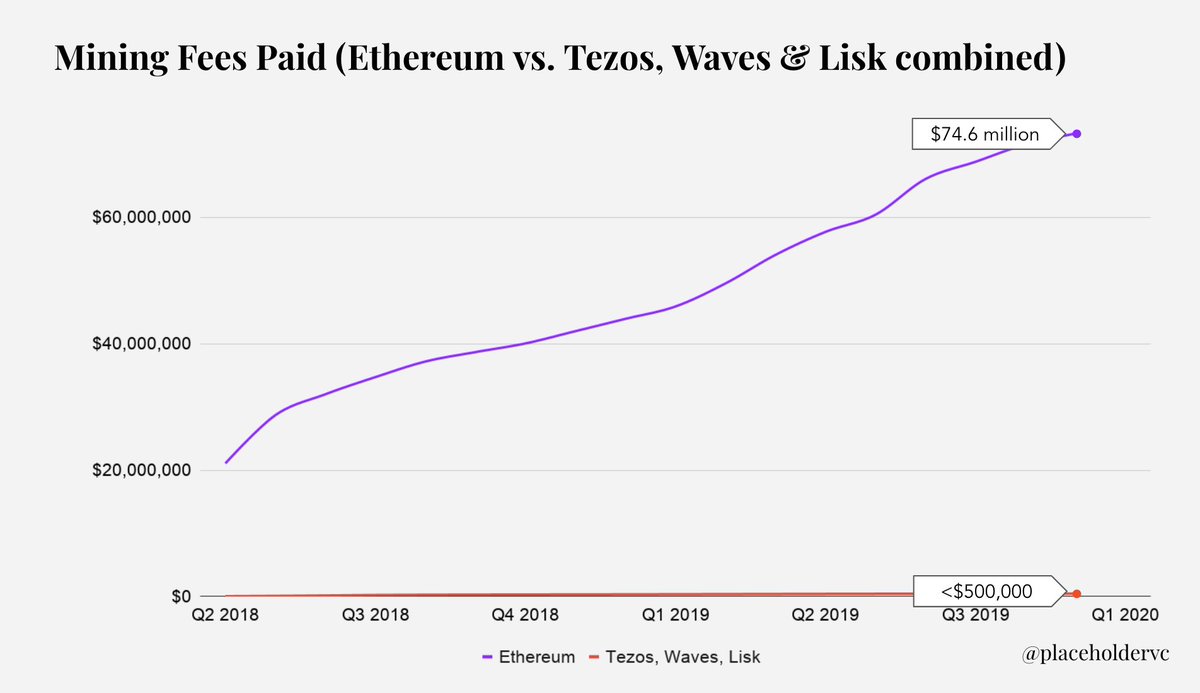

Chris Burniske, a partner at Placeholder Capital, shared the image below in December, showing the aggregate mining fees paid on Ethereum versus those paid on Tezos, Waves, and Lisk. As can be seen, the latter three networks have collected less in aggregate than $500,000 in mining fees while Ethereum has collected in excess of $70 million.

Chart of mining fees paid (Ethereum vs. Tezos, Waves and Lisk combined) from Chris Burniske, a partner at Placeholder Capital

Chart of mining fees paid (Ethereum vs. Tezos, Waves and Lisk combined) from Chris Burniske, a partner at Placeholder Capital

Not to mention, Ethereum has seen strong adoption from some of the world’s biggest companies while other blockchains haven’t.

Yet, the introduction of Cardano’s “Shelley” era will change this, with one prominent CEO saying that competition is needed.

Cardano’s “Shelley” upgrade is finally rolling out

At long last, after years of development and months of testing and optimizing, Shelley is finally here.

For those that are unaware, Shelley is Cardano’s next phase of development, similar to how there is Ethereum 1.0 (current) and Ethereum 2.0, which is currently in development. As the Cardano Foundation describes Shelley on its site:

“Shelley will also see the introduction of a delegation and incentives scheme, a reward system to drive stake pools and community adoption… Come the end of the Shelley era, we expect Cardano to be 50-100 times more decentralized than other large blockchain networks.”

Confirmed at the Shelly Virtual Summit, a digital conference dedicated to the upgrade, code for Shelley was released.

Deployed on Jul. 1 is node software that contains all of the Shelley features that will go live when a hard fork occurs at the end of July.

Also confirmed at the event is that Coinbase will eventually support ADA staking.

Competition is needed

Commentators on the space are optimistic about the upgrade.

Bill Barhydt, the chief executive of Abra and a former Goldman Sachs and CIA employee, commented on the Cardano upgrade and what it means for the rest of the cryptocurrency space in a Jul. 2 blog:

“Many are super bullish on the project and expect great things while others consider the project vaporware such that any failure to deliver would result in a precipitous drop in the token’s value. My take is that competition in the cryptocurrency space is always a great thing and is exactly what we need to accelerate the pace of adoption and improvement.”

Founder of the blockchain, Charles Hoskinson thinks this is the case. He said to Messari‘s chief executive Ryan Selkis that Ethereum may soon feel pressure from Cardano due to the upgrade.

Read Our Latest Market Report

Bitcoin deep dive: 15M BTC in self-custody as Binance withdrawals peak, derivatives switch to ‘risk-off’

A weekly recap of key Bitcoin metrics affecting its price performance in the market, published every weekend.

Crypto research firm: DeFi, not CryptoKitties, is giving “real value” to Ethereum

In 2017 and 2018, Ethereum seemingly had one purpose: it was a platform for crypto entrepreneurs to launch initial coin offerings.

Photo by danish ali on Unsplash

In 2017 and 2018, Ethereum seemingly had one purpose: it was a platform for crypto entrepreneurs to launch initial coin offerings.

As Avi Felman, the head of trading at BlockTower Capital, recently wrote on Twitter:

“The ETH all time high price [of $1,400] is likely a red herring, and was driven by a very specific dynamic: buy ETH to place in ICOs, no sell pressure because ICO treasuries didn’t think about that.”

Yet with the recent growth in decentralized finance — better known as DeFi — analysts are coming to the conclusion that Ethereum actually has a killer use case.

DeFi is giving Ethereum “real value”: Weiss Crypto Ratings

Due to DeFi, the level of network activity on Ethereum has dramatically spiked.

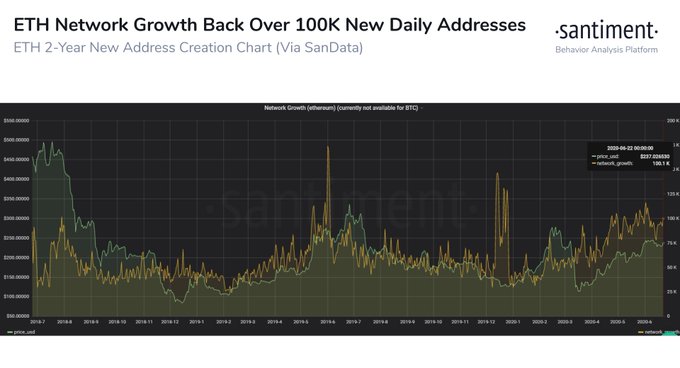

Blockchain analytics firm Santiment reported late in June that the number of new ETH addresses being created each day has just “crossed above 100,000 again.”

Ethereum network growth chart from Santiment

Ethereum network growth chart from Santiment

The count of transactions, too, has continued higher. According to Etherscan, there were multiple days in the past week during which 1,000,000 ETH transactions were processed.

Market research firm Weiss Crypto Ratings wrote on Jul. 2 on this extremely strong network growth:

“Activity on the Ethereum blockchain is nearing levels not seen since the peak of the ICO bubble. ETH withdrawn from exchanges has hit a six-month high. It’s obvious that this activity is related to DeFi.”

On why this is important, Weiss Crypto Ratings explained that DeFi is “giving real value to the Ethereum blockchain, unlike anything we’ve seen before.”

“Forget CryptoKitties, forget gaming — DeFi is where it is at,” the firm concluded.

ETH hasn’t benefited from DeFi… yet

Although DeFi is clearly driving Ethereum adoption higher and giving the blockchain more fundamental value, ETH has yet to benefit.

As can be seen in the chart below, the second-largest cryptocurrency has stagnated over the past few weeks. Over that time frame, ETH has been trapped between $220 and $250, barely deviating from that range.

The cryptocurrency is seemingly ignoring the fact that over the past few weeks, DeFi and altcoins related to the sector have exploded higher. CryptoSlate sector data indicates that in the past 24 hours alone, DeFi coins are collectively up by 4.6 percent.

Interestingly, there are some coming to the conclusion that Ethereum may not catch up to DeFi.

As reported by CryptoSlate previously, crypto-asset analyst Ryan Watkins said that there’s no reason for ETH to rally as DeFi tokens go parabolic.

He primarily cited the growth in stablecoins like Tether’s USDT and MakerDAO‘s DAI, which allows investors to “bypass native crypto assets like ETH for their speculative fervor” to access DeFi.

Watkins shared the image below displaying this point: