Decentralization at team level vs. protocol

Distributed networks and decentralization are concepts much older than Bitcoin. Satoshi Nakamoto proved that it was possible to create decentralized value that people could own, share and transfer without a middleman. In doing so, he laid the foundation for the entire cryptocurrency industry, or if you prefer, blockchain networks. Every public blockchain network needs native coins to enable decentralization itself. Coins may play a different role in each project, but they have one thing in common. It is necessary to ensure their fair distribution.

Imagine you want to start a new decentralized project. What do you need? First of all, someone has to define the goals or mission of the project and its basic parameters. Then, some research and analysis will take place. This is followed by protocol implementation and launch. For many projects, the launch is just the beginning. No protocol in the world can ever be said to be fully complete. On the contrary, each protocol continues to be worked on and developed by a team or community. That said, the most important thing any protocol has is a team. Maintenance, improvements, and new features are never-ending jobs. If the protocol works well, it will find its users. As the number of users grows, the amount and scope of work on the protocol naturally increase.

The team must be paid for their work on the protocol. Some entity or body manages the work on the project and must secure funding. Thus, if a new decentralized project is created, some of the coins usually stay with a foundation or team for protocol development.

Wait a minute. How come we’re talking about decentralization and some team is working on a protocol. Is this similar to, say, Microsoft working on the Windows operating system? There’s no way it should be. Every blockchain project should be open source. The IOG team working on Cardano has all the source code public and also all the scientific studies. Nothing is patented. Everything belongs to the community as much as to the team.

Decentralization at the team level is a difficult, if not impossible, thing. It is difficult to decentralize at this level because only a few people, often programmers, deal with a given protocol on a daily basis. Programming, networking, cryptography, and other things are too complex for ordinary people. There will always be a team behind the protocol. Even Bitcoin has a team. Satoshi Nakamoto abruptly left in silence but handed the project over to another programmer. The source code is on GitHub, people report bugs and the team fixes them and works on improvements. Trying to create governance where people understand the problems from the user side and express their opinion which is then implemented by the team is probably the best that can be achieved.

What is important to us is not control over the source code of the protocol, but control over the network consensus and funding of the development. The team delivers new versions of the protocol and the people are the ones who are motivated to keep the network running. This is where we finally get to the debate about project coins.

Decentralization at the network level is done via native coins. In the case of the Cardano protocol, ADA coins are used for this. This means that everyone who holds ADA coins is a so-called stakeholder. Such a person is actively involved in decentralization and network security. The way it works economically is that if there is demand for the coins, the coins have a market value. If a team or foundation also has coins, it has enough resources to develop the protocol. How does the team get to the coins? Either they keep a portion at the very beginning of the project launch, or they secure some stable income at the protocol level. Or some combination of both.

How to fairly launch a new project?

How to start a new project to make coin distribution fair? Clearly, at the source code level, each team can set up exactly what they need at the beginning. Of course, changes can occur in the protocol at any later time, but this should only be in accordance with the wishes of the majority of the community. This allows the team to decide at the beginning how many coins to keep for themselves, for their advisors, or to sell to seed investors. A part of the coins will then be sold publicly. Of course, not all of the coins that will always exist will be sold. Most protocols release new coins into circulation for a defined period of time, or forever. It depends on the monetary policy of each project.

What is most important for a fair launch is a ratio between the coins that are sold to the public at launch and the coins that the team keeps. The team should strive to decentralize the protocol as much as possible. Thus, it cannot keep most of the coins for itself or for Venture Capital (VC). The team should only keep as much coin as is strictly necessary for the first years of the project’s development. After that, it should secure funding through the collection of transaction fees and some form of decentralized management. We deliberately do not want to define some precise boundary as to when a launch is fair and when it is not. However, we believe that the team should keep less than half of the coins that will be in circulation. The rest of the coins should be sold publicly. Why? As we said, coin owners have control over the network consensus. If the team keeps most of the coins, it will of course also keep control of the network itself. In that case, it is not a decentralized network.

The network must be trustworthy right from the start. Trust in the network should grow over time. The team must not be able to manipulate either the network or the price of coins on the open market. If the majority of people trust the community and, by extension, the network, they buy the project’s coins. The team must not be able to sell coins in bulk and thereby harm the community. The team should be transparent and publish the address where they keep the coins. This way the community can keep an eye on what is happening with the coins.

The team can keep the coins not only for development but also for other purposes. For example, as airdrops to get the coins out to the public. Also as rewards for those who do something useful for the ecosystem. The team can fund development from volunteers or third parties. However, everything should always be completely transparent and, most importantly, it must not come at the expense of decentralization.

Is Bitcoin the fairest startup project? It’s hard to say. Satoshi created Bitcoin before it launched, so he may have funded it himself. In the beginning, not many people knew about the project and Satoshi mined a high number of BTC coins himself. The problem is that today we don’t know if anyone has access to the coins. The fate of the coins is unclear and shrouded in the belief that Satoshi will not spend his coins.

Unfortunately, neither team probably has access to BTC coins. The funding of the Bitcoin project is not transparent. It would be better for Bitcoin if Satoshi gave the coins to the development team. If funding is not clear, teams may struggle to fund research and development. An organization may come in and subsidize only the development that is useful to them without any guarantee that it will also be useful to users. Bitcoin is said to change only slowly. This narrative can mask the fact that there is no funding for development. Development can only be afforded by developers who themselves own large amounts of BTC coins from the beginning of the era. Decentralization at the source code level is a difficult thing to tackle and the only way out is to strive for maximum transparency.

Bitcoin is fair in the sense that every single coin must be mined. No one could decide at the beginning to keep some of the coins for some use. That’s certainly a nice thing. However, this approach is not possible today unless the project is to be a copy of an existing project. Today, the financing of the team must be taken into account in advance. This is the only way to fund new developments that move the whole industry forward. So the team is essentially doing the best they can. They offer their vision and then implement it.

Digital coins only ever have the market value that people assign to them. The demand for coins reflects the quality of the project. People can judge the team, the partnership, the quality of decentralization, the security, the network capabilities, and many other things. In the beginning, only the vision may be available. In the cryptocurrency world, the quality of projects does not correspond to market capitalization. Some projects are overvalued, others undervalued. That’s okay because people can’t make good estimates of the potential of disruptive technologies.

The demand for coins is what will make it possible to fund development. People buy coins and thus give them value. Thus, the coins that are held by the team themselves also have value. The coin holders can be said to support the development of the project.

As we have already indicated, a rogue team can sell the coins, grab the money and disappear forever. People need to be aware of this risk before they buy coins. The longer a project exists and delivers promised features, the more likely it is to stay relevant. Of course, it’s not just about creating the technology but seeking its adoption. A plan to create a strong community and real adoption must be part of the project. Neither community nor adoption can be bought. Both have to be worked on for the long term.

Cardano has been around since 2015. ADA coins entered the open market in 2017. The team has delivered a working PoS that has been running for over a year at the time of writing. Cardano also has smart contracts. So the team is gradually delivering on everything they promised and doing everything they can to make the development as transparent as possible. Anyone who is interested can follow the development in detail. Cardano definitely has one of the strongest communities in the cryptocurrency space. This is also a guarantee that the project is relevant and not going anywhere.

So how do you fairly launch a new blockchain project? It is fair to keep a reasonable amount of coins for the development of the project. However, most of the coins should be sold to the community on the open market. Subsequently, the team should be as transparent as possible about the disposition of its coins and development. It can be suspicious if the team does not communicate with the argument that they are trying to decentralize the project. The project should be as decentralized as possible at the network level and transparent at the development level.

Note that team members can buy their own coins at the public sale. But that’s very different from keeping them when you launch a project and then selling them. If they buy them like everyone else, they have to invest their own money in them. So they have skin in the game.

Cardano project coin distribution

The distribution of ADA coin vouchers took place in Asia in four stages between October 2015 and the start of January 2017. The team wanted to avoid potential future problems, so they followed the Know Your Customer guidelines. It was for the first time in the cryptocurrency space. Moreover, an audit was performed on the distribution process.

What is a Fair Reward for Cardano Pool Operators?

We have seen many interesting but also hot debates about the K parameter and its size. It influences many things including the rewards of operators and some people think that it should be increased. Let's discuss it.Read more

25,927,070,538 ADA coins were sold to the public. In addition, the Genesis block distributed coins to 3 entities: Cardano Foundation, Emurgo, and IOG (IOHK). Cardano Foundation received 648,176,761 ADA, Emurgo received 2,074,165,644 ADA, and IOG received 2,463,071,701 ADA.

The sale made 108,844.5 BTC. Over 8,000 BTC was donated to the Cardano Foundation.

At project start, a total of 31,112,484,646 ADA was distributed. Since the launch of the PoS, new ADA coins have been gradually released into circulation. A further 13,887,515,354 ADA coins will gradually enter circulation until the maximum of 45,000,000,000 ADA coins is reached.

Was the launch of the Cardano project fair? Cardano Foundation, Emurgo, and IOG kept 20% of the ADA coins that were in circulation at launch. So 80% of the ADA coins were sold to the public. The network is 80% controlled by the public. Moreover, IOG does not operate its own staking pools. The team has plenty of funding for research and development.

What is the distribution of coins in other projects?

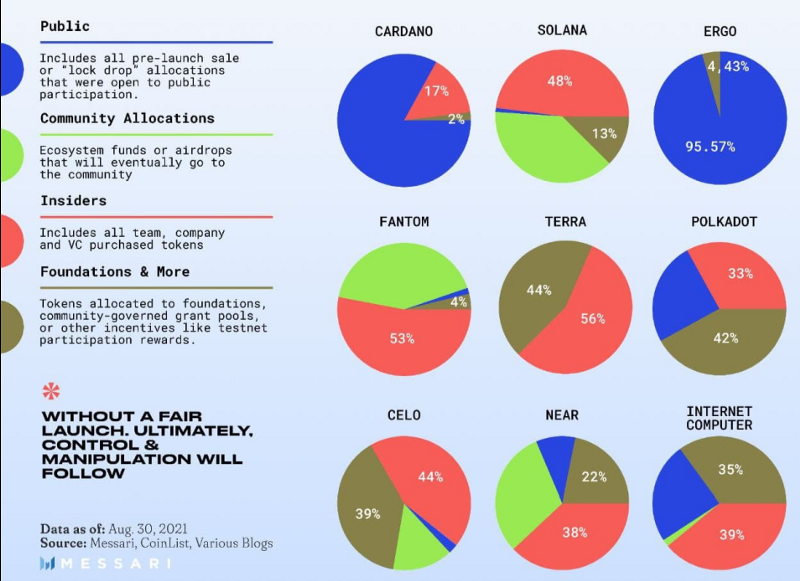

An interesting review was recently done by the Messari team. Cardano is one of the champions when it comes to fair coin distribution at launch. Many similar projects have publicly sold a relatively small amount of coins and the teams are still the majority owners of the projects.

Source: Messari

Source: Messari

Each project has its own coin release strategy and its own reasons for retaining control of the network. The reasons can be quite pragmatic. As long as the team has control of the network, it cannot happen that the network is attacked by a 51% attack from the outside. The team can wait to sell the coins until it is sure that the coins will be distributed fairly among the people.

The distribution of coins will be lowest at the beginning and will increase over time. The opposite would be strange. If coins are used to distribute decision-making power, as in PoS networks, it is important that the number of coin holders grows. Ideally, there should not be many influential whales in the ecosystem. Unfortunately, no system can do without entities that hold large numbers of coins. It doesn’t matter if they got the coins cheaply at the beginning or later. Anyone with enough money can become a whale in any ecosystem.

It is in the interest of the projects to spontaneously increase the number of coin holders. This is easier if the coins are in circulation from the start. It is likely that the whales will gradually sell their coins to newcomers. The value of the coins may fluctuate or even decline if the whales sell and there is no demand for the coins. It is always a good idea to look at the rich list to track the distribution of coins over time.

If a team holds, say, 80% of the coins and decides to sell a larger share, it is clear that the value of the remaining 20% of coins in circulation can drop dramatically. It is important to remember that the decision to sell is made by a single entity and one that knows exactly where the project stands.

In Cardano’s case, stakeholders hold the coins for the most part, so they directly determine the value of ADA coins with their next purchase or sale. Importantly, the team, by the number of coins they hold, may not materially affect the value of the coins by their eventual sale. Moreover, if the team did so and moved the coins from their publicly available address, others would notice.

Coins and decentralization

Satoshi’s plan was that anyone could mine BTC coins. In the beginning, all you had to do was let your computer mine and after a while, you received a reward. This is an important principle. The opportunity to earn coins for doing important work for the network should be open to everyone as much as possible. Unfortunately, this is no longer the case with Bitcoin, as the cost of entry has increased and the environment is too competitive for everyone to succeed. PoW mining favors powerful entities more than domestic miners. As a result, interested parties have to buy BTC coins on the open market. Unfortunately, this does not decentralize the network, it only increases the price of coins. This increases the security budget, which is also important.

Cardano uses PoS in such a way that decentralization grows with the distribution of coins. Everyone likes to get rewards from staking, so you can basically earn coins in a very similar way to PoW mining. By holding and delegating coins to a pool for the network you are doing useful work. The coins in the staking are not available on the market, so this stabilizes their market value, which tends to rise. The growth in value of ADA coins sells 51% of the attack. Importantly, there is almost no entry cost. You just have to buy the coins. Anyone can do this according to their financial capabilities and preferences. No one is disadvantaged based on their location.

Almost no one knew about Bitcoin in the beginning, so maybe no one thought to invest in an attack. The network had little economic or social impact. Now it’s different. Hackers are trying to attack every old and new network and make money from it. So a newly launched project has to be secure and economically hard to attack right from the start. When Cardano switched to PoS consensus, the coin distribution and market value were such that it was a safe move. There was a huge interest in running pools and staking, and that interest continues to this day. So the decentralization and security of the project are growing. This naturally also increases the confidence of newcomers in the project.

PoW networks are not decentralized based on the number of coin holders. The coin distribution is only interesting from the perspective of being able to influence the value through large sales. Furthermore, the meaning of the coins themselves must be taken into account. For some projects, growth in the number of coin holders is more important than for other projects.

The current development of many projects is that coins can serve as a governance tool. This makes sense, as who else but the users themselves should be able to make requests and express their opinion on the team. The team should not be the one doing whatever it wants at a certain stage of the project. On the contrary, it should be an entity that is driven from the outside by the community. Getting to this state is extremely difficult, and fair coin distribution is an essential prerequisite. If the team holds the majority of the coins, it can make decisions on critical issues on its own.

The topic of decentralized project management is still in its infancy and not much is said about it. It is clear that the team needs to deliver some basic protocol functionality at the beginning and there is no point in talking too much about it. However, after some time the will of the community should have more strength. The team or community should propose changes and vote on them. The team will be in the role of executor of the will of the majority. As we said, decentralization at the team level is difficult, but that doesn’t mean that teams won’t pursue it. The use of coins seems logical.

Conclusion

In the cryptocurrency space, you sometimes hear the opinion that it is impossible to fairly launch a new decentralized project. Many of these arguments don’t make sense, and if you want to be critical, you will find problems with any project, including Bitcoin. Satoshi is not the only one who is a BTC whale. There may be more similar entities and their coins will be slow to enter circulation. Every project launch rewards those at the very beginning the most. Unfortunately, there’s not much we can do about that. In the real world, it’s exactly the same. But let’s not make an idol of one project and say that something can’t be done again.

Cardano has had a fair coin distribution from the very beginning. Staking works on the basis of being able to buy ADA coins on the open market. You can’t earn coins incrementally as you can with PoW networks. First, you have to have coins, then you can earn more as a reward. Buying ADA coins is your skin in the game. The coin distribution is dependent on network consensus, and the IOG team probably did it the best they could at the time.

Cardano’s network is under stakeholder control and the team has minimal influence on the consensus. This cannot be said of other projects in many cases. Always be interested in how much control the team has over the coins. If it is high, consider well what that means for you. Venture Capital won’t like Cardano because the community already owns it. Those who want a stake need to buy ADA coins on the open market. Fair enough.