The diffusion of innovations theory

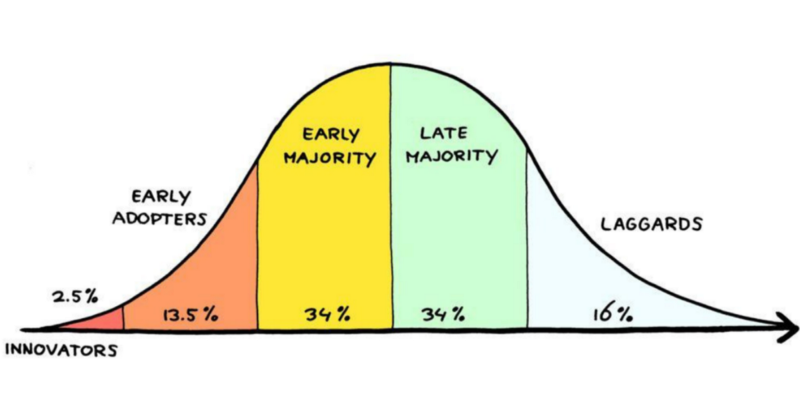

The diffusion of innovations theory is a hypothesis that tries to outline how new technology spread throughout societies and cultures, from introduction to wider adoption. The goal of the theory is to explain how and why new ideas and practices are adopted. The theory introduced adopter categories and it divides consumers into segments based on their willingness to try out a new innovation or product. Innovations are adopted by different parts of society in many ways and the tempo of spreading is often influenced by subjective opinions that are associated with the innovations. The theory explains the passage of an idea through a few stages of adoption by different actors. The main actors belong to the following groups:

- Innovators: 2.5% of the population belongs to the category of innovators. This group of people is prepared to take a high risk related to the adoption of new technologies. The group consists of younger and very social people that come from wealthier backgrounds. This group is very critical for further adoption. Only if this group is satisfied and adopts the product or service then the adoption of innovation can continue. Innovators are fine with the dropping of products or services, absorb the financial losses, and look for another interesting and breakthrough innovation.

- Early adopters: 13.5% of the population belongs to the category of early adopters. People in this category are demographically similar to innovators, however, they think a bit more about products or services. They make a purchase decision a bit longer and take into account practicability and benefits. Early adopters do not want to risk as much as innovators. If this group stays loyal to a product or service then it is a good sign of further success.

- Early Majority: 34% of the population belongs to the category of the early majority. They take a lot of time to make a purchase decision and they rely on the opinions of others, mainly to opinions of people from the early adopter’s category. This group consists of people that are less technologically skilled. Thus, they need to see that the trusted authorities or celebrities have already adopted a product or service. This group does not want to lose money. They need to be sure that they buy a solid product or service.

- Late Majority: Another 34% of the population belongs to the category of the late majority. This group needs to be sure that adoption is already high and that innovation becomes an important part of life. This group is very cautious since people in this group have less income and wealth. They are also skeptical of innovations. They are kind of followers.

- Laggards: The last 16% of the population belongs to the laggards. This group often consists of older people with low income and wealth. They are very cautious and skeptical of innovations and they accept it only if the new product or service specifically addresses a salient need of this group.

We are still deeply in the innovator's category. Judging by the number of addresses of the current biggest projects and the number of daily transactions, the adoption of cryptocurrencies has not reached even 1%. We are still in the phase where geeks play with the new technologies and investors search for new investment opportunities. Despite the fact that mass media reports about cryptocurrencies from time to time and we can even see ads, in reality, people do not use the technology. At least not in a way that is expected by the mission of cryptocurrencies.

The crypto movement has not persuaded even the small group of innovators. The group has only 2,5% of the population. It is necessary to saturate the group of innovators to cross the border and get closer to the early adopter’s group. This fact is very positive for new projects since it is still a lot of time to attract a significant part of users and gain a good market share. Innovators are used to trying new things and risks. It is also very positive since it is likely that when some innovations appear in the crypto space this group is going to try them. Success and adoption are not about trying but about using. Cardano needs to attract people from the innovator’s group that will try new Cardano technology and stick with it. We are still at the beginning of the phase where many competitive projects will struggle for developers and end-users. Some people might think that the current big projects from the top 10 have their position certain. Nothing is certain when the adoption is low and only a small group of innovators express their opinions. It is necessary to reach 16% adoption to be sure that the project stays relevant. It means to satisfy groups of innovators and early adopters.

Regarding adoption, the most influential group is the early adopters. This group is very active on social media and they will influence the rest of the population to adopt innovations. It is a bit more complicated to persuade this group to adopt a new blockchain project. Early adopters do not want to risk as much as innovators so a blockchain project must be secure. Both innovators and early adopters do not want to lose money so 100% reliability and security are a must. Moreover, The new blockchain project must be flawless, be fully functional, and provide some advantages over competitors. Early adopters like obtaining more information before they will write reviews. They will compare projects with each other and highlight the advantages and disadvantages. Opinions of early adopters can be more reliable and precise than the innovator's one.

Why have people not adopted crypto so far?

The adoption of decentralized services is low and slow. If we could name the most debated reasons then it would be the complexity of using, volatility, unclear use cases, unclear regulatory stance, slow and expensive transactions. We do not want to discuss all these reasons. We want to focus on the technological part of the adoption. What is more important, a technology that is ready for mass adoption or users, that will use the technology? It is an egg and chicken problem. People will adopt only mature blockchain technology. If a blockchain project is not matured and has a lot of issues then it will not probably get over the early-adopter group. We have stated that the current adoption is probably not higher than 1% of the population. Bitcoin and Ethereum get clogged when more people come and try to use them. Transitions can cost a few tens of dollars and settlement can take a few days. Only people from the innovator’s group are willing to accept such an unpleasant user experience. The majority of newcomers definitely will not be happy with that and they will not probably adopt the technology. People often argue that people will adopt such not good functional technologies if there is a strong economic reason. For example, if fiat currencies collapse, then cryptocurrencies with a capped supply of coins must win. Well, we will see. Let’s consider that from the technological point of view. If only 10% of the population needed to jump on crypto then the blockchain networks would have to process 10x more transactions. Bitcoin and Ethereum are not able to do it well at the beginning of 2020 when adoption is only 1%. It is kind of naive to think that people will start using these networks in the foreseeable future. These networks will have to solve the scalability issue. It does not matter whether it will be a second layer solution like a lightning network in the case of Bitcoin, or transition from PoW to PoS in the case of Ethereum. People can desperately search for a solution when fiat currencies collapse but these solutions must be viable and ready for that. People need to build trust in decentralized technologies and it will not be the case when the user experience will be so bad.

In our view, the real adoption of public blockchain projects has not even started. It is in the beginning and the next wave of newcomers will decide which decentralized services are useful and deserve adoption. We can even see more such waves in the future. The interest in cryptocurrencies depends on the market capitalization of projects. Volatility is not a good thing from the usage perspective, but it is an interesting topic for social media. It attracts the attention of people and they might try to use a decentralized service. It is needed to realize that newcomers will expect a similar or even better user experience than they are used to from the traditional financial world. The crypto space must be competitive. It is not enough to offer worse services and tell them that it is slow, expensive, less secure, but decentralized. Decentralization will be a big thing only if it is available for everybody and offers a competitive user experience. The IOG team strives to achieve a high level of decentralization but at the same time, Cardano will also be scalable. It is the only way to reach higher adoption and attract people from the early-adopters group.

With higher adoption, the media will be full of articles and comparisons. People will read it and try many projects to have their own experience. They will not have a bias to one or another project. They will just search for a better solution that fits their needs. Only a technology that will be ready for a competition can succeed. Cardano can easily overcome Bitcoin or Ethereum from the perspective of newcomers and it can happen soon in 2021/2022. Cardano can be technologically more advanced than competitors at a time when it will be really needed. We do not want to say that Cardano must be the winner. There are more projects in the crypto and their teams want to succeed. Bitcoin and Ethereum will be improved and many other projects will be also ready to be part of the competition. It is fine. It is fair. People will decide what they want to use and how. Older projects can have an advantage in popularity and a solid user base. Newer projects can be better technologically and for example, Cardano also has a very solid community with great people.

Decentralization is not only about transactions and related properties like price and speed. Everybody wants to use a fast network with cheap transactions. We can send native project coins but we can also send many other assets. Moreover, we can use smart contracts and build brand-new financial services. Maybe services that have not been here before. Cardano will be even capable to work with decentralized identity services via the Atala project. At the moment, it is difficult to evaluate the potential of crypto projects since we even do not know what people will want to use. The future will be significantly influenced by regulations and it can help a lot or the crypto space can struggle with it some time. Imagine that stock exchanges could work with the public version of blockchain projects and users could buy and sell them. If regulators for example in Europe would not have a problem with that then the potential of smart chain projects would rise significantly. Besides the traditional financial world that is highly regulated, there are plenty of use cases that can be realized by Cardano regardless of regulations. Nobody has tried to regulate DeFi so far and the potential of this sector is huge. Cardano will step into DeFi soon and the team will provide all necessary tools and infrastructure to make it the reality. We believe that smart contracts will be used much more once they will be more reliable and it will be easier to write one. Cardano will have a functional language for writing smart contracts Plutus and domain-specific language Marlowe. If people from the innovator’s group can see the potential of smart contracts, when companies slowly adopt blockchain technology including smart contracts, there are nearly no obstacles for further development and adoption. Again, a smart contract platform must be ready for adoption. It means that smart contracts must be reliable and secure. It was not the case so far and we believe that Cardano can bring quality into the sector.

Crypto can become a store of value but we can definitely see more use-cases. Some people claim that it is the only possible usage of blockchain but we think that it is not true. It is difficult to adopt a volatile crypto token and find other usages than price speculation or possibly a hedge against the fiat currencies. Price stability can bring tremendous usability. People from early adopters and early majority groups will not probably want to adopt speculative assets but they might want to adopt useful decentralized financial services. Newcomers will not need to buy ADA, BTC, or ETH for the price speculation. In an ideal case, they will just download an application and start to use it. They will have an easy opportunity to buy stable coins and by that, they will join the DeFi space. DeFi will have to offer some useful services that are not directly connected to volatile tokens. Utilizing Oracles and digital identity can help here a lot. Many people will use digital or even real identities if they get a chance to get a better loan. We can see a lot of opportunities for FinTech companies.

What is the future of crypto?

Nobody knows what the future of cryptocurrencies is. The current adoption is low basically for the reason that the technology is not mature and ready for the real world. Teams will have to carefully listen to end-users but mainly developers that will build on smart contract platforms. The winners will be projects that will fastly deliver what people expect in high quality. Basic market rules work everywhere and it will be true for crypto as well. Cardano has a few solid teams. The IOG team consists of over 200 smart and skilled people and there are more than 5 years of research. The team will be able to accommodate future needs and deliver everything that will be needed to succeed. It is the key to success. Let’s explain why. When a real adoption begins the projects cannot struggle with scalability, security, and other things as we can see now. Smart contracts developers will need to gain some competitive edge to satisfy users. Moreover, the business must work from an economic point of view. If there will be a platform that is more suitable for building applications the developers just try it and stay loyal if they will be satisfied. It will be a necessity to jump from one platform to another if it can satisfy more end-users. Developers will probably do it. It can be a case that more platforms will be viable. Like in the traditional world, where we can use Java, C#, Javascript, and many other platforms. In the future, we can see Cardano and Ethereum as platforms that will be both used and developers pick just based on their preferences regarding the language that is used for writing smart contracts. One will love Plutus, other Solidity, or its successor.

Cardano has prepared two funds that will be distributed to developers that are willing to build on the Cardano ecosystem or improve it. Value services can be created only if developers are well funded and can fully focus on work. It is a very smart move from the IOG and many teams can come and build DeFi services on Cardano. If only a few funded projects succeeded as it is usual in a start-up environment it would be a good step into DeFi. It can be said that it is not about what a platform has today but about what the team is able to deliver tomorrow. We will see a real competitive environment when more people come and start using decentralized services. The current experience is not satisfactory and we need to improve it. Cardano has been developed for years and it will be ready to show its strength soon.

The competitive environment is always good mainly for users since they can consume high-quality services. It is basically on users to say what they want and how they want it. There will be more groups of users from end-users to companies, banks, or even states. One single project cannot satisfy all these groups for many reasons. For example, a project that has a team from one big country can hardly be used as an infrastructure project in another big country. One another example, regulators in one country can agree with some particular use-case but other countries might disagree. Some use cases can require a big amount of fast transactions, another use case will require transparency and another use case privacy. Crypto adoption can take many different ways and directions and many projects can succeed and no project will probably not dominate as a single one in each particular sector. In the beginning, we can rather expect a lot of competitive projects. If a single project is to dominate in a certain sector, it will probably happen after many failures of other projects. Still, no project will be here forever. Only innovations and adaptation to future needs can ensure longevity.

Conclusion

Bright days of cryptocurrencies are ahead of us. Nobody knows how it will look like and making predictions is difficult and treacherous. There are a lot of variables and the crypto space changes every day. Having said that, we think that Cardano will succeed since it will probably become a technology leader if it is not already.