Data shows the daily Bitcoin entities have been recently retesting the bear market channel as the crypto’s userbase observed little growth.

Bitcoin Number Of Active Entities Continues To Move Sideways

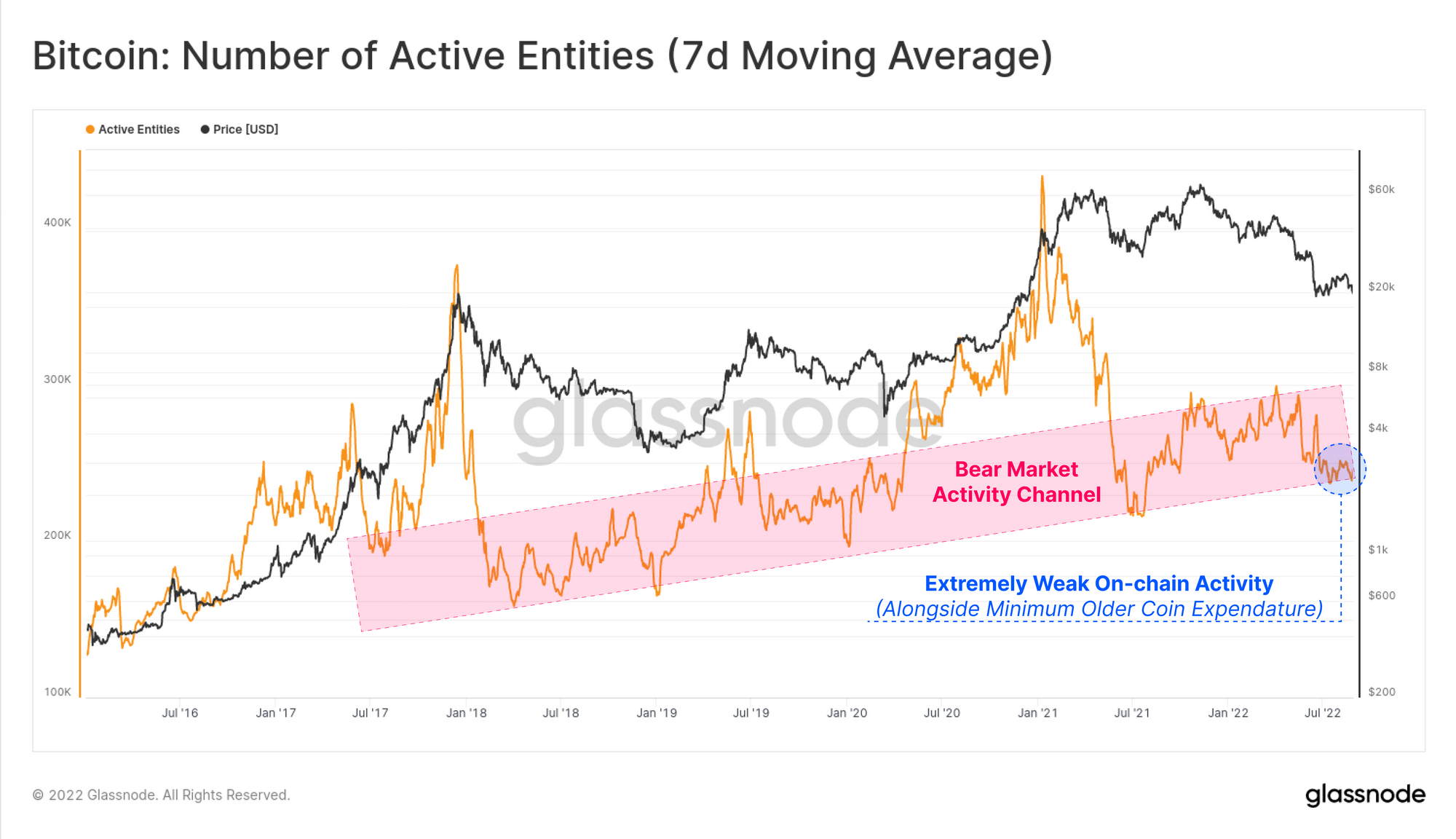

As per the latest weekly report from Glassnode, the BTC network is seeing weak on-chain activity as the daily users have been testing the lower end of the bear market channel.

The relevant indicator here is the “number of active entities,” which tells us about the amount of unique entities that were active on the Bitcoin blockchain as either senders or receivers.

“Entities” here refer to an address or a group of addresses on the network controlled by a single entity or user. Hence, the metric is closer to being analogous to daily active users than daily active addresses.

Now, here is a chart that shows the trend in the Bitcoin number of active entities over the past few years:

The value of the metric seems to have been moving mostly sideways in recent days | Source: Glassnode's The Week Onchain - Week 35, 2022

As you can see in the above graph, the value of the Bitcoin active entities has come down recently and has been showing stagnation.

Historically, the indicator has usually consolidated inside the “bear market activity channel” during bear markets. While in bulls, the metric has generally broken above and stayed there for the run.

The number of active entities are currently stuck at the lower end of this range, and have made a few retests of the boundary line during the last few weeks.

This implies that there has been little growth in the active userbase of Bitcoin as the on-chain activity has been extremely weak recently.

The report notes that if the active entities decline further from here, then they will dip into a zone of weakness not observed since many years now as the userbase will see an unfortunate deterioration.

BTC Price

At the time of writing, Bitcoin’s price floats around $20.4k, down 5% in the last seven days. Over the past month, the crypto has lost 14% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the price of the crypto has seen a little recovery during the past day | Source: BTCUSD on TradingView

Bitcoin plunged down some days back, and after seemingly hitting a bottom around $19.5k, the coin has rebounded back a little above the $20k level in the last couple of days.