Russian President Vladimir Putin overnight launched a full-scale “special military operation” into Ukraine, sending shockwaves through the markets.

Cryptocurrencies were among the hardest hit, led by an 18% decline for Cardano's ADA and a 14% fall for Solana's SOL, according to data from tracking tool CoinGecko. As for Bitcoin (BTC), it's not working as a safe-haven asset at the moment, falling nearly 10% to $35,000. Ethereum (ETH) is down 12% to $2,340. The total capitalization of the crypto market, according to CoinMarketCap, has fallen 8.4% today to $1.57 trillion.

Hardest hit stock markets in Western Europe are Germany's DAX, down 5.2%, and Italy's FTSE MIB, down 5.3%. Russian's MOEX index had its largest decline ever, falling 28%. In the U.S., Nasdaq futures are off by more than 3% and S&P 500 futures are just shy of a 3% decline.

Checking the technical picture for ADA, it slid to as low as $0.74 in European morning hours before a slight recovery to $0.76, which could act as support in the coming days. Just a week ago, the price was at $1.

ADA dropped to $0.74 from last week's $1 high. (TradingView)

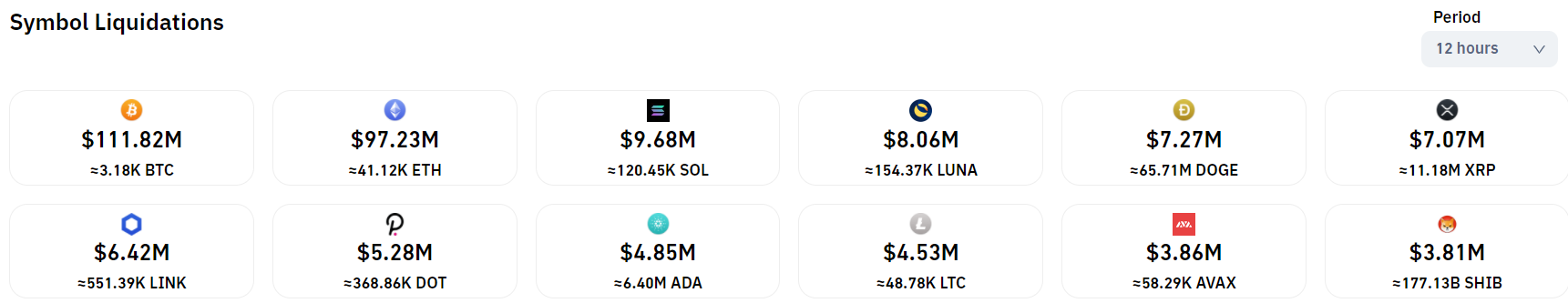

Crypto-tracked futures have seen nearly $350 million in liquidations since the start of the Russian invasion. Of that, almost $111 million occurred on bitcoin futures and $97 million on ether futures, followed by $9.67 million in losses on SOL, and $7.27 million on DOGE.

Crypto markets lost nearly $350 to liquidations in the past 12 hours. (Coinglass)

Anto Paroian, chief operating officer at digital asset investment fund ARK36, cautions not to expect the U.S. Federal Reserve to come to the rescue. If anything, he said, the war will worsen the inflation picture. “This means that the Fed and other central banks may really have no room to reverse their hawkish course and we can expect risk assets and cryptocurrencies to go deeper into the bear market territory," he told CoinDesk.

Rudd Feltkamp, CEO of crypto trading bot Cryptohopper, has a different view, reminding that markets generally do a good job of discounting big news. “If you look at major historical events and how the stock markets react, there is not an extremely large action/reaction,” he told CoinDesk in an email. “For example, after the attack on Pearl Harbor, the markets 'only' fell 3.8%. However, the run-up with the associated uncertainty seems to have a more significant impact."