If you’re looking to gain exposure to Bitcoin – you can invest in this top-rated cryptocurrency in less than 10 minutes via a trusted online broker. In this guide, we review how to invest in Bitcoin with a low-cost and regulated brokerage site.

We also discuss whether Bitcoin represents a viable investment and what risks you need to consider before proceeding.

How to Invest in Bitcoin 2022 – Quick Guide

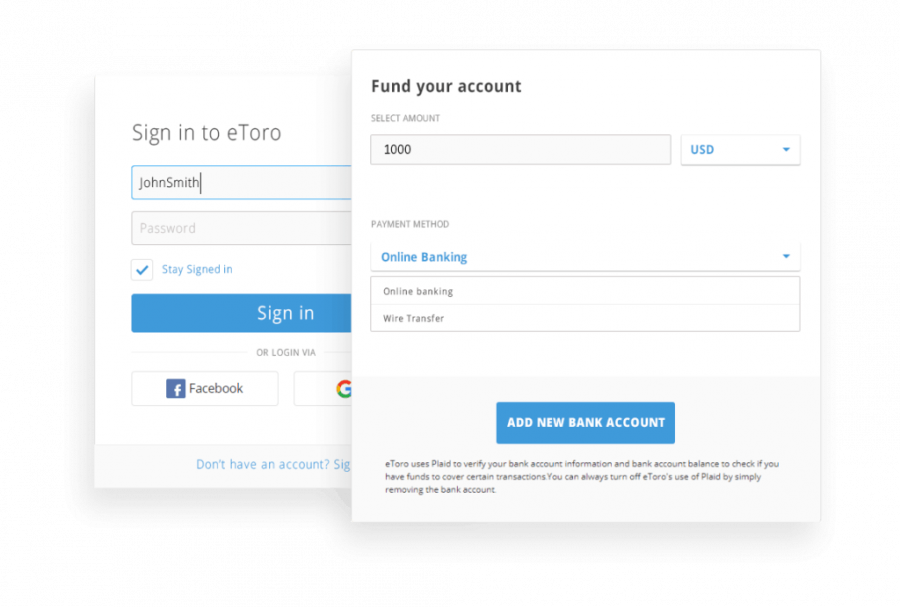

You can invest in Bitcoin right now via the SEC-regulated broker eToro – which allows you to get started with a minimum purchase of just $10.

Follow the steps below to buy Bitcoin with eToro:

- ✅Step 1: Open an Account: First register a free account on eToro.com. This requires you to enter some personal information and contact details, and upload a copy of your ID.

- 💳Step 2: Deposit Funds: US clients can deposit funds into their eToro account fee-free and from a minimum of just $10. Choose from an online bank transfer, Paypal, debit/credit card, or ACH.

- 🔎Step 3: Search for Bitcoin: In addition to cryptocurrencies, eToro hosts thousands of other financial instruments. As such, the easiest way to invest in Bitcoin is to enter ‘BTC’ into the search bar and click on ‘Trade’.

- 🛒Step 4: Invest in Bitcoin: You will now see an order box appear – simply enter the amount of money you would like to invest in Bitcoin and click on ‘Open Trade’ to confirm.

By following the quickfire guide above, you have just learned how to buy Bitcoin with an SEC-regulated broker in less than 10 minutes.

Keep on reading should you require a more in-depth walkthrough of the investment process.

Where to Invest in Bitcoin

It is important to assess the best place to invest in Bitcoin for your personal requirements.

For instance, some platforms are geared towards beginners, while others are more suited for large-scale investors that seek high-level trading tools.

With this in mind, when thinking about where to invest in Bitcoin – consider the selection of pre-vetted brokers reviewed below.

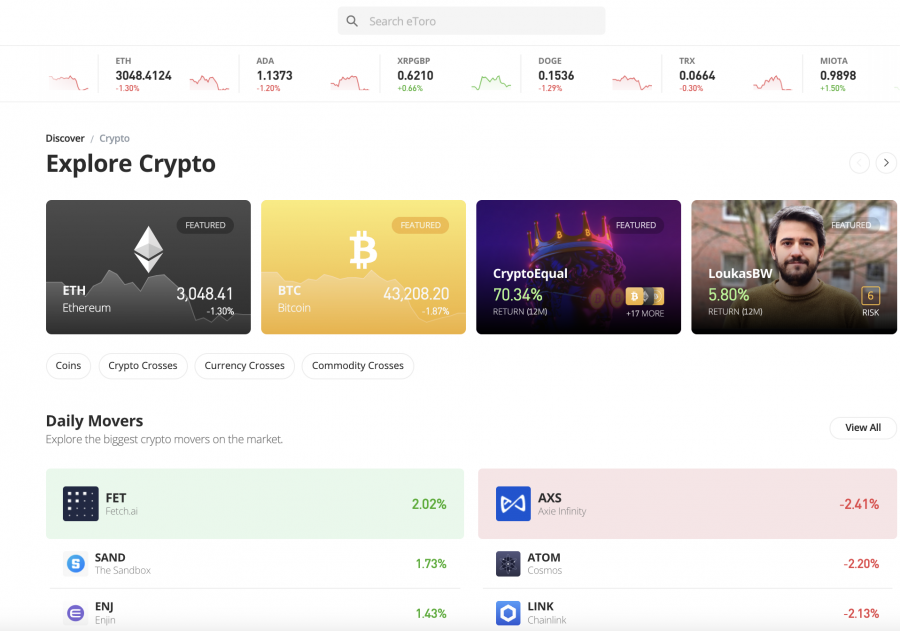

1. eToro – Overall Best Place to Invest in Bitcoin 2022

We used eToro as our example broker in the quickfire guide above, not least because this is the overall best place to invest in Bitcoin and buy cryptocurrency. Put simply, you can open a verified account in minutes at eToro and you only need to risk $10 to invest in Bitcoin in a safe and secure manner.

We used eToro as our example broker in the quickfire guide above, not least because this is the overall best place to invest in Bitcoin and buy cryptocurrency. Put simply, you can open a verified account in minutes at eToro and you only need to risk $10 to invest in Bitcoin in a safe and secure manner.

Payment types accepted at eToro include debit/credit cards issued by Visa and MasterCard, e-wallets like Paypal and Neteller, and traditional bank transfers. So whether you want to buy Bitcoin with PayPal, bank transfer, or any other method, the choice is yours.

Moreover, if you’re from the US, you won’t pay any deposit or withdrawal fees – regardless of which payment method you opt for. Once your account is funded in US dollars, eToro then allows you to buy Bitcoin on a spread-only basis (from 0.75%).

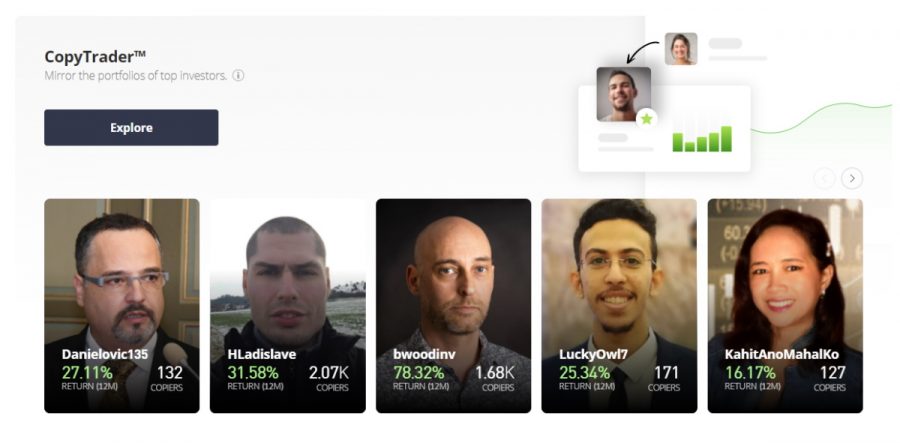

This means that instead of paying a variable commission, you simply need to cover the gap between the buy and sell price. eToro is also useful if you are looking to invest in alternative cryptocurrencies – with the broker supporting 70+ digital tokens. Hence, you can buy Solana, Dogecoin, Ethereum, Polkadot, The Graph, and more with the click of a button. You can also invest in stocks, ETFs, commodities, indices, and forex. If you’re strapped for time or have little to no experience in the investment space – you might also consider the eToro Copy Trading tool.

This allows you to select an experienced trader that you like the look of and then copy their ongoing investments. This comes at no additional fee and requires a minimum outlay of just $200. You can also invest in a pre-made basket of cryptocurrencies via the CryptoPortfolio tool – which is professionally managed and rebalanced by the eToro team.

When it comes to safety, eToro is regulated on multiple fronts. This is inclusive of the SEC (with FINRA membership), FCA, ASIC, and CySEC. The platform is home to over 23 million clients from around the world – and it’s planning to go public later this year. Finally, if you want to invest in Bitcoin via your smartphone, you can download the eToro app and use the eToro crypto credit card to conveniently spend your crypto holdings as and when you want.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Webull – Invest in Cryptocurrency With Just $1

The process of investing in Bitcoin doesn’t require a large capital outlay when you use an online broker like Webull. Not only does the user-friendly platform allow you to open an account without meeting a minimum deposit – but you can invest in Bitcoin from just $1 upwards.

The process of investing in Bitcoin doesn’t require a large capital outlay when you use an online broker like Webull. Not only does the user-friendly platform allow you to open an account without meeting a minimum deposit – but you can invest in Bitcoin from just $1 upwards.

And as such, this will suit first-timers that wish to test the Bitcoin markets out before risking higher sums. At Webull, this $1 minimum extends to all of the other cryptocurrencies supported on the platform – which includes everything from Shiba Inu, Dogecoin, and Litecoin to Ethereum, Chainlink, and Basic Attention Token. Moreover, Webull supports other asset classes on its platform – such as US-listed stocks, ETFs, and options.

Although Webull is typically used by casual traders, the platform does offer a selection of advanced tools and features that will appeal to seasoned investors. This includes no less than 12 charting tools and 50+ technical indicators. In terms of fees, you can invest in cryptocurrency – and any other supported financial instrument, at 0% commission. No deposit fees apply on ACH transactions, but bank wires are charged at $8.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

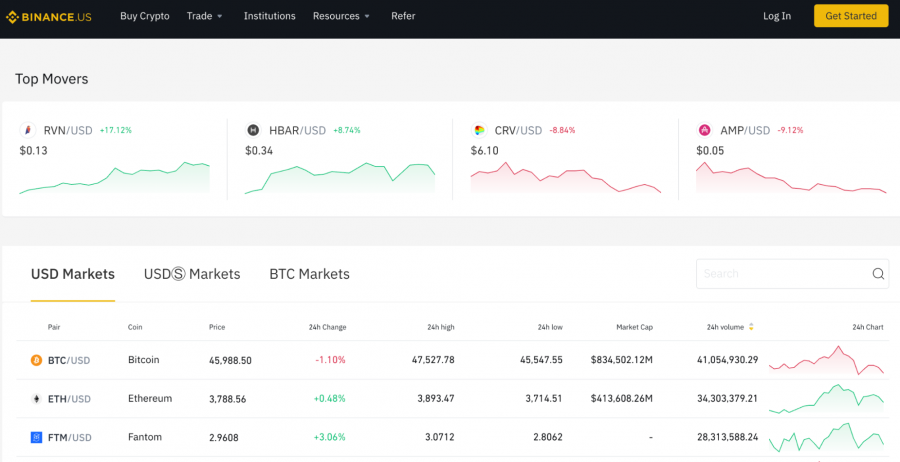

3. Binance – Invest in Bitcoin and 60+ Other Cryptocurrencies

The Binance US platform enables Americans to invest in Bitcoin and 60+ other supported cryptocurrencies. As such, this is a good option if you are planning to create a diversified portfolio of digital currencies. Some of the most popular tokens available in addition to Bitcoin include Ethereum, Litecoin, Dogecoin, and Cardano.

The Binance US platform enables Americans to invest in Bitcoin and 60+ other supported cryptocurrencies. As such, this is a good option if you are planning to create a diversified portfolio of digital currencies. Some of the most popular tokens available in addition to Bitcoin include Ethereum, Litecoin, Dogecoin, and Cardano.

Binance US also supports a wave of DeFi (Decentralized Finance) tokens – which includes the likes of Chainlink and VeChain. In terms of paying for your Bitcoin investment, the fees will depend on the payment method that you opt for. For instance, if you prefer the convenience of using a debit or credit card, this will set you back 4.5% in transaction fees – in addition to a 0.5% commission. Alternatively, ACH and domestic wire transfer deposits are free – so it’s just the 0.5% commission that you will pay.

If you decide to use Binance to exchange digital tokens – for instance, Bitcoin to Ethereum or Cardano to Litecoin, then the commission stands at just 0.1% per slide. Moreover, if you trade large volumes, this commission is lowered even further. To open an account at Binance, you will need to upload some ID. After that, you can proceed to invest in Bitcoin at the click of a button. Finally, Binance also offers educational materials and OTC services.

If you decide to use Binance to exchange digital tokens – for instance, Bitcoin to Ethereum or Cardano to Litecoin, then the commission stands at just 0.1% per slide. Moreover, if you trade large volumes, this commission is lowered even further. To open an account at Binance, you will need to upload some ID. After that, you can proceed to invest in Bitcoin at the click of a button. Finally, Binance also offers educational materials and OTC services.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Coinbase – Invest in Bitcoin via a Beginner-Friendly Platform

The next broker to consider when thinking about where to invest in Bitcoin is Coinbase. This NASDAQ-listed cryptocurrency broker is now used by tens of millions of clients – many of which are based in the US. The platform offers a safe and convenient way to invest in Bitcoin and dozens of other cryptocurrencies – so it’s ideal for beginners.

The next broker to consider when thinking about where to invest in Bitcoin is Coinbase. This NASDAQ-listed cryptocurrency broker is now used by tens of millions of clients – many of which are based in the US. The platform offers a safe and convenient way to invest in Bitcoin and dozens of other cryptocurrencies – so it’s ideal for beginners.

However, irrespective of how you intend on paying for your Bitcoin investment, Coinbase is a lot more expensive than the other brokers discussed thus far. For example, if you deposit funds via ACH and proceed to invest in Bitcoin once the money arrives – this will cost you 1.5% in fees. Paying for your Bitcoin investment instantly with a debit/credit card will set you back 3.99%.

Taking this into account, fee-conscious investors might be better off using eToro. Nevertheless, Coinbase also stands out for its commitment to security. Among many other safeguards, 98% of client funds are kept offline in cold storage and all account users must set up two-factor authentication. Furthermore, you can place a 48-hour time lock on withdrawal requests, which ensures that you have sufficient time to act should your account become compromised.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Kraken Pro – Invest in Bitcoin via an Advanced Trading Suite

If you’re an active trader that is looking to gain exposure to Bitcoin via sophisticated tools, Kraken Pro could be the best option for your skillset. This top-rated cryptocurrency exchange was launched way back in 2011 – which makes it one of the most established in this space. US clients can deposit funds only with a domestic bank wire or crypto. ACH payments are only accepted when making a withdrawal.

If you’re an active trader that is looking to gain exposure to Bitcoin via sophisticated tools, Kraken Pro could be the best option for your skillset. This top-rated cryptocurrency exchange was launched way back in 2011 – which makes it one of the most established in this space. US clients can deposit funds only with a domestic bank wire or crypto. ACH payments are only accepted when making a withdrawal.

With regards to the Kraken Pro platform itself, you will find a large suite of advanced order types and charting tools. The latter includes the ability to draw trend lines and overlays, as well as access technical indicators. In terms of trading fees, Kraken Pro charges market makers and takers 0.16% and 0.26% respectively. Lowers commissions are offered when trading volumes hit certain milestones, starting from $50,000 within a 30-day period.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Should I Invest in Bitcoin?

Once you have decided which online broker is a good fit for your trading goals and skill set, it’s time to do some independent research.

By this, we mean diving deep into whether or not a Bitcoin investment is right for your portfolio.

To help clear the mist, below we discuss five key reasons why you might choose to invest in Bitcoin right now.

Bitcoin is Still an Emerging Asset Class

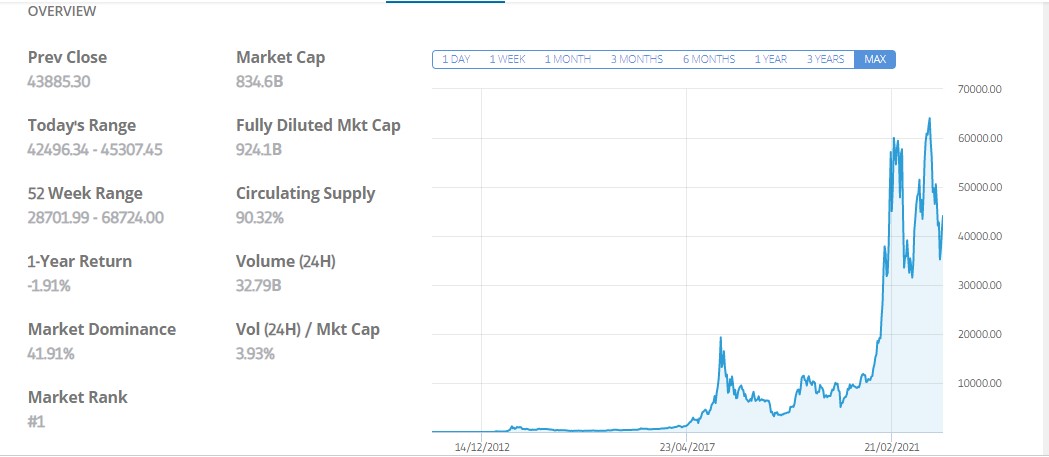

Many market commentators argue that Bitcoin in 2022 is the Apple or Microsoft of the 1980s. In other words, when you consider that Bitcoin was launched as recently as 2009, the concept of cryptocurrencies and blockchain technology is still in its infancy.

And as such, by investing in Bitcoin today, you have the opportunity to gain exposure to an emerging asset class that is yet to reach its full potential.

Bitcoin Growth Since 2009

Although Bitcoin was launched in January 2009, it wasn’t until February 2011 that the digital currency surpassed a value of $1 per token. Moreover, it took a further two years for Bitcoin to hit $1,000.

Fast forward to late 2021, and Bitcoin reached an all-time high value of nearly $69,000. When comparing this to the price of Bitcoin in 2011, this translates into 10-year returns of over 6.8 million percent.

In other words, if you invested $1,000 into Bitcoin back in 2011 and sold when the digital currency hit $69,000 per token, you would have cashed out more than $68 million. This highlights just how well Bitcoin has performed in such a short period of time.

Bitcoin vs Stock Markets

One of the best ways to assess whether or not an alternative asset class like Bitcoin is worth buying is to compare its performance against the broader stock markets. For this purpose, a great benchmark is the S&P 500 index.

- Over the past five years, the S&P 500 has grown by approximately 94% – which illustrates attractive returns.

- However, over the same period, Bitcoin has grown by over 3,500% – which dwarfs that of the S&P 500.

Crucially, it is important to note that your investment portfolio should remain well diversified. As such, if you choose to invest in Bitcoin, it’s also worth allocating some funds to the traditional stock markets – and perhaps, bonds too.

Digital Gold

BTC is one of the best coins to mine in 2022. Bitcoin is often referred to as the digital version of gold, not least because the two asset classes carry a number of similar characteristics. For instance, there is a finite quantity of gold, meaning that once the Earth’s entire supply is mined, nothing more can enter circulation.

- Similarly, Bitcoin is also finite, as only 21 million tokens will ever be created. Furthermore, just like gold, the circulating supply increases at steady intervals.

- In the case of Bitcoin, this happens every 10 minutes, albeit, every four years or so, the amount minted per block is halved.

Another characteristic that both Bitcoin and gold share is that both asset classes are viewed as a hedge against the broader financial markets. More specifically, when the inflation levels are rising and the stock markets are down, Bitcoin and gold offer attractive hedging opportunities.

Interest

Some platforms, such as Aqru, now allow you to earn interest on Bitcoin. This means you can earn on your investment in a passive way, with Aqru offering a very high 7% interest rate with flexibe account terms.

Easy to Invest and Highly Liquid

First-time Bitcoin investors are often concerned that the process of buying the digital currency is complex. Moreover, there is also a misconception that there are barriers when it comes to cashing out. However, this couldn’t be further from the truth.

First and foremost, anyone can invest in Bitcoin from the comfort of home in a matter of minutes with a debit/credit card or bank transfer. This can be achieved safely and conveniently via an SEC-regulated cryptocurrency broker.

Second, Bitcoin operates in a multi-trillion dollar cryptocurrency trading industry that never sleeps. As such, 24 hours per day, 7 days per week – you can easily cash out your Bitcoin investment back to US dollars through your chosen online broker.

What is the Best Way to Invest in Bitcoin?

There are essentially two ways to invest in Bitcoin in 2022.

You can either buy BTC tokens via an online exchange or broker, or invest in stocks that offer direct exposure to the digital currency.

Having said this you could also gain exposure to the crypto market via crypto CFDs. For example, if you opened an account with the leading crypto bots Bitcoin Prime, or Bitcoin Trader, you could speculate on the price movements of BTC crosses via contracts for difference. Moreover, the best part about using a crypto robot is that it does all the work for based on criteria and parameters that you configure.

Buying Bitcoin

It goes without saying that the easiest way to invest in Bitcoin is to simply open an account with an online broker and purchase some tokens.

In doing so, you will retain full ownership of your digital assets until you are ready to cash out. And, your profits or losses will directly correlate with the market price of Bitcoin.

That is to say, if you invested $500 into Bitcoin and its value subsequently increases by 25%, you make a profit of $125.

Investing in Bitcoin Stocks

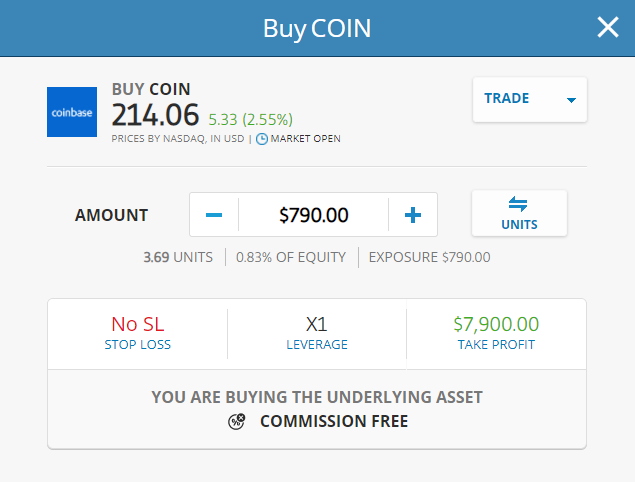

The other option is to buy some stocks that correlate to the Bitcoin market. If you’re wondering how to invest in Bitcoin stocks, the best option is to look at Coinbase.

As mentioned earlier, Coinbase is a large US-based cryptocurrency broker that is publicly listed on the NASDAQ. In theory, when the value of Bitcoin and the wider cryptocurrency markets are in an upward trend, this should have a positive effect on Coinbase stocks.

As mentioned earlier, Coinbase is a large US-based cryptocurrency broker that is publicly listed on the NASDAQ. In theory, when the value of Bitcoin and the wider cryptocurrency markets are in an upward trend, this should have a positive effect on Coinbase stocks.

However, the correlation will never be like-for-like. After all, there are many other variables to take into account when you buy stocks – such as the company’s balance sheet, quarterly earnings, debt levels, and more.

Once again, this is why buying Bitcoin is the best way to invest in the digital asset.

Invest in Bitcoin vs Trading Bitcoin

Another thing to consider when learning how to invest in Bitcoin is the specific trading strategy that you adopt.

For example, more experienced investors will often look to time the markets – which means actively placing trades.

This means that the investor might invest in Bitcoin when the markets are overly strong, and offload when it appears that the upward trend is beginning to reverse. Then, they might wait for the markets to correct before once again entering a new position.

On the other hand, beginners will be better suited to a longer-term investment strategy. In most cases, this will see you invest in Bitcoin and then keep hold of your digital assets for several months or years.

This option means that you can spend less time researching the markets and watching over the value of your position. Instead, you can sit back and ‘HODL’ until you feel it is the right time to sell.

Note: The term ‘HODL’ is a play on the word ‘hold’. In Bitcoin jargon, this simply means holding onto your investment in the long run – and not selling when the markets go through short-term pricing spikes.

How Much to Invest in Bitcoin

Irrespective of which asset class you are investing in – it is important to have a clear plan in terms of stakes. By this, we mean thinking about how much money you can realistically afford to lose when investing in Bitcoin – based on your budget and tolerance for risk.

- For example, although Bitcoin is a highly liquid asset – which means that you can cash out at any given time, it is also highly volatile and speculative.

- This means that should you need to cash out your Bitcoin tokens to fund an emergency expense – you might get back less than you originally invested.

- This is why you should only invest amounts that you are comfortable with.

Another thing to note is that you should avoid going ‘all-in’ when investing in Bitcoin. Instead, your portfolio should contain a much larger percentage of traditional asset classes – such as index funds, ETFs, and blue-chip stocks.

This will help balance out the risks involved with Bitcoin – and ensure that you are not overexposed to a single asset.

Moreover, and as we cover in more detail shortly, instead of investing a lump sum into Bitcoin – it’s best to inject small but regular amounts via a dollar-cost average strategy.

Choosing a Bitcoin Wallet for Investing

Another aspect that often puts newbies off from investing in Bitcoin are the steps involved in keeping the digital tokens safe. This is because Bitcoin – like all other cryptocurrencies, is stored in a ‘wallet’.

- These Bitcoin wallets often come in the form of a mobile app, albeit, desktop software, hardware devices, and online storage options also exist.

- Regardless of the wallet type you elect to use when storing your Bitcoin tokens, it is crucial that you adopt a range of security procedures.

- This includes never giving out your private keys, setting up two-factor authentication (if offered by the wallet), and sticking with reputable and trusted providers.

- After all, if the worst happens and your wallet is compromised, then there is every chance that your Bitcoin funds will be stolen.

If this does happen, you will have nowhere to turn. This is why we suggest considering SEC-regulated broker eToro for your Bitcoin storage requirements.

This is because once you invest in Bitcoin via the eToro website, the tokens will be safeguarded by eToro’s institutional-grade security tools.

This means that you don’t need to worry about learning the ropes of wallet security tools and risks, as the tokens will be kept safe by eToro until you decide to cash out.

Bitcoin Investment Strategies

Seasoned traders will never invest in Bitcoin without first having a pre-defined strategy in place.

There are many Bitcoin investment strategies to consider, albeit, the one that you opt for will typically depend on your financial goals and how much risk you are willing to take.

With this in mind, when learning how to invest in Bitcoin – consider some of the strategies discussed below.

Dollar-Cost Average to Avoid Volatility

We mentioned earlier that Bitcoin can be an extremely volatile asset class at times. As a newbie investor, this can be intimidating.

- For example, in mid-2021, Bitcoin went from highs of $61,000 to lows of $31,000 in the space of just a few months.

- However, just a few months later, Bitcoin then hit all-time highs of almost $69,000.

Crucially, this emotional rollercoaster ride can be mitigated by dollar-cost averaging your investments.

This simply means investing smaller amounts at regular intervals. For instance, you might elect to invest $100 per month – regardless of how Bitcoin is performing.

In doing so, you will average out your break-even point on each investment. If adopting this Bitcoin investment strategy, it’s best to use a broker that supports small stakes.

At eToro, for instance, you only need to meet a $10 minimum. As such, by depositing $120, you can invest $10 per month for an entire year.

Stay Safe With SEC-Regulated Bitcoin Brokers

The next strategy to adopt when learning how to invest in Bitcoin is to ensure that you only make purchases from a trusted broker that takes security and regulation seriously.

You can do this with ease by sticking with Bitcoin brokers that are authorized and regulated by the SEC.

The alternative to this is to use an unlicensed cryptocurrency exchange that offers nothing in the way of regulatory protection.

Although such exchanges might offer super-low fees and an assortment of features, you can never be certain that your Bitcoin funds are in safe hands.

Have an Investment Target in Place

Another strategy to consider using when investing in Bitcoin is to have clear targets in place.

- For example, let’s suppose that you want to make gains of 75% from your Bitcoin investment.

- If you invest when the price of Bitcoin is $40,000 – this means that the digital currency needs to exceed a value of $70,000 per token.

If and when your target is met, you can then elect to sell your Bitcoin tokens back to cash. The most effective way of deploying a target Bitcoin price is via a take-profit order.

For those unaware, take-profit orders – which are available at platforms like eToro and Binance, allow you to specify an exact price that you wish to sell your investment.

When this price is triggered by the markets (for example, $70,000), your chosen broker will automatically close your position.

In addition to take-profits, it is also worth considering a stop-loss order when you invest in Bitcoin. This works in the same way as a take-profit but in reverse.

- For instance, you might decide that the most you are prepared to lose from your Bitcoin investment is 20%.

- If the price of Bitcoin stands at $40,000 at the time of the investment, you would need to set your stop-loss at $32,000.

- If the specified price is triggered, then the broker will automatically close your position.

Ultimately, by placing both take-profits and stop-losses, this means that you don’t need to constantly check the price of Bitcoin, as your chosen broker will close your trade when one of your orders is triggered.

How to Invest in Bitcoin & Make Money – Example

If you’re wondering how to make money from a Bitcoin investment, this section of our beginner’s guide will explain the process with some simple examples.

Fractional Investment

The first thing to mention is that unless you are looking to invest thousands of dollars to purchase a single Bitcoin, you will be buying a fraction of one token.

The good news is that the returns on your investment will work out in exactly the same way as buying a full Bitcoin.

For example:

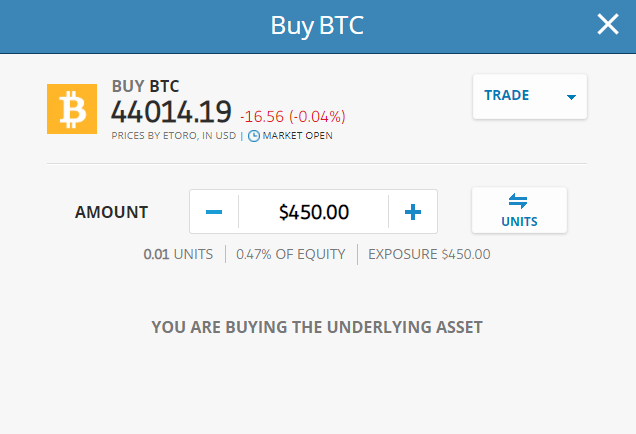

- Let’s suppose that you want to invest in Bitcoin when the digital asset is priced at $45,000

- You decide to invest a total of $450

- This means that you are buying 1% of a single Bitcoin token – or 0.01 units.

- We’ll then say that a few months later, Bitcoin is priced at $53,500 – or 30% higher

- On your stake of $450, this means that your investment is now worth $585

As per the above, it doesn’t matter if you own a full Bitcoin or just a tiny fraction of one token – your gains and losses will be determined by the percentage amount that the digital asset increases or decreases.

Long-Term Buy and Hold Strategy

In this example of how to make money by investing in Bitcoin, we’ll look at what returns you would have made had you entered the market five years ago.

- In the five years prior to writing this guide, Bitcoin was priced at just over $1,000 per token

- We’ll say that you decided to invest a total of $5,000 at this entry price

- As of writing, Bitcoin is trading around the $42,000 level

- This translates into 5-year returns of over 4,000%

In the above example, you invested $5,000 five years ago and you are now looking at returns of 4,000%. And as such, if you were to cash out, you would receive over $200,000. For more details on the best long term crypto investments be sure to read our full guide.

Short-Term Strategy

Now let’s look at a real-world example of how a short-term Bitcoin trade might pan out.

- Let’s say that you invested $2,000 into Bitcoin in mid-July 2021 – when the digital token was priced at just over $30,000

- Just three months later, Bitcoin was priced at $64,000 per token

- This represents growth of approximately 110%

- As such, you decide to cash out your investment

As per the above, in the space of just three months, you made a 110% profit on a $2,000 Bitcoin investment. Therefore, your total cash-out amount would have stood at $4,200.

When is the Best Time to Invest in Bitcoin?

Unless you are a seasoned investor with a firm understanding of technical analysis and high-level research, there is no value in attempting to time the market.

On the contrary, instead of trying to invest in Bitcoin at the right time – the previously discussed dollar-cost averaging strategy will be a lot more effective.

This is because you will be investing in Bitcoin in the long run by allocating smaller amounts to the digital token – but at regular intervals.

And as such, you do not need to worry about whether or not you have timed the market correctly – as each investment will be averaged out.

How to Invest in Bitcoin – Tutorial

This section of our guide will explain how to invest in Bitcoin via SEC-regulated broker eToro.

You will learn how to open a verified account, deposit funds, and place an investment order in less than 10 minutes.

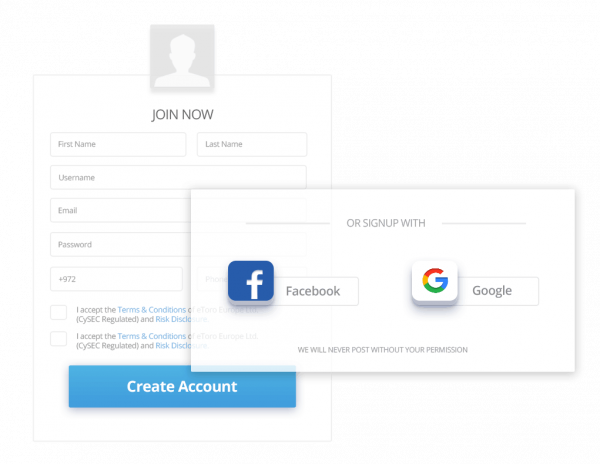

Step 1: Open an Account

The first step is to visit the eToro website and click on the ‘Join Now’ button – which you will find at the top of the homepage. A registration form will then appear on your screen.

Initially, you will need to enter your first and last name, email address, cell phone number, and a chosen username and password.

Next, you’ll need to provide some additional personal details – such as your date of birth and home address.

Next, you’ll need to provide some additional personal details – such as your date of birth and home address.

Finally, to complete the registration process, you will need to verify your cell phone number by entering the SMS code that eToro sends to you.

Step 2: Identity Verification

In less than 1-2 minutes, you can verify your eToro account by uploading some ID. This will increase your deposit limits and make you eligible to request withdrawals.

To get verified, you can upload a copy of your driver’s license, passport, or state-issued ID. To prove your residency status, upload a recently issued bank statement or electricity/water bill.

Step 3: Make a Deposit

If you are depositing funds in US dollars, then no fees apply. At eToro, you can choose from a debit/credit card or an e-wallet to have your deposit processed instantly.

If you’re happy to wait 1-3 working days, ACH and bank wire transfers are also supported. The minimum deposit at eToro for US clients is just $10.

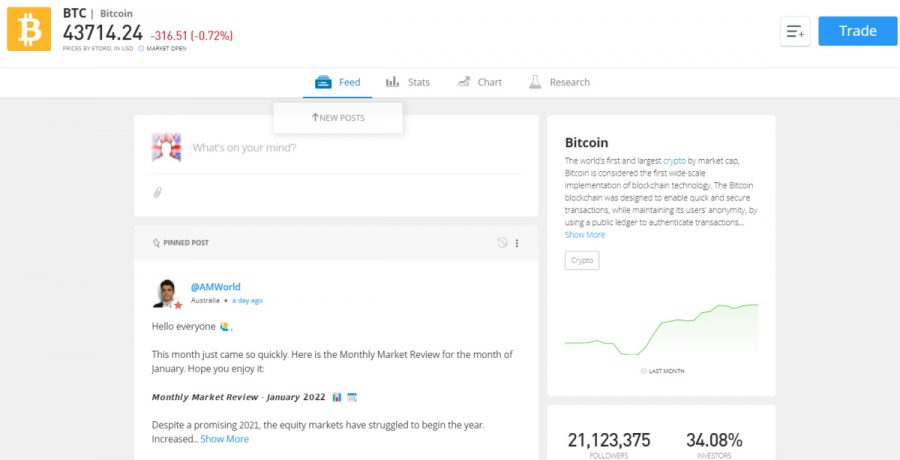

Step 4: Search for Bitcoin

You should now have a verified eToro account with at least $10 in funds. If so, you can invest in Bitcoin.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney