Solana’s SOL token dominated cryptocurrency markets in August, nearly tripling in price as investors speculated on fast growth in “smart contract” blockchains that might one day rival Ethereum.

The price of the SOL token rose 195% in August to $108, and it now has a market value of $33.7 billion, breaking into the ranks of the world’s 10 biggest cryptocurrencies, based on data from Messari and other providers. Just this year, the asset has jumped a staggering 62-fold.

The LUNA token from Terra, another smart-contract blockchain, also nearly tripled in price in August, pushing its market capitalization to about $13 billion.

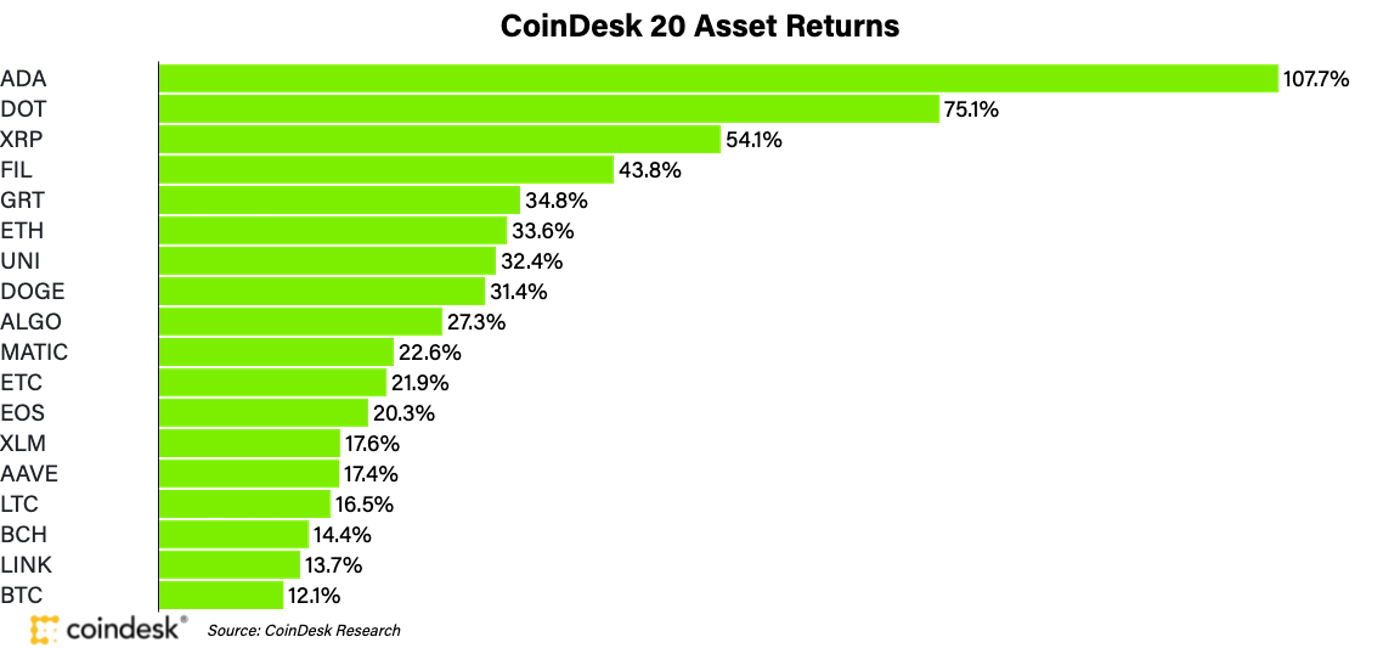

Among the CoinDesk 20, a curated roster of digital assets, the top performer was Cardano’s ADA token, which doubled in price during the month, followed by Polkadot’s DOT with a 75% return.

All of these top performers in August were members of a group dubbed “Ethereum killers” – so-called layer 1 blockchains offering low fees, enhanced scalability and fast transaction times designed to support applications such as decentralized finance (DeFi) as well as trading in non-fungible tokens (NFT).

The intense speculation comes as Ethereum, the second-largest blockchain overall after Bitcoin, prepares to undergo a major upgrade over the coming year known as Ethereum 2.0.

“We have enormous respect for the Ethereum developer community’s spirit,” Solana Labs CEO Anatoly Yakovenko, told CoinDesk. “It’s been an inspiration to watch, and in many ways laid the blueprint for disintermediating all of the world’s marketplaces, starting with DeFi. We are in the same fight.”

Among the CoinDesk 20 digital assets, Cardano's ADA token boasted the top performance in August, doubling in price. (CoinDesk)

Solana also launched its global five-week Ignition Hackathon on Aug. 31, which will focus on Web 3.0 development, DeFi, gaming and NFTs. While some traders and commenters on Twitter had speculated that the Ignition event implied that a token-burning announcement was imminent, a spokesperson for Solana said the rumor was false.

Solana, backed by investors including Andresseen Horowitz (a16z) and Polychain Capital, was founded in 2017 by Yakovenko and has garnered interest from investors because of its perceived scalability, low transaction costs and fast processing speed.

Ethereum is home to the most active development community among smart-contract blockchains and DeFi activity, as well as the fast-growing OpenSea NFT marketplace. But the network has struggled with congestion and high fees.

“ETH has experienced growing transaction fees amid the NFT frenzy, possibly attracting more users to other chains,” according to a report by Arcane Research. “However, in the DeFi ecosystem overall, Ethereum remains the clear leader, and it seems unlikely that any other protocol will dethrone Ethereum’s position in the near future.”