Bitcoin slipped below $48,000 on Tuesday as traders monitor the latest batch of regulatory developments. The cryptocurrency was trading around $47,000 at press time, down about 2% over the past 24 hours.

China’s central bank reiterated its concerns about cryptocurrencies on Tuesday, weighing on investor sentiment. The central bank highlighted perceived risks involved in crypto trading, a major reason for the country’s crackdown this year on exchanges.

In the U.S., analysts are waiting for the Securities and Exchange Commission to decide when and whether to approve a bitcoin-focused exchange-traded fund (ETF). “The fact that agency officials are sending signals about how they’re approaching these applications says something,” CoinDesk’s Nik De wrote in the State of Crypto newsletter published on Tuesday.

For decentralized finance (DeFi), however, “the SEC seems to be building precedents for more enforcement actions in this part of the crypto world,” De wrote.

Also on Tuesday, the parent company of stablecoin issuer Tether and crypto exchange Bitfinex, petitioned the New York Supreme Court to block the state’s attorney general from releasing documents to CoinDesk. The documents would detail the composition of Tether’s reserves over the past few years.

Latest Prices

- Bitcoin (BTC) $47,262, -2.7%

- Ether (ETH) $3,419, +2.2%

- S&P 500: -0.1%

- Gold: $1,817, +0.3%

- 10-year Treasury yield 1.305%, +0.025 percentage point

For now, some analysts see additional short-term consolidation in bitcoin, albeit above the 50-day moving average support level around $40,000.

“Once initial resistance is cleared, which we expect beyond the very near term, targeted resistance would become the all-time high near $69K-$70K,” wrote Katie Stockton, managing partner at Fairlead Strategies, in a Monday newsletter.

End of extreme leverage?

The winds are starting to shift in crypto markets from extreme leveraged trading to a more tame environment.

For example, crypto exchange FTX lowered its maximum leverage for these derivatives to 20 times, and Binance announced a similar move (which it said was implemented a week prior). BitMEX, whose former executives are facing trial in the U.S., still offers 100 times leverage, but its current CEO said in July that such aggressive borrowing is “very rare” on the platform.

While these actions seemed to signal the end of an exuberant era, they arguably capped off a trend that began months earlier, CoinDesk’s executive editor, Marc Hochstein, wrote in the Crypto Long & Short newsletter on Sunday.

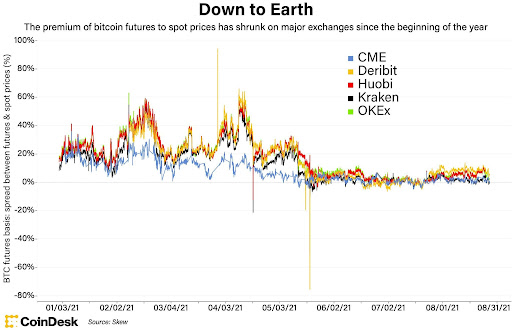

The chart below shows the one-month bitcoin futures premium across exchanges has declined from 40% in mid-February to current lows around 8% – likely a sign of decreased leverage.

Ethereum fee spike

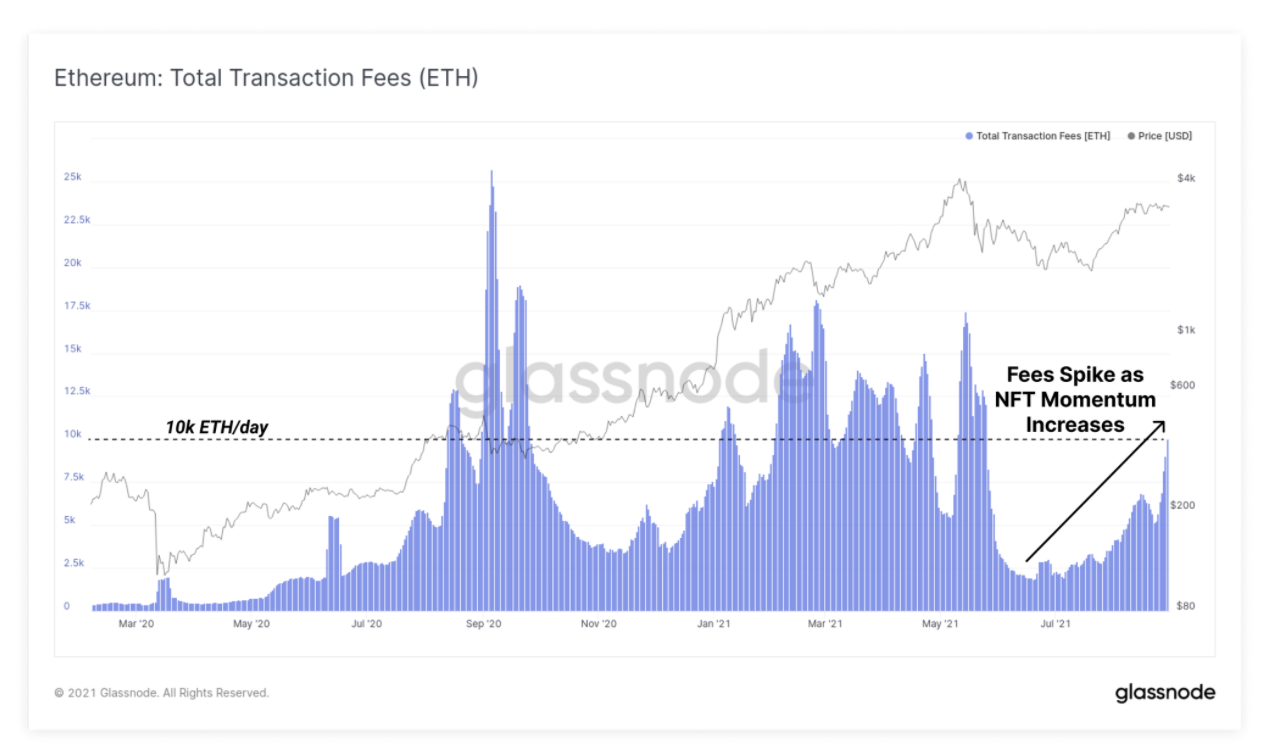

Transaction fees on the Ethereum blockchain have spiked recently, partly due to the resurgence of non-fungible token (NFT) activities.

Total transaction fees currently sit around 10,000 ETH per day, a relatively high level compared with the “DeFi summer” witnessed in 2020, according to data from Glassnode.

“However, the heightened market attention for NFTs has come at a cost, with DeFi tokens appearing to be the losers in the equation,” Glassnode wrote in a blog post. For example, blockchain transactions involving a number of large DeFi tokens have reached new lows.

Chart shows Ethereum total transaction fees per day. Source: Glassnode

DeFi activity heats up

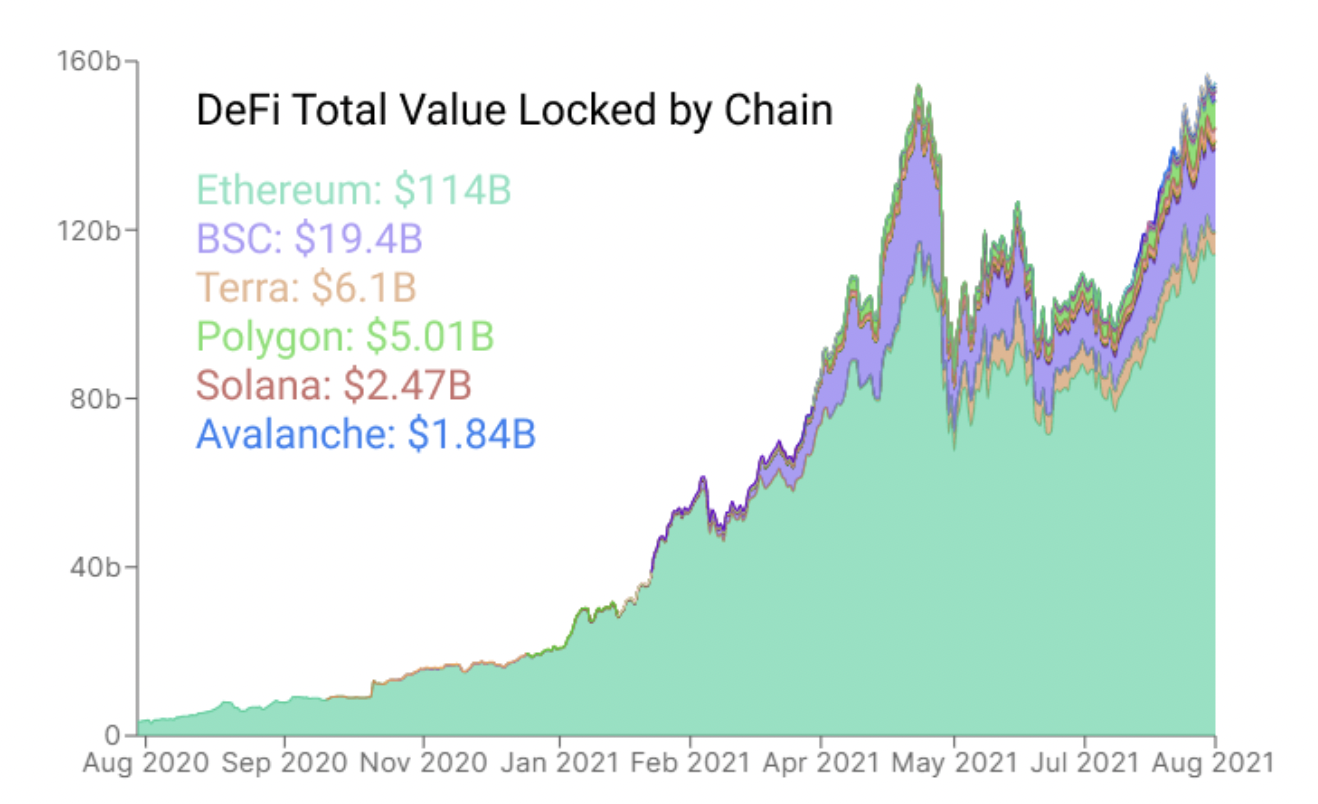

Despite some weak spots in transaction data, DeFi tokens have caught a strong bid this month. “This has especially been the case for Avalanche, where $180 million in liquidity mining incentives have triggered a parabolic move in the chain’s total value locked (TVL) and in the native token price,” Glassnode wrote in a blog post.

The chain’s TVL has increased from near zero to over $1.8 billion. Avalanche surged nearly 200% over the past month to an all-time high near $58, but has slipped just below $40 at press time.

Chart shows DeFi total value locked by chain. Source: Glassnode

August altcoin surge

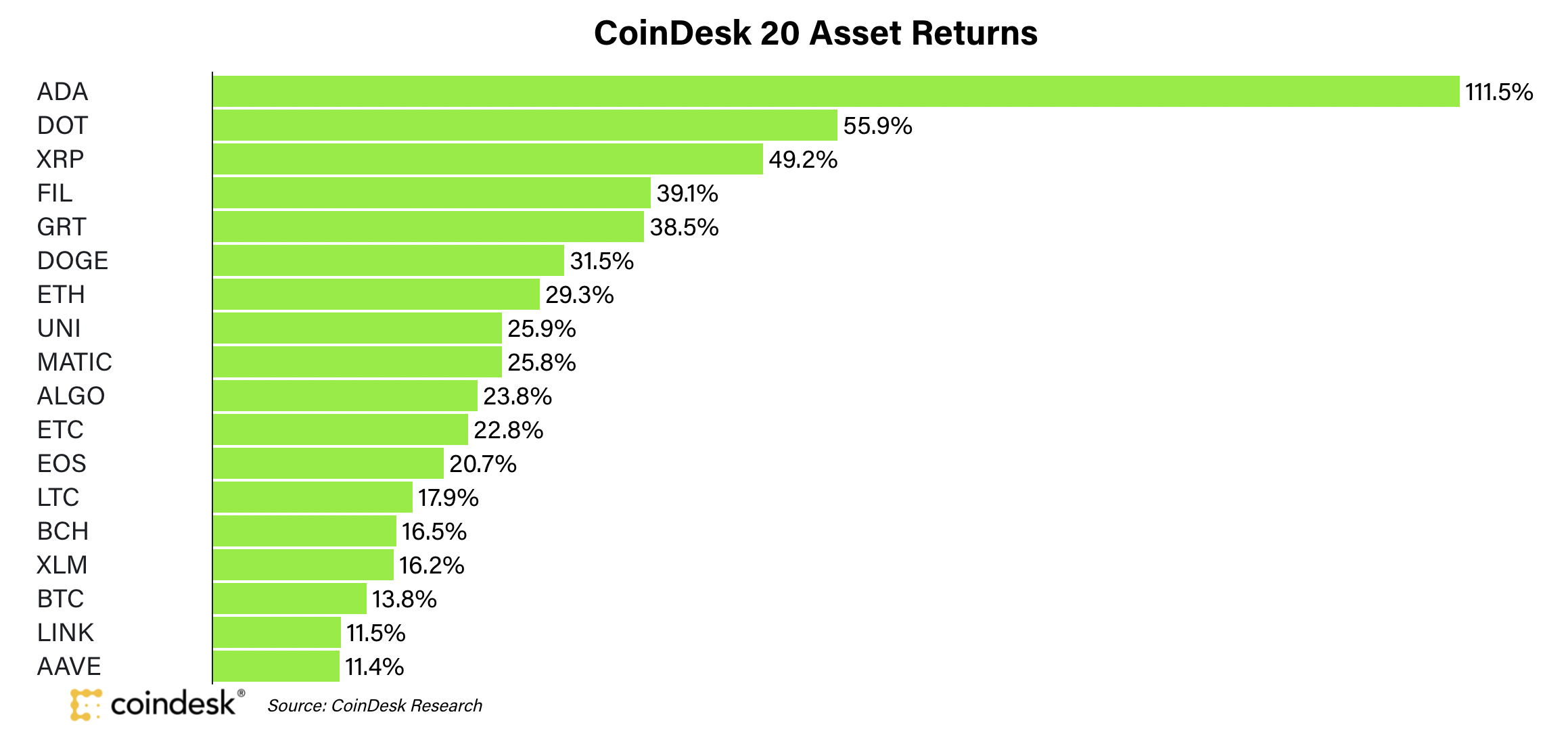

Speaking of altcoins, August was a strong month for cryptocurrencies such as Cardano’s ADA token along with Polkadot’s DOT and XRP. High returns, especially relative to bitcoin, suggests altseason is heating up, as discussed in Monday’s market wrap.

From a technical perspective, ADA is starting to pull back after reaching extreme overbought levels last week. Lower support is seen around the $2.40 to $2.60 breakout range, which could stabilize the decline.

Chart shows month to date returns for the CoinDesk 20.

Altcoin roundup:

- ETH looks to have become more scarce than BTC since the activation of EIP-1559. Data tweeted by Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, shows ether’s daily annualized net issuance fell to 1.11% earlier this week versus bitcoin’s 1.75%. If the trend continues, ether could attract store-of-value demand, which until now has been concentrated mainly toward bitcoin.

- NFT marketplace wars: Topps is utilizing the Avalanche blockchain to mint its latest collection with Major League Baseball (MLB), the trading card company announced on Tuesday, CoinDesk’s Eli Tan reports. That’s a switch from an earlier deal, where the Wax blockchain hosted the release of Topps’ first MLB-licensed non-fungible token (NFT) collection in April. Topps said in its press release that it was using Avalanche because it is “fast, low cost and eco-friendly.” The company added that “the site removes the need for special wallets or token apps and provides a single location to buy, sell and explore officially licensed Topps NFT collections.”

- Bored Apes, meet Modigliani: Sotheby’s is bringing Bored Apes to the world of fine art. The 277-year-old British auction house will be selling a collection of 101 Bored Ape Yacht Club (BAYC) NFTs created by Yuga Labs in an auction running Sept. 2-9. It will also offer a collection of 101 Bored Ape Kennel Club NFTs. Sotheby’s estimates the BAYC sale will total $12 million to $18 million, while those for the Bored Ape Kennel Club will fetch $1.5 million to $2 million, according to a press release. Bored Apes is the second-most popular NFT collection by total trade volume behind CryptoPunks, according to rarity.tools. The floor price at the time of writing for the cheapest available Bored Ape on the open market is 48.8 ETH, or $165,578.

Relevant News:

- FTX.US to Buy LedgerX in Bid for US Crypto Derivatives

- El Salvador to Create $150M Bitcoin Trust to Facilitate Exchange to US Dollars

- Genesis Digital Buys 20K Bitcoin Mining Machines From Canaan

- Why Everyone in NFTs Is Suddenly Talking About Price ‘Floors’

Other markets:

Most digital assets on CoinDesk 20 ended higher Tuesday.

Notable winners of 21:00 UTC (4:00 p.m. ET):

- Polkadot (DOT): $30.22, +10%

- Uniswap (UNI): $29.57, +4.7%

Notable losers:

- Terra (LUNA): $32.07, +9.9%