Bitcoin climbed over the weekend to the $19,200 territory. Looking at ether’s price as a percentage of spot BTC, it may be undervalued.

- Bitcoin (BTC) trading around $19,196 as of 21:00 UTC (4 p.m. ET). Gaining 0.35% over the previous 24 hours.

- Bitcoin’s 24-hour range: $18,990-$19,323 (CoinDesk 20)

- BTC near its 10-hour moving average but above the 50-hour on the hourly chart, a flat-to-bullish signal for market technicians.

Bitcoin trading on Bitstamp since Dec. 11.

The price of bitcoin reversed course over the weekend from a downward slide, with an upward trend that began on Saturday.

“This weekend, bitcoin demonstrated a V-shaped reversal. After the appearance of such a figure, the growth usually continues,” said Constantin Kogan, a partner at investment firm Wave Financial.

Daily spot bitcoin price the past six months on Bitstamp.

Over the past 24 hours, the price hit a high of $19,323, according to CoinDesk 20 data, before settling around $19,196 as of press time.

Read More: Bitcoin Still on Track to Breach $20K in Coming Weeks: Analysts

“Quite a strong move over the weekend,” noted Chris Thomas, head of digital assets for Swissquote Bank. “I wouldn’t expect a continuation of 3%-4% a day. We’ll likely test the highs again in the next few days and will be met with a lot more sell orders [from] short- to medium-term whales and institutional traders.”

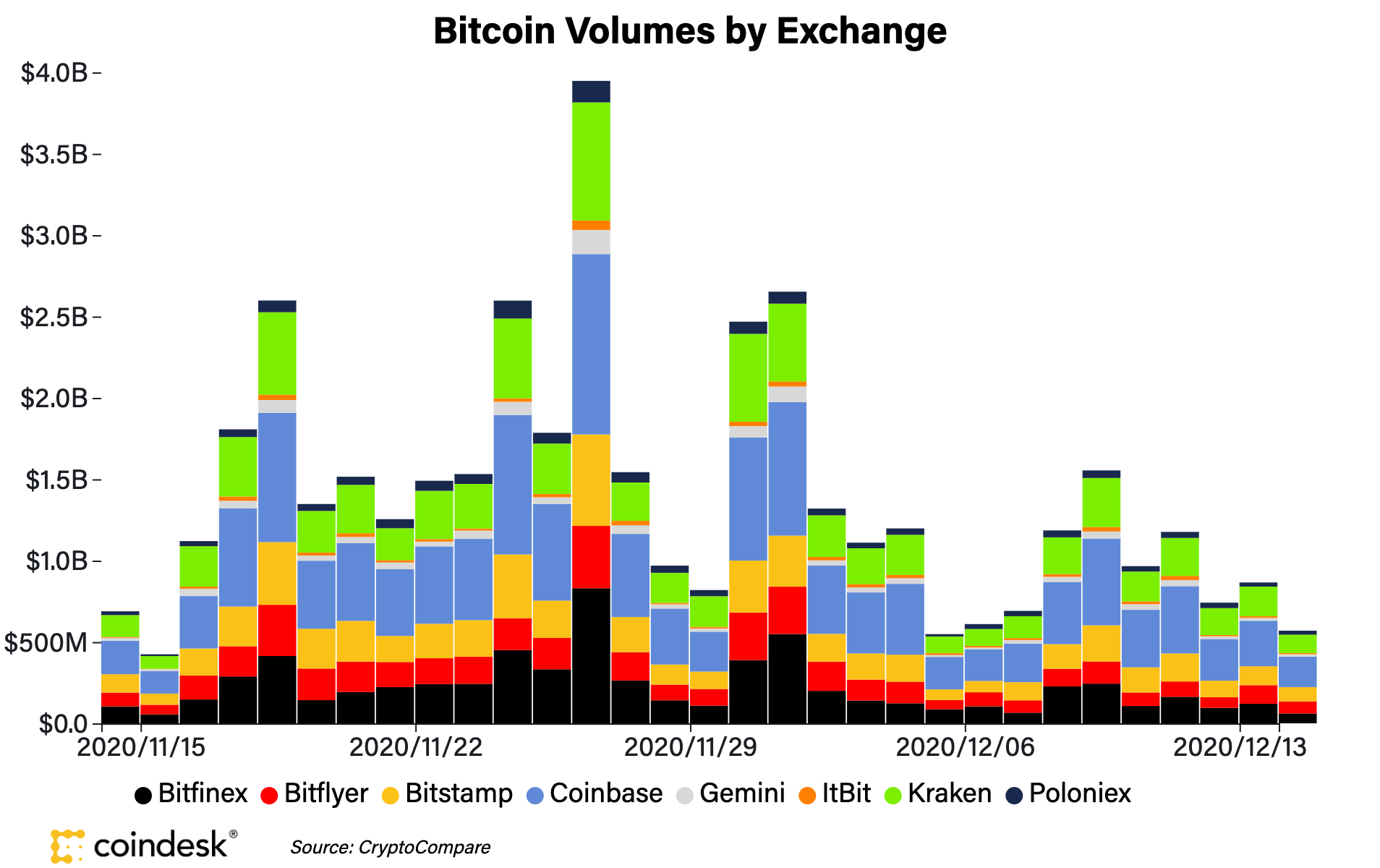

After a higher-than-expected amount of volume over the weekend, including over $865 million in spot exchange volume Sunday for the eight exchanges tracked by the CoinDesk 20, Monday’s tally is looking lower, at $569 million as of press time.

Bitcoin spot volumes on CoinDesk 20 exchanges.

“We still see the market challenging the all-time high but there is not a lot of conviction behind it. This can be seen in the lower volumes,” said Joel Edgerton, chief operating officer of cryptocurrency exchange Bitflyer USA. “December normally has lower volumes due to holidays and vacation among Western institutional clients.”

Read More: MassMutual’s Bitcoin Buy May Presage $600B Institutional Flood: JPMorgan

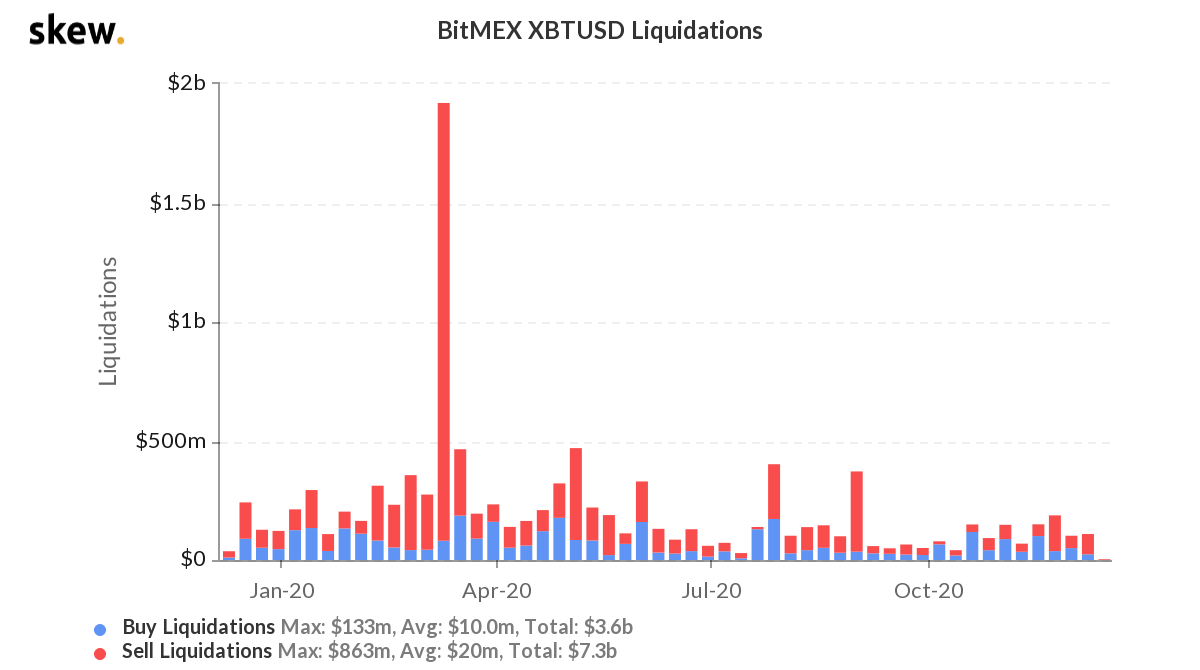

Fewer liquidations in the derivatives market is also helping bitcoin stay steadier. Stalwart futures platform BitMEX, for example, has seen liquidations, the platform’s equivalent of a margin call, dry up in the midst of its regulatory issues. The exchange’s influence in 2020 was previously obvious given the massive amount of sell liquidations that occurred in March when all markets crashed on macroeconomic issues related to the coronavirus.

Bitcoin liquidations on derivatives venue BitMEX the past year.

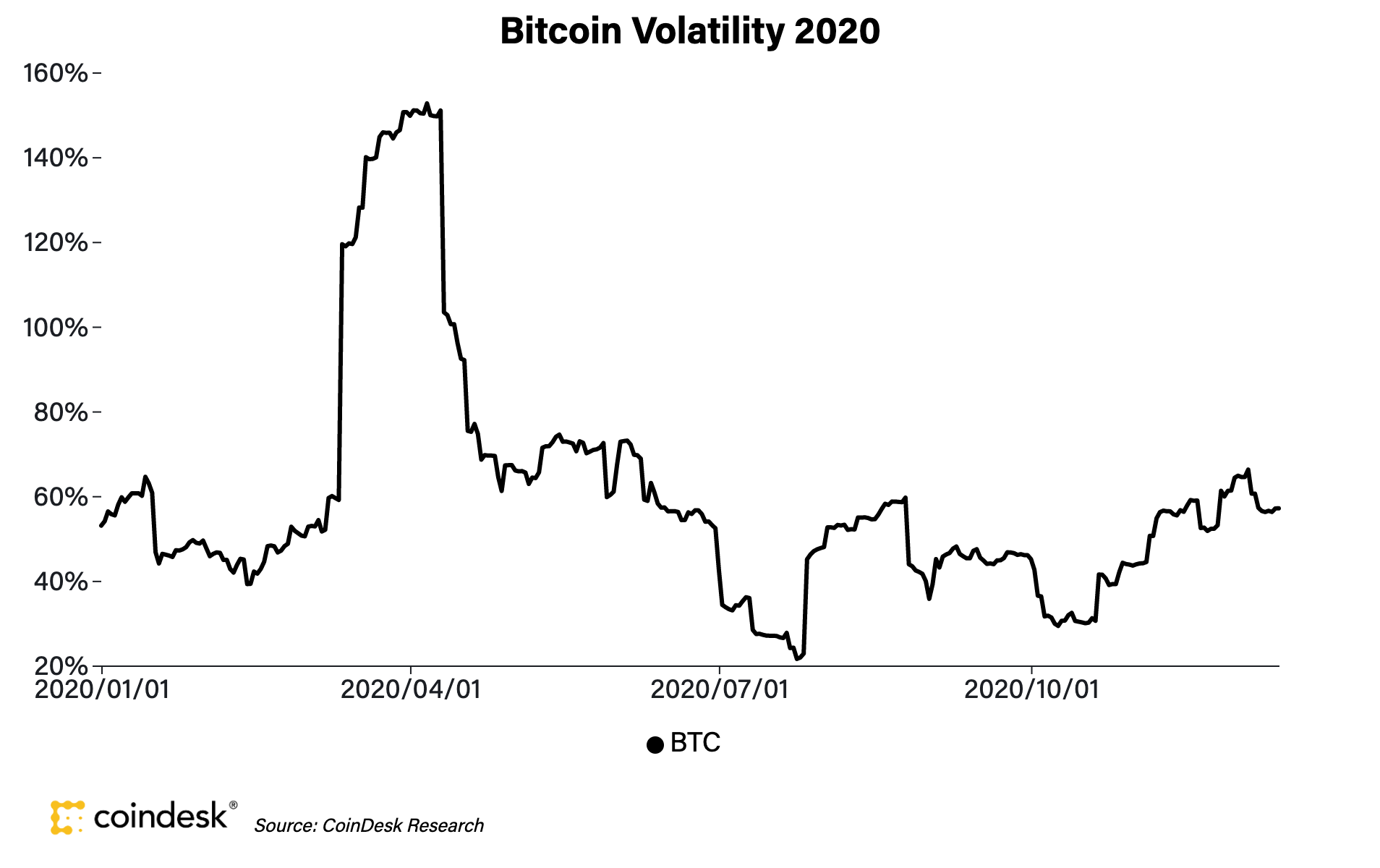

Since then, however, the BitMEX effect has waned. Bitcoin’s volatility has also flattened out of late, with the 30-day volatility as calculated by CoinDesk Research at 57%, close to where it started 2020 when it was at 53% Jan. 1.

Bitcoin’s 30-day volatility in 2020.

“There may be a few more attempts at the highs before the sellers disappear but, importantly, there is enough new volume on the buy side to keep us up around these levels and eventually buy all the sellers offers around $20,000,” added Swissquote’s Thomas.

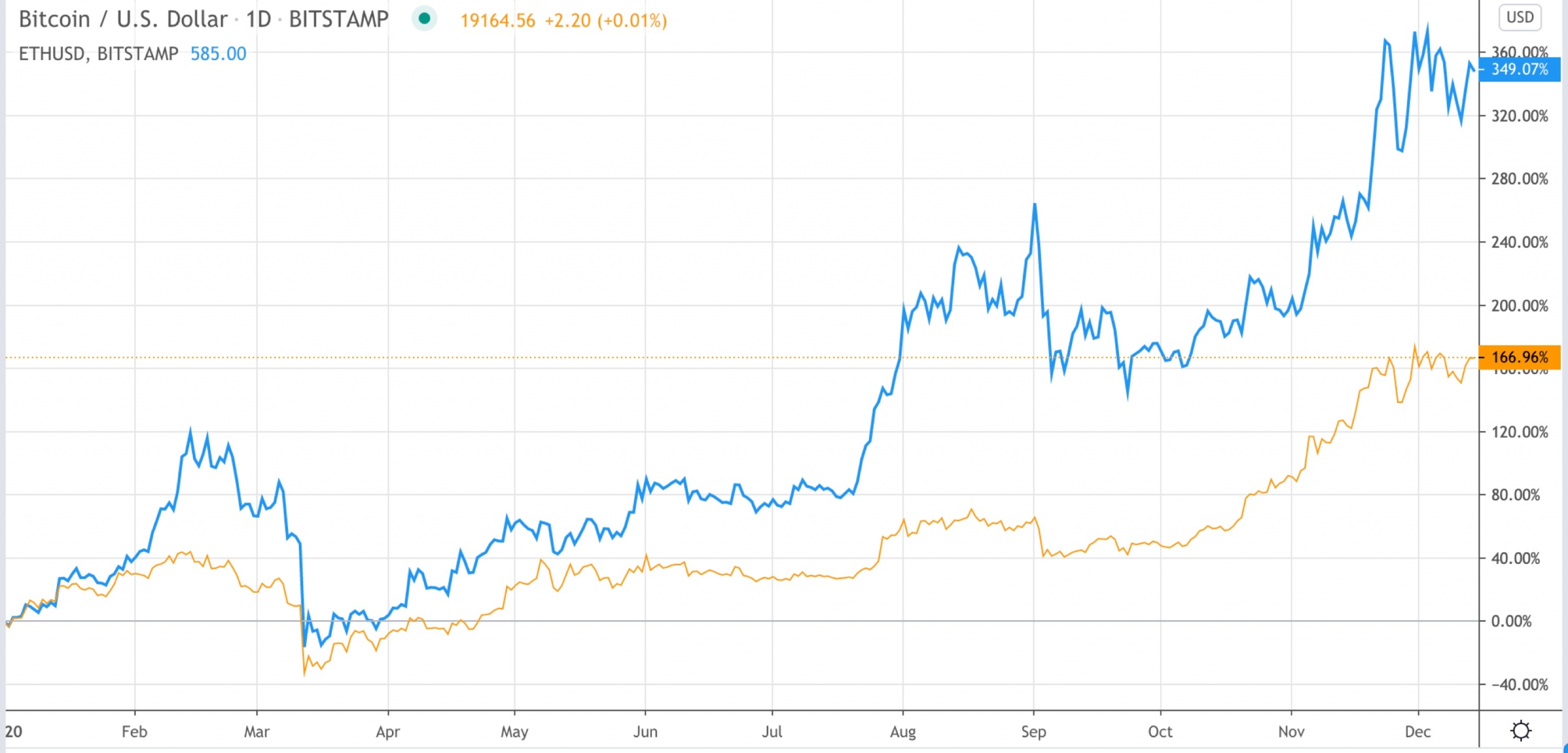

While bitcoin is up 166% so far this year, it’s ether that is going gangbusters in 2020, up over 346%.

Bitcoin (gold) performance versus ether (blue) in 2020.

Cryptocurrency veterans like Henrik Kugelberg, an over-the-counter trader, expect occasional peaks and troughs while remaining steadfastly mega-bullish. “Correction of course," he said, "on the way upwards on rocket fuel!”

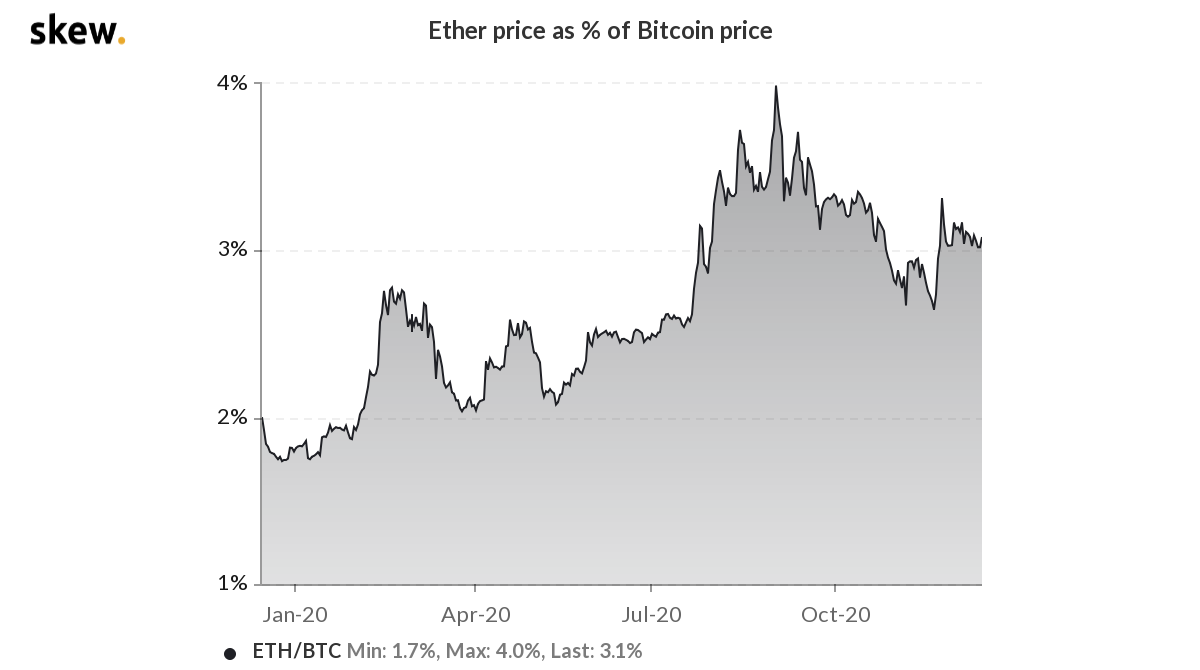

Ether at 3% of bitcoin’s price

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Monday, trading around $586 and climbing 0.14% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Read More: Mergers Position Yearn Finance as the Amazon of DeFi

Ether’s price as a percentage of the spot value of bitcoin is hovering around 3% according to data aggregator Skew. This is after the native asset of the Ethereum network started the year at below 2% of the price per 1 BTC and going as high as 4% on Sept. 1 during the fervent period of popularity for decentralized finance, or DeFi, in 2020.

Ether price as a percentage of bitcoin price over the past year.

John Willock, chief executive officer of Tritum, a diversified crypto services provider, is highly bullish on ether. He expects more institutional participation on the Ethereum network in 2021 and noted the increase in address activity in 2020.

“In the next six months, I think the most interesting metrics to follow will be large accumulations in addresses that can be attributed to institutional buyers soaking up supply, and proving long-term upward price expectations from educated participants,” Willock told CoinDesk. ”Things like [nonfungible tokens], DeFi and various other integrations this year that have utilized Ethereum as a layer but obfuscated it from users.”

Other markets

Digital assets on the CoinDesk 20 are mixed Monday, mostly red. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- algorand (ALGO) + 1.4%

- cardano (ADA) + 1.2%

- cosmos (ATOM) + 1%

Notable losers:

- xrp (XRP) - 3.5%

- omg network (OMG) - 3%

- 0x (ZRX) - 2.4%

Equities:

- Asia’s Nikkei 225 closed in the green 0.30%, pushed higher by big gains from Chiyoda Corp. and Kawasaki Heavy Industries, Ltd., which both jumped over 11% Monday.

- The FTSE 100 in Europe ended the day slipping 0.23% as U.K. Prime Minister Boris Johnson cautioned businesses to prepare for a possible Brexit no-deal Dec. 31.

- The S&P 500 in the United States slipped 0.60% as investors concerned with increasing coronavirus-related restrictions led to some selling.

Commodities:

- Oil was up 0.78%. Price per barrel of West Texas Intermediate crude: $46.93.

- Gold was in the red 0.59% and at $1,828 as of press time.

Treasurys:

- The 10-year U.S. Treasury bond yield fell Friday dipping to 0.898 and in the red 0.90%.