Bitcoin is making up for lost gains after hitting a one-week low. Over on Ethereum, the fee situation continues to be problematic for traders.

- Bitcoin (BTC) trading around $11,595 as of 20:00 UTC (4 p.m. ET). Gaining 2.1% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,119-$11,624

- BTC above the 10-day and slightly above the 50-day moving averages, a sideways yet turning bullish signal for market technicians.

Bitcoin trading on Coinbase since August 10.

Bitcoin rebounded Wednesday, making gains from a 24-hour low of $11,119 on spot exchanges like Coinbase, a price point not seen since Aug. 5.

Constantin Kogan, partner at crypto fund-of-funds BitBull Capital, sees a sideways market where the price of bitcoin could go either way.

“If sellers take control of the market, it is likely that BTC will be seen at $11,390 per coin. However, there is a chance the market will overcome resistance at $12,000 and retest the annual high at $12,300,” Kogan told CoinDesk.

Read More: Asset Manager NYDIG Raises $5M for Third Bitcoin Fund in 2020

Where the market goes next may very well hinge on the largest players. Institutional interest has a huge role in the crypto market for 2020, added Kogan. “Bitcoin is in many ways repeating the movement noted in the fourth quarter of 2016, on the eve of the 2017 crypto boom,” he said. “But this time institutions also play an important role in the market.”

Daily bitcoin prices since 2016 on Coinbase.

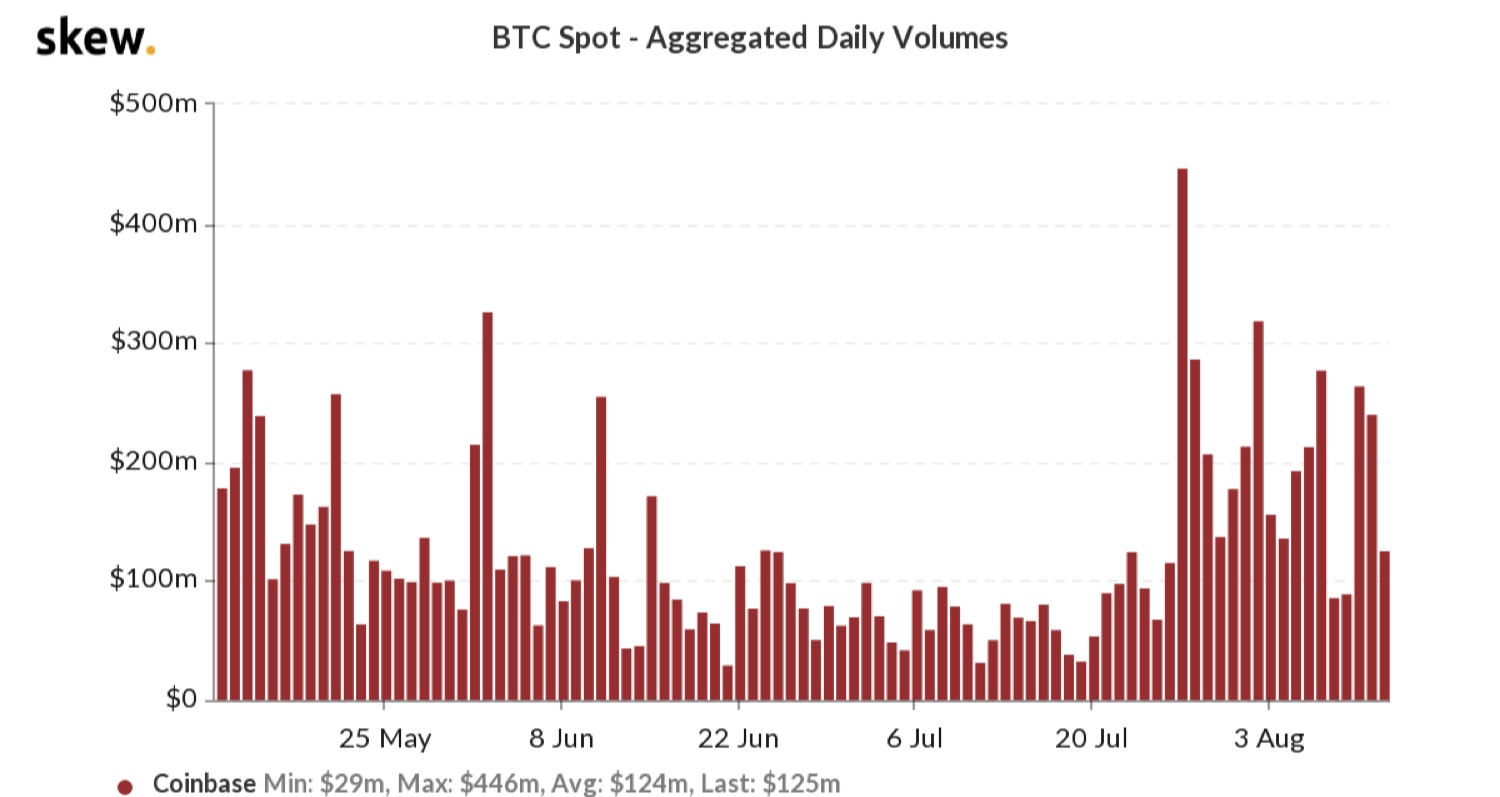

One promising statistic: Bitcoin spot volumes are much higher this month than last month so far, with July Coinbase volumes averaging $100 million and August at $198 million so far per day, according to data aggregator Skew.

Volumes on Coinbase the past three months.

Increased volume in August has clearly led to a jump in volatility, added Rupert Douglas, head of institutional sales for crypto brokerage Koine. Traders like to take advantage and profit from higher volumes. “There's a lot more upside to this market, but there will be sharp pullbacks along the way,” Douglas told CoinDesk.

Read More: Some Traders Now Taking Bets Ether Will Break $1K by December

Ethereum’s gas pain

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Wednesday trading around $388 and climbing 2.7% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Read More: How Much Ether Is Out There? Developers Create Scripts for Self-Verification

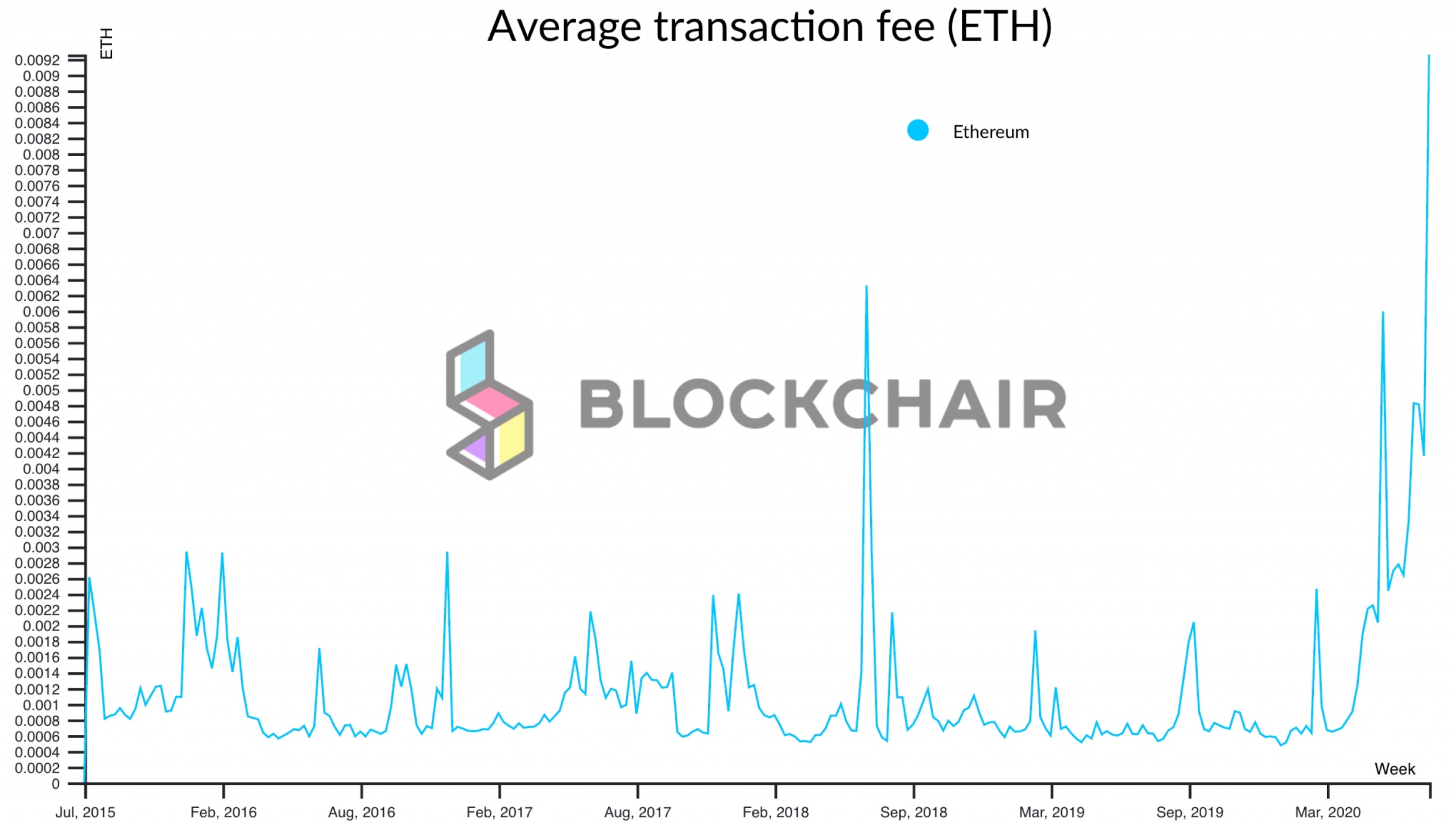

The average fee on the Ethereum network required to conduct transactions, including in decentralized finance, or DeFi, applications, is as high as it has ever been. It is currently at 0.009255 ETH, which is over $3.60. In Ethereum’s five-year existence as a platform, fees are now literally off the charts, according to data aggregator Blockchair.

Fees on Ethereum since its launch.

These fees, also known as gas, are causing pain for traders. This is particularly true for market makers that have seen the price of gas double in just the past week and cannot predict just how much higher it might go in the near term due to the explosion of interest in DeFi overall.

“It’s jamming up a lot of decentralized exchanges,” said Peter Chan, lead trader for crypto trading firm OneBit Quant. “We and a few other market makers have been forced to stop quoting since gas cost is so high.”

Other markets

Digital assets on the CoinDesk 20 are mixed Wednesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

- chainlink (LINK) + 18.9%

- dogecoin (DOGE) + 4.4%

- tezos (XTZ) + 4.1%

Read More: How a DeFi Trader Made an 89% Profit in Minutes Slinging Stablecoins

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- cardano (ADA) - 3.2%

- bitcoin sv (BSV) - 2.4%

- xrp (XRP) - 2.1%

Read More: Court Backs Coinbase in Bitcoin Gold Fork ‘Breach of Contract’ Lawsuit

Equities:

- Asia’s Nikkei 225 closed in the green 0.41% as industrial manufacturer Ebara’s 11.4% gain helped boost the index.

- Europe’s FTSE 100 ended the day up 2% on optimism the Bank of England might step up quantitative easing due to poor economic data.

- The United States’ S&P 500 gained 1.6% as tech stocks rallied, including Microsoft and Apple both gaining more than 3%.

Read More: Grayscale Tells SEC Its Bitcoin Trust Rose $1.6B Over Six Months

Commodities:

- Oil is up 2.2%. Price per barrel of West Texas Intermediate crude: $42.56

- Gold is flat, in the green 0.01% and at $1,911 as of press time.

Read More: Ex-NYSE Broker Accused of Running $33M Crypto Scam Pleads Not Guilty

Treasurys:

- U.S. Treasury bonds all climbed Wednesday. Yields, which move in the opposite direction as price, were up most on the two-year, in the green 5%.