Bitcoin’s price is trending down and an Ethereum competitor is entering the DeFi race this weekend.

- Bitcoin (BTC) trading around $11,579 as of 20:00 UTC (4 p.m. ET). Slipping 2.4% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,348-$11,919

- BTC below 10-day and 50-day moving averages, a bearish signal for market technicians.

Bitcoin trading on Coinbase since August 5.

Bitcoin’s price was able to rally to as high as $11,917 Friday before losing momentum, falling back into the $11,500 range. “Over the past day, bitcoin tested the level of $11,900 but it did not succeed, and BTC slipped,” said Constantine Kogan, partner at crypto fund of funds BitBull Capital.

Read More: Fixing This Bitcoin-Killing Bug Will (Eventually) Require a Hard Fork

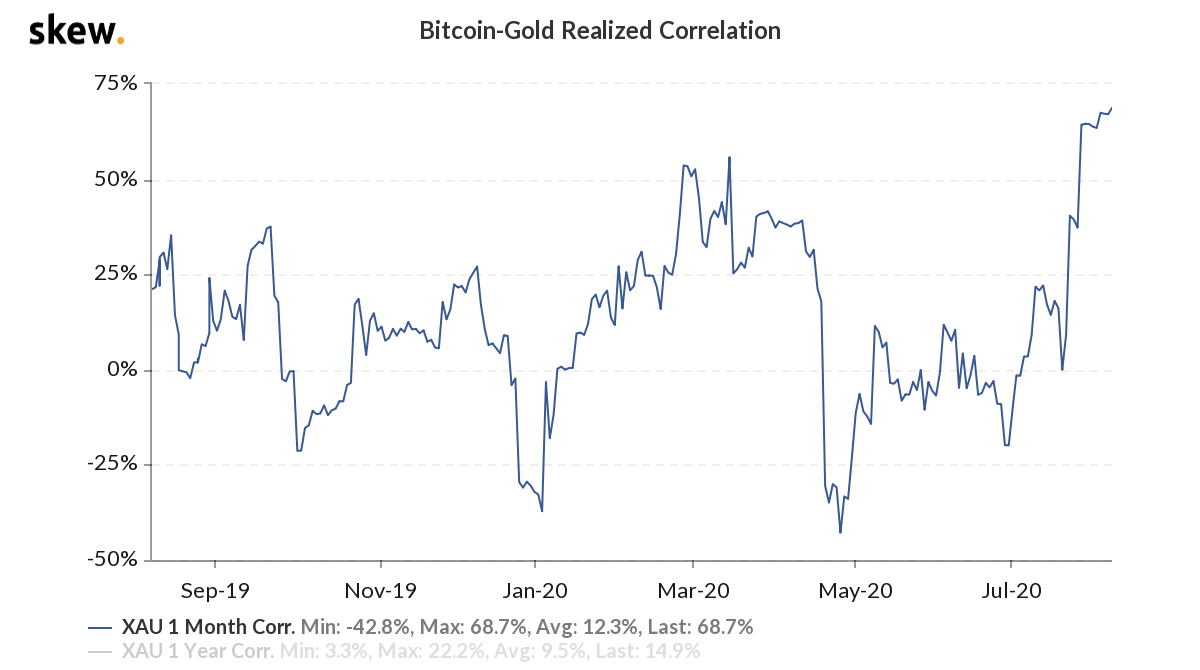

Bitcoin and gold continue to trade together. Gold is also down Friday, in the red 1.6% and at $2,030 as of press time. “The gold/BTC correlation is at an all-time high right now,” said Daniel Koehler, liquidity manager for cryptocurrency exchange OKCoin. “The one-month correlations between BTC and gold have seen a significant spike over the past two weeks, currently sitting at about 67%,” he added.

One-month realized correlation for bitcoin-gold over the past year.

One downward trending day is not altering optimism about the crypto market, added Koehler. “With bitcoin following gold as a store of value, and DeFi pushing ETH, the excitement is palpable in the trading community right now."

John Willock, CEO of digital asset liquidity provider Tritum, agrees. “Sentiment in the market is highly buoyant and generally positive market news is increasing confidence and aggression in positioning,” he said. “I expect to see bitcoin bounce back quickly to $12,000 with ether to $400 this weekend.”

Ethereum rival Cardano making progress

The second-largest cryptocurrency by market capitalization (ETH), ether, was down Friday, trading around $347 after slipping 4.6% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Read More: Polkadot Releases Rococo, Test Environment for Interoperable ‘Parachains’

Smart contact platform Cardano intends to start producing proof-of-stake (PoS) mainnet blocks this weekend. Ethereum’s switch to PoS from its current proof-of-work setup is expected sometime by the end of the year.

Since the start of 2020, Cardano’s token, ada, has seen a market capitalization increase from $1 billion to $4.5 billion, according to CoinGecko. The platform, a competitor to Ethereum, has taken a methodical approach towards launching and now has 770 pools staking almost 20% of ada supply.

Cardano’s ada token market capitalization since 1/1/20.

George Clayton, managing partner of Cryptanalysis Capital, is looking forward to watching Cardano in the DeFi race, as smart contract capabilities for building decentralized applications on the platform are expected to launch later in 2020. “The transition to PoS mainnet is complete but stake pools do not start producing blocks until Aug. 8,” he said. “Very interested to see what happens with Cardano; that's a big moment for the protocol.”

Other markets

Digital assets on the CoinDesk 20 are mostly in the red Friday. One notable winner as of 20:00 UTC (4:00 p.m. ET):

- chainlink (LINK) + 0.62%

Read More: Kyber CEO Predicts 2020 Transactions at $3B as DeFi Token Soars

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- zcash (ZEC) - 8.1%

- tezos (XTZ) - 7.4%

- dash (DASH) - 7.4%

Read More: Ethereum Classic Attacker Double-Spends $1.68M in Second Attack

Equities:

- In Asia, the Nikkei 225 closed in the red 0.39% as weak corporate earnings spurred profit taking ahead of a three-day weekend in Japan.

- In Europe, the FTSE 100 ended the day flat, in the green 0.09%. as U.S. tensions with China countered better-than-expected job numbers.

- In the United States, the S&P 500 lost 0.40% as progress slows on negotiations for fresh coronavirus economic stimulus.

Read More: NBA’s Spencer Dinwiddie, Andre Iguodala Join Dapper Labs $12M Funding

Commodities:

- Oil is down 1%. Price per barrel of West Texas Intermediate crude: $41.51.

Read More: Binance Says NY Banks Can Now Use Its Stablecoin After Approval

Treasurys:

- U.S. Treasury bonds all climbed Friday. Yields, which move in the opposite direction as price, were up most on the 10-year, in the green 5.4%.