As bitcoin closes in on $9,600, gold surpasses $1,900 and DeFi liquidity steadily grows.

- Bitcoin (BTC) trading around $9,592 as of 20:00 UTC (4 p.m. ET). Slipping 0.03% over the previous 24 hours.

- Bitcoin’s 24-hour range: $9,475-$9,601

- BTC above 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin trading on Coinbase since July 22.

Gold is on the brink of an all-time high, up 0.80% Friday, at $1,901 per ounce. Sweden-based over-the-counter bitcoin trader Henrik Kugelberg sees gold nearing its all-time high as a positive for the world’s oldest cryptocurrency. “Bitcoin will pass $20,000 in a surge. I suspect a new normal discounted bitcoin price will be around $15,000 in 2021, like it has been around $9,000 in 2020.”

Bullish bitcoin traders love to talk about gold, since they see similarities between the yellow metal and the cryptocurrency. “I think we are just a couple weeks or months out from a strong continuation on bitcoin as gold reaches $1,900 today,” said William Purdy, a New York-based equity options and crypto trader.

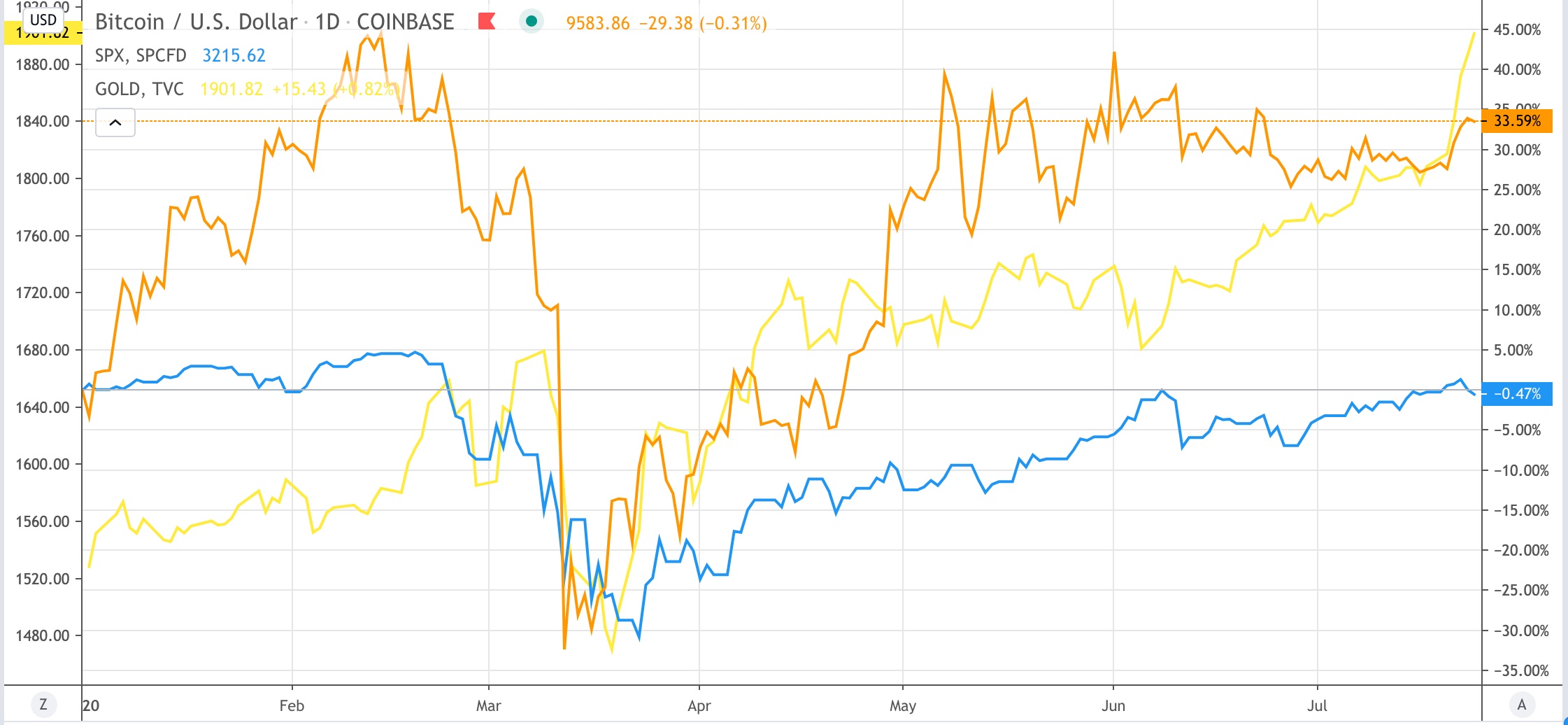

Indeed, gold’s jump this week occurred as bitcoin eked gains and the S&P 500 U.S. stock index performance was back to being flat for 2020.

Bitcoin (orange), gold (yellow) and S&P 500 (blue).

Kugelberg is pessimistic on stocks for the balance of 2020. “I believe there will be at least a 30% drop in stocks on average at the latest in Q4. So where to go? To real assets with lasting value,” said Kugelberg. He mentioned gold, bitcoin and property as “real assets”.

“Bitcoin bulls have momentum on their side for now,” said Alessandro Andreotti, an Italy-based over-the-counter bitcoin trader. “The crypto market is likely to be heading towards a bullish continuation from here.”

Within crypto, ether is doing even better than bitcoin this week. ETH/BTC, that is, ether priced in bitcoin, has seen a jump in the past few days.

ETH/BTC pair on Coinbase since July 22.

Ether prices have increased almost 12% against bitcoin, said Aaron Suduiko, head of research for cryptocurrency liquidity provider SFOX. “It will be interesting to see whether any trends develop in the event that more DeFi projects continue to grow.”

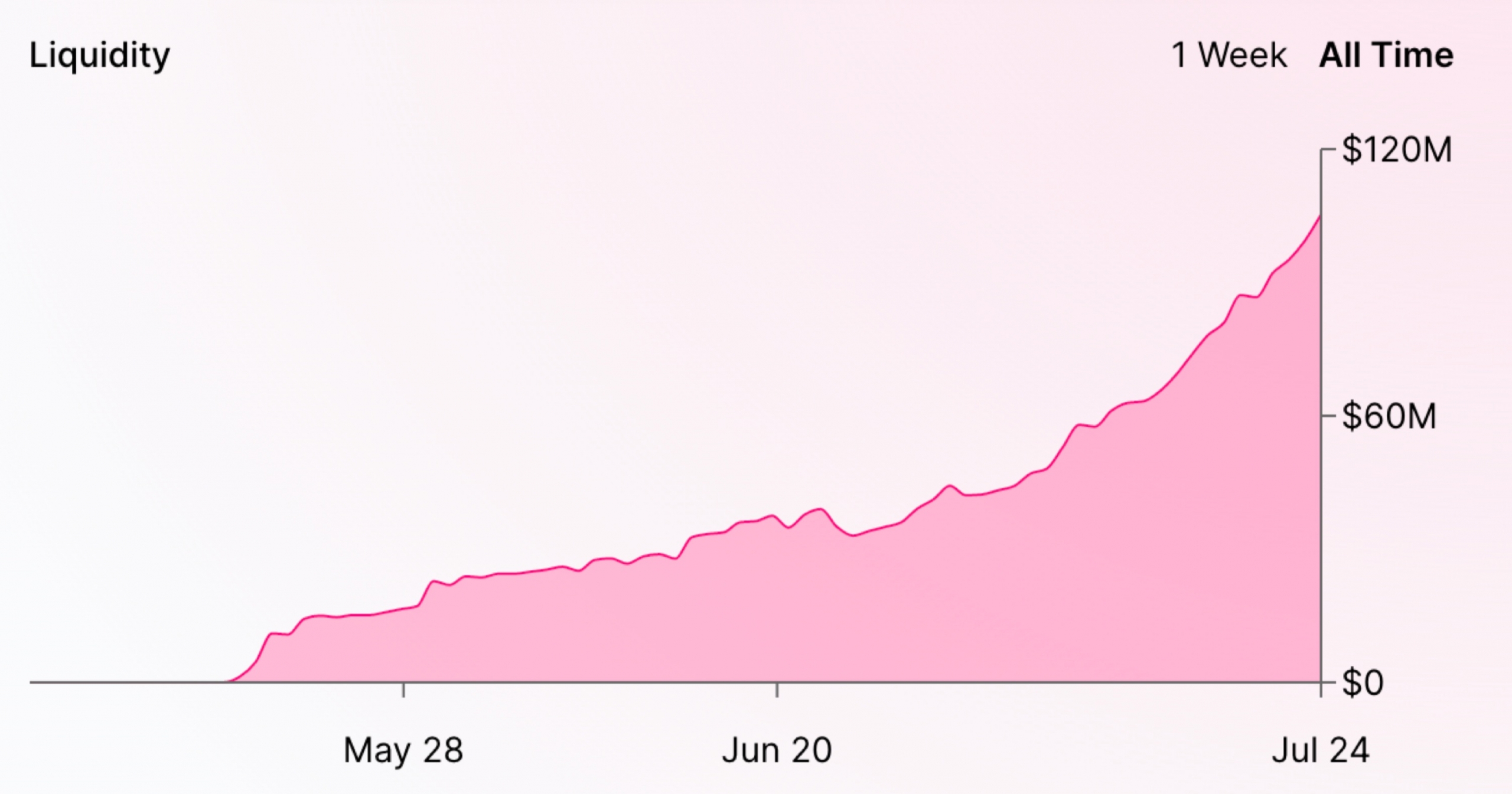

Uniswap crosses $100 million in liquidity

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Friday trading around $283 and climbing 3.6% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Read More: Ether Leaves Bitcoin Behind With 2020 Gain of Over 100%

“The recent gains in ether are due to the on-going thematic chatter on social media around new DeFi projects that have been showing considerable strength,” said Purdy, the equity options and crypto trader. Indeed, Uniswap, a decentralized exchange (DEX), for trading various DeFi project tokens, surpassed $100 million in liquidity Friday.

All-time liquidity of DEX Uniswap.

Instead of order books, Uniswap uses liquidity pools that investors can “stake” cryptocurrency into and profit or “yield” from trading fees on the DEX. This liquidity is what enables Uniswap traders to quickly exchange between ether and various Ethereum-based ERC-20 tokens, with total daily volume reaching $71 million per day, according to data aggregator Dune Analytics.

Other markets

Digital assets on the CoinDesk 20 are mostly red Friday. Notable winners as of 20:00 UTC (4:00 p.m. EDT):

- nem (NEM) + 1.6%

- tron (TRX) + 1.2%

- zcash (ZEC) + 0.44%

Read More: Arca’s Flagship Crypto Hedge Fund is Up 77% in 2020

Notable losers as of 20:00 UTC (4:00 p.m. EDT):

- chainlink (LINK) - 3.6%

- cardano (ADA) - 2%

- monero (XMR) - 2%

Read More: Carlos Ghosn’s $600K Bitcoin Escape Fee Paid via Coinbase

Equities:

- In Asia the Tokyo Stock Exchange is on holiday. Hong Kong’s Hang Seng slipped 1.8% on news China demanded the closing of a US consulate in Chengdu.

- In Europe the FTSE 100 ended the day in the red 1.6% as the U.K. and the E.U. are still at an impasse on a Brexit trade deal.

- The U.S. S&P 500 index lost 0.80% as tensions with China dragged stocks lower, including Intel in the red 16%.

Read More: Crypto’s $35T Moment Could Come From Analog-World Stock Listings

Commodities:

- Oil is up 0.40%. Price per barrel of West Texas Intermediate crude: $41.21

Read More: No One Has Traded Bitcoin Options on Bakkt for Over a Month

Treasurys:

- U.S. Treasury bonds were mixed Friday. Yields, which move in the opposite direction as price, were down most on the 2-year, in the red 4.3%.