A quant has suggested that the reason behind the recent negative Coinbase Premium could have been due to Tesla’s Bitcoin selling.

Tesla Dumping 75% Of Its Bitcoin Holdings Might Be Behind Negative Coinbase Premium Gap

As explained by an analyst in a CryptoQuant post, the news about Tesla selling off 75% of its BTC stash looks to be behind the recent negative premium gap on Coinbase.

The “Coinbase premium gap” is an indicator that measures the price difference between the Bitcoin listings on crypto exchanges Coinbase and Binance.

Since Coinbase is popularly used by US investors (especially large institutionals) while Binance has a more global userbase, this indicator can tell us about the buying or selling behavior from the US-based holders.

When the value of the metric is negative, it means the value of BTC listed on Coinbase is currently less than on Binance. This suggests there has been some selling going on from American investors.

Related Reading | Bitcoin Hashrate Downtrend Leads To Largest Negative Difficulty Adjustment In A Year

On the other hand, the premium gap’s value being greater than zero implies there is buying happening on Coinbase a the moment.

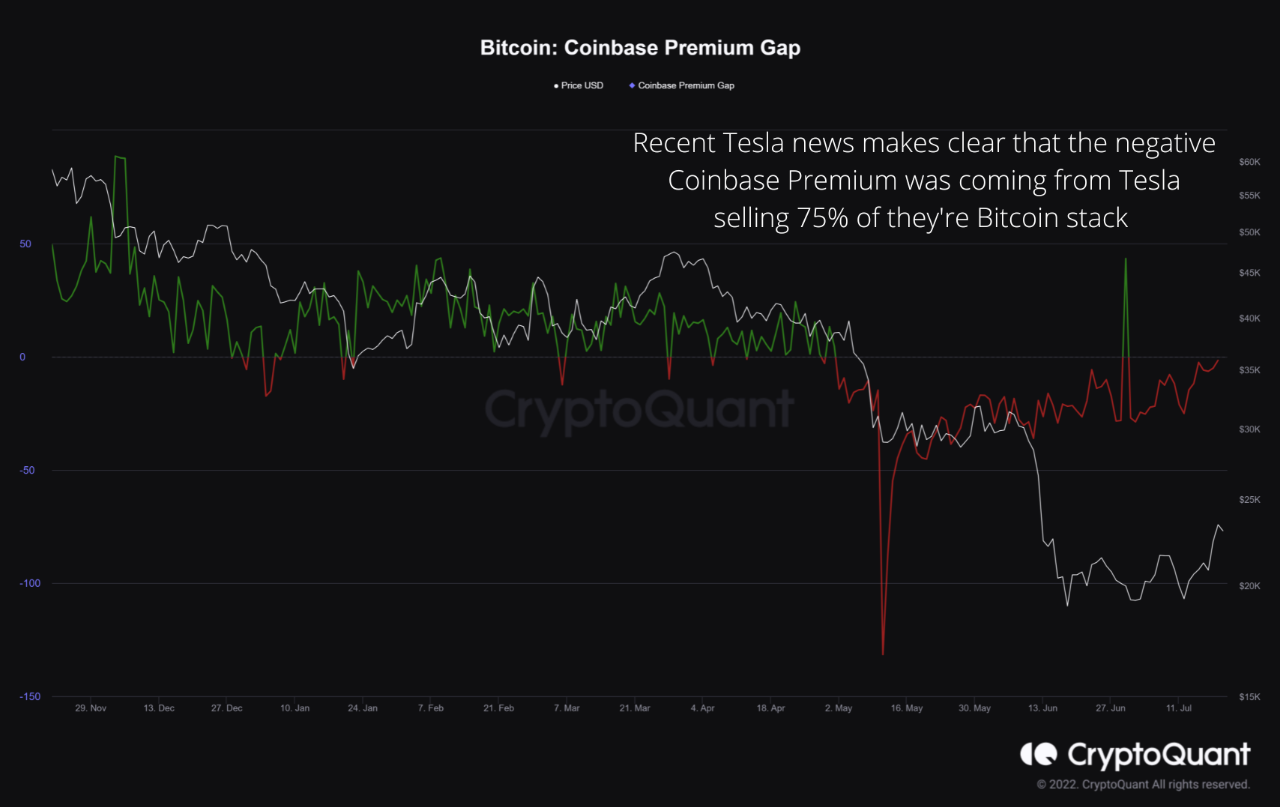

Now, here is a chart that shows the trend in the Bitcoin Coinbase premium gap over the last few months:

The value of the metric seems to have been red during the past couple of months | Source: CryptoQuant

As you can see in the above graph, the Bitcoin Coinbase premium gap has been negative for a good while now, besides one brief spike to green values.

The quant notes that this was an indication that heavy selling was constantly occurring from high net worth investors or institutionals based in the US.

Related Reading | Uniglo (GLO) Brings Forth Fractionalized Asset Ownership, Overshadowing Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA)

The latest news about Tesla having dumped 75% of its total BTC holdings makes it apparent that the selling source was Elon Musk’s company.

Also, as is visible in the chart, the Coinbase premium gap has improved in recent days as the selling pressure from Tesla has dropped off.

BTC Price

At the time of writing, Bitcoin’s price floats around $22.6k, up 15% in the last seven days. Over the past month, the crypto has gained 10% in value.

The below chart shows the trend in the price of the coin over the last five days.