The Cardano price action shows little respite for holders despite the recent short-term bullishness that pumped the ADA price by nearly 4%

The Cardano (ADA) price action has been rather dramatic since reaching its all-time high. Even though ADA managed to maintain its spot in the top 10 ranked cryptos by market cap, its price action has kept ADA holders wanting more.

The Cardano price recently touched the $0.31 level, equating to an 85% loss from its all-time high price of $3.10 made in August 2021. After making an all-time high, the ADA price has traded under a major bearish trendline.

/Related

MORE ARTICLES

XCN, SOL, APT, AXS and Sand Are the Crypto Market’s Least Successful Cryptocurrencies

LBank’s 2022: A year of Challenge and Perseverance

Ethereum Merge Checkpoint Reached in 2022; What’s to Come in the New Year?

Bitfarms CEO Steps Down After Selling Shares; Bitcoin Mining Capitulation Spreads

Ripple and CEO Brad Garlinghouse’s Top 5 Crypto Wins of 2022

Investigator Shows How Poor Crypto Exchange KYC Can Empower Criminals

After the Cardano price dropped back to January 2021 levels, what could be next for the eighth-ranked cryptocurrency by market cap?

ADA whales and sharks offloading

A look at Cardano address balances indicated that sharks and whales were off-loading their coins. Since May 2022, these groups have sold 600 million ADA and seem to be actively trading price changes in both directions.

Balance of Addresses Holding between 100k-10M ADA | Source: Sanbase

The Network Realized Profit/Loss indicator divided by actual price shows signs of capitulation similar to the March 2020 COVID-19 crash. As large losses are realized on-chain, price recovery could take an exceptionally long time.

Network Realized Profit/Loss | Source: Sanbase

Notably, for Cardano, the major capitulation events took place in two waves, with the second wave shorter than the first. Historically, the first accumulation wave has attracted traders who want to make quick money and exit before losing everything in the second wave.

Low development to favor ADA price

On Nov. 2, Cardano’s development activity made a new local high. Significantly higher development activity seems to occur alongside price rises.

However, development activity data from Sanbase showed that development activity has now fallen in tandem with the ADA price.

Cardano development activity | Source: Sanbase

Cardano development activity | Source: Sanbase

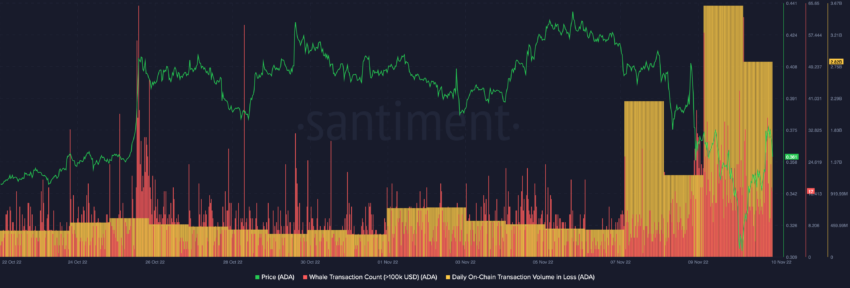

Cardano’s daily on-chain volumes in loss have massively spiked, which could further induce some sell-side pressure if short-term profits are realized.

ADA’s high whale transaction count supported the aforementioned argument that Cardano whales had been rather active. Most are now likely selling or redistributing.

Whale transaction and daily on-chain volumes in loss | Source: Sanbase

Whale transaction and daily on-chain volumes in loss | Source: Sanbase

Most of the on-chain metrics for ADA presented a slow price growth ahead of ADA holders. In the case of short-term bullish price action, ADA could appreciate between $0.40-$0.50.