The Cardano price has been trading under a bearish trendline for almost a week now, but with fresh gains in sight, can ADA chart a weekend run to $0.50?

The Cardano price action has been rather boring as of late amid the larger market’s mostly-bullish trajectory. At press time, the ADA price kicked off Friday on a higher note, charting a 2.5% daily gain to $0.405.

Cardano price reverses short-term losses

The recent 4% gain in the ADA price reversed the Nov. 2 losses that brought the coin’s price down by over 5%. The Cardano price began that day at a low of $0.384, but bulls have managed to keep prices above the key support level at the $0.375 mark for over 10 days now.

/Related

MORE ARTICLES

XCN, SOL, APT, AXS and Sand Are the Crypto Market’s Least Successful Cryptocurrencies

LBank’s 2022: A year of Challenge and Perseverance

Ethereum Merge Checkpoint Reached in 2022; What’s to Come in the New Year?

Bitfarms CEO Steps Down After Selling Shares; Bitcoin Mining Capitulation Spreads

Ripple and CEO Brad Garlinghouse’s Top 5 Crypto Wins of 2022

Investigator Shows How Poor Crypto Exchange KYC Can Empower Criminals

ADA/USDT | Source: TradingView

After rising to a high of $0.4082, ADA’s next key resistance level would be found at $0.42, then $0.50.

A look at ADA’s 1-day price chart suggested some bullish momentum in the market, especially as the Chaikin money flow indicator shows ADA inflows rising. Daily RSI had also started to recover, but buyers and sellers still appear to be at equilibrium.

Development activity sparks off

Input Output HK (IOHK) delivered some fresh updates on Nov. 3 about the Daedalus mainnet 5.1.1 release, which reaped some positive social responses for Cardano. On Nov. 2, Cardano’s development activity spiked to an all-time high, but it had little affect of the ADA price.

Cardano development activity | Source: Sanbase

Despite ADA’s largest whales slightly increasing their holdings over the last 3 months, smaller whales have reduced their holdings.

Source: Sanbase

ADA’s MVRV-7 day indicates that Cardano was largely undervalued at current price levels. Notably, the MVRV-7 day ratio was sitting at a 3-month low.

The 30-day MVRV was treading in positive territory and supported ADA’s price recovery from the $0.33 level but has flattened out at the time of press.

Source: Sanbase

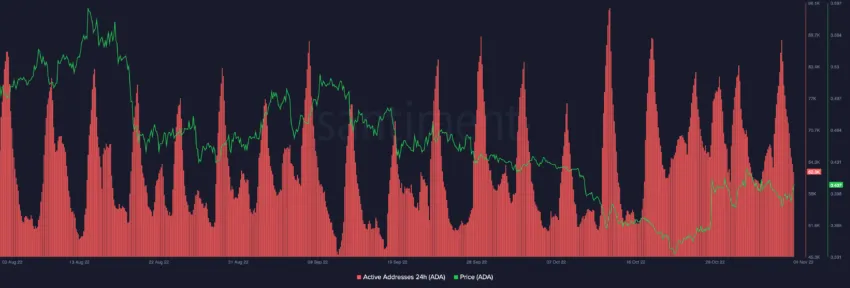

A potential worrying trend that could keep the ADA price down concerns active addresses. This figure has fallen by over 25% in the last two days despite the price gaining momentum. This indicates that participants exited the market even though the price was appreciating.

Source: Sanbase

Source: Sanbase

ADA’s technicals and on-chain conditions seem a little too loose for a price breakout and recovery to the $0.50 mark. However, a spike in retail interest and active addresses could potentially lead to short-term price growth, especially since price action has turned bullish at press time.

In case of a bullish breakout, ADA could target the $0.42 mark next before overtaking $0.50. If bears take over, a pullback to the lower $0.375 level could be expected.