After four long years, ADA price is poised to surge following Cardano’s smart contract upgrade. Codenamed Alonzo, the testnet for the much-anticipated milestone had already been released on May 27. This puts Cardano on the collision course with other programmable blockchains, such as Ethereum.

In this excitement, Cardano ADA price had already shown a steep rise, but will it continue during the next couple of months or years?

This Guide Contains:

- What Makes Cardano (ADA) Stand Out from the Crowd?

- Where Is Cardano (ADA) In Its Development Cycle?

- What Is ADA Price’s Current Position?

- Will ADA Cardano Price Dominate this Bear Season?

- Which dApps Are to Make Their Appearance on Cardano First?

What Makes Cardano (ADA) Stand Out from the Crowd?

As programmable blockchains go, serving as the infrastructure for decentralized finance, yield farming, and NFT marketplaces, Ethereum hasn’t been the only game in town for a while. Polkadot, Solana, Cosmos, Binance Smart Chain, and others have tried to unseat Ethereum (ETH) as the second-largest cryptocurrency and a smart contract ecosystem.

However, Cardano’s story is unique because its key developer, Charles Hoskinson, was one of the co-founders of Ethereum.

He decided to abandon the second-largest cryptocurrency in 2017 and create his own project because he thought the foundations must be solid and robust to create a lasting value.

This translates to scalability, resistance to smart contract coding vulnerabilities, and proof-of-stake (PoS) consensus algorithm. Unlike PoS, which uses economic validators instead of miners, energy-intensive proof-of-work (PoW) is in use by Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH), Dogecoin (DOGE), and many other cryptocurrencies.

It is safe to say that the nature of PoW was the main cause for Elon Musk’s tweet on abandoning BTC for Tesla payments, which was a major contributor to this year’s huge crypto crash. In contrast, both Cardano and Ethereum are viewed as eco-friendly by the financial media. Therefore, this alleviates the pressure from institutional investors to disown them within the ESG investing framework — Environmental, Social, and Corporate Governance.

Furthermore, Cardano stands apart from Ethereum in that it represents a third-generation blockchain technology for creating secure smart contracts with negligible transaction fees. Something that still ails Ethereum.

/Related

MORE ARTICLES

Best Christmas Crypto Promotions in 2022

Top 10 Telegram Channels for Crypto Signals in 2022

9 Best Crypto Exchanges for Beginners

Copy Trading: A Definitive Guide for Beginners (2022)

What Is the Crypto Fear and Greed Index?

Top 7 Crypto Debit Cards in Europe

How To Make Money With Bitcoin in 2022: 9 Proven Methods

Web3 Jobs: How to Get a Job in Crypto Sector

Who Owns the Most Bitcoin in 2022?

Although Ethereum gas fee at $5.75 seems small, it is still drastically higher than Cardano’s minuscule $0.27: YCharts.com

Although Ethereum gas fee at $5.75 seems small, it is still drastically higher than Cardano’s minuscule $0.27: YCharts.com

Moreover, the reason why Cardano only now implements smart contracts is due to a more thorough development approach. Each Cardano stage — era — undergoes code audits and peer review research, just like an academic work would.

Where Is Cardano (ADA) In Its Development Cycle?

Cardano roadmap: Official website

Cardano roadmap: Official website

All of Cardano’s code is written in Haskell programming language, within the user-friendly framework called Plutus. Coders would know this language has a lofty pedigree in academic pursuits, but even giant financial institutions like AT&T and the Bank of America are taking advantage of it. In charge of Cardano’s development is IOHK (Input Output Hong Kong).

Interestingly, it became Hoskinson’s partner for a very practical reason — tracking footwear from New Balance manufacturer in order to prevent counterfeits from popping up on the market. In addition to IOHK, the Cardano Foundation and Emurgo drive its research and development. However, Emurgo is more focused on making Cardano enterprise-ready.

Thus far, these three organizations have propelled Cardano (ADA) to the middle stage of development, consisting of four eras:

- September 2017 – Byron era when Cardano launched, supporting only ADA token transactions.

- July 2020 – Shelley era when Cardano introduced multi-assets, ADA staking, and up to 100 times increased decentralization.

- August 2021 – Goguen era when Cardano is to finalize smart contract integration. This phase had practically started with Alonzo’s testnet launch at the end of this May.

- Sometimes in 2022 – Basho era when Cardano is to improve scaling, and integrate on-chain governance.

In practical terms, Cardano’s middle stage of development means that it is ready to be deployed for large-scale projects.

For instance, as of April this year, Cardano Foundation partnered with the Ethiopian government to service 5 million students and teachers as a method for identity verification, grades record, performance monitoring, and other educational activities.

This is one of the largest institutional projects involving blockchain, owing to Cardano’s fast transaction speed and future-proofed interoperability with other blockchains. Speaking of which, on May 17, IOHK announced ERC20converter, allowing Ethereum tokens to run on Cardano’s blockchain.

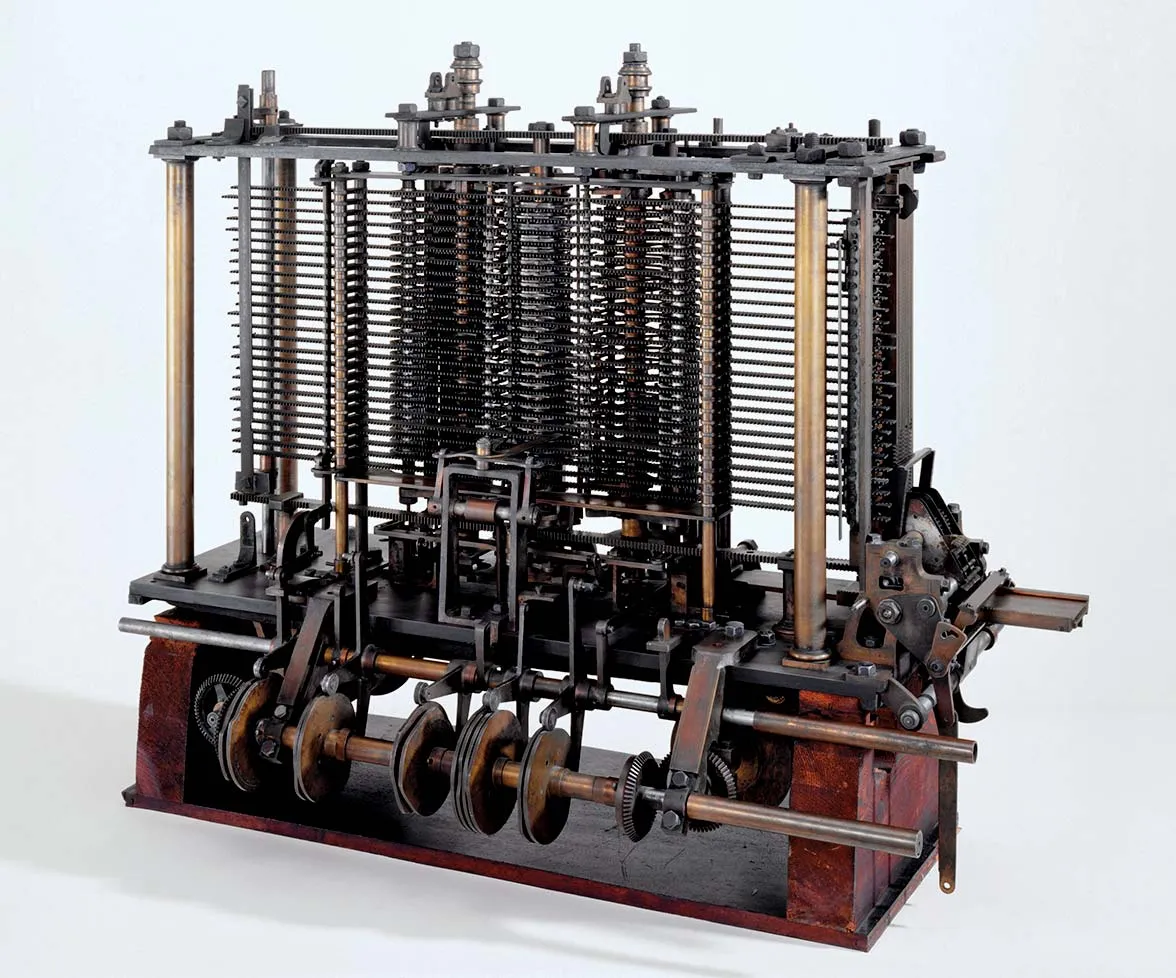

Ada contributed in creating the first general-purpose mechanical computer called the Analytical Engine, developed by Charles Babbage: Britannica

Ada contributed in creating the first general-purpose mechanical computer called the Analytical Engine, developed by Charles Babbage: Britannica

Such compatibility and ease of use is yet another factor contributing to ADA price rise. For those who are curious why its native token is called ADA, it is after the 19th century mathematician Ada Lovelace. She was the daughter of the legendary poet Lord Byron and the first known computer programmer in the form of the Analytical Engine.

What Is ADA Price’s Current Position?

With a maximum supply of 45 billion ADA, its market capitalization is holding at $55.58 billion. On June 1st, its trading volume has increased by almost 13%. More importantly, in anticipation of smart contract integration via Alonzo upgrade, ADA price jumped dramatically. From January 2021 to June 2021, ADA crypto coin surged by 886%, from $0.1753 to $1.73. It currently trades at $1.51 at press time.

Cardano price

Cardano price

In other words, if you followed Cardano news early on and had the foresight to invest in January, you would’ve gotten an almost 10X return on your investment! Suffice to say, this is almost an unthinkable level of gains in the stock market in such a short time span. The question is, can Cardano hit $10 from its all-time-high price of $2.3 on May 16th?

Will ADA Cardano Price Dominate this Bear Season?

If you’ve been reading closely so far, you can conclude that ADA price has the following factors driving it upward:

- It is built from scratch as a PoS blockchain, with a more systemic approach to development which is likely to result in more secure and stable smart contracts. This should lead to much fewer hacking and exploit incidences in the form of flash loan attacks.

- Its transaction fee is 21 times lesser than Ethereum’s while providing the same capability and great speed (maximum of 40 million transactions per day).

- These features made it the blockchain of choice by the Ethiopian government, covering its entire education system. This is on top of previous commercial contracts with food and footwear manufacturers related to logistics monitoring and product tracking.

- Cardano’s PoS consensus algorithm is exceedingly eco-friendly because the transaction count doesn’t increase the number of nodes (computers) needed to run the blockchain’s network.

- Even before the launch of smart contracts, the anticipation itself skyrocketed ADA price by almost 900%, which is a very good indicator for its demand.

- Cardano’s two-way ERC-20 token converter is a huge deal. It makes Cardano very enticing to seamlessly move into once its DeFi ecosystem of yield farming, lending, and borrowing comes online. Any dApp, from BSC, Polkadot, or Ethereum, can integrate the converter to make the blockchain space interoperable.

According to Charles Hoskinson, the Alonzo testnet, which started on May 27th, will last for two months. At the end of June, the development team will freeze on feature sets. Then, it will take about six weeks to launch the smart contracts on the mainnet. This time frame aligns with the Goguen era starting in August.

More importantly, Hoskinson reported that already over 1,000 developers are interested in developing dApps (decentralized applications aka smart contracts). These dApps will include the full range of protocols that can be currently found on other programmable blockchains: NFT marketplaces, DEXes, stablecoins, and oracles (interfaces with off-blockchain data).

While Haskell as Cardano’s programming language holds a much smaller developer pool than Ethereum’s Solidity, keep in mind that developers will be creating smart contracts via Plutus. This plugin has been hailed as a very easy interface for programming, in addition to providing greater security. If you are interested in joining in, here is what the Plutus Pioneer Program requires.

When it comes to the number of users already present in the Cardano space, there are already one million ADA wallets.

Out of those wallets, 70% of ADA crypto coins are staked among 2,500 active pools, making it a highly decentralized network.

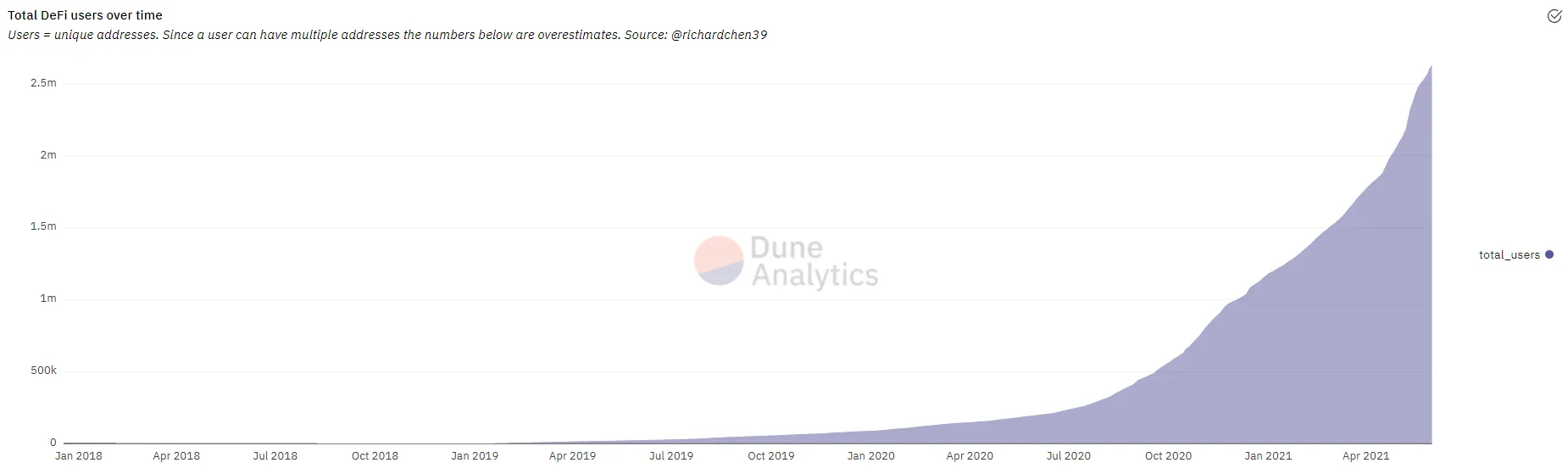

This is a considerable number of participants. To put it into perspective, the total number of DeFi users, represented by unique addresses, holds at around 2.6 million.

Lastly, institutional investors are turned off by Bitcoin’s portrayal in the financial media as a dirty coin.

In turn, environmental concerns are turning them toward PoS blockchains, with Cardano representing itself as a ready-to-go platform that already has a track record of signing big deals with African governments.

On the other hand, it will take much longer for Ethereum to finalize its own transition into PoS. In contrast, Cardano only has to integrate its smart contracts within a few short months, by August.

Which dApps Are to Make Their Appearance on Cardano First?

Decentralized exchange Occam.fi had already announced its launch of OccamX DEX on Cardano. This is a part of OccamRazer launchpad solution for the Cardano ecosystem. As Uniswap has shown, those DEXes that enter the scene first tend to have the highest growth, so OccamX may find itself in a similar position to Uniswap, Sushiswap, Pancakeswap, or Polygon.

Another big project worthy of note is DeFIRE, brought to you by the creators of Changelly, one of the first crypto exchanges before even Ethereum launched.

Considering their solid track record and that Changelly still makes billions in trading volume, you should count on DeFIRE to get the best token prices, gas fees, and lowest slippage. On the outset, DeFIRE will provide limit orders, which is great for catching price dips.

DeFIRE’s token CWAP is also intriguing. If you stake them, you will acquire a percentage of trading fees distributed on a pro-rata basis. Pro-rata just means in proportion, so you receive the amount based on your staked CWAP share.

As you can see, ADA price is all ready to move even higher this summer with these exciting projects, which will all have negligible transaction fees compared to Ethereum.

As we have seen from the exodus to Binance Smart Chain (BSC) during the last few months, this consideration alone will likely be a powerful ADA price driver. Combined with other good Cardano news listed and contrasted, it would be difficult to imagine Cardano (ADA) staying under its ATH of $2.3 anytime soon.