Binance and Coinbase top the list of the largest cryptocurrency exchanges in the world by volume and number of users. Both crypto platforms allow users to buy, sell and trade the top cryptocurrencies on the market.

To find out which is the better exchange for you, our crypto investing experts put together this comprehensive guide to compare both exchanges and specific features of their trading platforms.

Binance vs Coinbase Summary

Ever wondered what the best Coinbase alternatives in 2022 are? A Binance vs Coinbase comparison is a close call as they both support buying crypto and staking crypto, both have wallets, educational resources and more. Both work well with few bugs or downtime, and are very popular among crypto investors. Binance has an advanced trading interface good for active traders, while Coinbase attracts beginners with its easy to use one-click style and simple UI.

- Binance offers 600+ cryptos and has lower transaction fees (0.1% max). The comprehensive charting options and technical indicators make it a perfect fit for day traders doing technical analysis (TA). The coin choices for US users, however, are more limited.

- Coinbase is good for US residents, and considered more secure. The platform has higher trading fees in comparison with Binance. On the plus side, the user interface is more beginner friendly. There is a separate Coinbase Pro platform for lower fees (0.6% max) and a price chart, however still not as low as the Binance fees or with as detailed a chart.

One main difference is Binance has both spot trading and margin trading (opening a long or short position on leverage). Coinbase doesn’t have perpetual futures trading pairs.

Binance is suggested for more experienced traders, while beginners find it easy to navigate through Coinbase and Coinbase Pro. Many crypto investors open accounts on both however, alongside our #1 recommendation which is eToro.

In terms of Binance vs Coinbase we think Binance has a slight edge. However, US residents may prefer Coinbase. If you wish to invest in a wide range of altcoins, Binance has more listed. We like eToro as it’s more regulated than both of these platforms and has copytrading and copy portfolio features.

For more details check out our Binance review now.

Cryptoassets are a highly volatile unregulated investment product.

| Fees & Features | Binance | Coinbase |

| Licensing | Central Bank of Bahrain (CBB), Dubai | 42 US states, FCA, BaFIN |

| Number of Cryptocurrencies | 600+ | 100+ |

| Pricing Structure | Varying transaction fee | Flat fee + transaction fee |

| Fee for Buying Bitcoin | 0.1% of purchase | $0.99-$2.99 + 1.49%-3.99% |

| Trading Tools and Features | Technical charts, Crypto Order book, Staking, Binance Academy | Crypto order book, customizable indicators, Staking |

| Mobile App Rating | 4/5 | 3.5/5 |

| Payment Methods | Debit card, credit card, PayPal, Google Pay, Bank transfer | Debit card, PayPal, bank transfer, Apple Pay, Google Pay |

| Minimum Deposit | $10 | $2 |

| Demo Account | No | No |

Cryptoassets are a highly volatile unregulated investment product.

What are Binance and Coinbase?

Launched in 2017 by Changpeng Zhao, Binance has managed to quickly climb the charts and become one of the top crypto exchanges around the world. In fact, it is the largest crypto exchange by volume.

Binance offers a diverse selection of cryptocurrencies when compared with other alternatives. At this moment, the exchange hosts over 600 cryptocurrencies and counting. Binance caters its services to people in more than 180 countries, but the main entity – Binance.com – isn’t accessible in the US due to regulatory issues with the government.

Binance US (at the Binance.us domain) is a separate website that operates in compliance with governmental regulations, but the options for cryptocurrencies there aren’t as varied. There are about 50 cryptocurrencies listed on their site open to America.

Coinbase was launched in 2012 by Brian Armstrong and Fred Ehrsam,  and has been operational for almost a decade. Coinbase is very popular in the US due to its easy-to-use interface. The exchange is also highly trusted and is publicly traded on NASDAQ.

and has been operational for almost a decade. Coinbase is very popular in the US due to its easy-to-use interface. The exchange is also highly trusted and is publicly traded on NASDAQ.

Coinbase offers over 100 currencies for trading, including Bitcoin, Ethereum, Solana and Dogecoin. Unlike Binance, the platform primarily hosts only the major cryptos – and fewer low cap altcoins.

One place where Coinbase is worse than Binance is the fees. Coinbase Pro charges a 0.60% trading fee for market orders (use limit orders to pay 0.5%) higher than the 0.10% charged by Binance. Coinbase Pro used to be free to place limit orders on some years ago, unfortunately that’s no longer the case.

Both Binance and Coinbase offer staking, where you can earn interest on your cryptocurrencies by contributing to the security of the network. Coinbase supports 6-7 staking coins, and Binance 100+.

Tradable Cryptocurrencies on Binance & Coinbase

Binance allows non-US traders to exchange more than 600 currencies, while traders in the US are limited to roughly 50. Coinbase on the other hand supports more than 100 currencies on its primary platform and close to 50 currencies on Coinbase Pro. Both keep up to date with crypto trends and offer e.g. metaverse coins.

If you are a non-US trader, Binance is better than Coinbase. The same is true for the number of fiat currencies supported. While Coinbase supports USD, GBP and EUR, Binance supports 18 fiat currencies including HKD, INR, AUD and the ones Coinbase does.

While it’s difficult to list all the supported cryptocurrencies, popular cryptos on both include Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Cardano (ADA), Polygon (MATIC), Litecoin (LTC), and new addition in 2022 ApeCoin.

Simply download either platform and sort the list of trading pairs in alphabetical order to see what’s on offer. Coinbase enables you to purchase cryptocurrencies with a minimum order amount of $2, while Binance has a minimum order amount of $1.

One thing neither offer is the ability to copytrade professional investors or copy a smart portfolio which is a weighted allocation of the best cryptos to buy and hold for the long-term. Copytrading had a return on investment (ROI) of 30.4% last year for eToro users.

Cryptoassets are a highly volatile unregulated investment product.

Account Types

Binance has a basic trading account that can be created online for free. To deal with cryptocurrencies, a minimum deposit of $10 is required. However, a US resident will need to create an independent account to access Binance US.

There are no such restrictions with Coinbase. You can create an account from any region as long as it’s not a jurisdiction that banks crypto trading. Interestingly you can buy crypto in Australia on Coinbase but can’t withdraw to Australian banks.

You can just open an eToro account though which is regulated by the Australian Securities and Investments Commission (ASIC), transfer to yourself on there, and then withdraw.

A standard Coinbase account allows users to trade crypto but access to advanced tools is limited.

To access the advanced trading platform, a Coinbase Pro account is necessary. This account has a fee of 0.6% per trade which will reduce as the trade volume increases. Furthermore, to gain access to the most advanced technical tools the platform has to offer, one can create a Coinbase Prime account. Particularly aimed at institutional traders and corporate investors.

Binance vs Coinbase Fees

Binance and Coinbase, both follow a maker-taker type structure in calculating the fees. The makers are the ones who add liquidity to the market, while the takers withdraw liquidity from the market. Consequently, along with the volume, the kind of trade decides the resultant fees.

Binance charges a transaction fee of 0.10% under the maker/taker system for transactions below $50,000. This fee decreases inversely in relation to the order value.

Transferring fiat from a bank account is absolutely free, but the platform charges a fee equivalent to 1.8% of trade value on the main exchange and 4.5% on Binance US when the transaction is done via a debit card.

With Coinbase, there is a flat fee ranging from $0.99 to $2.99 for transactions less than $200. For order values above that, a 0.5% transaction fee (for transactions up to $10,000) combined with a convenience charge is charged.

The convenience charges differ depending on the method of payment. The platform charges 3.99% for credit card purchases, 1.49% for Coinbase wallet or purchases via bank account, and $10 for wire deposits and $25 for wire withdrawals. For more details on the best Binance alternatives in 2022 read our comprehensive guide today.

| Fees | Binance | Coinbase |

| Instant Buy Fee | 0.5% | $0.99-$2.99 + 1.49%-3.99% |

| Trading Fee | 0.1% | 0.00-0.60% |

| Cost to Buy $100 of Bitcoin with a Bank Transfer | $0.2 | $4.48 |

Cryptoassets are a highly volatile unregulated investment product.

| Non-Trading Fee | Binance | Coinbase |

| Account Fee | None | None |

| Withdrawal Fee | Dynamic | None |

Binance vs Coinbase User Experience

Binance vs Coinbase comparisons are close when it comes to user experience. Binance, however, may get extra marks for the aesthetic appeal.

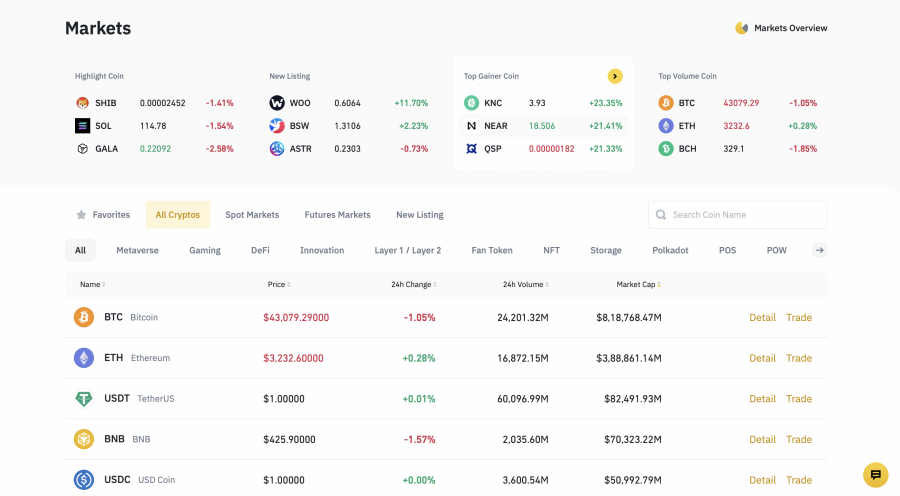

Binance, right off the back, welcomes a user to its inclusive dashboard. This dashboard provides investors and traders with all the quick information they need to decide on a purchase. To start with, at the top, the website displays day trends; namely “Highlight Coins”, new listings, top gainers for the day and coins traded by volume.

You will also find a dashboard that provides you with relevant information about each crypto coin. These include the latest price, percentage change in price in the last 24 hours, 24 hour traded volume and a coin’s market cap. The dashboard includes various filters and sorting tools that help a user personalize the dashboard based on their preference and needs.

To top it all off, the process to open an account and buy crypto on Binance is pretty seamless. Also one of the reasons for its popularity.

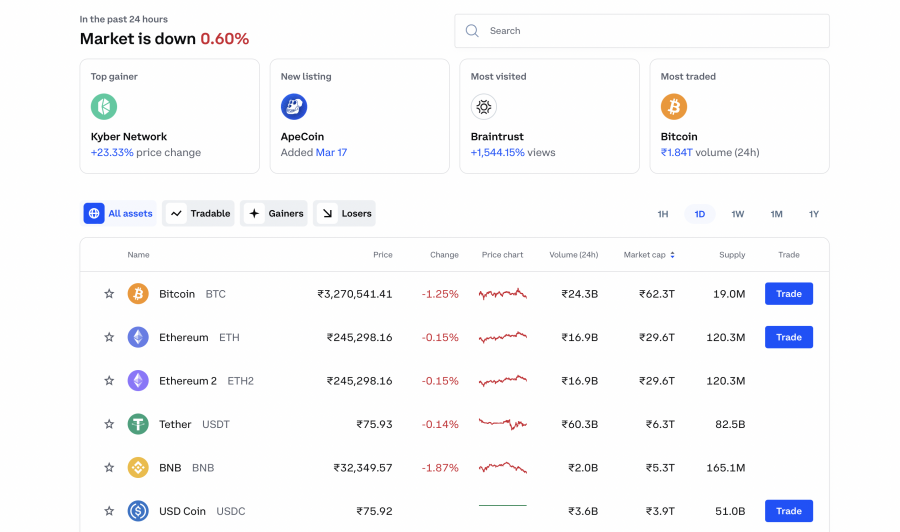

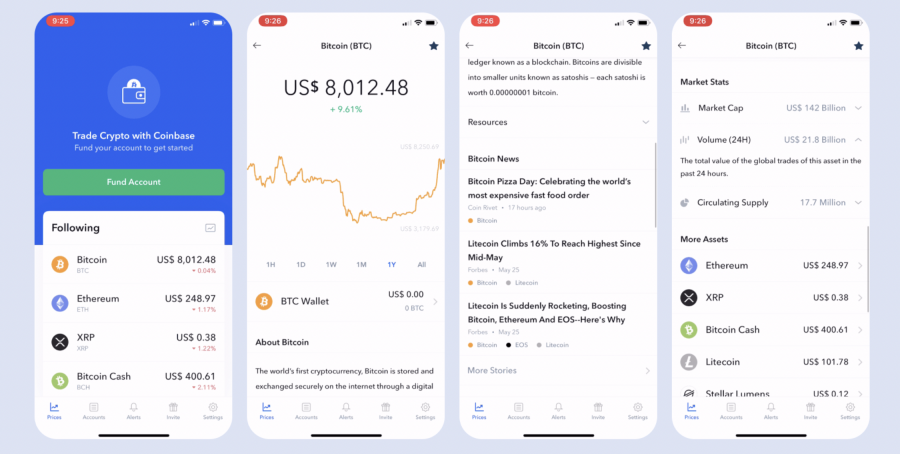

The Coinbase dashboard is fairly identical to the Binance dashboard with the exception of the price chart. The price chart displays a graphical representation of the price movement of a coin, while the supply denotes the total number of coins in existence. Both the platforms have a simple and easy-to-understand UI which helps make the purchase decision easy, especially for beginners.

Coinbase price charts use a line chart format, if you prefer candlesticks use Coinbase Pro.

The process of buying a coin is pretty simple with Coinbase as well. Once you’ve set up an account, simply click on trade for an order form to show up. Now, enter the amount equivalent of crypto you want to buy and press buy after you’ve selected a payment method. And there it is, you’ve instantly bought crypto.

Binance and Coinbase Mobile Apps

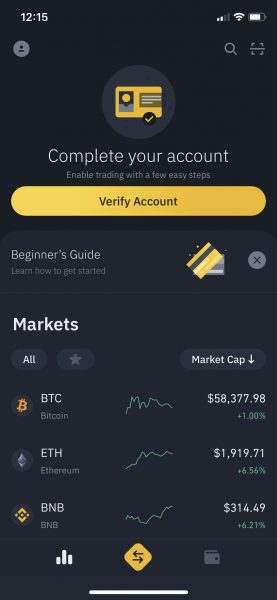

Binance and Coinbase both have a mobile app available on the Playstore and AppStore. The apps are available for free and have over 50 million and 10 million downloads respectively.

The Binance app has the same high performance as the website and carries a powerful aesthetic appeal that instils confidence in the platform. All the necessary tools required to carry out a transaction are available within the app. The mobile app also allows to trade and deposit non-fungible tokens (NFTs). The Coinbase wallet also supports storing NFTs.

A major distinction between the two alternatives is that Coinbase has two apps. The first app is simple and easy to use, making it a perfect choice for beginners and long-time investors. On the other hand, the second app – Coinbase Pro – is inclined to be helpful for crypto traders. It offers advanced tools, in-depth charts and rigorous market data, everything an active trader needs.

Switching between the apps can be inconvenient, and therefore as far as convenience goes, Binance is debatably the winner again.

eToro also offers a mobile app and their eToro Money Wallet supports 120+ cryptos.

Trading tools and features on Binance and Coinbase

Technical Charts

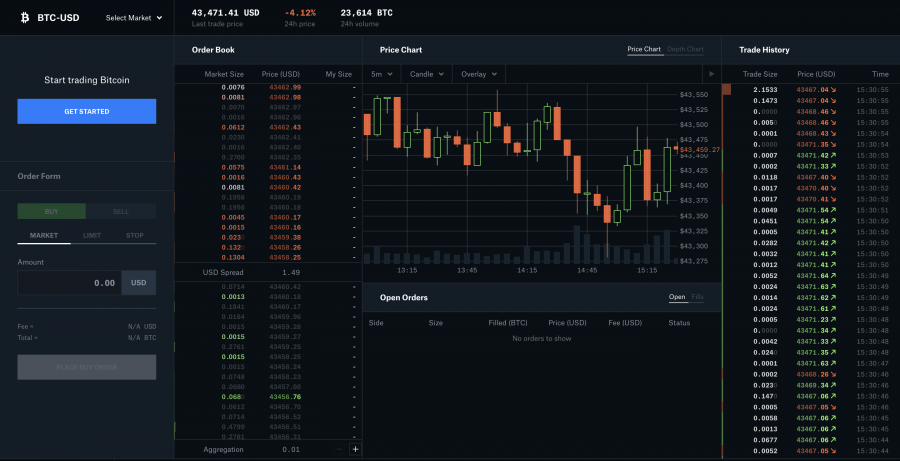

To help you with your trading analysis, Binance has multiple features integrated into its technical charts. The prominent ones are candlestick charts, depth charts, time interval selections, and drawing tools. All these features allow for a personalized interface needed for technical analysis (TA).

Additionally, the platform offers elaborate features, such as more than 100 technical indicators including but not limited to average price, volume, moving averages and the daily open / close or whatever timeframe you trade on. Drawing tools, including trend lines, pitchforks, brush and text are present in the view as well.

If you’re familiar with Tradingview, all its indicators are integrated – Fibonacci extensions, EMAs (exponential moving averages), and more. There’s a ‘classic’ option if you don’t need TA tools.

To display market movement, multiple graphic tools are available. These include bar graphs, candlesticks, Heikin Ashi candlesticks, line graphs, and more. The order book is placed in a separate dashboard in the middle right of the page displaying the market movement.

To make a buy/sell order you don’t have to switch to a different tab as the platform offers an order form on the main page itself.

Coinbase, though a close competition, is considerably different from Binance when it comes to technical analysis. As mentioned earlier, Coinbase has two separate platforms. To access the technical charts one has to venture out to the advanced platform, Coinbase Pro.

In comparison to Binance, the technical chart of Coinbase Pro still isn’t as elaborate. The mapping features, for example, are limited to only line graphs and candlestick models. However, there are some other similarities. Both the platforms have an order book on the main page itself. In addition to that, Coinbase also displays the live trade history of a particular coin. Overall it’s still a decent trading platform.

| Features | Binance | Coinbase |

| Candlestick Charts | Yes | Yes |

| Customizable Indicators | 125+ | 100+ |

| Trading from Charts | Yes | Yes |

| Price Alerts | Yes | Yes |

| Depth of Market | Yes | Yes |

Cryptoassets are a highly volatile unregulated investment product.

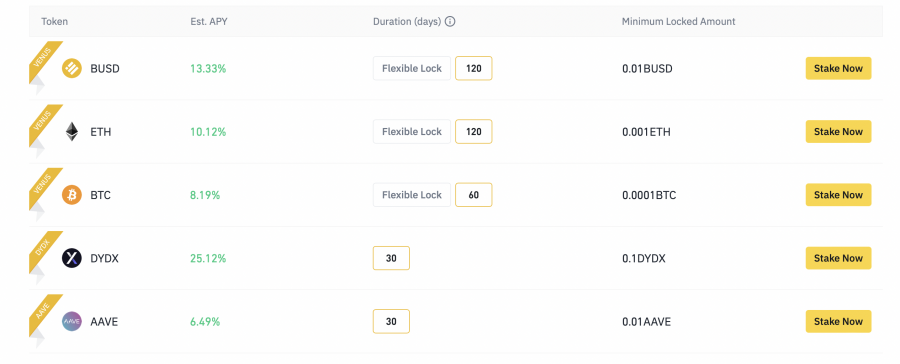

Staking

Bitcoin uses a Proof of Work mechanism(PoW) or mining to validate the transactions on its network. Alternatively, Ethereum uses a Proof of Stake protocol simultaneously with the PoW mechanism.

Proof of Stake requires a user to set aside their coins, or stake them, and be randomly selected as a validator. In doing so, the user is rewarded for their contribution to keeping the network functional.

Similar to Ethereum, most blockchain networks depend on validators to validate new blocks on the blockchain. Binance and Coinbase, both offer the option to stake and earn passive income rewards on their platforms. But there are a few differences you must know before staking your precious crypto.

Binance offers locked staking on 100+ coins including Solana, Cardano, and Polygon. On the contrary, Coinbase offers only 6 coins (7 with the upcoming 2022 addition of Cardano). Along with Ethereum, Coinbase supports staking for Algorand, Cosmos, Tezos, Cosmos, and USD coin.

Initially, Coinbase was the only platform to offer ETH staking (ETH 2.0), but now Binance has that too. The presence of ETH staking fails to bring Coinbase into the limelight, unlike previously.

Additionally, Binance bears another advantage to making the staking decision even easier. On staking your crypto, you need to pay Coinbase a share of your rewards as commissions. In the case of Binance, staking is completely free and the APY (annual percentage yield) is higher, making it a perfect choice for users interested in crypto staking.

It’s clear who’s the winner here.

Cryptoassets are a highly volatile unregulated investment product.

Binance Academy

For a lot of beginners in the crypto space, it’s hard to find all the necessary learning material in one place. And that’s where Binance Academy is a lifesaver.

Right off the back, the platform offers educational resources on topics such as Blockchain, Economics, History, DeFi (Binance exchange lists many DeFi coins), NFTs, and much more. Preferences such as difficulty level and reading time can be set to make the learning process tailored to each individual.

The platform has a collection of in-depth articles that explain crypto-related concepts in detail. Binance also has a free trading course where students performing excellently are rewarded on a weekly basis. And to top it all off, all these resources can be availed on a mobile app that works on both Android and iOS.

Coinbase has its Coinbase Earn platform which is another way to learn. Both platforms offers ways to earn free crypto after completing the tutorial lessons. eToro also has trading courses and an academy to learn to trade.

Demo Accounts

A demo account educates a beginner on all the dynamics of trade. The tool is particularly beneficial because one can afford to make mistakes and not lose actual money. A beginner can learn skills like positioning and risk management that go with actively trading a cryptocurrency.

Unfortunately, none of the platforms mentioned above offers a demo account. But that’s no reason for disappointment. Both the platforms have a minimal minimum deposit enabling a user to trade crypto without risking too much capital upfront.

However, if you still wish to practice on a demo account there are multiple third-party crypto apps available on the internet to paper trade, or open an account on eToro which offers a demo account.

Binance vs Coinbase Payments and Minimum Deposits

Binance and Coinbase, both allow the purchase of cryptocurrencies with a bank account, wallet, and credit or debit card. Neither of them charges a fee on deposits and withdrawals done with ACH. On wire transfers, however, Binance comes out as a better alternative. Coinbase charges $10 for wire deposits and $25 for wire withdrawals, while Binance does that for free.

Along with other payment methods, Coinbase allows you to purchase crypto with Apple Pay, while Binance allows you to do the same with Google Pay.

To purchase a cryptocurrency on Coinbase, the minimum order value should be $2. The withdrawal is capped at $50,000/day for a Coinbase pro account. This amount applies across all available currencies.

The minimum deposit amount for Binance has been $10. Normally, an unverified user can withdraw up to 2btc a day, while on verification a user can withdraw up to 100btc a day.

| Brokers | Binance | Coinbase |

| Payment Methods | Debit card, credit card, PayPal, Google Pay, Bank transfer | Debit card, PayPal, Apple Pay, Google Pay, bank transfer |

| Minimum Deposit | $10 | $2 |

| Processing Time | Instant | Instant |

Cryptoassets are a highly volatile unregulated investment product.

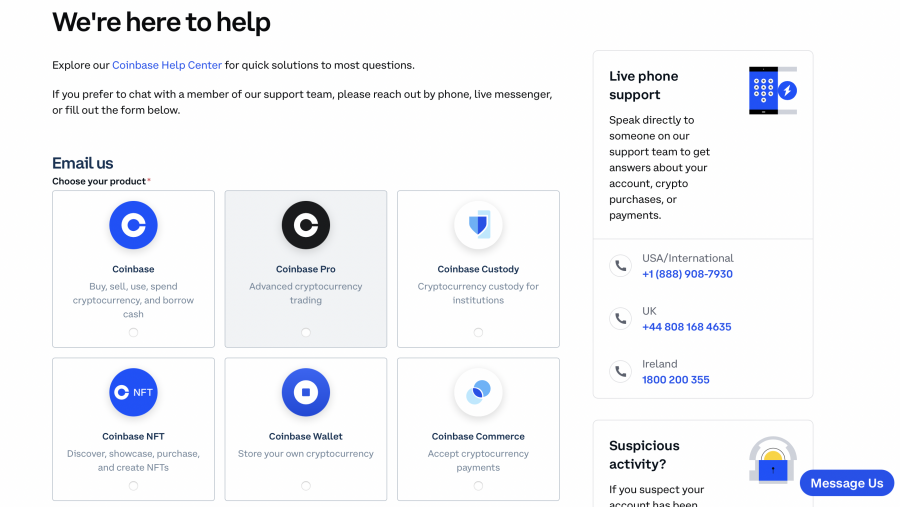

Customer Service

To get a query answered, a user has to go through a chatbot on the Binance website. The chatbot displays the most relevant FAQs and elaborates on an issue after a requested input.

If the issue remains unsolved, a user can click on the thumbs down button and a customer service executive will enter the chat within 5 minutes. There is also material available like FAQs and comprehensive how-to guides and articles explaining relevant crypto topics thoroughly.

The customer service of Coinbase is equally as impressive but in a different fashion. Coinbase offers multiple ways to contact customer support, including phone, email, and chat. Certainly, a call is the most preferred option to solve a query and is available round the clock. Therefore you can expect Coinbases’ Customer service to be quicker and more efficient.

Binance vs Coinbase Regulation & Security

Binance was initially launched in China, unlike Coinbase, which initiated its operations from San Francisco in 2012. Binance, being an unregulated platform, banned US residents from accessing the exchange. However, the new platform BinanceUS follows United States regulations and operates from San Francisco.

Though both the platforms are considered to be fairly secure, Binance has a compromised image and is under regulatory investigation in the US. Coinbase is regulated by the FCA and needs its consent to handle any regulated activity. eToro is regulated by the FCA, ASIC and CySEC.

All USD balances in both Binance and Coinbase are insured for up to $250,000 by the Federal Deposit Insurance Corporation(FDIC). In the case of Binance, these funds are stored in Custodial bank accounts.

While Coinbase has two additional ways to manage these funds. It can either invest the funds in liquid U.S. Treasuries or hold the funds in USD denominated money market funds under state money transmitter laws.

On the security front, Binance has multiple security settings put in place to safeguard its digital assets. Binance works in partnership with Trust Wallet- an open-source online wallet with over 5 million active users across the globe. To access this wallet, a user needs a PIN, biometric access, encrypted keys, and the 12-word recovery phrase.

Furthermore, Binance offers features like address whitelisting, advanced verification, and an option to review devices that have access to your account. All these features promise robust security and provide confidence about the security of one’s digital assets.

Unlike Binance, Coinbase has its own digital wallet. Both the wallets share similar features. Additionally, Coinbase keeps 98% of user assets in cold storage – preventing online theft.

And lastly, both the platforms provide two-factor authentication(2FA) through SMS or the Google Authenticator App, wherein a six-digit passcode is required to access an account.

Are Binance or Coinbase the best Crypto Exchange in 2022?

Binance and Coinbase, both have their respective pros and cons. Determining the “best” really comes down to the subjective demands of a user.

While both exchanges tick most of the boxes in the “essentials of a crypto exchange list”, both fail to tick all the boxes. While Binance is popularly known for its low fees, the platform can be somewhat complex for an average user. If you’re an advanced trader and familiar with day trading on leverage, it’s a good option.

Coinbase has a simple UI but the transaction fees can be high even if using Coinbase Pro. Subjectively speaking, neither can be considered the best crypto exchange available.

If we were to increase our scope for contending exchanges, eToro – a multi-asset brokerage company unfolds as a more holistic crypto exchange available. There are multiple features exclusive to the platform that make it the better alternative of the three.

Firstly, eToro is handy for a beginner. The user interface is even more friendly than Coinbase, and the platform provides buy, sell and hold ratings to make the trading decision easier. Secondly, eToro charges less in fees.

Each user has to pay 1% of a crypto purchase as fees, which is a quarter of what Coinbase can end up charging if using a debit card to buy crypto. Finally, eToro offers a built-in social media platform with a community of 27 million plus users across 140 countries.

Additionally, eToro also supports copy trading, wherein a user can mimic the trades of an experienced trader.

Many of these traders have displayed constant returns and outperformed major benchmark indices. For those interested in copy trading eToro beats both Binance and Coinbase, although you might want to open accounts on several platforms.

Cryptoassets are a highly volatile unregulated investment product.

Binance vs Coinbase – The Verdict

Both Binance and Coinbase, are as much similar as they are different. Binance exchange is primarily known for its vast offering of coins and low fees on purchase orders. On the other hand, Coinbase is a user-friendly platform, especially beneficial for beginners.

If you are an active trader, Binance is expected to be a better choice. The choice of coins is extensive, and the platform offers all the necessary tools for complex analysis. However, as a US resident, you have access to only 50 cryptocurrencies.

Conversely, Coinbase exchange allows unrestricted access to all its cryptocurrencies and is available in every US state except Hawaii. Coinbase is extremely easy to use – a crypto purchase requiring only a few clicks.

In conclusion, the choice of exchange is up to you. If you are a US resident, Coinbase would be a perfect choice. Conversely, for non-US residents, Binance comes out to be a better alternative owing to its availability of currencies and lower fees.