A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones.

Quant Suggests This Bitcoin Bear Market Is Unlike The Rest

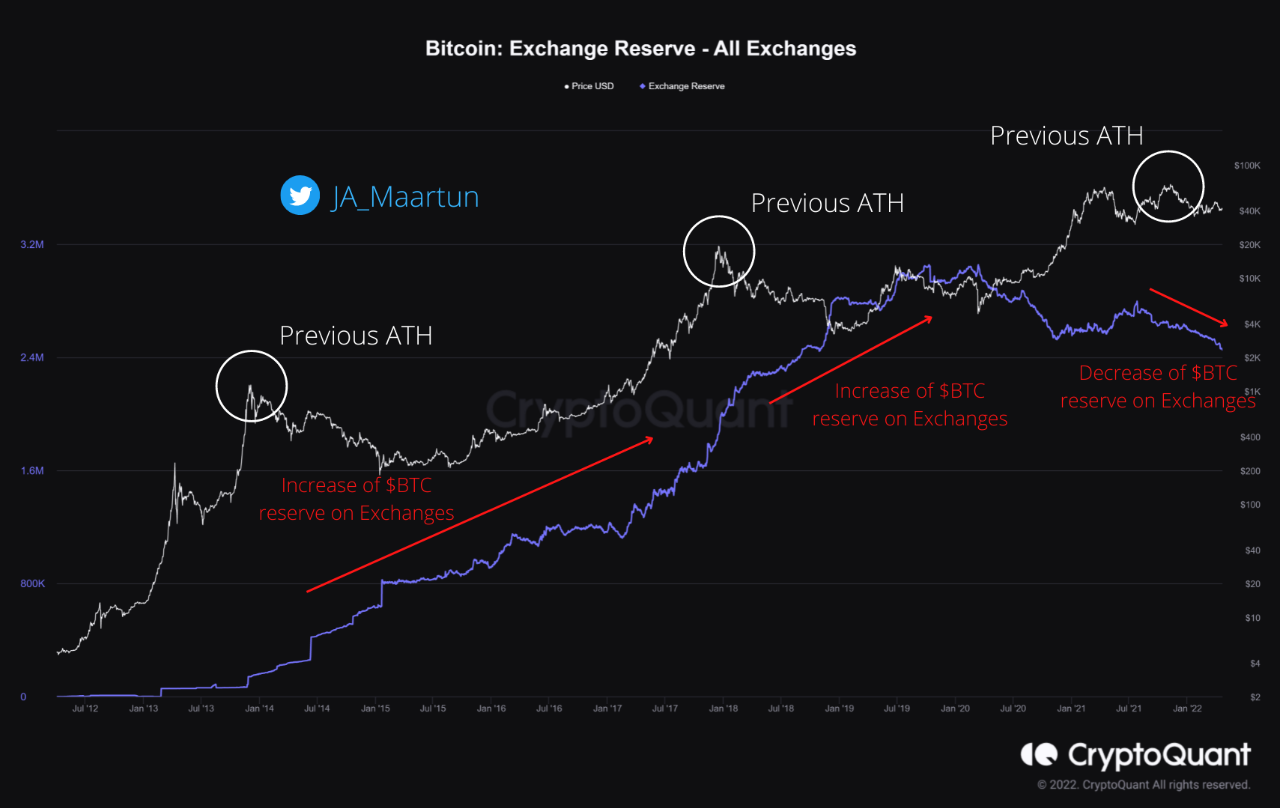

As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of previous bear markets.

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin stored in the wallets of all centralized exchanges.

When the value of this metric trends up, it means the supply on exchanges is increasing. Such a trend may be bearish for the price of the coin as investors usually deposit their crypto to exchanges for selling purposes.

On the other hand, the reserve’s value going down would suggest holders are withdrawing a net amount of coins right now.

Related Reading | Data: Much Of The Bitcoin Market Has Held Strong Since January 2022

This trend, when sustained, can imply accumulation may be going on in the market, and thus could prove to be constructive for the price of the coin.

Now, here is a chart that shows the trend in the Bitcoin exchange reserve over the history of the crypto:

Looks like the value of the indicator has been going down recently | Source: CryptoQuant

In the above graph, the quant has marked some previous price ATHs and the trends in the Bitcoin exchange reserve that followed them.

It seems like the value of the indicator rose up during the bear markets starting from 2014 and 2018 after the respective ATHs were formed.

Related Reading | EU And Sweden Discussed Banning Bitcoin Proof Of Work: FOI Documents

Following the May ATH, too, the indicator seemed to be observing some upwards movement as a mini-bear market appeared. This trend matched up with what was seen during previous bear markets.

But things changed quickly. A new rally began that took Bitcoin to a new ATH in November, following which the coin observed some major downtrend.

A bear market seems to have griped the market in the last few months, but unlike those previous bear market examples, the exchange reserve has actually been going down this time.

There could be several reasons behind this trend. One major factor may be that part of the supply has just shifted into new investment vehicles such as ETFs.

Whatever the reason may be, one thing’s clear. This bear market is looking to be quite different from the previous ones, at least in terms of the exchange reserve.

BTC Price

At the time of writing, Bitcoin’s price floats around $40.5k, up 1% in the past week.

BTC's price seems to have plunged down over the past day | Source: BTCUSD on TradingView