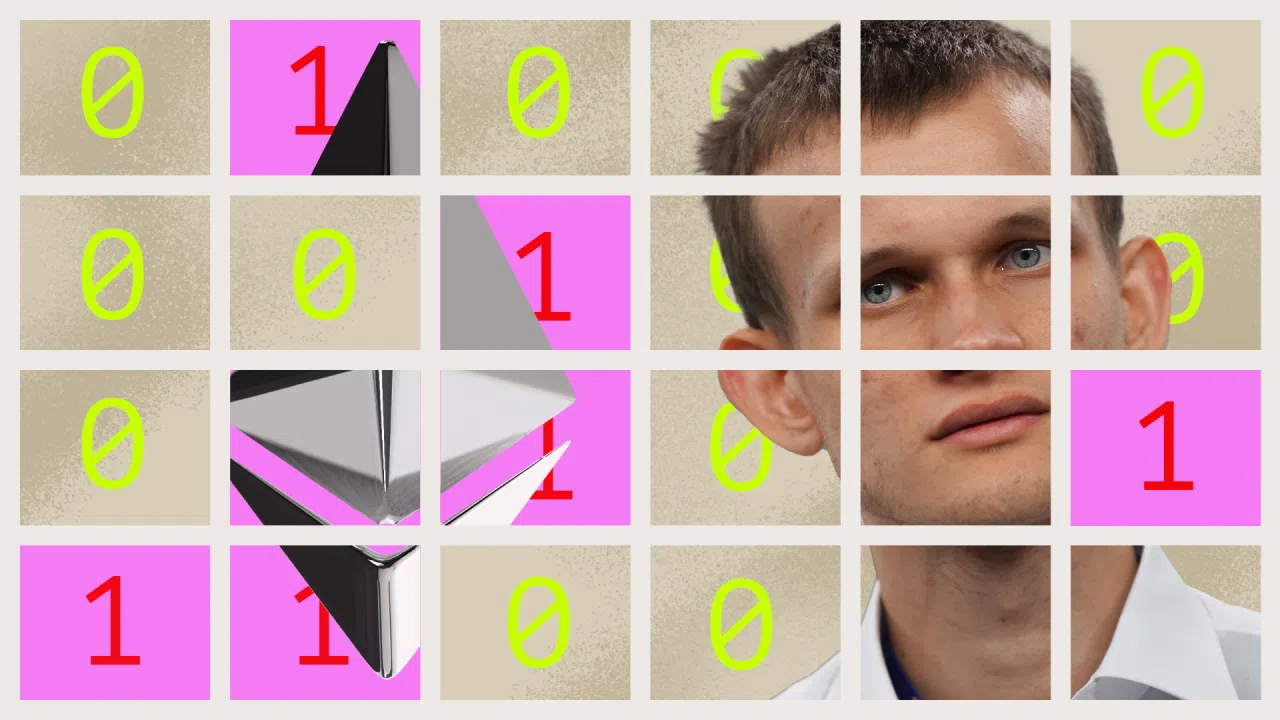

Ethereum co-founder Vitalik Buterin has shared his views on the implosion of FTX, saying that its impact is much more significant than Terra’s Luna crash.

Buterin made the statement in response to a tweet that compared FTX’s collapse to that of Mt. Gox.

Buterin Says FTX Fraud ‘Cuts Deeper’

According to the tweet, the Mt Gox event happened when the industry was not mainstream, and the impact of FTX’s crash could become synonymous with that of Enron.

Buterin noted that while Mt Gox and Luna were similar as they both looked sketchy from the onset and never tried to whitewash themselves completely, “FTX was the opposite and did full-on compliance virtue signaling (not the same thing as compliance).”

He added that FTX’s type of “fraud cuts deeper” than anything Luna or Mt Gox could have caused.

Buterin on CEXs Vs. DEXs

Buterin further argued that conversations surrounding centralized exchanges and decentralized exchanges miss a key issue.

According to him, the two act as a substitute for some kind of service. He noted that while DEXs can be used for cross-crypto trading, custody, and even leverages, they are currently unable to “function as a fiat-crypto gateway.”

The Ethereum co-founder concluded that “it depends on the details of the regulation, particularly the practical outcome in terms of what the easiest process for converting $X of fiat into crypto and back becomes.”

Other Stakeholders Share Views on FTX Collapse

Other stakeholders in the crypto space have also expressed their views on FTX collapse. Coinbase CEO, Brian Armstrong, said the crisis has offered US lawmakers and regulators an opportunity to hasten crypto regulation.

Binance CEO Changpeng Zhao also shared the same view. According to CZ, the incident has set the industry back by a few years. However, he believes the regulatory scrutiny that will follow would be good for the growth of the space.

Cardano founder Charles Hoskinson described the series of events as the latest crisis of the current bear market. He continued that this will cause more issues for the whole crypto sector, adding that situations like this “tend to invite regulation, and they tend to invite enormous scrutiny.”

Ripple CEO Brad Garlingouse said the reason why most crypto trading is offshore is that the United States does not provide guidance for how firms can comply. Garlinghouse continued that Singapore, on the other hand, has a licensing framework and token taxonomy which can allow them to “appropriately regulate crypto.”