Earning passive income with crypto is not just a pipe dream. At the time of writing, it is a topic that all long-term crypto adopters should seriously consider. In a time when crypto is becoming mainstream and more crypto-backed financial projects are emerging, regular users need to know how to successfully navigate this new sea of opportunities.

In this guide:

- Earning a passive income with crypto is a realistic goal

- Why your crypto assets should be working for you

- How to make passive income with cryptocurrency

- Other passive income strategies

- 7 ways to earn passive income with cryptocurrencies

- 1. Staking

- How the earnings happen

- How staking is designed

- On-chain vs application level staking

- 2. Yield farming

- How the earnings happen

- How yield farming is designed

- Earning Passive Income with Yield Aggregators

- 3. Cloud mining

- How the earnings happen

- How cloud mining is designed

- Downside to Mining

- 4. Crypto savings account

- How the earnings happen

- How crypto savings account is designed

- 5. Crypto lending

- How the earnings happen

- How crypto lending is designed

- Crypto lending options

- 6. Affiliate programs, airdrops, and forks

- How airdrops and fork provide a passive income

- How airdrops and forks are designed

- 7. Dividend-earning tokens

- How these tokens provide a passive income

- How dividend-earning tokens are designed

- 1. Staking

- Are your crypto assets earning you passive income?

- Frequently asked questions

Earning a passive income with crypto is a realistic goal

Opportunity cost is an important topic for all types of investors. Financial resources that are not being used, in many ways, are being wasted. By the same token, the quickness to go out and invest your resources will often lead investors, especially in the crypto world, into trouble occasionally.

This happens to many cryptocurrency investors. Cryptocurrency trading and investments can be extremely profitable, but also very time-consuming. The profitability is in no small part due to the volatility of the market. This can create stress for investors. It’s all due to the constant need for users to track their portfolios, and try to capitalize upon opportunities. Managing this kind of economic system is no easy task.

Many investors are unaware that cryptocurrencies can provide passive income. The sole strategy of many investors is to purchase bitcoin, ethereum, or other cryptocurrencies. Next, they wait for the value of these assets to increase. Historically, this logic has proven, at times, to be correct. However, it also means that those funds are frozen. During the same period, these investors could have greatly increased their financial capabilities. They chose not to do so.

Passive income is earned directly from ownership over your digital assets. It involves no continuous effort. Instead, it requires that users make a few smart choices at the start of their journey. The system is similar to compounding interest, reinvesting dividends, or renting investment properties. Passive crypto income is possible in 2022 because the market includes a multitude of projects looking to compete with the traditional financial sector.

/Related

MORE ARTICLESBest Christmas Crypto Promotions in 2022

Top 10 Telegram Channels for Crypto Signals in 2022

9 Best Crypto Exchanges for Beginners

Copy Trading: A Definitive Guide for Beginners (2022)

What Is the Crypto Fear and Greed Index?

Top 7 Crypto Debit Cards in Europe

How To Make Money With Bitcoin in 2022: 9 Proven Methods

Web3 Jobs: How to Get a Job in Crypto Sector

Who Owns the Most Bitcoin in 2022?

Why your crypto assets should be working for you

It is never a good idea to have money in an idle state. People are usually forced to convert their cash into a valuable asset by inflation. Or, at the very least, they should consider it. While some people invest, others feel it’s too risky.

Stocks are often a risky proposition and involve a lot of background knowledge of the subject. Many people buy immovable assets such as real estate to make passive income by renting. This is a great idea. However, it involves other difficulties with managing these resources.

Crypto culture did not always encourage adopters to earn income from existing assets. The features of liquidity and decentralization, however, can aid greatly in doing just that. Decentralized Finance (DeFi) protocols looked to change the crypto landscape. It made passive income more lucrative and easier than ever before. These opportunities persuaded many investors. Let’s take a further look at the methods that any crypto-enthusiast can adapt to earn a passive income from their digital assets.

How to make passive income with cryptocurrency

There are numerous methods to consider when looking to earn a passive income from cryptocurrency. Each present unique opportunities, as well as challenges that need to be considered. Some are more profitable than others. At the end of the day, however, if executed correctly, each strategy can present you with a handsome crypto profit earned without effort.

Lending and yield farming are perhaps the most popular ways to earn passive income with crypto. Both involve providing some of your digital assets, for a small period of time, towards a crypto project. In return, you will receive a fee proportional to the amount you have lent.

Other passive income strategies

Mining is another popular method. Currently, the classic PoW model of mining is no longer profitable for most users. Instead, cloud mining can be a great alternative. Crypto staking is another method to take advantage of your digital assets.

Let’s also not forget about crypto savings accounts. These crypto companies will provide a yield to those choosing to deposit funds into the accounts.

The passive income options do not stop here. There are also affiliate programs and airdrops that are worth exploring. Running a lightning node may be an option for those interested also in the technical aspects involved with blockchain technology. Users can also purchase dividend-earning tokens that will provide them with a stake in a company. All of these are options worth considering. All of them require a good amount of investigation.

In order to save you some of the research work, we have assembled a list of the most profitable strategies. Let’s look at them and how each one can earn you crypto income.

7 ways to earn passive income with cryptocurrencies

1. Staking

Proof-of-stake is a blockchain consensus mechanism. It allows distributed network participants to come to an agreement about new data being added to the blockchain.

In many ways, staking is the purest form of earning a passive income from crypto. It is an alternative or even a replacement for the role of the crypto miner. And it can be highly profitable for users over time.

How the earnings happen

Blockchains allow open, decentralized networks that enable participants to join the governance process. This is involved in validating transactions. This is important because it eliminates the need to have central authorities such as banks. Blockchains can randomly select participants and elevate them to the rank of validators. In turn, they are rewarded for their efforts.

Instead of “miners,” who receive new block rewards like in Proof-of-Work (PoW), the validators get new block rewards in Proof-of-Stake (PoS). While validators don’t need costly hardware, they must have enough tokens to be eligible for the next block in the chain.

How much you will make from staking depends largely on the token itself. The value of the tokens being staked can increase over time. Historically, this has happened on different occasions. This also involves a certain amount of risk. If the token’s value decreases, so do your earnings. Making the right choices, initially, can greatly help your chances of being successful.

Cosmos (ATOM), tezos(XTZ), and cardano (ADA) are some of the most popular cryptocurrencies that can be staked at this time. All of these are also available on large crypto exchanges.

How staking is designed

Essentially, the validators receive rewards on staked funds in return for their contribution to the network’s validity. This validation mechanism is known as Proof-of-Stake. It allows holders (those who are in it for the long-term) to earn passive income.

There are many systems that pick validators. They can be used in different ways. Some blockchain networks require that users deposit or commit financial resources. A blockchain chooses validators from a pool of users who have staked a certain amount of its native digital asset.

Crypto staking is a great way to earn crypto rewards. It is also a great way to support the philosophy behind blockchain technology. Focusing on staking is a great strategy for long-term adopters of crypto. Even in 2022, this can be very profitable.

On-chain vs application level staking

In laymen’s terms, staking is the act of locking up your cryptocurrency to earn more cryptocurrency. This

is typically done at the protocol level — on-chain, but can also be facilitated at the application level. A proof of stake blockchain will allow you to escrow your cryptocurrency into a computer program

called a smart contract.

This would give you the right to earn a protocol’s native cryptocurrency by

processing transactions or blocks on the blockchain. Ethereum 2.0 and Polkadot’s protocols offer this form of staking.

Applications and protocols built on a blockchain allow staking as well. Though they do not have their

own native blockchains, protocols built on Ethereum — like Chainlink and the Graph — offer staking. These are also excellent ways to earn passive income with crypto.

2. Yield farming

With the rise of decentralized exchanges and smart contracts, yield farming became very popular in 2020–2021. The system relies on users contributing to the financial liquidity of the protocol.

Investors deposit tokens into a special smart contract called a liquidity pool to earn the reward. The liquidity pool’s traders receive a portion of the fees they generate. This is a method to contribute to a decentralized exchange system and receive rewards for it.

How the earnings happen

Yield farming is another way to earn passive crypto income. These are possible thanks to the dynamic operations and liquidity of decentralized exchanges. Trading platforms exist that allow users to rely on smart contracts. These are programmable, self-executing computer contracts.

In turn, investors can obtain the liquidity that they need. Users do not trade with brokers or other traders. Instead, they trade against funds that investors have deposited into the liquidity pools. Liquidity providers, in turn, receive a portion of the trading fees from this pool.

The interest rate depends on a number of factors. On a good day, farming returns can have an Annual Percentage Yield (APY) of 30% on well-known coins. The rewards can be even higher for lesser-known coins looking to build a reputation.

However, the strategy is not without its risks. First of all, users need to consider price volatility. This is particularly important for the lesser-known coins that we mentioned. Furthermore, rug pulls must be considered, when endorsing these strategies.

How yield farming is designed

You will need to become a liquidity provider (LP), in order to start making passive income through the yield farming system. The system often requires ethereum and a DeFi token such as Uniswap or PancakeSwap. You may also need to own a stablecoin, such as Tether (USDT) to get started.

After you deposit liquidity, the decentralized exchange will transfer LP tokens that represent your share of total liquidity pool funds. These LP tokens can be staked on supported decentralized lending platforms, to earn additional interest. This strategy provides you with two interest rates for a single deposit. Overall, in 2022, yield farming is one of the most popular strategies for earning passive income from crypto.

Earning Passive Income with Yield Aggregators

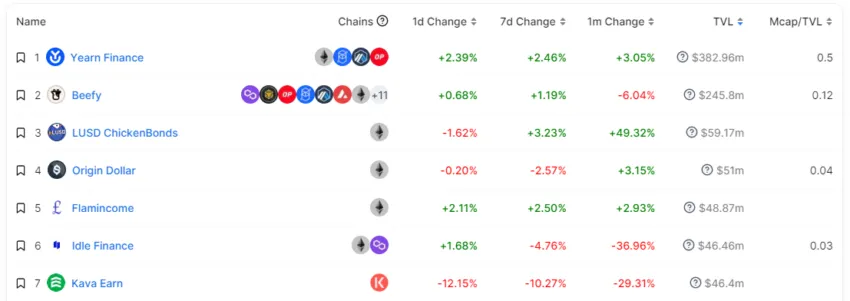

Yield Aggregator Metrics: Defi Llama

Yield Aggregator Metrics: Defi Llama

Yield optimizers make the yield farming process much smoother, which ultimately makes earning passive income with crypto easier. It is important to remember that yield aggregators (a.k.a., yield optimizers) only make the yield farming process smoother. Users are still able to earn passive income through yield farming crypto without the use of applications.

Some of the most popular yield farming protocols are Curve/ Convex Finance, Yearn Finance, and Beefy Finance. Yearn Finance alone has a TVL of almost $400 million, down significantly from its ATH. This gives much credence for the ability of crypto to earn its users passive income.

3. Cloud mining

Cloud mining helps you to mine cryptocurrency using cloud computing power that is rented. Essentially, you are using somebody else’s computer to mine cryptocurrencies, such as bitcoin. It is a system worth considering in your bid to earn passive crypto income. However, it requires a good deal of forethought and calculations.

You don’t have to install or run any software. Cloud mining companies allow users to open an account to participate remotely in cryptocurrency mining. This makes it more accessible to everyone around the globe. This type of mining can be done remotely, and it reduces the need for equipment maintenance and direct energy costs.

How the earnings happen

Cloud miners can become members of a mining pool where they purchase “hash power.” In exchange, they pay for the service. Participants are entitled to a proportionate share of the profits based on the amount of hashing power rented.

What is the interest rate? This, once again, depends on a number of factors. Primarily, you will need to look at your daily costs and at the expected rewards. The most optimistic investors claim that with an investment of $2000, they are able to earn around $100 daily when mining with a 14.33 Th/s capacity for Bitcoin.

The strategy can be more profitable, however, based on the coin being mined and on the costs involved.

How cloud mining is designed

Cloud mining is similar to pool mining. However, both are excellent ways of earning passive income wih cryptocurrency.

With pool mining you can either purchase additional resources for your CPU or share yours. With cloud mining, you purchase hash power. The miners receive what is left over. You only pay for the hash rate that you choose at the start. Based on the hashes that you bought, you get a share of what miners make.

The most popular type of cloud mining is hosted mining. This model allows customers to lease or purchase mining hardware at a miner’s location. The equipment is maintained by the miner. They are the ones who ensure that it works as intended. Customers have direct control of their cryptocurrency through this model. Because of its scaling system, mining farms can reduce the high costs of electricity and storage. However, this type of mining comes with a significant upfront cost.

Downside to Mining

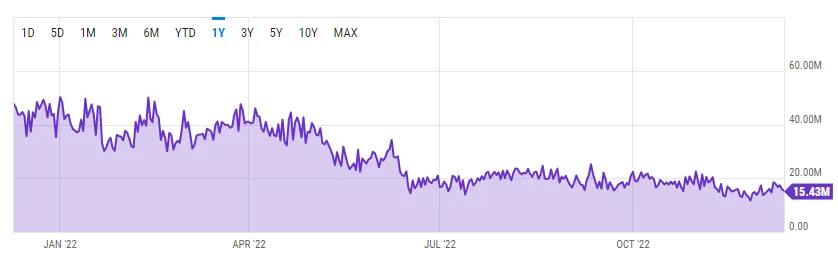

Bitcoin Mining Revenue Per Day: YCHARTS

Bitcoin Mining Revenue Per Day: YCHARTS

One of the downsides to earning passive income crypto through mining is the profitability of mining. Mining profitability is calculated by taking the miner’s revenue per kilowatt hour (kWh). When the cost to mine outweighs the rewards created from mining, miners do not reap any revenue.

This problem is compounded when taking into account that many miners must acquire loans to start mining operations. When miners can not earn passive income with crypto mining, they must turn off their miners or sell their mining equipment equipment to cover costs.

To continue, this creates even further issues when taking into account that selling unproductive mining equipment is a virtually illiquid market. Though cloud mining is slightly different, it is however ultimately mining with a couple of extra (or fewer) steps.

4. Crypto savings account

Savings accounts are another conservative, generally safe option to earn passive income from cryptocurrencies. Users can earn a return on crypto deposits by opening a crypto savings account. They work similarly to the financial products offered by regular banks.

These types of interest-bearing digital asset accounts are still a new crypto proposition. Their rate of return is very impressive. It often puts bank yields to shame. Your APY will differ depending on whether you choose a flexible or fixed term. In a nutshell, this option allows you to make use of crypto assets that you plan to hold for a long time. They are more profitable than bank savings and are worth considering.

How the earnings happen

High yield or interest rates are the main reason to consider a crypto savings plan. Various companies offer yields of 10–20% at this time. Modern banks can’t compete with these figures. Banks usually offer a lower interest rate.

These savings accounts provide yearly yields. These accounts, unlike banks, estimate their yields using crypto. Crypto assets can fluctuate. It is important to keep this in mind. This can impact the annual yield. Offers that are based on stablecoins might be best.

Simply put, companies that offer these types of savings accounts are already considering the needs of different types of customers. You can opt for accounts that provide greater protection against asset volatility. At the same time, you can embrace price fluctuation and attempt to make a greater profit.

How crypto savings account is designed

The way savings accounts operate are quite straightforward. What you will need to consider is the available options when it comes to taking out your cash. Flexible or fixed terms will be available for withdrawals from savings accounts. Fixed terms will allow you to lock your money up for a specific period of time and receive higher yield rates. These savings accounts are similar to crypto staking’s high yields.

Users earn interest on crypto in exchange for a deposit. The best interest rates are often found in stablecoins such as Dai (DAI) and U.S. Dollar Coin (USDC). These types of deals are offered by a number of crypto companies such as Celsius and BlockFi.

Once more, this strategy is especially worthwhile for those looking to remain invested in crypto for a long time. It is a generally safe method to earn passive income on your already owned assets.

5. Crypto lending

Crypto lending is another good way of ensuring that your digital assets do not sit around idly. You will be earning a profit for providing liquidity to other crypto users. The loan will be paid back to you, with interest, with a DeFi platform acting as the intermediary.

You can borrow or lend digital currency through DeFi platforms such as Aave or Compound. Alternatively, you can use central finance (CeFi) networks such as Celsius. Essentially, you will be using a DeFi platform to become the liquidity provider in a crypto loan. In exchange, you will be rewarded with an interest rate once the loan is paid back.

How the earnings happen

In 2022, crypto lending can still be very profitable. Like all other strategies, the interest rate will vary based on the project with which you are working and on the coin being lent. However, currently, the regular yield for numerous crypto coins varies from 3% to 8%. It is also expected that for stablecoins, the rewards can be higher. Users can expect 10% to 18% interest rates on those.

Crypto lending, however, is not without its risks. For this reason, we encourage users to thoroughly and properly research all projects with which they get involved. Usually, this refers to having the loan paid back. However, normally, the borrower will offer certain collateral. This can be seized in the event that the loan is not paid in full at the convened time.

How crypto lending is designed

Investors can lend crypto in many ways. All cases involve lending crypto to another person for a period of time, in return for a fee. It is worth taking a loan at the available options.

Higher interest rates, longer loan periods, and larger loans can affect the conditions for the deal. These will, normally, increase the interest rate that the borrower will pay. In some cases, it is the crypto lender that negotiates the deal. In most cases, however, it is a third party that is responsible for setting up the loan.

Crypto lending options

Here’s a quick look at the crypto lending options:

With margin lending, users can lend their crypto assets out to traders who are interested in borrowing funds. These traders can increase their market positions by borrowing funds. They then repay the loans with interest. In this case, there are crypto services ready to set up the deal for you. In turn, you will need to make your digital assets available.

Peer-to-peer lending allows users to choose their terms. They will need to decide how much they wish to lend. In this way, the interest on loans. Similar to the way that peer-to-peer trading platforms match buyers with sellers, crypto platforms match borrowers with lenders. These lending platforms allow users to have better control over their lending deals. You will need to deposit your digital assets on the custodial wallet of the lending platform before you can lend them.

Centralized lending relies solely upon the lending infrastructure of third parties. The lock-up period and interest rates are also fixed in this scenario. To start earning interest, you will need to transfer your crypto funds to the lending platform.

Decentralized lending is also known as DeFi lending. As the name implies, this allows users to conduct lending services on the blockchain without any intermediaries. Instead, lenders and borrowers interact using programmable smart contracts. These autonomously and periodically set the interest rate.

TVL on Ethereum DeFi Protocols: intotheblock via DefiLama

TVL on Ethereum DeFi Protocols: intotheblock via DefiLama

6. Affiliate programs, airdrops, and forks

The crypto world is full of projects looking to make themselves known. Some of them will reward early adopters. Others will provide rewards for bringing them business. Others, still, will provide rewards for those who have bought into their philosophy and who endorsed the system that they created. All of these are great methods to earn passive income. They all require fewer actually resources. However, you will need to conduct a lot of research to be on top of all the upcoming projects.

There are many types of affiliate programs available. Most of these focus on crypto-related products or services. Some high-profile exchanges offer affiliate programs as well. These repay you for bringing customers to try their service.

Forks are when an existing coin is branched into a new chain. They reward you because you embraced the original product. Airdrops are usually provided when new coins are created. They act as an incentive to try out a new crypto product.

How airdrops and fork provide a passive income

All of these strategies can be massively rewarding, but likely not immediately. All three of these methods involve receiving crypto, essentially, for free. However, it is worth noting that these rewards, likely will not have a tremendous value at the moment at which they are provided. The goal of the companies providing this is to grow the market for their product. Your success with this strategy depends on how the cryptocurrency’s value will evolve.

For example, users who frequently interact with existing and new platforms using crypto will most likely be eligible for an airdrop. As part of a larger marketing campaign, airdrops are where developers and blockchain-based projects send tokens free of charge to their members. It is the equivalent of receiving a free sample of a product.

Still, do not neglect to research these types of opportunities. Many of the most valuable cryptocurrencies were once worth cents and could have been received through similar programs.

How airdrops and forks are designed

Each one of these incentive opportunities arrives with different conditions. Forks of important coins reward users of the original system. The creators of the forks hope to promote their coins to the existing community.

For example, in 2017, everyone who owned bitcoin (BTC) received the equivalent amount of bitcoin bash. Similarly, users of the KeepKey hardware wallet received an airdrop from ShapeShift in 2021. All ShapeShift users who logged in during a specified time period received the tokens directly to their crypto wallets. To receive these rewards, you will need to be eligible. Furthermore, you will need to get involved in claiming your reward.

Crypto airdrops are not unlike receiving a discount coupon or a free sample for a product. A crypto airdrop doesn’t primarily encourage recipients to spend money. Their goal is to raise awareness about a new service. However, if the product does become highly successful, this will mean, essentially, receiving free cash.

Crypto affiliate programs can be very useful in promoting new crypto products as well. These programs are used by many businesses to increase their sales and trading volumes and grow their customer base. These often use social media channels such as affiliate marketing on Facebook and Twitter to achieve their goals. You should look for a program that has a high commission rate and a good reputation. The affiliate programs are especially profitable if you already have a large audience that is likely to listen to your suggestions.

7. Dividend-earning tokens

A dividend is the part of the profit that is paid to shareholders in a business. It is the reward that they receive for supporting the development of the business. The dividends themselves are paid off either in cash or shares in the company.

Crypto companies can function similarly. Some of these suggest a business system whereby users show their support by acquiring crypto tokens. These tokens can have various functions. One of them is providing rewards based on the profit of the company. This strategy should not be confused with staking. There, a user merely invests in a token in the hopes that its price will increase. Companies like Decred or Ontology pay cryptocurrency dividends.

How these tokens provide a passive income

Like with all other strategies, some of the companies involved pay better than others. This is why it is important to make wise choices based on research. Some of the backers of these projects can receive up to 30% per year in dividends based on the amount invested.

How dividend-earning tokens are designed

Most cryptocurrencies promise something akin to a passive income. In exchange, users offer their financial support. The income can come in the form of price appreciation of the token or investment opportunities.

Dividend-earning tokens, however, are supposed to resemble the system of stock ownership in a company. The logistics for this are still being worked out. However, the system looks to reward the project backers with dividends based on the company’s profits. These rewards naturally will also depend on the contribution that the users have made to the company.

Are your crypto assets earning you passive income?

Your digital assets provide you with immense opportunities. Naturally, the most obvious one involves the price valuation of these increases. However, waiting for this to happen may not be the best use of crypto finances.

In this article, we have looked at seven strategies to earn passive crypto income. All of them can be valuable to both novice and experienced users. These crypto-enthusiasts know very well that the opportunity cost involving their crypto should not be ignored. Your assets should be working towards making you richer. By making wise decisions and continuing to research the market, you are on track to achieving this.