From bitcoin — the first and most popular cryptocurrency — to thousands of other cryptocurrencies, blockchain technology continues to make waves while entering into several industries. This includes gaming, real estate, health, and many more. Factors such as transparency, decentralization, and accountability have played crucial roles in the applications of the tech.

However, with the mainstream media set ablaze with a myriad of issues this technology fixes, only a few are aware of its limitations. Well, one major issue with it going mainstream is its inability to interact with data outside the network.

This leads to the birth of Chainlink. In simple words, Chainlink integrates real-world data into smart contracts and vice versa. The project seeks to solve this problem by enabling access to real-world data and off-chain sources securely and reliably. But, first, let’s take a brief background check.

In this guide:

- A very short story of Chainlink

- What is Chainlink (LINK)?

- What are oracles?

- How does Chainlink (LINK) work?

- Core features

- Comparison with competitors

- Roadmap and development history

- Tokenomics

- Token information

- How to buy Chainlink (LINK)?

- Steps involved in buying LINK

- Price analysis and prediction

- Should you buy Chainlink (LINK)?

- Moving forward

- Frequently asked questions

A very short story of Chainlink

“A rising tide raises all boats,” as they say; the significant 2017 bull run came with the eruption of many blockchain projects, and Chainlink is one.

In 2014, Sergey Nazarov and Steve Ellis founded SmartContract— a smart contract that aims to expand smart contracts functionality by integrating them into external data sources. Fast forward to 2017, Sergey Nazarov — a 32-year-old web entrepreneur with an in-depth knowledge of the crypto market, started Chainlink.

/Related

MORE ARTICLESBest Christmas Crypto Promotions in 2022

Top 10 Telegram Channels for Crypto Signals in 2022

9 Best Crypto Exchanges for Beginners

Copy Trading: A Definitive Guide for Beginners (2022)

What Is the Crypto Fear and Greed Index?

Top 7 Crypto Debit Cards in Europe

How To Make Money With Bitcoin in 2022: 9 Proven Methods

Web3 Jobs: How to Get a Job in Crypto Sector

Who Owns the Most Bitcoin in 2022?

The platform was initially built as an oracle system that settles agreements made on a blockchain. However, Chainlink 2.0 has been developed, and it is now considered to be the original version. It’s a decentralized oracle network, acting as a robust abstraction layer, offering interfaces for smart contracts to extensive off-chain resources.

Brief milestones in Chainlink’s history includes:

- 2017: Chainlink raised $32 million during its ICO, with 1billion LINK tokens in circulation.

- 2018: Chainlink acquired Town crier, an authenticated data feed for smart contracts.

- 2019: Chainlink launched its platform on Ethereum’s mainnet.

- 2021: Chainlink’s project integration grew to more than 1000.

What is Chainlink (LINK)?

Chainlink is an open-source technology that is highly secure and reliable yet decentralized, deploying off-chain computing resources within the blockchain technology. In other words, it expands the ability of smart contracts to access real-world data that exist off-chain. You might be curious what smart contracts are?

Smart contracts are agreements that run on a blockchain. It creates a trustless and transparent environment. Smart contracts automate contracts only when the prestated conditions are met. One of these conditions can be the interest paid to node operators.

Smart contracts only offer on-chain services, which makes them limited in functionality. Chainlink is committed to creating a safe network where decentralized oracle networks are incentivized by money to provide on-chain functionality to the abundance of off-chain services. These two functions make up a hybrid smart contract.

Chainlink is an Ethereum-based network running on a proof-of-stake consensus mechanism.

What are oracles?

Basically, oracles send data from the outside world, such as retail payments, price feeds, and weather data, to a blockchain. Thereafter, a smart contract on the blockchain utilizes the data, typically to determine whether to carry out the conditions or not.

Oracles read, report, and confirm real-world data for blockchains and smart contracts through web APIs or market data feeds.

For instance, let’s assume Jay and Harry are betting on whether the Super Bowl 2022 will hold or not. Jay bets $1000 on hold, and Harry bets $1000 on won’t hold, with $2000 saved in escrow by running code.

When the event occurs, how does the smart contract figure who the winner is? This is where oracles come in. They read accurate event results outside of blockchain and report them to the on-chain, ensuring security and reliability of the data.

Oracles form the basis of Chainlink, and it’s more of a complex oracle itself that functions as a data feed based on predetermined conditions. For example, DeFi systems like AAVE and Synthetix employ Chainlink data feed oracles to get accurate real-world prediction markets in their smart contracts.

Chainlink offers an incentive market structure driving a “web of trust” — transparent reporting.

How does Chainlink (LINK) work?

Chainlink has the capability of making each concentrated procedure and action completely self-ruling. This implies that the platform successfully disposes of mediators, professionals and beats the trust of third parties.

In this manner, Chainlink addresses these problems, and a particular property’s record can contain an accurate and validated history of data.

Now this question is how?

First, real-world data is transferred to the smart contracts through node operators, and it is done by setting up a requesting contract. Chainlink then registers this request as an event and then sets up a matching smart contract known as a Chainlink service-level agreement contract, which then creates subcontracts that explain the working principles of Chainlink.

Core features

Chainlink’s primary working principle is with smart contracts. It registers a smart requesting contract as an event by setting a new matching smart contract known as a Chainlink service-level agreement contract, which provides access to any off-chain API you want to connect it to. Thus, it is possible to transact via a contract to any conventional payment network or banking system.

Below are three core features of this smart contract.

1. Reputation contract

Typically, this checks performance history, and it computes and records the performance history of operating nodes on the chain. This feature assures a reputation-based method that inspects, filters, and authenticates performance data on node operators and data sources by removing scruffy and unreliable nodes.

For example, marketplaces such as market.link provides individual data providers access to the Chainlink network to directly deploy their data on the chain via their own Chainlink nodes. Also, its analytical tools grants users access to check records on the historical performance of individual nodes.

2. Order-matching contract

This feature handles the contract query by sending and requesting to trustable nodes, checking their bids and the choices from the list obtained, and then selecting the suitable amount and types of nodes to answer the questions.

Oftentimes, queries this contract checks are average response latency, the deviation of values in their reports from consensus values relayed on-chain, revenue generated, jobs fulfilled, and more. During this process, Chainlink converts the research contract queries into the off-chain to go into the real-world and grab data from the internet.

3. Aggregating contract

Aggregating contracts validate data from both single and multiple sources. Then averages it to create a validated aggregate response, shedding away useless data.

Comparison with competitors

Chainlink is growing a solid ecosystem that is highly tamper-resistant, reliable, and future-proof. The cross-chain platform is by far the biggest oracle network. Factors such as integration, partnership, and market price top the list of what puts it in number one.

Currently, Chainlink successfully has more than 1000 partnerships, including Binance, Ethereum Classic Labs, Matic Network, Dapps Inc., and other mainstream organizations like Google, Swipe, and a lot more.

The closest competitor being, Band protocol has less than 100 integrations and fewer partnerships. Band protocol is a community-based data resource that grants operators access to the data feeds.

Chainlink differs from Band protocol in terms of operations. Band protocol allows DApp operators to access its data through its smart contract data feeds instead of Chainlink’s off-chain oracles.

Other interesting oracle service providers are Witnet, API3, and WINKlink. Chainlink has eight times more partnerships and integrations than the three others combined.

Roadmap and development history

Releasing its whitepaper in late 2017, Chainlink has successfully become the top leading blockchain-based oracle network with over 10,000 active addresses worldwide. With just six project integrations in 2018, the company has experienced enormous growth over the years.

Among several wins, In 2021, Chainlink announced more than 400 project integrations, including Cardano and Arbitrum.

The company has already launched a mainchain with “seven key on-chain functionality,” enhancing developers’ interaction with, CoinMarketCap, CryptoCompare, Kaiko, EasyPost, FlightStats, Brave New Coin, and Chainlink Alarm Clock APIs.

2022 is already looking great for Chainlink fans, as Co-founder Sergei Nazarov talked about launching staking rewards. The company will soon start staking rewards and improving scalability to an “insane vertical rate.”

Needless to say, with its potentially improved scalability, more enterprises are likely to join the network this year.

Tokenomics

The LINK token is the inherent currency of the Chainlink network. This ERC token runs all the operations on the Chainlink network.

LINK token is used as an incentive to compensate node operators for participating in tasks that lead to blockchain success. It is currently trading at $14.75 amounts to over a 21,000% increase from the launch price.

At the time of this writing, the LINK token has a circulating supply of over 460 million tokens. Which is about 46% of the total supply, making the token limited. 35% of LINK token is given to the decentralized oracle network operators and another 30% to the overall development of the ecosystem.

Token information

- Total Supply: Maximum supply of 1,000,000,000 LINK

- ICO Price: $0.11

- Circulating Supply: 467,009,550 LINK

- Trading Volume: $539,613,969.25

- Market Cap: $6,882,799,619.26

- Full Market Cap: $14,738,027,576.37

- Current Price: $14.74

How to buy Chainlink (LINK)?

Chainlink token is supported by many exchanges, including but not limited to, Binance, Coinbase, and Gemini. Here, you can exchange your fiat currency, such as USD, for LINK.

To get this done, you need to set up an account on one of the secure and reliable centralized exchanges. Do some verification by providing any means of identification.

Also, you can buy LINK with a debit and credit card. Some online wallets like Skrill and international payment networks like Swift allow the easy purchase of LINK tokens.

Decentralized exchanges also make it easy to buy or swap other altcoins for LINK tokens.

Ultimately, since it is an Ethereum-based token, you can easily purchase LINK on any Ethereum wallet — MetaMask and TrustWallet. These wallets also make it easy to swap LINK for any other altcoins on your wallet.

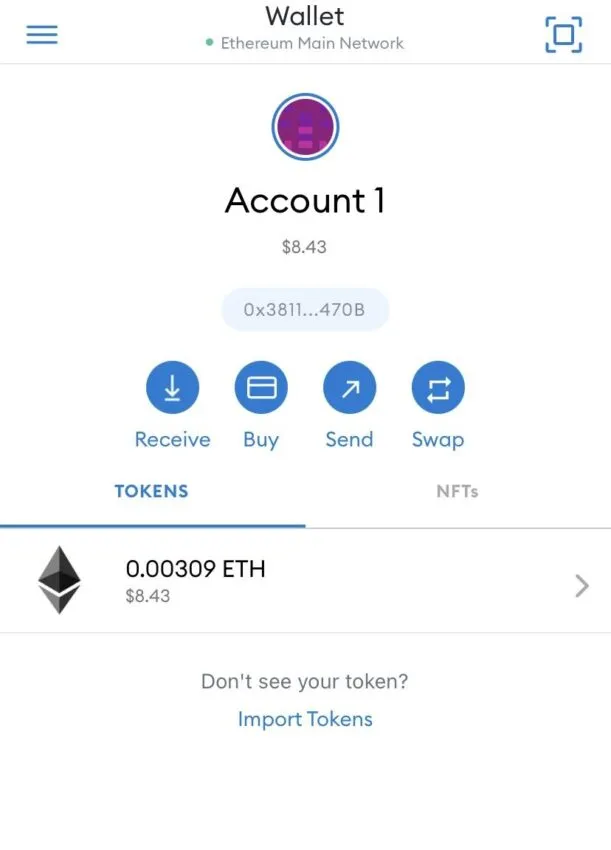

Using Metamask as an example, below is a step-by-step guide on how to buy LINK.

Steps involved in buying LINK

- Create an account.

Before you can purchase any cryptocurrency, you need to create an account with a crypto wallet. There are several wallets and exchanges available, but for this guide, let’s go through the process of buying LINK on Metamask.

This is what your main page would look like. Now you can proceed to fund your wallet.

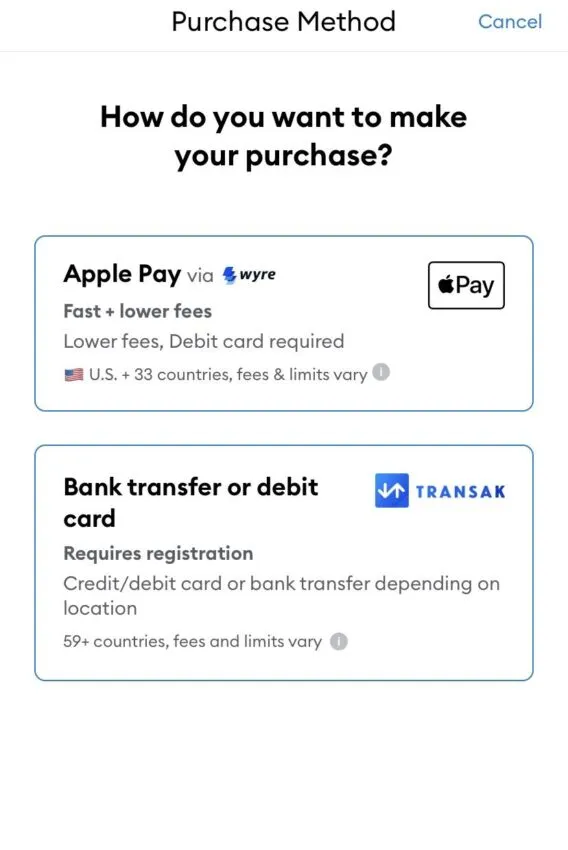

- Buy Ethereum with fiat currency.

Once you are done verifying and setting up your account, you should proceed to fund your wallet with ethereum. Here you can choose to fund via Wyre transfer or through credit/debit card.

- Swap Ethereum for LINK

Now that you have successfully funded your Metamask wallet, you have to swap, click the Swap option right at the main page, choose LINK and get quotes for your transaction.

Once you have confirmed the transaction, LINK tokens will appear in your main dashboard for a few minutes.

Interacting with the Ethereum blockchain comes with gas fees, and it varies from time to time, which sometimes might be highly ridiculous. If it is too high for you, wait several hours and try again as it continuously varies.

Price analysis and prediction

LINK price: TradingView

LINK price: TradingView

In the course of this current bearish market, LINK has tumbled well below $14, and it’s possible that the closest support will still be broken. As much as this might be bad news for the crypto degens, it’s a blessing in disguise for those willing to hold on for the long term.

LINK is currently trading below $15 after reaching an all-time high of $54 during a brief bull season in May 2021. So, it’s safe to assume that LINK will surge, giving buyers control in the market.

Should you buy Chainlink (LINK)?

It really should be about your investment goals. However, Chainlink has many interesting future-proof features that can potentially lead to more integrations.

Simply put, it is a low-risk investment with potential returns. If your investment milestone is still open, you should definitely add it to your portfolio.

Moving forward

Chainlink seamlessly brings real-world data into blockchain technology and has proven sustainability and reliability over the years. Its current price is multiple times much more than its ICO price. And 2022 is looking all good already.

If you’re feeling inspired enough to start investing in LINK, you should go ahead and do some research before you consider adding it to your portfolio. No matter how sweet it sounds.