There have been so many new developments and networks in the crypto space that it can be hard to keep up with these cutting-edge solutions. Decentralized exchanges (DEXs) and DApps remain some of the hotspots of activity, especially for next-generation networks like Cardano. The Cardax DEX and token, which operates on Cardano, is one of the most interesting of such developments.

In this guide, we’ll cover what Cardax is, how it differs from other DEXs, its core features, and where you can buy the CDX token.

In this guide:

- What is Cardax?

- Automated Market Makers

- Cardax’s EAMM protocol is an improvement over AMMs

- What makes Cardax different from other DEXs?

- Core features of Cardax

- Liquidity and fee model

- Cardax development phases

- Cardax tokenomics and distribution

- How to buy Cardax CDX token?

- Cardax could accelerate DeFi on Cardano

- Frequently asked questions

What is Cardax?

Cardax is a DEX that is built on the Cardano ecosystem. A crypto exchange that makes use of a novel version of an Automated Market Maker (AMM) called the Extended Automated Market Maker (EAMM). The DEX has some interesting design choices that make it worth examining.

Cardax, as its whitepaper states, aims to provide liquidity to projects that issue native tokens on Cardano. This is similar to other DEXs, but because it’s Cardano, there’s a little more interest surrounding its development. Plus, the fact that it does indeed have a unique design in the form of the EAMM protocol makes it compelling.

To give you a better sense of how Cardax distinguishes itself, it is worth going over what AMMs are, before explaining Cardax’s EAMM protocol.

/Related

MORE ARTICLESBest Christmas Crypto Promotions in 2022

Top 10 Telegram Channels for Crypto Signals in 2022

9 Best Crypto Exchanges for Beginners

Copy Trading: A Definitive Guide for Beginners (2022)

What Is the Crypto Fear and Greed Index?

Top 7 Crypto Debit Cards in Europe

How To Make Money With Bitcoin in 2022: 9 Proven Methods

Web3 Jobs: How to Get a Job in Crypto Sector

Who Owns the Most Bitcoin in 2022?

Automated Market Makers

Automated market makers, like Uniswap, allow trades to occur directly between peers thanks to the use of a price constant formula and liquidity pools. The price is maintained using a formula in the liquidity protocol, and the specific formula can vary from platform to platform.

AMMs also allow users to provide liquidity for trading pairs, which means anyone can become a market maker. Think of an AMM as a decentralized form of market making and taking. It has rightly made a huge difference in the way that crypto traders interact, rewarding users for fleshing out the market by providing liquidity.

This model is different from the order book model of centralized exchanges. AMMs are still relatively new, so it’s not perfect, which is why the likes of Cardax is hoping to bring some changes to the design.

Order book vs. Automated Market Makers

Order books are simply lists of buy and sell orders on the market. In a centralized exchange, the matching engine matches buy and sell orders to facilitate the exchange.

Together, the order book and AMM model make up the bulk of the exchange design on the market. In a traditional exchange, you would have an order book that provides a list of orders and maintains the record of liquidity.

With AMMs, you can get price quotes for assets that don’t have high liquidity. It’s mainly here that you have an advantage, as you can get trade for assets that are comparatively illiquid.

However, there are downsides as well. AMMs suffer from the problems of slippage and impermanent loss. Both of these are issues that are familiar to DeFi enthusiasts. It’s not something we’ll go over in detail here, but know that it can be problematic for trading.

Cardax’s EAMM protocol is an improvement over AMMs

Cardax makes use of an improved version of AMM protocols, something it calls Extended Automated Market Maker (EAMM). The EAMM protocol addresses some of the disadvantages present in typical AMMs.

It provides pricing power to takers upon the creation of new token pairs. The price discovery mechanism relies on takers, not makers. And like other AMMs, anyone can create a liquidity pool on Cardax.

Cardax notes that one of the problems with AMMs is the high barrier of entry. Teams have to provide liquidity for two assets to begin building their Cardano native token. They point out that small projects may have trouble providing enough ADA to get off of the ground. Putting the power of pricing power in the hands of takers is one way they see can help these teams.

What makes Cardax different from other DEXs?

In most respects, Cardax functions similarly to other DEXs. But there are a few key ways in which it improves upon existing DEXs.

Cardax aims to package the benefits of an order book as well as an AMM into its platform via the EAMM model. The advantages of this model is that it reduces slippage and impermanent loss, provides more price transparency, while still letting anyone become a market maker without requiring large capital.

This, according to the team, is the best way to overcome the limits of both order books and AMMs.

To sum up, Cardax provides a robust way for Carano native tokens to flourish, with convenient transactions that feel minimal effects from slippage and impermanent loss. It helps that Cardano is a next-generation blockchain with a lot of benefits of its own, which users may find could be helpful in their investing.

Core features of Cardax

The core features of Cardax focus on boosting the Cardano ecosystem. The most important one is that it supports any native Cardano token, allowing you to trade ADA for them. You can also join liquidity pools to collect fees on ADA-cardano native token pairs.

And being a DEX that is trying to provide more options for Cardano holders, it also provides swaps between ADA and Cardano native tokens in a single transaction. It also supports these transactions directly from Cardano’s Yoroi wallet.

Cardax will also facilitate governance through the Cardax DAO, which will go live as soon as the DEX hits the mainnet. Holders of the CDX token will be able to carry out many common governance decisions, such as deciding how treasury funds should be budgeted.

As you can see, most of the strong features revolve around bolstering the capabilities of the Cardano ecosystem. In other respects, it is similar to other DEXs.

Liquidity and fee model

Cardax imposes a 0.35% fee for swapping tokens, 0.30% of which will be split by liquidity providers proportional to their contribution to liquidity reserves. The remaining 0.05% goes to Cardax’s treasury. The protocol distributes fees among liquidity providers and the Cardax treasury. Liquidity providers are paid in Cardax utility token, CDX.

Bear in mind that Cardax is still in the very early stages of development. It can be subject to change, but it appears that this is the design that the team is going with in the beginning.

On the subject of development, the Cardax team has also released a brief roadmap that describes the general outline of its development.

Cardax development phases

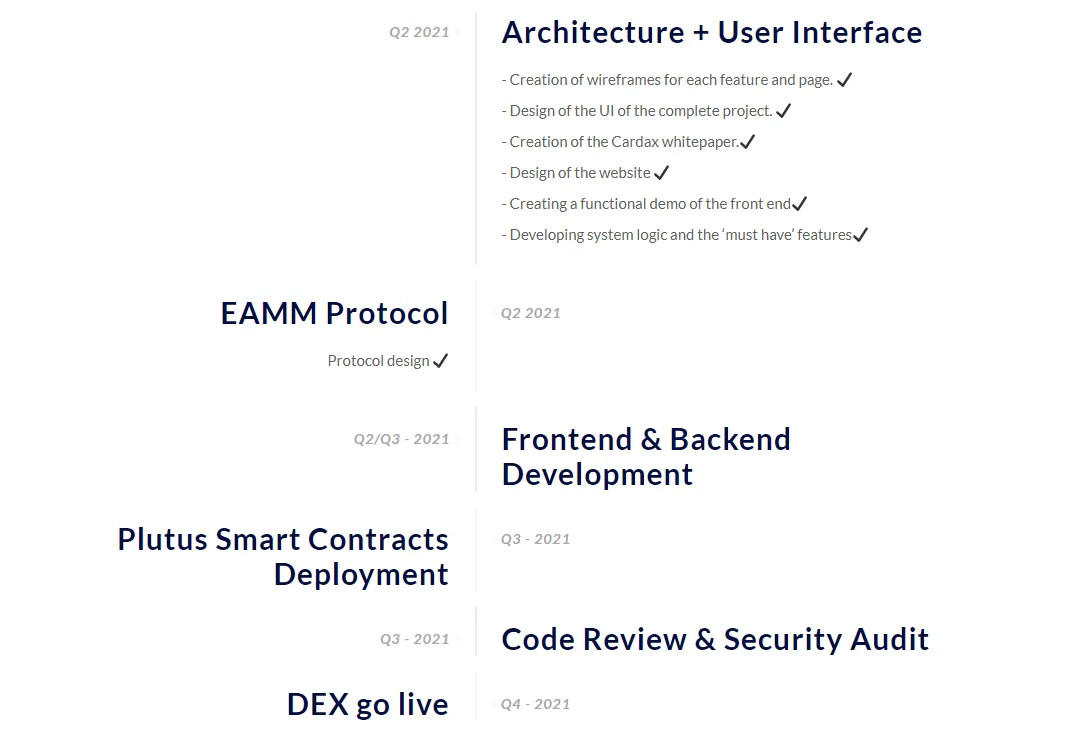

Cardax’s roadmap has been divided into six phases, with the first focusing on architecture and UI/UX. This phase will see system logic, essential features, and a functional demo released, along with UI/UX tasks.

The next two phases focus on the EAMM protocol and backend development, respectively. There have not been too many details on specifics of this. Following that, the team will focus on security and smart contracts, which are the two phases that precede a testnet and mainnet release.

The final phase will see extensive testing before the launch of the DEX on the mainnet.

The team most recently announced that it would turn its attention to creating a minimum viable product. They say that they will soon reveal its approach, so if you’re interested in the project, it’s worth keeping an eye on it.

Cardax tokenomics and distribution

The CDX token, the Cardax native token, isn’t widely available yet, so don’t expect price targets. This is an early-stage project, so a better analysis of its tokenomics and price will arrive later.

All we know at the moment is that there is a total supply of 1 billion Cardax CDX tokens. 20% has been allocated towards the team, 5% to advisors. A total of 250 million CDX vested into smart contracts that will be released to the team after two years.

How to buy Cardax CDX token?

You can’t currently buy the CDX token anywhere, but you can obtain it via staking.

You can earn CDX by staking the VYFI NFT on the VyFinance platform. Furthermore, you can purchase those NFTs on the CNFT.io platform, which will require a Nami wallet. Once you’ve obtained the NFT, simply stake it, and wait until it can be harvested. You’ll then get CDX tokens.

Cardax could accelerate DeFi on Cardano

The Cardano ecosystem is looking like it’s shaping up with a suite of platforms beginning development, which is essential to its growth. Both the network and the ADA token are closely tied to the success of these developments, which hopes to leverage the technical benefits of the Cardano blockchain.

The arrival of a unique DEX like Cardax can help spark a migration towards the Cardano network, which is proving itself with multiple new releases and updates. It helps that the Cardax model has some lucrative benefits going for it, so it may well come out on top as a major DEX on the network.