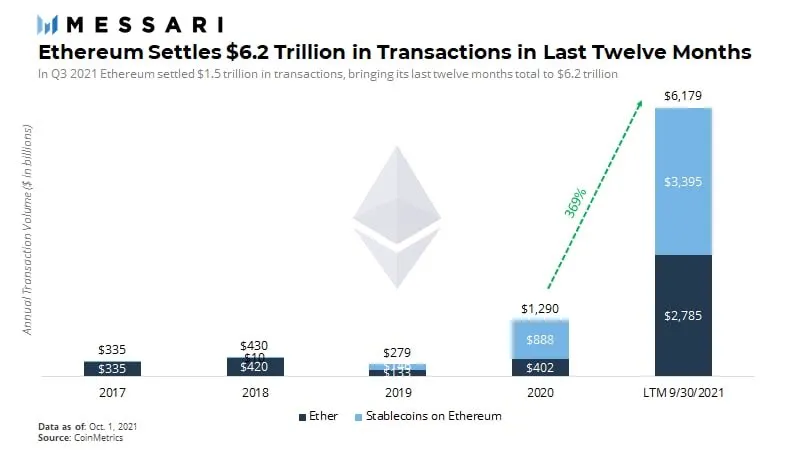

Ethereum settled over $6 trillion in transactions in the past 12 months, a 369% increase over 2020. $1.5 trillion worth of transactions were settled in Q3 alone.

Ethereum is hitting new milestones by the week, it appears, as data from Messari shows that a staggering $6.2 trillion in transactions were recorded in the past 12 months. Compared to 2020, that represents a 369% increase in transaction volume. Unsurprisingly, the price of Ethereum has increased significantly alongside this jump in usage.

Ethereum settled $6.2 trillion in transactions: Messari

Ethereum settled $6.2 trillion in transactions: Messari

Q3, in particular, was a very strong period for the Ethereum network, where it recorded $1.5 trillion in transactions. Stablecoins have also been a major part of the transaction volume, which is not surprising given the versatility of its use.

Ethereum is currently valued at over $3,400 and shows strong signs of staying above $3,000. As for its performance and presence, it’s outperforming bitcoin by 43x in terms of fee revenue.

The Ethereum network is currently in the midst of upgrading to ETH 2.0, which will bring a shift to proof-of-stake consensus and scalability improvements, among other features. This will greatly increase the usability of the network, even as many competitors like Cardano introduce smart contract upgrades.

/Related

MORE ARTICLESCan Polygon (MATIC) Price Hit a New All-Time High Against Bitcoin (BTC)?

ApeCoin (APE) Price Could Leap 30% if It Moves Above This Level

ECB Official Wants Crypto Users Protected Under Online Gambling Laws

Why Is the Crypto Market Down Today?

Binance Coin (BNB) Price Jumped 7% This Week Despite FUD. Can Rise Continue?

Huobi Global Trading Volume Tanks After Rumors of Meltdown

ETH 2.0 is still a ways off from releasing all of its features, as the development team is releasing the upgrades in a phased manner. However, the benefits are already beginning to show, especially with the advent of new DeFi products and NFTs.

NFTs and DeFi boosting Ethereum

Ethereum is really coming of age as both enterprise companies, and independent development teams take to its smart contracts. The arrival of scalability solutions, like that provided by Polygon, has also helped tremendously in facilitating usage.

Two niches that are pillars of the Ethereum network are non-fungible tokens (NFTs) and decentralized finance (DeFi), both of which have been having a tremendous 12 months. NFTs, in particular, are showing great signs of growth, pulling in companies, major brands, and celebrities. The versatility of its smart contracts has really begun to show within these two sectors.

For the longest time, gas fees and network bottlenecks have suffocated the market. Though this is far from fully fixed, it has indeed taken a large leap forward. As Ethereum transactions continue to rise and more use cases arrive, the need for scalability will only increase.