Coinbase is one of the biggest crypto exchanges in the world and is considered to be a crypto market leader. Although exchange competition has stiffened, Coinbase has managed to do an initial public offering (IPO) and run ads during Superbowl. Our Coinbase review explores this San Francisco-based crypto firm.

We analyzed the firm’s fees, features, benefits, app and everything cryptocurrency investors and traders need to know about the exchange.

Coinbase Review: Pros & Cons

Pros

- More than 200 cryptocurrencies

- Offers an NFT marketplace

- Institutional investor accounts

- Based in more than 100 countries

- Provides a derivatives market

- Coinbase Visa card offers rewards

- Educational content and tutorials

- Enables cash borrowing

- Staking – Cardano, Solana new in 2022

- Advanced trading features new in 2022

Cons

- Low APY for staking coins

- More KYC and ID documents needed

- High debit card deposit fees

Cryptoassets are a highly volatile unregulated investment product.

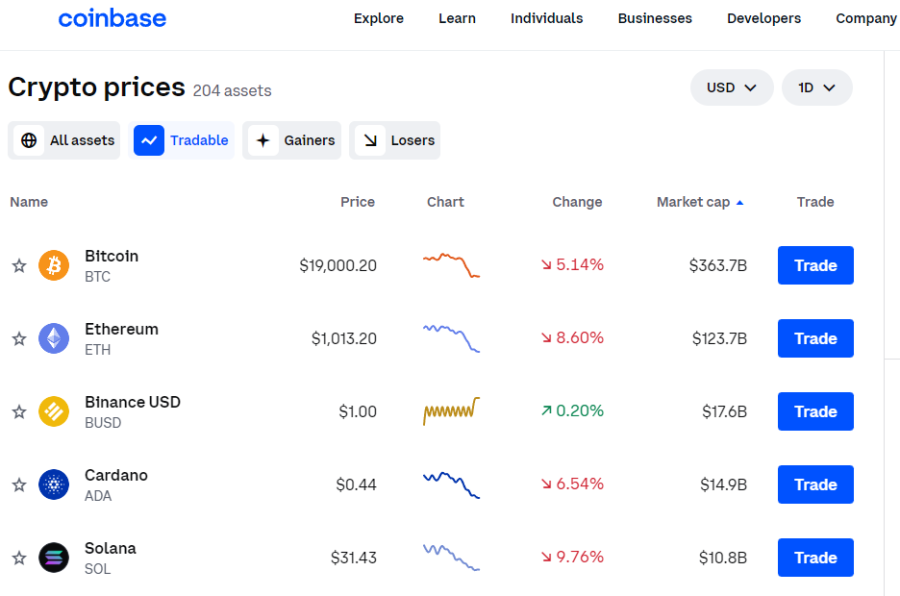

Tradable Cryptos on Coinbase

Our review of Coinbase first looked at which cryptos are available to buy and trade then other types of digital assets.

Cryptocurrencies

Coinbase offers more than 200 cryptocurrencies on its platform. It has a diverse altcoin collection, from most popular big cap coins such as Ethereum, Dogecoin and Cardano, to new low market cap coins like GMT.

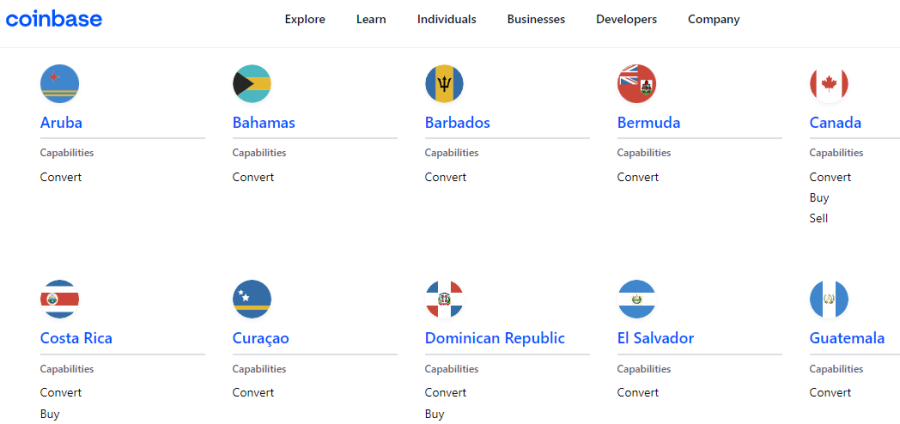

Although it has numerous coins, Coinbase has geo-restrictions in certain countries. It’s limited in the services it can provide in certain countries. Investors can trade all the coins in some countries while others are limited only to conversions.

Notably Coinbase hasn’t listed Ripple (XRP) but eToro has for investors that would like to trade XRP.

Besides trading cryptos, investors can also stake coins. This is a less risky way of earning from crypto than trading it. With staking, investors buy the staking coins the Coinbase offers and lock them in for a specific period. Investors can stake even $1 to earn interest.

Some of the coins Coinbase offers for staking are Ethereum, Algorand, Cosmos, Dai, Tezos and Cardano – and as of mid 2022 Solana staking is now also supported.

To stake coins on Coinbase, users must have an identity verified with a valid TIN. Investors can earn up to 5.75% interest per annum. Ethereum will provide investors with only 3.675%.

One of the things that separate Coinbase from other exchanges is that it enables investors to earn cryptos while learning about them. After users watch educational videos, they’ll complete a quiz and Coinbase offers cryptos associated with the specific course.

Cryptoassets are a highly volatile unregulated investment product.

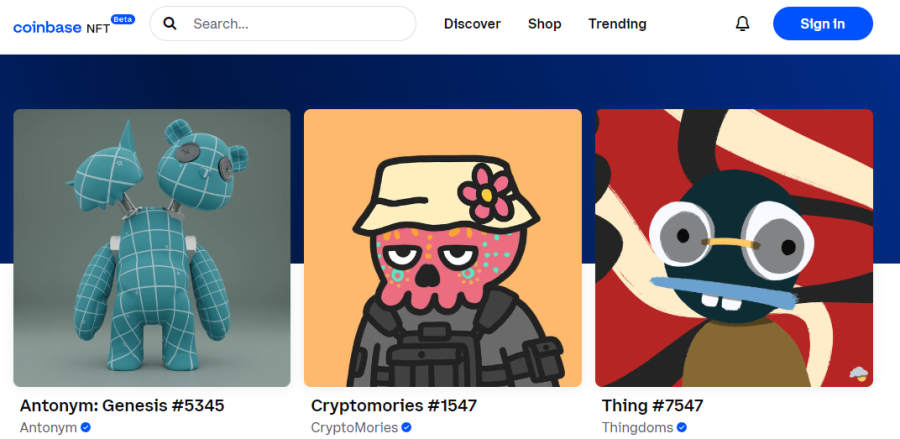

Non-fungible Token (NFTs)

NFTs have blown up in the last few years, and numerous celebrities have promoted them. The NFT market is estimated to reach $147 billion by 2026. It’s no wonder that Coinbase has provided investors with a platform to trade NFTs.

Coinbase offers a significant range of NFTs, ranging from Long Neckie Ladies, Dour Darcels, Genesis and Cryptomories. The best part about trading NFTs on Coinbase is that it’s free for a limited time.

The platform intends to make NFT purchases easier with a Coinbase wallet. Users won’t need a username and a password because they can use a self-custody crypto wallet as a digital passport. Coinbase’s NFT marketplace is still in its beta stage, so it seems that it can only get bigger.

Cryptoassets are a highly volatile unregulated investment product.

Derivatives

Coinbase enables investors to access futures markets. The platform enables derivative trading without owning crypto or holding a crypto wallet. Investors can trade, speculate and hedge crypto prices. Its derivative offering is Bitcoin, Bloomberg US Large Cap Index, crude oil and SuperTech.

Cryptoassets are a highly volatile unregulated investment product.

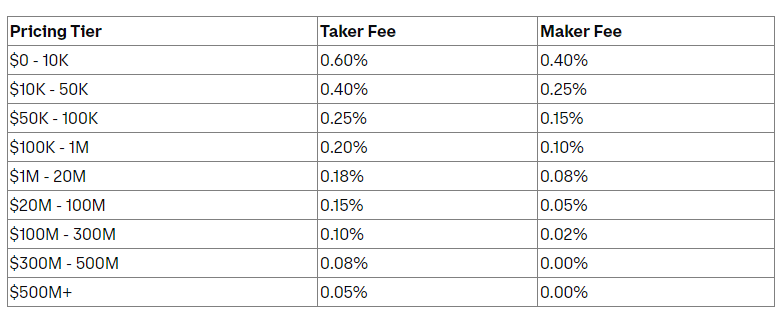

Coinbase Fees & Commissions

An extremely important factor to cover in our Coinbase review is fees. High fees can lower profits, and they can be detrimental to losing trades. Although exchanges generate most of their revenue from fees, they need to be reasonable and transparent.

Crypto Trading Fees

Coinbase fees are determined based on trading volume. The larger a trader’s volume, the less Coinbase charges. It splits its fees between takers and makers. Traders with a volume of up to $10,000 monthly will be charged 0.6% as takers and 0.4% as makers.

Once traders exceed that limit and trade up to $50,000 in a month, Coinbase charges takers 0.4% and makers 0.25%. Let’s take a look at an example using the tier 1 fees. Investors wanting to invest in Bitcoin with $1,000 will receive $994 worth of Bitcoin. Takers pay 0.6% fees, so that equates to $6 fees. Deduct the $6 from the original investment of $1,000, and investors end up with $996 in Bitcoin.

Another popular feature of Coinbase is that it offers a Coinbase Pro platform. The fees on the pro platform are much lower. Investors won’t incur a sign-up fee for Coinbase Pro or for having an account.

In mid 2022 Coinbase began to add the same advanced trading features that the Pro platform has, onto its main Coinbase platform as well. Coinbase Pro itself may be phased out in 2022 however all its features and low fee structure will still be available.

Coinbase’s deposit fees can still be slightly higher than the best crypto exchanges however. Traders who want to buy crypto with a debit card will incur a fee of 2.49% per transaction for example – use bank transfers to avoid that.

NFT Trading Fees

Since Coinbase’s NFT marketplace is still new, it wants to attract new users to the platform. So it has offered free NFT trading for a limited time. Investors will struggle to find an exchange offering free NFT trading, so this platform might be an NFT investor’s playground.

Derivative Trading Fees

The trading fees for derivatives on Coinbase vary amongst the different products offered and traders. As an example, Trading Bitcoin futures as a market maker will be $0.07, and a non-pro will be charged $0.10. A pro will be charged $0.07. The derivative Coinbase fees are charged per side.

Opting for the Micro Bloomberg US Large Cap Index Futures trading will result in the maker paying $0.35, non-prog $0.05 and pro $0.10.

| Asset | Trading Fees |

| Cryptocurrencies | 0.6% taker, 0.4% maker |

| NFTs | Free for a limited time |

| Derivatives | $0.07 maker, $0.10 non-pro and $0.07 pro |

Coinbase Non-Trading Fees

Like most exchanges, Coinbase charges fees other than for trading. Let’s take a look at some of the other Coinbase fees

Deposit Fees

Coinbase offers several payment options to fund accounts. The one that traders choose will determine the fees. Opting for an ACH deposit will not incur any fees. Selecting a wire transfer in USD will incur a $10 fee.

European traders wishing to deposit money via SEPA will pay €0.15. British traders can opt for a SWIFT transfer, which is free.

Withdrawal Fees

The only free method to withdraw fees on Coinbase is via ACH. Choosing to withdraw dollars via a wire will cost investors $25. European investors who want to withdraw via SEPA will pay €0.15. Although UK investors don’t pay anything via SWIFT to deposit, they are charged £1 for withdrawals.

The Coinbase withdrawal fee is pretty high when compared to other exchanges.

Inactivity Fees

While some of the best altcoin exchanges charge an inactivity fee for being inactive for a certain period, Coinbase doesn’t have such a charge.

| Type | Fee |

| Deposits | $10 bank wire |

| Withdrawals | $25 bank wire |

| Inactivity | Not applicable |

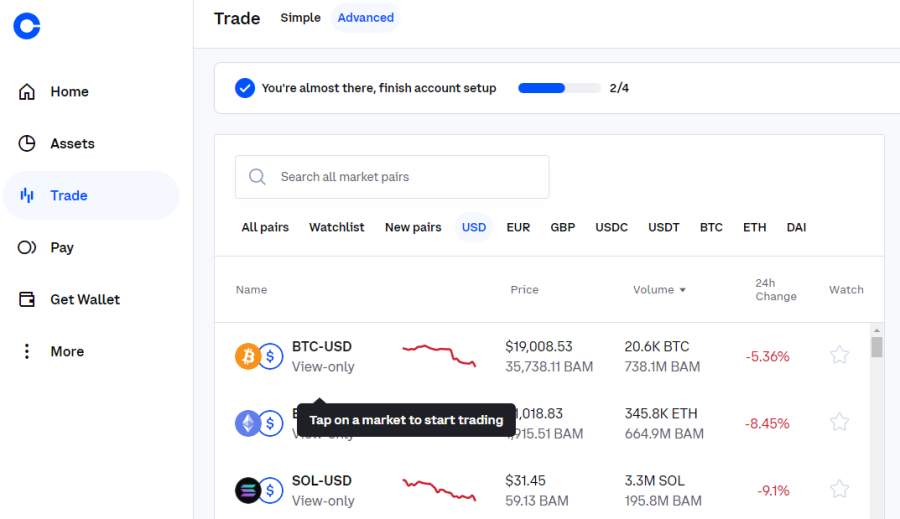

Is Coinbase User-Friendly?

The desktop version is easy to navigate. The site has only a few icons at the top that enable investors to reach the asset they need quickly. All the other information such as earning free crypto while learning about it and its derivatives trading is at the bottom so that the site doesn’t feel cramped and information overloaded.

Crypto traders can quickly navigate to the platform to open trades. The great thing that Coinbase did is cater to beginners and professionals. The standard platform contains everything beginners need to start trading, but it doesn’t bog them down with unnecessary buttons that may confuse them.

Professional traders will get free access to Coinbase Pro. It contains all the advanced tools that traders need to optimize their strategies. The pros can use indicators and incorporate several strategies to get the most out of their technical analysis. The advantage of the pro version is that the trading fees are cheaper and determined based on the trading volume.

All the necessary options that most traders use are grouped together, so investors are a click away from the platform performing a function they seek. Traders who wish to use a mobile phone can download the app on iOS and Android.

Coinbase also developed two apps: the standard one and Coinbase Pro. Since this platform has catered to traders of all levels, it’s easy to see why it has amassed more than 100 million users. If traders get stuck and don’t know what to do, they can contact 24/7 support.

The one thing that Coinbase could improve is having icons dedicated to each feature. If traders want to stake coins, they should be able to do that by clicking on the stake button. Instead, Coinbase has that feature on the homepage slide, or users have to specifically Google Coinbase staking.

The same applies to the fees. At the bottom of the page are numerous links, yet fees is not one of those links. The fees are in the help section.

One of the things that beginner traders will like about this platform is that it features tutorials. Users who are new to trading can access free video and text content to help them get started. The tutorials also help traders to learn the platform so they can execute the trades that they want.

Coinbase Features, Analysis & Trading Tools

Investors can buy Bitcoin on Coinbase or use several other great features that the platform offers.

Coinbase Earn

One of the great features for beginners is being able to get paid while learning. Coinbase makes that possible with its Coinbase Earn program. Investors who want to know more about crypto can take advantage of this feature. All they need to do is select one of the courses offered to learn about a particular cryptocurrency. After a user watches one of the tutorial videos, they have to complete a quiz to earn the cryptocurrency they’re learning about.

The only thing that could approve about that feature is direct rerouting to it when a user logs in. Once a user selects the course to take and logs in, the next screen is the dashboard. It should take users directly to the course.

Staking

Trading on Coinbase isn’t the only way to profit from cryptocurrencies. Investors who prefer a less risky method of making money with cryptos can opt for staking. Coinbase offers several staking coins such as Ethereum and Tezos. To earn interest from stake coins, investors need to pick the ones they want to stake and lock them in for the desired period.

Annual staking yields the highest return, but Coinbase’s returns are some of the lowest of all exchanges. We have reviewed some of the best staking platforms.

Each coin yields a different annual return. But the highest interest that staking investors can earn on Coinbase is 5.75%. That’s significantly lower than exchanges such as Binance, which offers a 100% return on certain coins. The selection of staking coins that Coinbase has offered is small.

Trading Tools

The best part of this platform is that it has tailored two platforms to help beginners and advanced traders customize their trading. Beginners don’t want to be overwhelmed by numerous technical indicators, and they need a platform that guides them to the next step so they can easily open a trade. Coinbase’s standard platform does just that.

Traders who need tools that will enhance their technical analysis can use Coinbase Pro. It features tools such as Fibonacci extensions and moving averages. Both versions of the platforms are available as individual apps.

Borrow

Lending money has become a profitable business, so it seems that Coinbase wants to get in on the action. It offers a borrowing feature, enabling investors to borrow cash by using their Bitcoins as collateral. Borrowers can request up to $1 million from Coinbase with Bitcoin collateral.

Borrowers need to pay an 8.75% annual percentage rate, and loans are issued without credit checks. The platform has also enabled investors a flexible repayment schedule. This feature suits investors who don’t want to sell their Bitcoins because of a taxable gain/loss, but they need cash.

Coinbase requires borrowers to pay only the interest at the end of the month. It allows borrowers to pay the balance when they’re ready. Coinbase offers the borrow feature only to 22 US states.

Coinbase Account Types

Apart from separating the platforms based on trader skills, Coinbase offers an institutional account. It enables institutions to integrate trading and custody, access to a broader market and offers the lowest prices from Coinbase’s network.

Coinbase also provides an account for private clients. One of the perks of this account is that it offers personalized support so that each investor has a full team focusing on their needs. The platform can also execute trades on behalf of the investor.

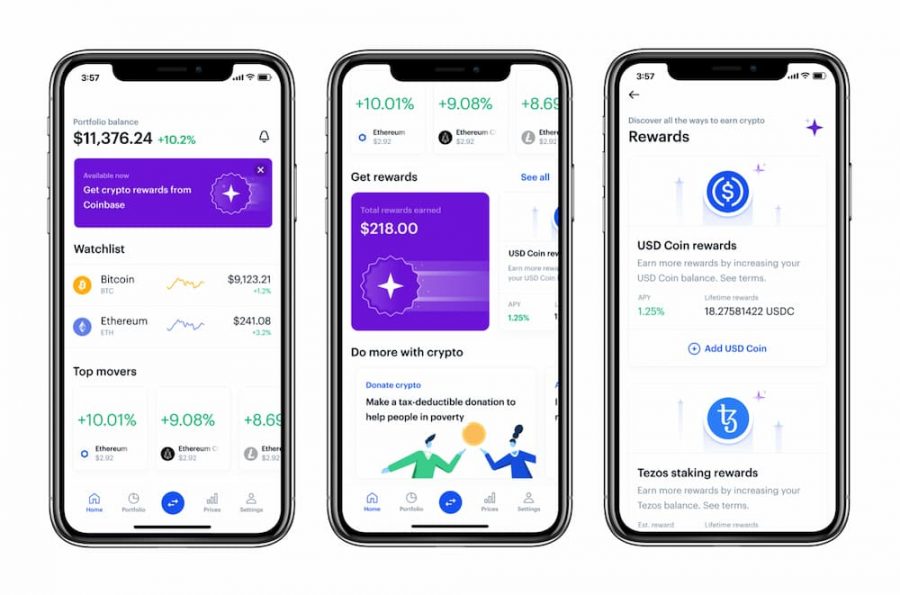

Coinbase App Review

The Coinbase app is one of the company’s strongest products. It has developed two apps to offer beginners and advanced traders each a platform to suit their needs. The apps contain most of the features found on the desktop version, and it features the key functions that traders need to trade.

The apps are straightforward and designed to perfectly fit a mobile screen without the buttons being too small so that users don’t tap the wrong function. Traders can use the panel at the bottom to navigate to the desired function. In many ways, the app is more convenient to use than the desktop version.

Sometimes there’s a few seconds delay when a user accesses the app; it needs some time to load and may even prompt users to log in again. Otherwise, once a user is in, switching between the different functions is seamless.

While doing the Coinbase review, we found that this is one of the best crypto apps on the market.

Coinbase NFT Marketplace

Since NFTs exploded into the crypto ecosystem a few years ago, several exchanges have started offering them. Now, Coinbase wants to lure in NFT investors and offer something that most exchanges don’t. Investors can find the major NFTs on Coinbase such as Doodles, Thing and Akutars, but it’s the fees that make Coinbase’s NFT marketplace alluring.

Coinbase has waived the fees. So NFT investors can trade and create collections on the platform for free. The offer is available for a limited period.

Coinbase Wallet

Coinbase is determined to make its wallet more useful and convenient, so it’s developing a self-custody crypto wallet as a digital passport. With this wallet, users won’t need a username and a password, and it will enable users to pay for certain things and store NFTs. That’s going to make the Coinbase wallet one of the best crypto wallets.

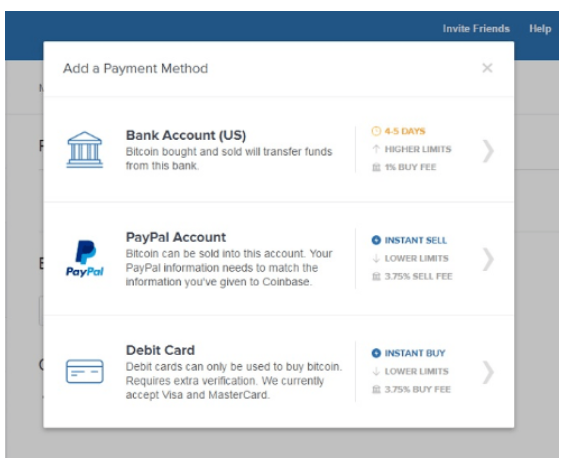

Coinbase Payment Methods

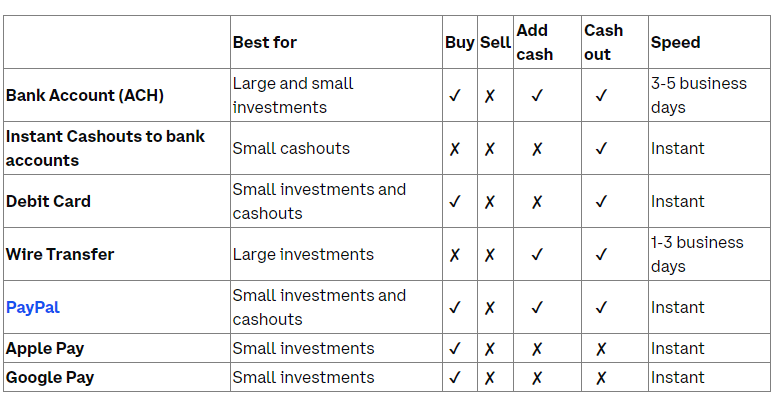

Coinbase offers several payment methods.

ACH

This payment type is suitable for large or small investments and takes 3-5 business days to reflect. With this option, investors can buy, add cash, cash out but not sell. This method of funding is free.

Instant Cashouts to Bank Accounts

The only function this performs is enabling investors to cash out their funds instantly.

Debit Card

Investors can use their debit cards for small investments and cashouts. The transaction is instant, and investors can use cards also to buy cryptos. Coinbase charges 2.49% for card transactions.

Wire Transfer

This option is suitable for investors wanting to perform large investments, and the transaction takes 1 to 3 business days to reflect. Coinbase charges $10 for wire transfers.

Paypal

Using Paypal as a payment method is suitable for investors wanting to perform small investments and cashouts. Transactions are instantaneous.

Apple Pay

Opting for Apple Pay means that investors are looking to make small investments. The transaction is instant, and investors can use it only to buy cryptos.

Google Pay

Google Pay is exactly the same as Apple Pay. The transaction reflects immediately, and it’s for small investments when investors want to buy cryptos.

Coinbase Minimum Deposit

Coinbase enables investors to buy Bitcoin for as little as $25. But the platform advises investors to deposit at least $50 so that it can verify an investor’s account. Investors should keep in mind that doing a bank wire will incur a $10 charge, so a provision should be made for that to ensure that the final amount in the investor’s account after deductions ends up being $50.

Coinbase Withdrawal Times

Withdrawing from Coinbase via ACH is going to take about 3 to 5 business days for funds to reflect in an investor’s account. A wire transfer will take 1 to 3 business days. Withdrawals via Paypal and Instant Cashout should be immediate.

Coinbase Bonuses & Promos

Coinbase runs a referral program (also known as a ‘refer a friend’ program) that rewards users for inviting friends to the exchange. The referer and referee are both rewarded with a $10 Coinbase bonus.

For larger affiliates Coinbase also offers a percentage of trade fee revenue as part of their affiliate program.

Coinbase Demo Account

Coinbase operates as an exchange, so traders using the platform are doing so in a live environment. If Coinbase was to develop a demo account, it may entice many beginners to join.

Coinbase Customer Support

Coinbase trading is convenient, but some traders may get stuck. The great thing about this platform is that traders don’t need to wait long for assistance as the platform offers 24/7 support. No need to worry about time zones or weekends. Coinbase offers prompt responses.

Coinbase Licensing & Security

Due to its expansion efforts in Europe, Coinbase is in the process of applying for licenses to trade in Span, Italy, France and Switzerland. Coinbase is licensed in 45 of the US states. It complies with each jurisdiction it operates in.

Coinbase takes security very seriously, so users have to add a mobile phone number to receive a code to be used as 2-FA. The exchange also keeps investor assets offline in secure storage.

Coinbase Accepted Countries

Coinbase is open to more than 100 countries – including the United States – but the services it offers in each country differ. Some countries have full access to its services, enabling them to convert, buy and sell cryptocurrencies. Quite a few countries have access only to conversion. US traders have full functionality, enabling them to convert, buy and sell cryptos.

How to Start Trading with Coinbase

Coinbase trades are easy to place after users have set up their accounts. Most Coinbase reviews don’t feature a step-by-step guide, but we have included it.

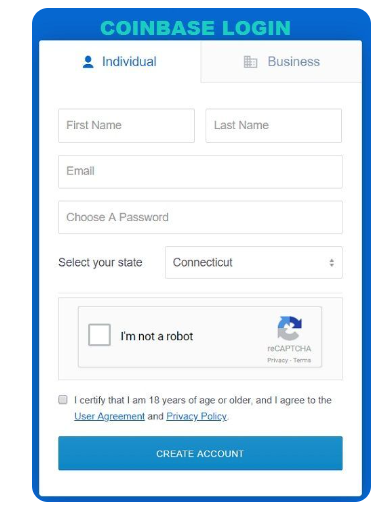

Step 1: Open Account

Visit Coinbase.com and fill out the quick registration form.

After inputting personal details, Coinbase will prompt users to verify their email addresses and add a phone number for 2-FA.

Step 2: Deposit Funds

Click ‘Add Payment Method’, then select the preferred method.

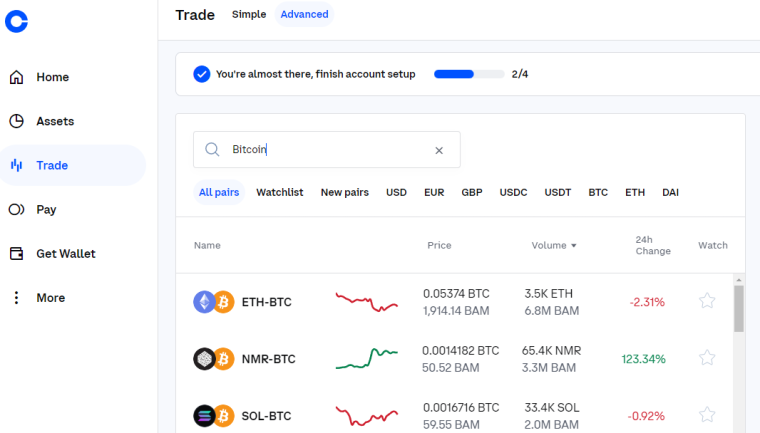

Step 3: Search for Cryptocurrency to Buy

In the search box, users should type in the cryptocurrency to buy. Our example is Bitcoin. When it comes up, click on the desired cryptocurrency.

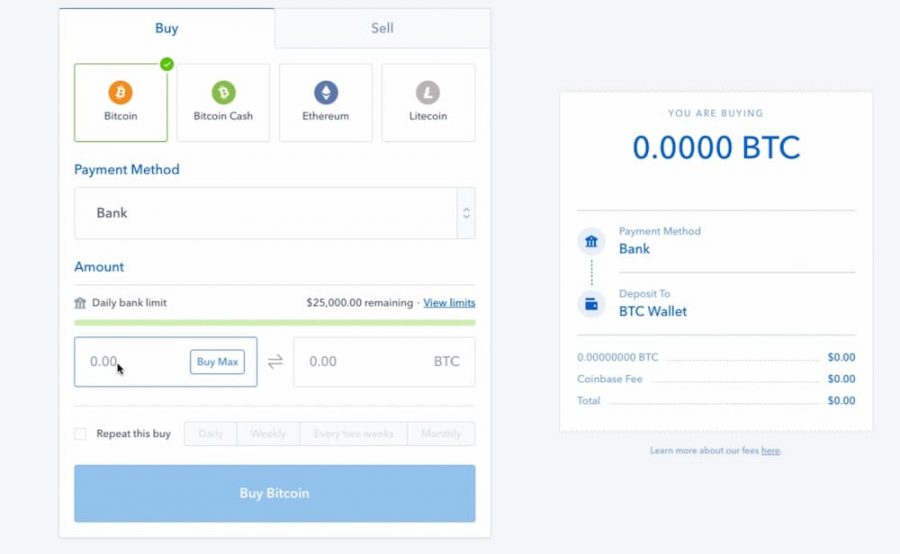

Step 4: Buy Cryptocurrency

The last thing that users need to do is enter the amount of Bitcoin to buy, then click ‘Buy Bitcoin.’

How to Sell on Coinbase?

The screenshots above guide users on how to buy on Coinbase. Investors who want to sell should click ‘Sell’ instead of ‘Buy’.

Is Coinbase the Best Crypto Exchange?

Coinbase offers more than 200 coins and enables investors to stake coins. The platform also serves as a lender, enabling investors to borrow cash and use their Bitcoin as collateral. The other great thing about this platform is that it has an active NFT marketplace. It offers free NFT trading for a limited time.

This platform offers beginners and advanced traders each a platform that caters to their needs. A standard version is convenient while Coinbase Pro incorporates tools to optimize strategies. Coinbase copy trading isn’t available.

Although Coinbase offers several benefits, we found that eToro provides CopyTrading and Smart Portfolios. Beginner traders who want to see how the pros trade can copy their trades. It’s a very interactive platform that enables traders to share ideas and swap strategies. Smart Portfolio enables traders to diversify their portfolios by investing in several cryptos. Fund managers periodically rebalance the portfolio to achieve the best returns, and they don’t charge a management fee. eToro doesn’t charge for USD deposits.

Conclusion

Our Coinbase review has featured everything investors need to know about the exchange. We’ve gone in-depth about the exchange’s fees, features and benefits. We’ve even included screenshots of how to open an account starting from the Coinbase login. The Coinbase crypto selection consists of 200 coins. Investors wondering how to copy trade on Coinbase will be disappointed to know that the exchange doesn’t offer it.

eToro provides CopyTrading and several other great features. It doesn’t charge for USD deposits and enables investors to diversify their portfolios by opting for Smart Portfolios. eToro offers numerous payment options and charges 1% for trading fees. This platform offers more than 70 cryptocurrencies and regularly adds more. It offers live chat so that users can receive feedback immediately about queries and provides safe crypto storage. The best part is that eToro is regulated, so it takes the management of investor funds seriously.