Trading crypto on margin allows investors to buy and sell digital assets with more money than they have in their exchange account.

In fact, some platforms in this space offer margin of 1:100 – which turns a $100 stake into trading capital of $10,000.

In this guide, we compare the best crypto margin trading exchanges for fees, leverage limits, safety, supported coins, and more.

The Top 10 Crypto Margin Trading Exchanges

Check out the 10 best crypto margin trading exchanges listed below:

- Capital.com – Overall Best Crypto Margin Trading Exchange

- eToro – Access Leverage of 1:2 on Crypto Alongside Copy Trading Tools

- Binance – Margin Trading Accounts of up to 1:100

- Huobi Futures – Top Crypto Trading Margin Exchange for Futures

- ByBit – Trade Crypto Futures and Options on Margin

- Kraken – Top Exchange for Crypto Margin Trading in the USA

- Bitmex – Advanced Crypto Trading Margin Platform

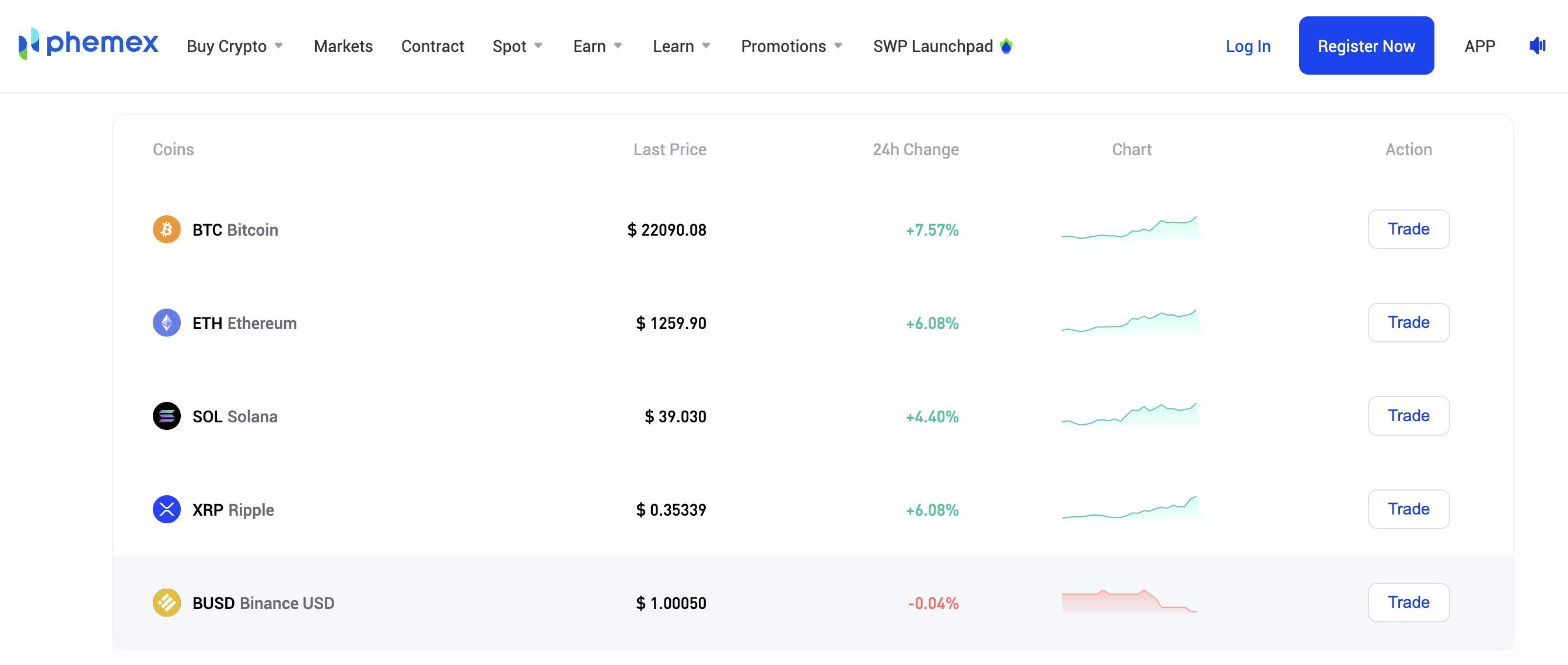

- Phemex – Crypto Derivatives With Leverage of up to 1:100

- Kucoin – Trade Leveraged Crypto Tokens

- Prime XBT – Multi-Asset Trading Platform With Huge Leverage Limits

Read on to learn more about the above crypto margin trading platforms.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Crypto Margin Trading Exchanges Reviewed

The best crypto margin trading exchanges that we came across offer leverage in a regulated environment.

Typically, unregulated exchanges are able to offer much higher limits, but safety and security are questionable. It is also wise to explore what coins the margin exchange supports and what fees it charges.

Below, we review the 10 best crypto margin trading exchanges in the market right now:

1. Capital.com – Overall Best Crypto Margin Trading Exchange

Capital.com is the overall best crypto margin trading exchange. The key reason for this is that unlike many other exchanges in this space, Capital.com is heavily regulated. In fact, the platform is licensed on multiple fronts, including the FCA, ASIC, CySEC, and NBRB.

As a result, traders can access margin here in a safe and secure ecosystem. In terms of limits, this best low margin rate broker is able to offer retail clients leverage of up to 1:2 when trading cryptocurrency. This means that traders can double their stake at the click of a button. Moreover, Capital.com is also one of the best crypto margin trading exchanges for listed markets.

This is because the platform offers nearly 500 digital asset pairs. This covers fiat-to-crypto pairs like BTC/USD and XRP/USD. Traders can also access crypto-crosses, like ETH/BTC. Either way, each and every crypto trading market hosted on the Capital.com platform can be traded at 0% commission alongside tight spreads.

We should also note that Capital.com specializes in CFD instruments. These are financial products that track the real-time price of a crypto asset and thus – traders can speculate on tokens without taking ownership. In turn, Capital.com supports both long and short positions when entering a trade.

In addition to cryptocurrencies, Capital.com offers ETF trading markets, as well as thousands of stocks, commodities, forex, and indices. The minimum balance to get started with Capital.com is $20 when making a deposit with an e-wallet or debit/credit card. Bank wire transfers require a minimum first-time deposit of $250.

| Max Margin | 1:2 on crypto |

| Trading Commission | 0% on all markets |

| Margin Trading Fee | 0.05% on BTC/USD (long positions) |

What We Like

- Overall best crypto margin trading exchange in the market

- Leverage offered on all markets

- Go long or short on crypto

- Regulated by the FCA, ASIC, CySEC, and NBRB

- Also supports commodities, forex, stocks, and indices

- 0% commission and tight spreads

- One of the best investment apps for iOS and Android

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. eToro – Access Leverage of 1:2 on Crypto Alongside Copy Trading Tools

eToro is a leading online broker that offers everything from crypto and stocks to forex, commodities, and ETFs. This provider is one of the best crypto margin trading exchanges for beginners. This is especially the case when using the Copy Trading tool, which permits passive crypto investing.

eToro is a leading online broker that offers everything from crypto and stocks to forex, commodities, and ETFs. This provider is one of the best crypto margin trading exchanges for beginners. This is especially the case when using the Copy Trading tool, which permits passive crypto investing.

In a nutshell, users can elect to copy the investments of an experienced crypto trader like-for-like. This means that even newbies can actively trade crypto without needing any prior experience. Those wishing to trade on a DIY basis can buy Bitcoin and nearly 80 other cryptocurrencies at a fee of just 1% plus the market spread.

Moreover, users can deposit USD on a fee-free basis via a debit/credit card, e-wallet, or bank wire. The minimum deposit at eToro depends on the country of residence, albeit, this starts at $10. In terms of trading on margin, this can be achieved via CFD instruments. Limits stand at 1:2 – so eToro users can double their stake.

In terms of margin funding fees, this will depend on a variety of factors – such as the crypto being traded, stake, and broader market conditions. Nonetheless, we like that when setting up an order at eToro, the funding fee is displayed in USD. eToro is authorized and regulated by the SEC, FCA, ASIC, and CySEC.

| Max Margin | 1:2 on crypto |

| Trading Commission | 1% |

| Margin Trading Fee | Depends on market conditions and the asset – displayed when creating order |

What We Like:

- Dozens of crypto assets to trade

- Regulated by numerous top-tier entities

- Accepts PayPal and credit/debit card deposits

- User-friendly crypto app

- Crypto copy trading and smart portfolios are supported

- Very low and transparent fees

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Binance – Margin Trading Accounts of up to 1:100

Next up on our list of the best crypto margin trading exchanges is Binance. This platform is the largest crypto exchange globally for trading volume. In most cases, Binance will facilitate tens of billions of dollars in trading volume each and every day.

Next up on our list of the best crypto margin trading exchanges is Binance. This platform is the largest crypto exchange globally for trading volume. In most cases, Binance will facilitate tens of billions of dollars in trading volume each and every day.

In total, Binance offers traders more than 600 supported coins. This translates into over 1,000 trading pairs. In order to trade on margin at Binance, users will need to switch this feature on manually. In doing so, leverage of up to 1:100 is offered on certain markets – such as BTC/USD.

This will turn a $100 stake into a position worth $10,000. Margin fees at Binance vary depending on the pair being traded, alongside the user’s VIP level. To offer some insight, trading BTC/USD on margin on a standard account tier will attract a margin fee of 0.01%. Standard trading commissions at Binance amount to just 0.10%.

| Max Margin | 1:100 |

| Trading Commission | Up to 0.1% |

| Margin Trading Fee | 0.01% on Bitcoin-denominated pairs |

What We Like:

- One of the best low margin rate brokers for crypto

- Huge selection of markets

- Trading fees of just 0.10% per slide

- Supports debit cards

Cryptoassets are a highly volatile unregulated investment product.

4. Huobi Futures – Top Altcoin Exchange for Diversification

![]() Those with prior experience in trading complex derivatives might consider Huobi Futures. As the name suggests, this platform specializes in futures – which allows investors to speculate on the value of digital currencies without taking ownership of any coins.

Those with prior experience in trading complex derivatives might consider Huobi Futures. As the name suggests, this platform specializes in futures – which allows investors to speculate on the value of digital currencies without taking ownership of any coins.

Instead, the user will need to determine whether the future value of the respective coin will rise or fall on or before a certain point in time. At Huobi, all futures markets can be traded with leverage and both long and short positions are supported. There are several types of crypto futures supported by the platform.

This includes perpetual futures, which do not come with an expiry date. There are also futures that come with weekly, bi-weekly, quarterly, and bi-quarterly trading periods. Crucially, those in the market for the best crypto margin trading exchanges for high limits might consider Huobi Futures, not least because it offers up to 1:200.

| Max Margin | 1:200 |

| Trading Commission | 0.04% for makers, plus 0.015% delivery fee |

| Margin Trading Fee | 0.01% on BTC/USD |

What We Like:

- Trade crypto futures on margin

- Leverage of up to 200x

- Competitive futures trading fee of 0.04% per slide

5. ByBit – Trade Crypto Futures and Options on Margin

ByBit is a popular crypto derivatives platform that supports a wide range of markets. Not only does this include conventional spot markets, but perpetual and inverse futures. Traders at ByBit can also access crypto options. When it comes to limits, traders can access leverage of up to 1:100 on Bitcoin-denominated markets.

Most other supported cryptocurrencies come with a lower limit of 1:50. Trading fees are very competitive at ByBit, with users never paying more than 0.1% per slide on spot markets, and 0.03% on options. Inverse and perpetual futures can be traded at a commission of 0.01%.

Lower fees are offered to those that trade higher volumes. Funding rates at ByBit – which are charged for as long as a leveraged trade remains in place, amount to just 0.01%. ByBit is particularly suited to experienced traders that seek high-level tools. The platform is home to a wide range of charting features and technical indicators, alongside custom order types.

| Max Margin | 1:100 |

| Trading Commission | Up to 0.1% commission on spot trading markets |

| Margin Trading Fee | 0.01% |

What We Like:

- High-level trading tools

- Leverage of up to 1:100

- Supports crypto futures and options

6. Kraken – Top Exchange for Crypto Margin Trading in the USA

Kraken is a popular crypto exchange that has been operational since 2013. This makes the platform one of the most trusted and reputable exchanges in this space. Moreover, Kraken is perhaps the best exchange for crypto margin trading in the USA.

Put simply, US traders will be able to access 36 different crypto tokens with margin of up to 1:5. This means that for every $100 staked, traders can access $500 worth of crypto. When it comes to pricing, Kraken has a maximum rollover fee of 0.02% – which is charged every four hours.

To open a margin trading position, Kraken charges up to 0.02% of the transaction size. With that said, Bitcoin markets come with a more competitive opening fee of 0.01%. Another thing to note about Kraken is that the platform offers sophisticated trading tools that come packed with advanced charting screens and indicators.

| Max Margin | 1:5 |

| Trading Commission | Up to 0.2% to open a margin position |

| Margin Trading Fee | Up to 0.2% – charged every four hours |

What We Like:

- Supports margin crypto trading in the USA

- Trade 36 different crypto tokens with margin

- Competitive margin fees

7. Bitmex – Advanced Crypto Trading Margin Platform

![]()

Bitmex is one of the best crypto margin trading exchanges for seasoned traders. The platform comes packed with advanced trading tools – such as customizable charts and technical indicators like the MACD and RSI. The Bitmex exchange generates significant trading volumes, so liquidity is rarely an issue.

As an unregulated exchange, Bitmex does not directly accept fiat payments. On the contrary, accounts need to be funded in Bitcoin. With that said, Bitmex does offer a fiat payment portal that connects to third parties, albeit, fees are high. Nonetheless, when opening an account with Bitmex, traders will have access to leverage limits of up to 1:100.

The most popular trading product on this platform is the BTC/USD perpetual futures market. More than 30 cryptocurrencies are supported by Bitmex, but lower margin limits will be offered on non-BTC instruments. standard trading commissions of 0.075% are on offer. Lower fees are available when trading higher volumes. Funding rates on BTC/USD amount to 0.01%.

| Max Margin | 1:100 |

| Trading Commission | Up to 0.075% in trading commission |

| Margin Trading Fee | 0.01% on BTC/USD |

What We Like:

- Huge trading volumes

- Advanced trading tools and features

- Leverage of up to 1:100 on BTC/USD

8. Phemex – Crypto Derivatives With Leverage of up to 1:100

![]() Phemex is an online crypto exchange that offers a wide range of trading products and markets. This includes conventional spot trading markets alongside the ability to buy cryptocurrency with a credit card. Those looking to trade crypto on margin can do so via the

Phemex is an online crypto exchange that offers a wide range of trading products and markets. This includes conventional spot trading markets alongside the ability to buy cryptocurrency with a credit card. Those looking to trade crypto on margin can do so via the

Phemex derivatives platform. This offers access to 132 trading pairs and the maximum leverage limit stands at 1:100. When it comes to fees, Phemex operates a maker/taker pricing structure. Market takers will pay a commission of 0.075% per slide on all supported derivative markets.

There is no fixed funding rate at Phemex when trading on margin. Instead, this is calculated on a minute-by-minute basis based on interest rates and whether or not a premium discount applies. Nonetheless, funding fees are charged every eight hours. Those looking to deposit Bitcoin into Phemex will only need to meet a minimum of 0.00000001 BTC.

| Max Margin | 1:100 |

| Trading Commission | Up to 0.075% in trading commission |

| Margin Trading Fee | Variable – calculated every minute and charged every eight hours |

What We Like:

- Low trading commissions

- Access margin on more 132 contract pairs

- Lots of charting and analysis tools

9. Kucoin – Trade Leveraged Crypto Tokens

Kucoin is one of the best altcoin exchanges for asset diversity, with the platform listing more than 700 digital assets. The exchange claims to be home to over 18 million active investors from over 200 countries. While most Kucoin users will engage with the Kucoin spot trading markets, derivatives are offered too.

Kucoin is one of the best altcoin exchanges for asset diversity, with the platform listing more than 700 digital assets. The exchange claims to be home to over 18 million active investors from over 200 countries. While most Kucoin users will engage with the Kucoin spot trading markets, derivatives are offered too.

In fact, Kucoin allows users to access leverage tokens across a wide range of coins. Most supported tokens allow users to go long or short with leverage of 3x. Leveraged tokens at Kucoin do not require funds to be borrowed, which makes the process cost-effective. Furthermore, standard trading fees amount to just 0.1% per slide.

A 20% discount on trading fees is available when holding the KCS token, which is native to the Kucoin exchange. Those in the market for the best crypto trading margin exchange for futures might also consider Kucoin. The reason for this is that the Kucoin futures department offers leverage of up to 1:100.

| Max Margin | 1:100 |

| Trading Commission | Up to 0.1% in trading commission |

| Margin Trading Fee | No fee on leveraged tokens. Futures funding depends on market conditions. |

What We Like:

- Leveraged tokens with no funding fees

- Futures with leverage of up to 1:100

- Clean trading interface with lots of features

10. Prime XBT – Multi-Asset Trading Platform With Huge Leverage Limits

![]() Prime XBT is one of the best crypto margin trading exchanges for those that wish to gain exposure to a broad range of asset classes. In addition to crypto, Prime XBT also offers access to forex, stock indices, and commodities.

Prime XBT is one of the best crypto margin trading exchanges for those that wish to gain exposure to a broad range of asset classes. In addition to crypto, Prime XBT also offers access to forex, stock indices, and commodities.

Not only is Prime XBT great for diversification purposes, but it offers some of the highest margin limits in this industry. For example, those trading BTC/USD will have access to a maximum leverage ratio of 1:200. This turns a $100 stake into $20,000 worth of trading capital.

Non-crypto assets come with even higher limits, with forex attracting a maximum leverage ratio of 1:1000. Commissions will vary depending on the market being traded. For instance, crypto positions attract a commission of 0.05% per slide. Forex is a lot more competitive at 0.0001% per slide. Funding rates depend on the asset, but margin on BTC/USD will cost 0.0694%.

| Max Margin | 1:200 on crypto |

| Trading Commission | 0.05% on crypto |

| Margin Trading Fee | 0.0694% on BTC/USD |

What We Like:

- Trade crypto with leverage of up to 1:200

- Also supports forex, stock indices, and commodities

- Offers copy trading tools

Best Margin Trading Crypto Exchanges Compared

The best margin trading crypto exchanges discussed above are summarized in the comparison table below.

| Exchange | Max Margin | Commission | Margin Fee |

| Capital.com | 1:2 | 0% | 0.05% on BTC/USD (long positions) |

| eToro | 1:2 | 1% plus market spread | Depends on market conditions and the asset – displayed when creating an order |

| Binance | 1:100 | Up to 0.1% | 0.01% on Bitcoin-denominated pairs |

| Huobi Futures | 1:200 | 0.04% for makers, plus 0.015% delivery fee | 0.01% on BTC/USD |

| ByBit | 1:100 | Up to 0.1% commission on spot trading markets | 0.01% |

| Kraken | 1:5 | Up to 0.2% to open a margin position | Up to 0.2% – charged every four hours |

| Bitmex | 1:100 | Up to 0.075% | 0.01% on BTC/USD |

| Phemex | 1:100 | Up to 0.075% | Variable – calculated every minute and charged every eight hours |

| Kucoin | 1:100 | Up to 0.1% | No fee on leveraged tokens. Futures funding depends on market conditions |

| Prime XBT | 1:200 | 0.05% | 0.0694% on BTC/USD |

What is Crypto Margin Trading?

In a nutshell, crypto margin trading allows investors to speculate on a digital asset like Bitcoin or Ethereum with more money than they have available in their exchange account. This is possible because the trader will borrow the excess funds from the respective exchange.

And, in turn, the exchange will charge a funding rate to the trader that executes a position on margin. Most of the providers from our list of the best crypto margin trading exchanges display limits as a multiple or ratio. For example, at Capital.com, retail clients can access margin of up to 1:2.

This means that for every $100 staked, $200 worth of trading capital can be accessed. When using a non-regulated exchange like Bitmex or ByBit, much higher limits are available. For example, both of the aforementioned platforms offer a maximum margin limit of 1:100. This allows the trader to enter a $10,000 position with just $100.

With that said, unregulated exchanges should be used with caution. After all, users can never be sure that the exchange in question is legitimate. Instead, although lower limits are offered, we found that the best crypto margin trading exchanges are heavily regulated. This is why we much prefer Capital.com and eToro.

How Much Margin Can You Trade Crypto With?

As we briefly alluded to in the section above, leverage limits will often be determined by whether or not the exchange is regulated. This is because retail clients are limited in how much leverage they can legally obtain when trading crypto.

For example, those in the EU and Australia are capped at leverage of 1:2. However, when using an unregulated exchange, these limits are not adhered to. Once again, such exchanges offer leverage of 1:100 and more.

Professional clients, on the other hand, can legally access much higher limits than retail traders. The specific amount will vary depending on the exchange.

Why Use Margin in Crypto Trading?

The overarching reason why investors will seek margin when trading crypto is that they have the opportunity to amplify the size of their position.

In other words, margin allows the trader to access more capital than they have available in their exchange account.

- On the one hand, this means that successful trading positions will result in higher profits.

- For instance, suppose the trader stakes $1,000 at leverage of 1:10 and closes the position at gains of 10%.

- Ordinarily, this would result in a profit of $100 (10% of $1,000 stake).

- But, with leverage of 1:10 applied, this increases the profit by a factor of 10x to $1,000.

However, it is important to remember that margin will also amplify losing trades.

In fact, if the value of the trade goes down by the amount of margin applied, the exchange will close the position. When this happens, the trader will lose the entire value of their stake.

How to Margin Trade Crypto

Those learning about margin trading crypto for the first time can refer to the step-by-step walkthrough below.

This explains how to trade crypto with margin at the regulated platform Capital.com, which offers a 0% commission pricing model.

Step 1: Open a Capital.com Trading Account

The first part of the process requires an account to be opened with Capital.com.

As a regulated platform, Capital.com will collect some personal information. A username and password will need to be entered too, alongside some contact details.

To get the trading account verified, upload a clear copy of a government-issued ID – such as a passport or driver’s license. Documents are usually verified in less than five minutes.

Step 2: Deposit Funds

Depending on the location of the user, the minimum deposit at Capital.com is $/£/€ 20. This is the case when making a deposit with a debit/credit card or wallet.

A minimum deposit of $/£/€ 250 is required when making a bank wire. All deposit methods accepted by Capital.com can be utilized fee-free.

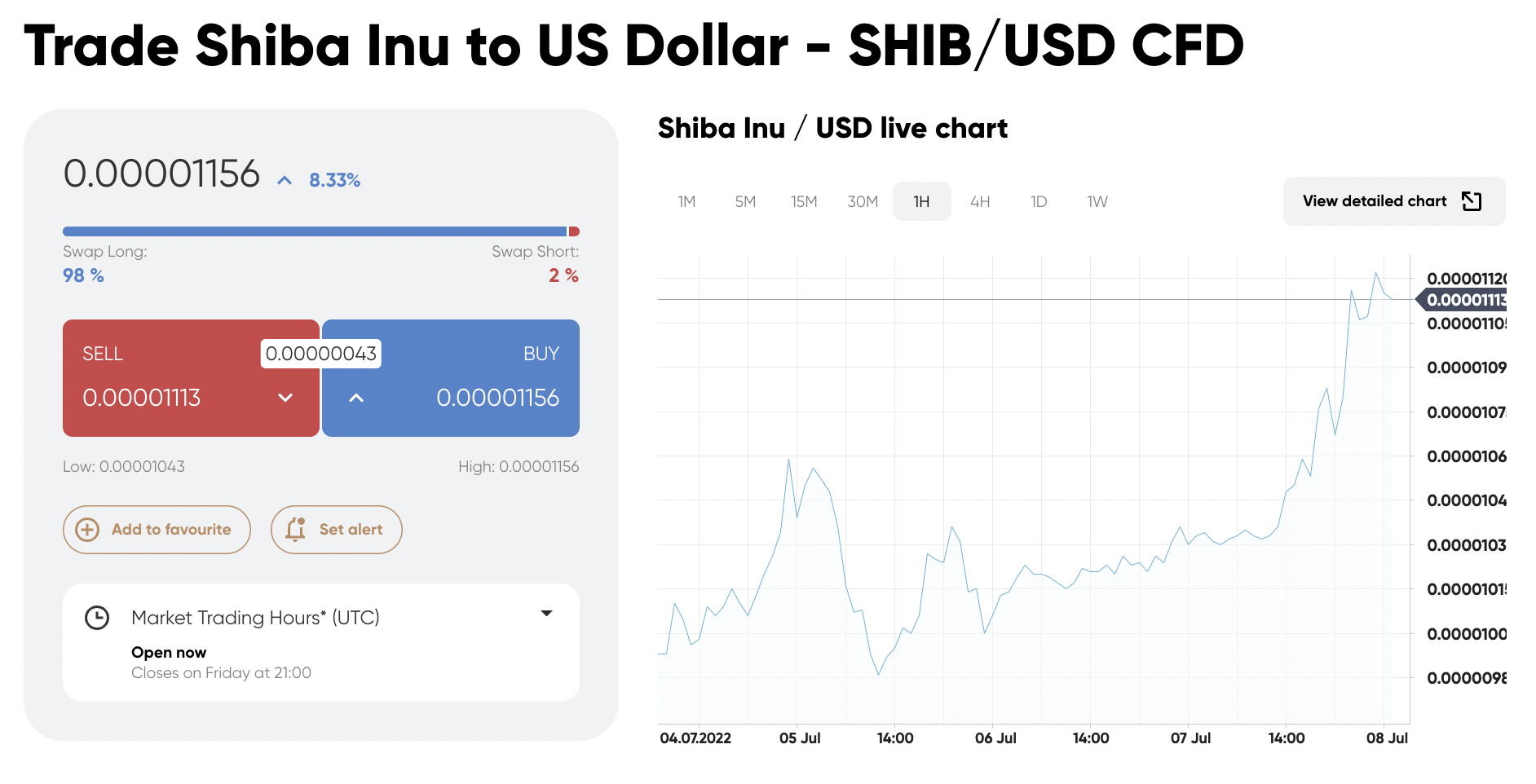

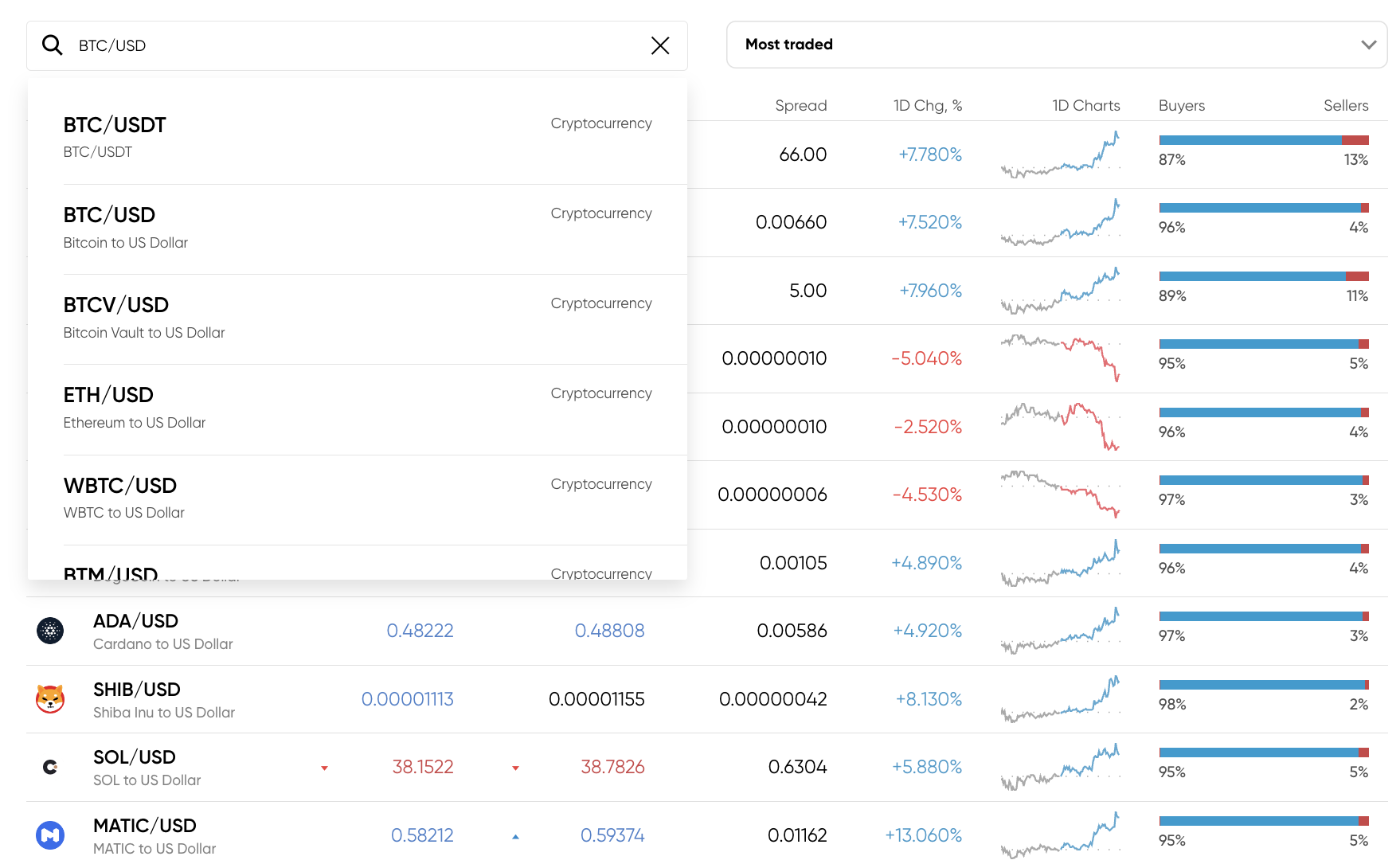

Step 3: Search Crypto Market

In the search tab, the user will need to type in the name of the crypto that they wish to trade with margin. In our example below, we are searching for BTC/USD.

Otherwise, the user can click on the ‘Markets’ button followed by ‘Cryptocurrencies’ to manually find a suitable digital asset.

Step 4: Place Margin Trade

The user will now need to set up a margin trading crypto order. To do this, the user must first select from a buy or sell position. This will indicate whether the trader believes that the pair will rise (buy) or fall (sell) in value.

Next, the user will need to type in their stake.

Those wishing to trade on margin will need to select this via the order form. At Capital.com, retail clients can apply margin of 1:2.

Finally, to confirm the margin trading crypto position, confirm the order.

Conclusion

The best crypto margin trading platforms allow users to gain exposure to digital currencies with more capital than they have available. This can have the desired result of amplifying profitable trades. Do note that margin will also increase losing positions.

Nonetheless, those wishing to get started with a margin trading crypto platform right now might consider Capital.com. Unlike the majority of providers in this space, Capital.com is heavily regulated.

Furthermore, Capital.com offers nearly 500 crypto markets at 0% commission – all of which can be traded with margin of 1:2.