Decentralized finance – or simply DeFi, allows everyday citizens to access traditional investment and lending services without needing to go through a centralized entity – such as a bank.

Instead, it is now possible to ‘become the banker’, insofar as top DeFi platforms allow you to lend your idle digital assets in return for an attractive rate of interest.

In this guide, we compare the best DeFi lending platforms in the market today – with a strong focus on supported coins, interest rates, APRs, terms, customer service, and user-friendliness.

The Best DeFi Lending Platforms for 2022

Before reading our reviews of the best DeFi lending platforms in the market, check out which providers we like the look of:

- DeFi Swap – Overall Best DeFi LendingPlatform for 2022

- Aqru – Lend Your Idle Bitcoin and Ethereum Tokens to Earn 7% per Year

- YouHodler – Global DeFi Lending Platform

- Crypto.com – Various DeFi Lending Accounts to Choose From

- Nexo – Earn up to 17% on Stablecoin Tokens

- Binance – Great DeFi Lending Platform for Medium and Low-Cap Coins

There are many metrics to consider when choosing the best DeFi lending platform for your requirements. As such, be sure to read comprehensive reviews before proceeding.

The Best DeFi Lending Platforms for 2022

When you invest in cryptocurrency, you have the opportunity to generate an attractive rate of interest on your digital tokens.

This can be achieved by depositing your tokens into a leading DeFi lending platform. You must, however, consider important factors surrounding APYs, lock-up terms, security, and fees before choosing a provider.

To help you make an informed decision, below you will find reviews of the best DeFi lending platforms for 2022.

1. DeFi Swap – Overall Best DeFi Lending Platform for 2022

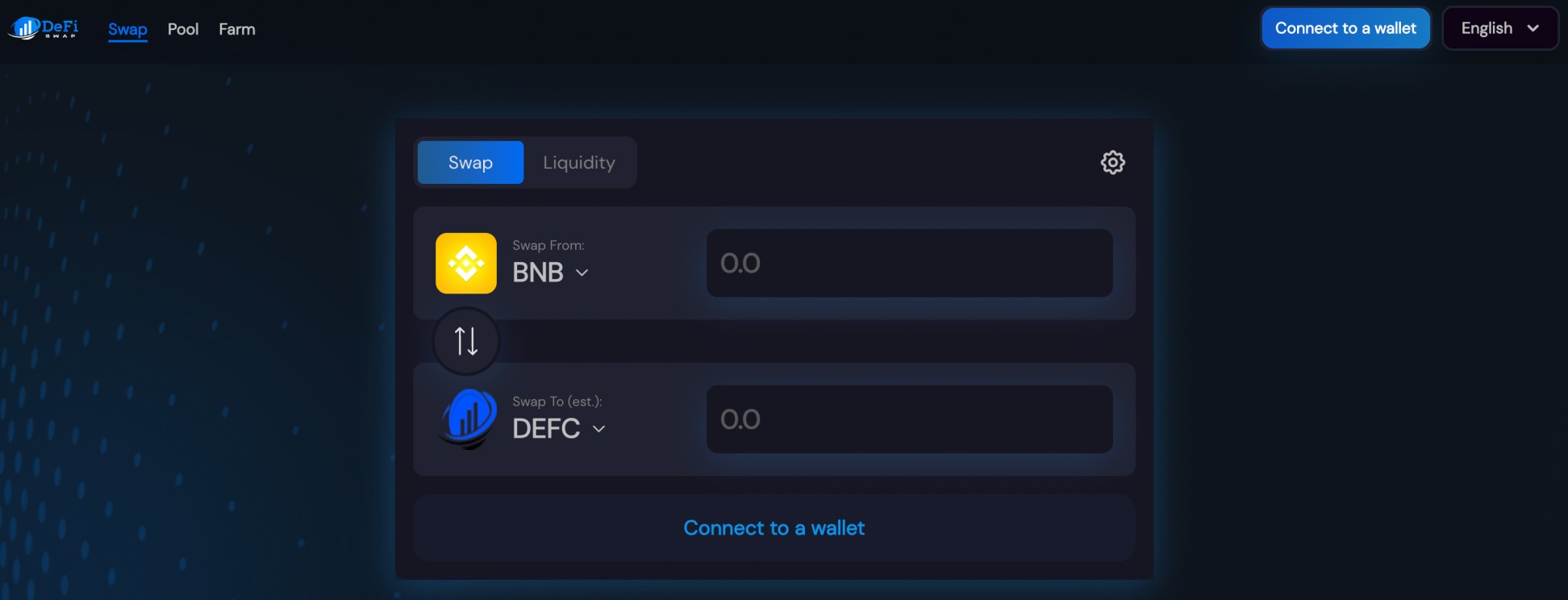

![]() The overall best DeFi lending platform to consider right now is DeFi Swap. This newly launched platform offers a decentralized exchange that enables users to buy and sell digital currencies without requiring a third-party entity.

The overall best DeFi lending platform to consider right now is DeFi Swap. This newly launched platform offers a decentralized exchange that enables users to buy and sell digital currencies without requiring a third-party entity.

In addition to this, DeFi Swap also offers a variety of lending services that allow you to generate an attractive APY on your idle tokens. First, you have the platform’s crypto yield farming offering, which offers a variety of interest rates depending on the token you wish to lend.

Moreover, DeFi Swap gives you the chance to choose your preferred lock-up period. The longer you are happy to lock the tokens away, the more you will be paid in interest. For example, if you were to lend out the platform’s native digital token – DeFi Coin, you would generate an APY of 30% on a 30-day term.

However, by opting for the maximum lock-up term of 365 days, your APY will increase to 75%. There are also 90-day (45%) and 180-day (60%) terms on offer. Irrespective of which token you wish to lend out, DeFi Swap will return your principal amount alongside any earned interest once the term has concluded.

The second lending tool available is the option of providing liquidity to the DeFi Swap exchange. In doing so, you will earn a share of any trading fees that are collected by the platform. Both of the aforementioned DeFi lending services are executed and maintained by transparent and immutable smart contracts.

This falls in line with the broader decentralized finance ethos, which DeFi Swap follows to the ‘t’. After all, a platform cannot claim to be a proponent of DeFi if it is backed by a centralized operator. In terms of getting started with this top-rated lending platform, you will first need to connect your wallet to the DeFi Swap website.

The platform supports MetaMask and WalletConnect – and the latter enables you to use Trust Wallet. DeFi Swap is also planning to launch an iOS/Android mobile app and an NFT marketplace in the coming months.

- Overall best DeFi lending platform in the market

- High yields on offer

- One of the best DeFi apps on the market

- Supports crypto yield farming and liquidity provision

- 100% decentralized – the platform is backed by smart contracts

- NFT marketplace and mobile app coming soon

- Backed by top-rated growth crypto token DeFi Coin

- High APY when holding DEFC making it a leading DeFi staking platform

Cons

- Not as established as other DeFi lending platforms

Cryptoassets are a highly volatile unregulated investment product.

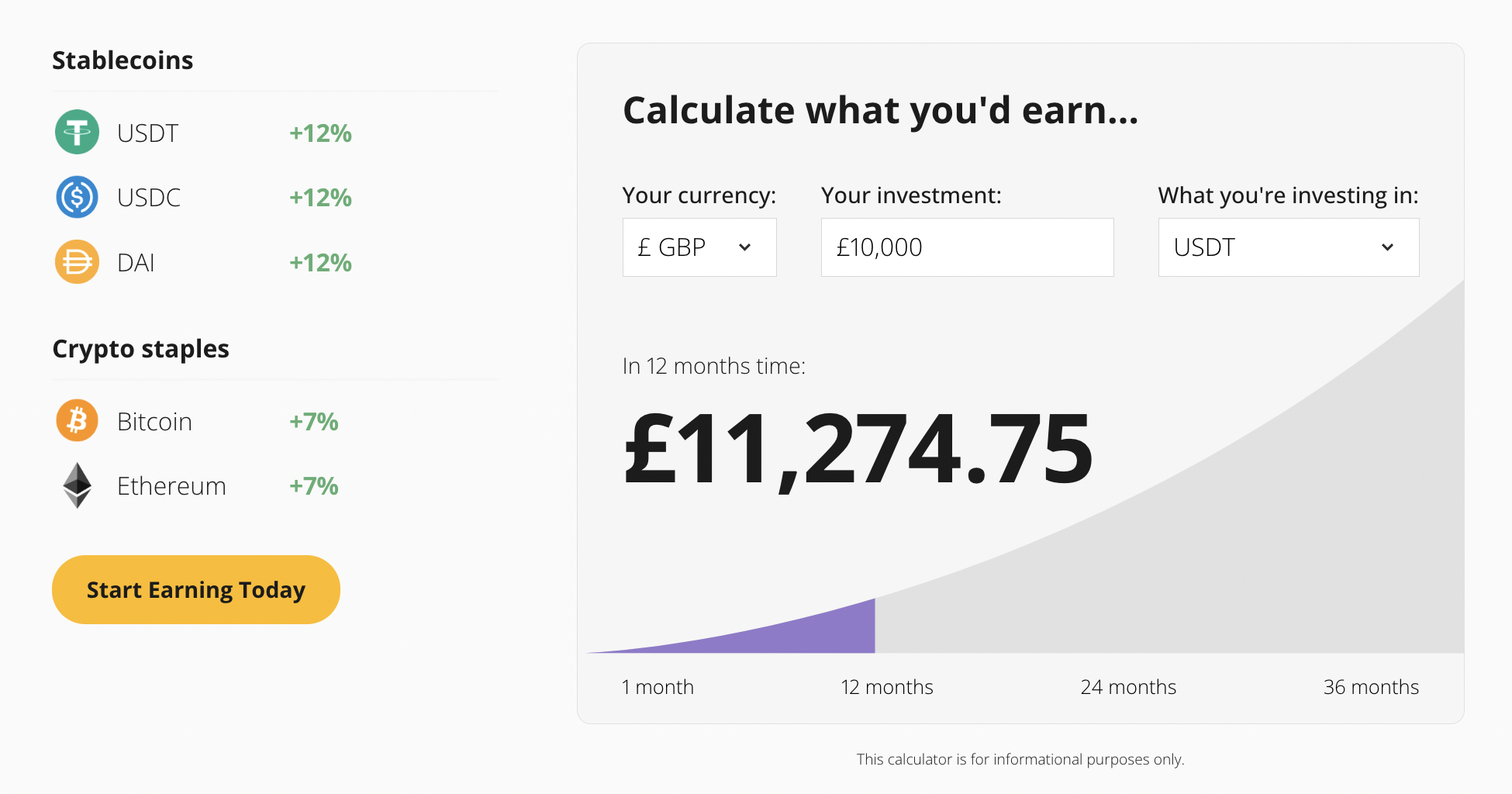

2. Aqru – Lend Your Idle Bitcoin and Ethereum Tokens to Earn 7% per Year

Aqru is a top-rated DeFi lending platform that allows you to earn interest on your idle digital tokens. By opening a crypto savings account with this provider, you will earn interest on Bitcoin and Ethereum deposits.

You will earn an even more attractive APY if you deposit a supported stablecoin. At Aqru, this includes DAI, Tether, and USD Coin. All of the crypto interest accounts offered by Aqru come without lock-up terms. As such, you will earn interest on your chosen account on a flexible basis – meaning you can elect to make a withdrawal whenever you wish.

Aqru also makes our list of the best DeFi lending platforms in the market because it distributes interest payments every 24 hours. This means that you can instantly reinvest your interest payments back into the same account to benefit from the impact of compound growth.

You keep tabs on how much interest your tokens are generating by logging into your account. Perhaps the easiest way to do this is to download the Aqru app to your mobile phone. The Aqru app has been fully optimized for iOS and Android devices. We should also note that both the Aqru app and website are very user-friendly.

There is no unnecessary jargon or steps to take, so beginners will appreciate the simplicity offered by this popular DeFi lending platform. Moreover, Aqru gets extra bonus points for its support for fiat currencies. You can deposit GBP, USD, or EUR into your account with a debit/credit card or bank wire – and then convert the cash for a supported digital asset.

In doing so, your chosen crypto token will be deposited into its respective interest-bearing account on your behalf. There are no fees for withdrawing fiat money out of Aqru. However, a $20 fee will apply on crypto withdrawals. And finally, there are no commissions deducted from the interest that you earn at Aqru.

Pros

- Earn 7% on Bitcoin and Ethereum deposits

- Stablecoin deposits earn 12%

- No lock-up period or tier limits

- Low minimum balance ($100)

- Free fiat cash withdrawals

Cons

- Relatively new to the industry

- $20 fee on crypto withdrawals

Cryptoassets are a highly volatile unregulated investment product.

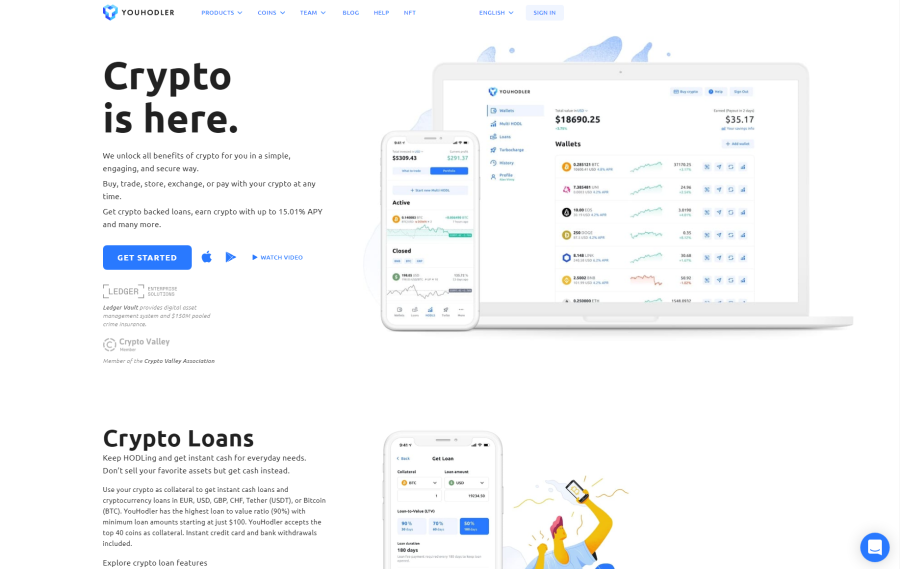

3. YouHodler – Global DeFi Lending Platform

With crypto growing, there’s an increasing number of people looking for the best DeFi lending platform. Swiss-based YouHodler aims to take that title thanks to its well-designed platform, great rates, and innovative approach.

YouHodler is a secure exchange with more than 150,000 users worldwide. It has incorporated Ledger Vault technology to provide clients with a ton of custodial options. Furthermore, the platform’s unique ‘3-factor authentication’ allows investors with over $10,000 to block crypto withdrawals to add an extra layer of protection.

Loans on YouHodler are simple and easy to understand. Users can decide on payback terms, ranging from 30 to 365 days. The loan-to-value (loan to collateral) ratio ranges from 90% to 50% based on the payback term, which is quite a bit higher than most platforms. Furthermore, YouHodler supports loans using the top 50 cryptocurrencies meaning there are plenty of collateral options.

There’s a reason why YouHodler is quickly picking up steam. It’s a great choice for investors looking for a high loan-to-value lender. It has an easy-to-understand interface and clearly defined terms, so there won’t be any nasty surprises when lending with YouHodler.

Pros

- 3-Factor authentication

- Variety of flexible lockup terms

- Easy to use

- Transparent fee structure

Cons

- Small user base

Lend Crypto on YouHodler Now

4. Crypto.com – Various DeFi Lending Accounts to Choose From

The next option to consider in your search for the best multi-chain DeFi lending platform is Crypto.com. This platform offers a vast range of services. This includes a fully-fledged crypto exchange, interest-earning accounts, a DeFi wallet, loans, credit cards, and more. As such, Crypto.com offers a one-stop shop for all things DeFi.

In terms of its lending services, you can earn interest on dozens of different crypto assets. APYS vary depending on the respective token, as well as the lock-up term that you choose. You have the option of a flexible account or a term of one or three months.

Just like DeFi Swap, the longer you are happy to lock your tokens away for, the more you will earn. Moreover, Crypto.com allows you to boost your interest rate by staking CRO. This is the digital currency that sits at the heart of the Crypto.com ecosystem. This is not too dissimilar to DeFi Coin, which fuels the DeFi Swap exchange.

Nonetheless, the top-tier rate available on Crypto.com is 14.5% per year. Crucially, there are no limits in place – meaning that you can maximize the income that you generate from the platform’s lending tool. At the other end of the spectrum, Crypto.com also allows you to play the role of a borrower.

You can get an instant crypto loan by putting up an LTV of just 50%. As such, if you were to deposit $500 worth of Ethereum, you would be able to borrow $250 worth of your chosen asset. This essentially allows you to access capital without being forced to sell your digital currency.

If you are also interested in crypto exchange services, Crypto.com offers over 250 digital tokens on its platform. You will pay just 0.40% per slide to buy and sell tokens here, albeit, low rates are offered when you trade large volumes or stake CRO. You can access all of the aforementioned services and features online or via the Crypto.com app.

Pros

- Earn up to 14.5% on crypto savings accounts

- Wide range of lock-up terms including flexible withdrawals

- Great reputation

- Also offers crypto exchange services and loans

- Spend your interest payments via the Crypto.com credit card

Cons

- Higher APYs on Bitcoin available elsewhere

- Need to stake CRO to get the highest yields

Visit Crypto.com Now

5. Nexo – Earn up to 17% on Stablecoin Tokens

Nexo is perhaps one of the best DeFi lending platforms for those seeking to generate interest on stablecoins. Crucially, this top-rated platform offers an interest rate of up to 17% on UST tokens. Other stablecoins, such as Tether and True USD, pay a lower interest rate at 12%.

Nexo is perhaps one of the best DeFi lending platforms for those seeking to generate interest on stablecoins. Crucially, this top-rated platform offers an interest rate of up to 17% on UST tokens. Other stablecoins, such as Tether and True USD, pay a lower interest rate at 12%.

The highest interest rate at Nexo is actually paid on a conventional crypto token. That is to say, by depositing Axie Infinity, you will be paid a highly attractive rate of 36%. However, it is important to note that the aforementioned rates are based on earning your interest payments in NEXO – which is the digital asset native to this platform.

Otherwise, your interest rate is reduced slightly. In addition to its interest accounts, Nexo also allows you to borrow funds. You can borrow from $50 to $2 million in either fiat or crypto. By depositing Bitcoin as collateral, you can access an LTV of 50% with no credit checks. As such, Nexo loans are approved instantly. Other tokens require a higher collateral rate.

Pros

- Earn up to 17% on stablecoins

- Flexible accounts

Cons

- You need to stake NEXO to get the maximum APY

- APYs seem to change regularly

Visit Nexo Now

Cryptoassets are a highly volatile unregulated investment product.

6. Binance – Great DeFi Lending Platform for Medium and Low-Cap Coins

The final option to consider from our list of the best DeFi lending platforms is Binance. This platform is best known for its leading crypto exchange – which offers more than 1,000 trading markets to its nearly-100 million clients.

You can, however, use Binance for its DeFi lending services too. At the forefront of this is its crypto interest accounts, which offer some of the best yields in the market on medium and low-cap coins. For instance, This is also the case with its liquidity provision tools.

For example, if you provide liquidity on LUNA/BNB, you can earn up an APY of 161%. BSW/USDT is also very competitive at 133%. If you are interested in some of the high yields available at Binance, you can purchase the respective digital currency directly on its exchange. After all, the platform is home to 600+ coins.

Opening an account at Binance takes just minutes and if you live in an eligible country, you can deposit funds with a debit/credit card. Fees will vary depending on your country of residence. Crypto deposits are also supported at Binance. Finally, the Binance app is available on iOS and Android and this doubles up as both an exchange and wallet.

Pros

- Huge yields on medium and small-cap coins

- Flexible and locked terms on offer

Cons

- Headling interest rates are often capped

- Some yields are somewhat misleading

- Yields can change at any time

Cryptoassets are a highly volatile unregulated investment product.

Best Defi Lending Platforms Compared

The comparison table below highlights the core features and offerings of the five DeFi lending platforms that we reviewed in the sections above.

| Best Crypto APR | Best Stablecoin APR | Terms | Staking Required for Best Rates? | |

| DeFi Swap | 75% | TBC | 30-days to 1-year | No |

| Aqru | 7% | 12% | Flexible accounts – No limits | No |

| YouHodler | 6.8% | 12.3% | Flexible accounts – No limits | No |

| Crypto.com | 14.50% | 10% | Flexible – 3 months | Yes |

| Nexo | 36% | 17% | Fixed and Flexible | Yes |

| Binance | Over 100% | 19%+ | Various terms | No |

The most important thing to remember when choosing the best DeFi lending platform for you is to ensure you have a full and frank understanding of the underlying terms and conditions.

In addition to lock-up terms, you should also explore whether or not APYs can change without notice. You should also explore factors surrounding fees and limits.

How Does DeFi Lending Work?

The overarching objective of DeFi crypto lending is to connect investors and borrowers on a peer-to-peer basis. This means that loans can be funded by everyday citizens and thus – there is no longer a requirement for centralized bodies like banks and financial institutions.

From the perspective of investors, if you currently own cryptocurrency tokens, it makes sense to maximize your potential earnings by depositing the funds into a DeFi lending account. In doing so, your tokens will be used to facilitate loans. In turn, you will be paid a rate of interest for as long as the tokens are being loaned out.

Crucially, there are some very attractive yields on offer at DeFi lending platforms. For example, DeFi Swap offers an APY of up to 75% when you lock up its native token DeFi Coin for 365 days. On a 30-day term, you will get an APY of 30%.

Although this practice isn’t risk-free, loans that you fund are secured with collateral. For instance, at Crypto.com, users are offered a maximum LTV (Loan to Value) ratio of 50%. This means that by providing $10,000 worth of collateral, the user could borrow up to $5,000.

If you are thinking of using DeFi lending platforms to borrow funds, you will not need to go through a credit check. In fact, you won’t even need to give any information about your financial background or affordability levels. Instead, you simply need to deposit your collateral and decide which fiat or crypto asset you wish to borrow.

Example of DeFi Lending

If you are still unsure how DeFi lending actually works, let’s look at an example to help clear the mist.

- Let’s say that you decide to use the best DeFi lending platform in the market today – DeFi Swap

- You deposit $1,000 worth of DeFi Coin tokens into the platform

- For simplicity, let’s say that at the time of the deposit, 1 DeFi Coin is worth $1

- As such, you deposit a total of 1,000 DeFi Coin tokens

- You are a long-term investor, so you decide to opt for a 365-day lock-up term, which yields an APY of 75%

The outcome of the above is as follows:

- After 365 days have passed, you will receive your principal deposit back – which was 1,000 DeFi Coin tokens.

- You will also receive your interest payment of 75% – so that’s another 750 DeFi Coin tokens.

- As a result, you now own 1,750 Defi Coin tokens.

However, you also need to consider the value of the token you are lending out – as this will fluctuate on a second-by-second basis as per market forces.

- We mentioned above that when you originally deposited your 1,000 tokens, one DeFi Coin was worth $1

- With that said, when the 365-day term had concluded, DeFi Coin was trading at $3 per token

- You received 1,750 tokens back – so at $3 each, that’s a total value of $5,250

- You originally invested the equivalent of $1,000 – so that’s a profit of $4,250

It is really important to remember that the market value of the token being lent out will have a direct impact on your APY – for both the good and bad.

For example, if the value of the token increases, you are essentially multiplying your yield. But, if the opposite happens, then you can get back less than what you originally invested – at least in dollar terms.

Which Platforms Have the Best DeFi Lending Rates?

DeFi lending rates offered by platforms in this space will vary considerably. Not only in terms of yields but the underlying terms and conditions that you are required to meet.

For example, if you decide to lend out your idle crypto tokens at DeFi Swap or Aqru – what you see is what you get. By this, we mean that there are no other requirements to get the maximum DeFi lending rates offered.

However, when you opt for a platform like Nexo, the highest rates offered are only available if you receive your tokens in NEXO. Other platforms will also require you to stake its native token to get the highest DeFi lending rates.

Taking this into account, it is important that you do not fixate on APYs alone. On the contrary, be sure to read the fine print in terms of lock-up periods, limits, and staking requirements.

What DeFi Coins Can You Lend?

There is no limit to the number or type of tokens that you can lend at DeFi platforms. Instead, support for a specific token will be determined by the DeFi provider in question.

For example, Aqru has decided to focus on just two cryptocurrencies – Bitcoin and Ethereum, and three stablecoins – DAI, Tether, and USD Coin. Crypto.com, on the other hand, allows you to lend out dozens of tokens across both standard cryptocurrencies and stablecoins.

In the case of DeFi Swap – which we ranked as the overall best DeFi lending platform in the market, the provider aims to offer support for hundreds of tokens listed on the Binance Smart Chain.

Further down the line, the consensus is that DeFi Swap will then begin to incorporate other blockchain networks into its portal.

If you’re not sure which tokens you should lend out – consider the following options:

- DeFi Coin – You can lend out DeFi Coin on the DeFi Swap exchange across four terms – 30, 90, 180, and 365 days. The longest term offers an APY of 75%.

- Bitcoin – You can buy Bitcoin and then deposit the tokens into Aqru to earn interest of 7% per year. No lock-up terms are required and interest is paid daily.

- Tether – If you want to earn interest without taking on volatility risk, then you might consider lending out Tether. This stablecoin can be deposited into a Crypto.com account and in turn, you can earn up to 10% in annual interest.

Just remember, some platforms in this space require you to stake a specific token or agree to a long lock-up term to get the best DeFi lending rates. As such, make sure you do plenty of research before parting with any funds.

How to Earn Lend Defi?

If you are ready to start maximizing your potential crypto earnings through a DeFi lending platform – we will now walk you through the process step-by-step.

Simply follow the tutorial below to earn an APY of up to 75% per year at DeFi Swap.

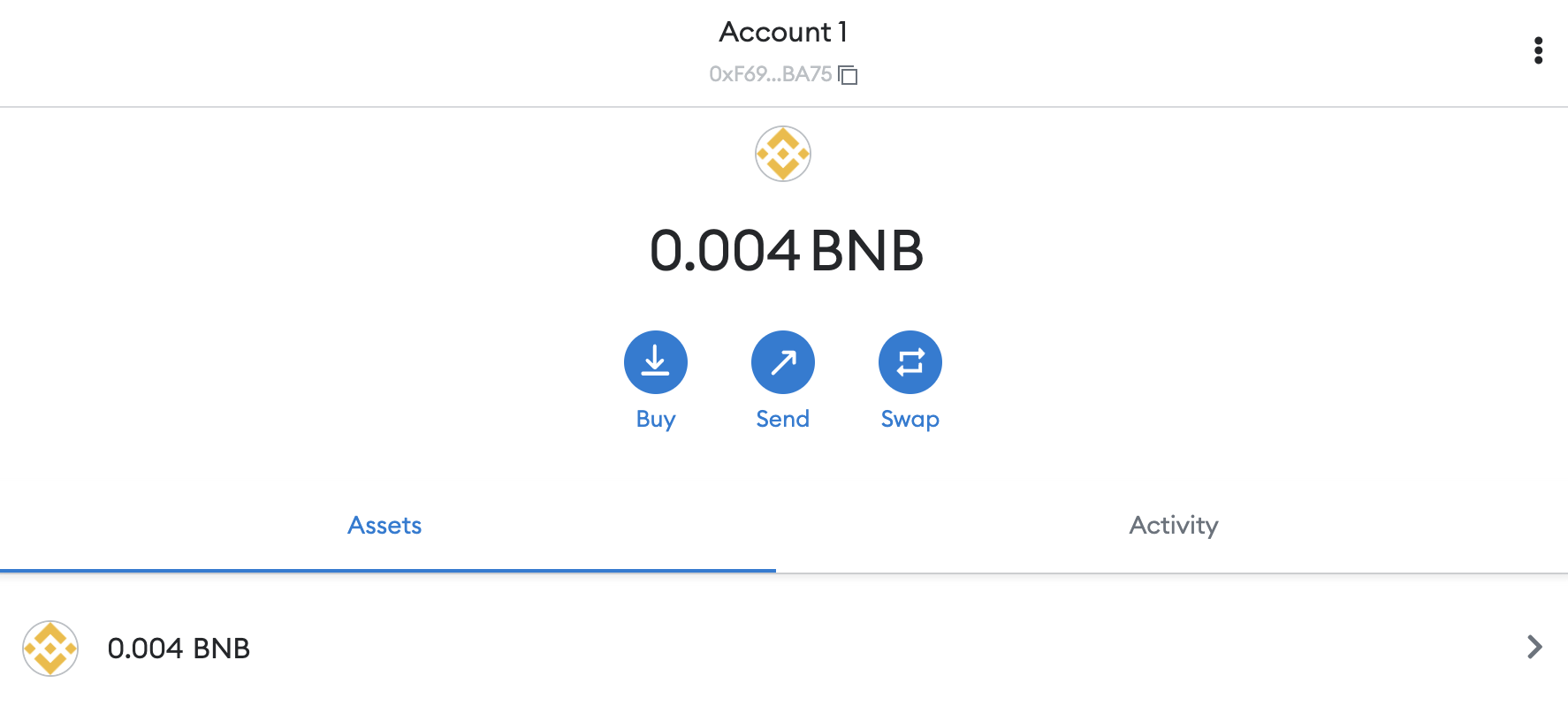

Step 1: Set up a Crypto Wallet That Connects to BSc

To start, you will need to ensure that you have a wallet that can connect to the Binance Smart Chain (BSc). This is the blockchain network that the DeFi Swap lending platform operates on.

The Trust Wallet app is a good option here – which is backed by Binance. However, for this walkthrough, we will show you the process with MetaMask.

Among several other perks, MetaMask comes in the form of a browser extension, so you can complete the DeFi lending process via a laptop device.

Once you have installed the MetaMask extension, open it up and create a password when prompted.

You will then be shown 12 words – which is your backup passphrase. Write the words down in the correct order and keep this somewhere safe.

Step 2: Connect MetaMask to BSc

When you first download and install MetaMask, it only connects to the Ethereum network. As such, you will need to manually connect the Binance Smart Chain to your wallet.

To do this, click on > Settings > Add Network

Then paste in the following data:

Network Name: Smart Chain

New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com

Click on ‘Done’ to proceed.

Step 3: Transfer BNB to Wallet

Next, you will need to transfer BNB so that you can buy DeFi Coin on the DeFi Swap exchange.

After all, you won’t be able to earn up to 75% in interest on DeFi Coin per year if you do not actually own any tokens.

So, at the top of MetaMask, you will find your BNB wallet address. Copy it to your clipboard and then head over to your location where you currently have BNB.

If you do not have BNB right now, you can buy some at Binance in less than five minutes with a debit or credit card.

Either way, you can transfer BNB to MetaMask by pasting in the wallet address that you have copied to your clipboard. Once you have made the transfer, BNB should appear in your MetaMask wallet within 60 seconds.

Step 4: Connect Wallet to DeFi Swap

The next step is to visit the DeFi Swap platform and click on the ‘Connect to Wallet’ button.

Select MetaMask and then confirm the connection when the pop-up notification appears from your wallet extension.

Step 5: Swap BNB for DeFi Coin

You can now type in the number of BNB tokens that you want to swap for DeFi Coin. Click on Swap to proceed.

You will then need to click on Confirm Swap’ to finalize the exchange.

Step 6: Generate Interest on DeFi Coin

Now that you have DeFi Coin in your wallet, you can immediately lend it out to start earning interest.

First, click on the ‘Farm’ button from the top of the page. In the ‘Amount’ box, type in the number of DeFi Coin tokens that you want to lend out.

Next, click on the ‘Package’ button and select the number of days that you want to lock your tokens away.

As you see from the image above, the longer terms pay the highest interest rates.

Once you have confirmed everything and provided authorization via the MetaMask pop-up notification, your DeFi Coin tokens will be deducted from your wallet.

You will automatically receive your principal investment and interest payment back into your wallet when the term concludes.

Is Defi Lending Safe?

There are a number of risks that you need to consider before you begin to use a DeFi lending platform.

First, you need to do some solid research on the DeFi lending platform itself. After all, you will be required to connect your crypto wallet to the platform and subsequently lend out your tokens.

If you do not use a reputable platform for this purpose, then you face the risk of being scammed. Always do your own independent research to determine whether or not a DeFi lending platform can be trusted.

The next risk that you need to consider is with respect to lock-up terms. While platforms like Aqru offer flexible withdrawal terms on all supported coins and accounts, others require you to lock your tokens up for a minimum period.

During this period, you will not be able to make a withdrawal. As such, if you need access to immediate funds, there is nothing that you can do.

Finally, you also need to remember that the value of cryptocurrencies fluctuates. Oftentimes, in a volatile manner. In other words, if the value of the token you are lending out declines by more than you earn in interest, you will be running at a loss.

This risk can be reduced by creating a diversified lending portfolio of multiple cryptocurrencies. To reduce volatility risk, you might also consider lending out stablecoin tokens.

Conclusion

DeFi lending platforms sit at the heart of the decentralized finance arena.

That is to say, the best DeFi lending platforms in the market give you the opportunity to generate an attractive APY on your idle tokens.

In turn, the tokens will be lent to those that wish to borrow funds without going through a centralized party.

If you’re ready to start earning interest on your crypto investments right now – we like the look of DeFi Swap.

All you need to do is connect your wallet to the DeFi Swap platform and select your preferred term – and you’ll be earning interest right away.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney