Ethereum will soon be moving to a Proof-of-Stake algorithm in order to ups its performance. Some high profile cryptocurrency commentators have called this a rouse and a scam and insisted that the project is also falling out of favor. However, a new post from Coinmetrics, called “The Evolution of Ethereum Tokens,” describes how much has changed and grown on the network. It also illustrates how the network is being used as an asset insurance and programmable money network.

Report Highlights

In dissecting how Ethereum has evolved in the last two years, Coimetrics begins by pointing out the difference between the network value as opposed to the token value. As a project, the second-highest cryptocurrency in terms of market cap is seeing its value chased down by the aggregate market caps of tokens launched on that platform. This ratio, referred to as the “Network Value to Token Value” (NVTV) ratio, as proposed by Chris Burniske, is shrinking, which is a good thing for Ethereum.

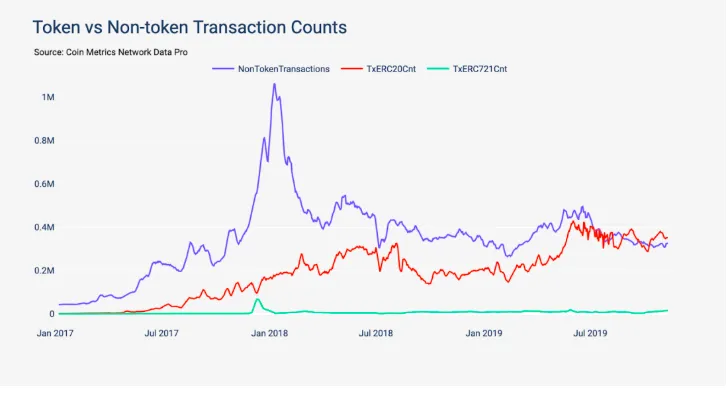

Another indicator that the network is starting to perform as intended is the recent transaction flippening that is happening more and more often. The report states that historically, aggregate token transaction count has been lower than Ethereum’s non-token transaction count. However, in Q3 of this year, a flippening occurred where ERC-20 transaction counts surpassed ETH transaction counts. A lot of this is down to USDT, which started gaining ground in May and now has over 80 percent of the share of transaction counts of the top ten tokens.

People Do Use Ethereum

The narrative has been for some time now that Ethereum was losing its grip on the ‘World Computer’ stage. By being rattled at the peak of CryptoKitties to competitors of the magnitude of NEO, Cardano, EOS, and Stellar, Ethereum was supposed to be dying off. However, the data in many areas points towards a different conclusion. Ethereum certainly has faced a brick wall when it comes to scaling, but this is soon to be addressed in the upcoming upgrade. Ethereum’s need to scale could also be indicative of its performance for the network is still rather full despite the abandonment narrative. The final key metric in the Coinmetrics data, as pointed out by Ryan Sean Adams, shows that “Ethereum contract calls have grown from a couple thousand to a couple million in less than 2 years. Ethereum is being used for its intended purpose: settlement for programmable money”