The decentralized finance (DeFi) industry is home to a number of innovative ways that you can generate an attractive yield on your cryptocurrency investments.

In addition to staking and interest accounts, you might also consider DeFi yield farming as a way to make your crypto tokens work for you.

In this beginner’s guide, we explain everything there is to know about the yield farming DeFi space – such as how much you can earn and what risks you need to consider.

The Best Yield Farming DeFi Platforms for 2022 List

In order to take advantage of the benefits that DeFi yield farming offers, you will first need to choose a suitable platform.

A list of the best yield farming DeFi platforms for 2022 can be found below.

- DeFi Swap – Overall Best Yield Farming DeFi Platform for 2022

- Aqru – Crypto Interest Account Offering Yield on Flexible Savings

- Crypto.com – Generate an APY of 10% on Solid Stablecoins

- Pancakeswap – Great DeFi Yield Farming Site for BNB Pairs

- UniSwap – Leading DEX for Ethereum-Based Yield Farming Pools

Each of the above DeFi yield farming sites will differ in terms of yields, supported coins, and safety – so be sure to read our platform reviews further down on this page.

What is DeFi Yield Farming? – A Quick Overview

In a nutshell, crypto yield farming is a tool offered by DeFi platforms that allows you to generate interest on your idle digital assets. In this regard, the process is somewhat similar to crypto staking or interest accounts – insofar that your primary objective is to earn an attractive APY on tokens that you currently own.

However, where yield farming differs is that you will be providing crypto tokens for a trading pair offered by a decentralized exchange – or DEX. For instance, let’s supposed that you are interested in earning a yield of 20% on ETH/USDT. In order to benefit from this high APY, you would be required to provide an equal value of Ethereum (ETH) and Tether (USDT).

This could be, for example, $1,000 worth of ETH and the same amount in USDT. And in doing so, this allows the respective exchange to offer enough liquidity to its users. In other words, users can swap ETH for USDT or visa-versa instantly and at competitive spreads. In fact, it’s just a case of the underlying smart contract performing the swap autonomously.

- Now, when users opt to swap tokens for a pair that you have provided liquidity for, trading fees will apply.

- And, as a stakeholder in that respective liquidity pool, you will earn a share of any fees collected.

- For example, let’s say that by depositing $2,000 – you own 2% of the ETH/USDT liquidity pool.

- If on day one the pool collects $500 in fees, you would earn $10 in commission.

As great as yield farming DeFi platforms are in terms of passive income and attractive yields, they do not come without their risk.

At the forefront of this is impairment risk, which refers to the opportunity cost of depositing funds into a yield farming pool – more on this later. There are also risks associated with the DEX itself, as well as a potential malfunction of a smart contract.

How Does Yield Farming DeFi Work?

The services offered by yield farming DeFi platforms can appear confusing at first glance. And as such, it is important that you have a firm grasp of how things work before you part with any funds.

In the sections below, we explain in great detail everything you need to know about DeFi yield farming.

Yield Farming Pairs

First and foremost, we mentioned above that yield farming always requires a deposit of two tokens. This is because you will be providing liquidity for a specific pair.

- For instance, let’s say that your chosen DEX specializes in tokens listed on the Binance Smart Chain.

- We’ll also say that one of the platform’s most traded pairs is DEFC/BNB.

- This means that the platform requires an equal measure of both DeFi Coin (DEFC) and Binance Coin (BNB).

To elaborate:

- We’ll say that 1 BNB is equal to 1,000 DEFC tokens

- As such, you decide to deposit 3 BNB and 3,000 DEFC

As we cover in more detail shortly, BNB and DeFi Coin will never increase or decrease in value on a like-for-like basis.

That is to say, on any given day, DeFi Coin might increase in value by 10% while BNB might drop by 5%. This is where impairment risk comes into play.

DeFi APY

The next thing to understand is the annual percentage yield (APY). This simply lets you know how much you will make by providing liquidity for a specific yield farming DeFi pair.

For instance, if the APY is offering 10% and you deposit a total of $1,000 in crypto, you should expect a return of $100. However, your returns are paid in crypto tokens as opposed to fiat money.

Therefore, if you originally deposit 1,000 ETH at 10%, your rewards will amount to 100 ETH.

Furthermore, and perhaps most importantly, the specific digital asset that your rewards are paid in might be completely different from the two tokens that you have provided to the liquidity pool.

- For example, when using Pancakeswap, your rewards will likely be paid in the platform’s native token – CAKE.

- When opting for Binance Earn, rewards are often paid in BNB.

- And when using DeFi Swap – which came out as the overall best yield farming site – your rewards will be paid in DEFC.

With this in mind, you need to take into account the market value of the respective tokens. After all, crypto token valuations change on a second-by-second basis – which will either benefit or hinder your investment returns.

How Yield Farming Generates Yields

One of the biggest questions that DeFi newbies ask is how yield farming sites are actually able to pay you interest. After all, the generation of interest cannot appear out of thin air.

- As noted earlier, when you lend tokens to a farming pool, this will provide the respective exchange with sufficient levels of liquidity.

- Meaning – traders can use the exchange to swap tokens in a decentralized manner.

- And in doing so, the trader will pay a small fee on each swap that they execute.

In terms of specific yields, this depends on two things in particular:

- The share that you have in the liquidity pool

- How much the exchange collects in trading fees

To illustrate the above, let’s look at a simple example:

- Let’s say that you provide liquidity for the pair BNB/BUSD

- You provide $1,000 worth of each token – so your total outlay is the crypto equivalent of $2,000

- In total, the liquidity pool on your chosen DeFi platform has $200,000 worth of liquidity

- This means that your stake in this liquidity pool is 1%

Now that we know what your stake in the farming pool is, we can then calculate the fees that you earn:

- Over the course of one year, the BNB/BUSD liquidity pool collects $120,000 in trading fees

- This means that on a stake of 1%, your share of collected trading fees amounts to $1,200

- On an initial investment of $2,000 – this amounts to a yield of 66%

However, it is once again important to highlight that your rewards will be paid in crypto tokens. As such, the monetary value of the respective tokens that you receive will depend on market prices.

Of course, one such way to counter the volatility risk associated with yield farming DeFi pools is to opt for a stablecoin pair. On the other hand, as we saw with the recent TerraUSD crash, even stablecoins are not free of risk.

For more information on yield farming you might want to check out our guide on yield farming vs staking.

Is Yield Farming DeFi Profitable?

Yield farming can be a very profitable way to generate income on your idle crypto tokens. However, there are many factors at play that will determine how profitable yield farming is – if at all.

Crucially, while leading yield farming DeFi sites will give you an estimated APY, there is no guarantee that this will come to fruition. Nonetheless, you will often find that the most liquid pairs pay the least amount of interest.

A great example of this would be BNB/BUSD on the Binance Smart Chain or ETH/USDT on the Ethereum network. At the other end of the scale, if you decide to add liquidity for new and illiquid tokens, then you should expect a much higher rate of return.

This ultimately comes down to the age-old risk vs reward theory. Nonetheless, whether or not you are able to make a profit will also depend on the potential impact of impairment loss.

Impairment Loss in DeFi

Some yield farming DeFi sites will not make the risks of impairment loss clear-cut. Instead, they will focus entirely on advertising the potential yield that you can earn.

Impairment loss refers to the negative difference between what you earn from yield farming with what you could have made had you kept the tokens in a standard wallet or exchange.

- For example, let’s say that you put $500 worth of ETH into a farming pool, and the same amount in USDT. This means that at the time of the deposit, you have $1,000 worth of crypto.

- In an ideal world, this 50/50 balance will remain in place at all times

- However, due to market forces, the liquidity pool will never be balanced – as one side of the pair will at some point outweigh the other

- When this happens, your yield is directly impacted

This results in a lower yield than what you could have made simply by holding onto your tokens in a wallet.

| Yield Farming DeFI | Kept Tokens in Wallet | |

| Day 1 (Date of deposit) | Total value of pair: $2,000 | Total value of pair: $2,000 |

| Day 30 (Date of withdrawal) | Total value of pair: $2,500 | Total value of pair: $2,800 |

The above table is a simplified example of impairment loss. ‘Day 1’ states that when the tokens were deposited into the farming pool, they were collectively worth $2,000.

‘Day 30’ shows us that the total value of the tokens that we deposited into the farming pool is now worth $2,500.

Had the tokens been in a private wallet as opposed to a yield farming DeFi site, they would have been worth $2,800 – the loss in this example is $300. This is also commonly referred to as impermanent loss, as the value of your DeFi tokens can still recover over time.

DeFi Yield Farming Rates

As noted throughout this guide on yield farming DeFi, interest rates, and APYs will vary considering depending on a number of factors.

This includes:

- The DeFi platform itself – not least because some sites are more competitive than others

- The specific tokens that you are depositing into the pool – less liquid digital assets pay a higher yield

- Whether you are opting for a standard crypto token or a stablecoin

Ultimately, DeFi yield farming rates can vary from a few percentage points to an APY of over 100%. Just remember that the higher the yield, the more risk you are often taking.

What Are the Best Yield Farming DeFi Coins?

When choosing the best DeFi coins for the purpose of yield farming, there are many important things to consider.

This includes:

- The market value of the token from when you make the deposit to the date that you decide to withdraw the funds. After all, if the value of the token increases, you will earn capital gains in addition to the yield generated from farming

- The yield on offer for the respective pair that you wish to provide liquidity for

- The blockchain network that the coin operates on top of

- Which yield farming DeFi sites support the coin in question

Taking all of the above into account, we found that the overall best DeFi coins to farm are those discussed below:

DeFi Coin (DEFC) – Overall Best DeFi Coin to Farm

As the name implies, DeFi Coin (DEFC) sits at the heart of the decentralized finance system. This digital asset is backed by an up-and-coming DEX – DeFi Swap, which offers a full suite of interest-earning opportunities. In addition to staking, DeFi Swap also enables you to engage in yield farming at highly competitive rates.

We like that DeFi Coin rewards long-term holders and penalizes short-term market speculators. This is because, on each and every sell order, DeFi Coin takes a mandatory tax of 10%. Half of this tax is subsequently passed on to DeFi Coin holders. This means that in addition to earning interest via yield farming, you’ll also generate an attractive share of collected tax.

BNB (BNB) – Top DeFi Coin to Farm on the Binance Smart Chain

BNB – formally known as Binance Coin, the native token of the Binance ecosystem. This not only includes its leading exchange platform but the Binance Smart Chain itself.

The latter is now home to thousands of tokens – all of which are paired against BNB. Therefore, by holding BNB tokens, you have plenty of yield farming opportunities at your disposal.

Tether (USDT) – Most Liquid and Traded Stablecoin for Yield Farming

Tether runs on top of the Ethereum blockchain and it is the largest stablecoin in terms of volume and liquidity. USDT, as it is also known, is often the go-to stablecoin for traders that seek a safety net against ultra-volatile markets.

If you decide to stake tokens that operate on the Ethereum network, then you will be able to farm them alongside Tether. This option will suit those of you that want to reduce the risk of volatility as best as practically possible.

Pancakeswap (CAKE) – Native Token of the Pancakeswap DEX

Pancakeswap is often the first platform that newly launched tokens opt for when operating on top of the Binance Smart Chain.

The decentralized exchange facilitates billions of dollars in trading volume throughout the week. And, if you wish to farm BSc tokens in a user-friendly manner alongside attractive APYs, your rewards will be paid in CAKE.

Ethereum (ETH) – Leading Blockchain Behind ERC-20 Tokens

The Ethereum blockchain is home to thousands of ERC-20 tokens. This is inclusive of plenty of DeFi projects – including the likes of Uniswap and Yearn.finance. As a result, by holding an allocation of Ethereum, you will never be short of yield farming options.

Top Yield Farming DeFi Platforms Reviewed?

The only way to access yield farming DeFi services is via a top-rated platform.

Your chosen provider should have a great reputation for safety and offer a wide selection of supported coins. You will, of course, also want to opt for a platform that offers high yields and fast withdrawals.

In the sections below, we discuss the best platforms in this marketplace that allow you to generate a yield on your idle crypto tokens.

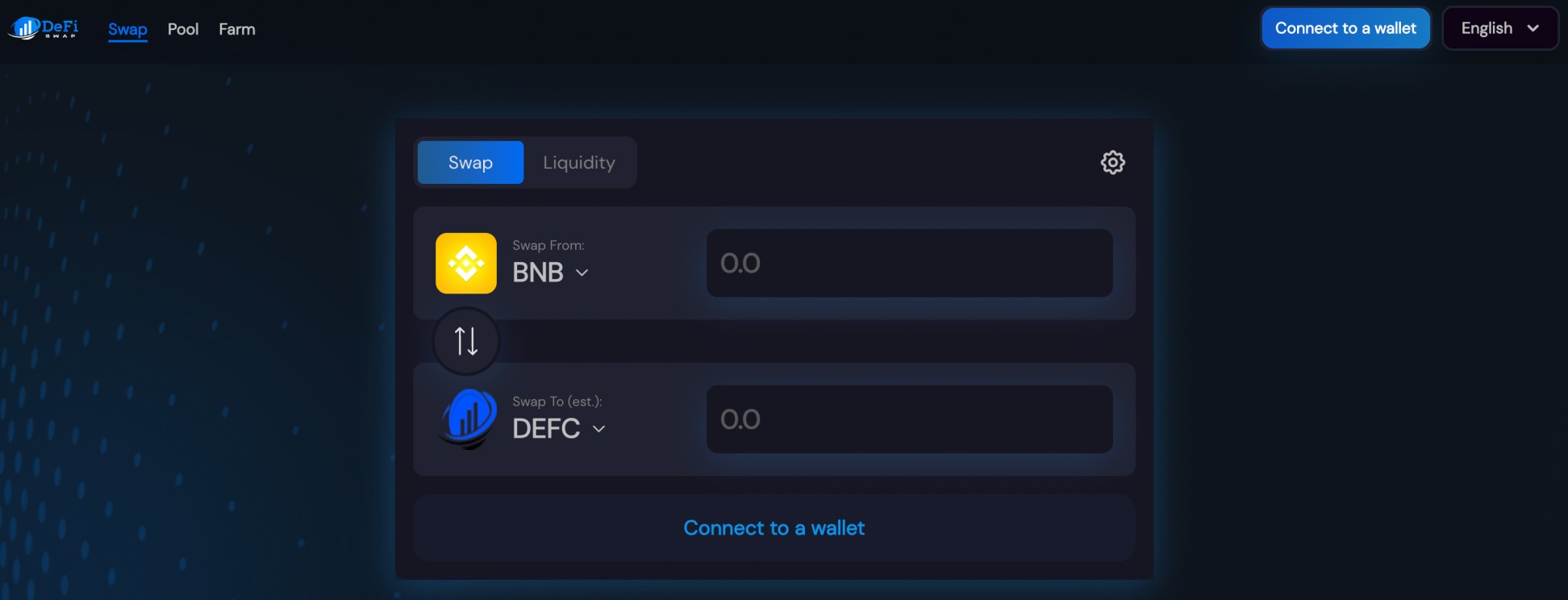

1. DeFi Swap – Overall Best Yield Farming DeFi Platform for 2022

![]() DeFi Swap offers the overall best platform to generate interest on your DeFi investment today. This is a decentralized platform, which means that you utilize all of its services without needing to create an account. You won’t need to upload any KYC documents or even give your name.

DeFi Swap offers the overall best platform to generate interest on your DeFi investment today. This is a decentralized platform, which means that you utilize all of its services without needing to create an account. You won’t need to upload any KYC documents or even give your name.

Instead, it’s just a case of connecting your wallet on the DeFi Swap website – navigate there from Deficoins.io. In doing so, you will be able to begin your yield farming journey instantly. The DeFi Swap protocol operates on top of the Binance Smart Chain and you will have access to a wide range of yield farming pools.

Once you have selected a pool and transferred your preferred number of tokens, you will be entitled to a share of any trading fees collected on the respective pair. This allows you to earn passive income, insofar that once your tokens are deposited, there is nothing else for you to do.

In addition to yield farming, you might also consider using DeFi Swap for its leading staking tool. When staking the platform’s native digital token – DeFi Coin, you can earn an APY of up to 75%. This is based on a staking period of 365 days, albeit, much shorter terms are on offer too.

Moreover, DeFi Swap is also home to an instant conversion facility that allows you to exchange one token for another. This prevents the need for you to use a centralized exchange – which can be both cumbersome and slow. Finally, DeFi Swap is in the process of launching its iOS and Android mobile app, as well as a fully-fledged NFT marketplace.

Pros

- Overall best DeFi platform in the market

- High yields on offer

- Supports crypto yield farming and staking

- 100% decentralized – the platform is backed by smart contracts

- NFT marketplace and mobile app coming soon

- Backed by top-rated growth crypto token DeFi Coin

Cons

- Not as established as other DeFi platforms

Learn More About DeFi Swap

Cryptoassets are a highly volatile unregulated investment product.

2. Aqru – Crypto Interest Account Offering Yield on Flexible Savings

Aqru is a leading DeFi platform that offers flexible crypto interest accounts. This means that you can benefit from the growth of DeFi without needing to take on impairment loss. Instead, it’s just a case of depositing your tokens into your chosen account and collecting interest every day, free to withdraw any time.

That’s the case for Bitcoin, Ethereum, or stable coin USDC. They do also now offer Maple Finance with a 90 day lockup, but the other cryptos have no fixed terms.

Another thing that we like about Aqru is that the DeFi platform supports fiat currency. This means that if you do not have any crypto tokens to hand, you can deposit funds into your Aqru account with a debit/credit card or bank wire.

You can then elect to have your USD, EUR, or GBP deposit converted into one of the DeFi platform’s supported tokens. If you decide to withdraw fiat money out of Aqru, then no fees apply. Crypto withdrawals, on the other hand, come with a fee of $20 – which is paid in the respective token.

With that said, no commissions are dedicated from the interest that your tokens generate on Aqru. On the contrary, the APY that you see is exactly what you get. If you like the sound of Aqru, you can open an account in less than five minutes.

The APY can flucuate depending on market conditions – visit Aqru to see the latest interest rates. You can access the platform via your desktop browser or the mobile app for iOS and Android.

Pros

- Earn on BTC, ETH, USDC or Maple Finance

- No lock-up period commitment or tier limits

- Low minimum balance ($100)

- Free fiat cash withdrawals

Cons

- Relatively new to the industry

- $20 fee on crypto withdrawals

Visit Aqru Now

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com – Generate an APY of 10% on Solid Stablecoins

Another top-rated DeFi platform that we like the look of is Crypto.com. This popular platform offers crypto exchange services in addition to a wide variety of other products – including savings accounts. When using Crypto.com for this purpose, you can earn up to 10% per year on a range of stablecoins.

This means that you can make your tokens work for you without needing to worry about volatility risk. The specific APY that you are able to get will, however, depend on how long you decide to lock your tokens. Terms at Crypto.com are inclusive of 1-month, 3-month, and flexible plans.

It goes without saying that the highest rates are offered on a 3-month savings account. You can actually boost your APY by staking the Crypto.com digital currency – Cronos (CRO). This will also get you lower commissions when trading crypto on the platform’s exchange. If trading is of interest to you, then you will only pay 0.40% per slide at Crypto.com.

We also like Crypto.com for its DeFi wallet. This allows you to store digital currency tokens in addition to earning interest – all in a decentralized environment. This means that Crypto.com never has access to your private keys. Another DeFi tool offered by this platform is its loan service.

This allows you to borrow funds in return for putting up a security deposit. For instance, if you were to deposit $1,000 worth of Bitcoin, you would be able to get a loan of up to 50%. All loans are instantly approved and no credit checks are carried out. You can also use Crypto.com for its leading NFT marketplace and Visa-backed debit card.

Pros

- Earn up to 10% on stablecoin savings accounts

- Wide range of lock-up terms including flexible withdrawals

- Great reputation

- Also offers crypto exchange services and loans

- Spend your interest payments via the Crypto.com credit card

Cons

- Higher APYs available elsewhere

- Need to stake CRO to get the highest yields

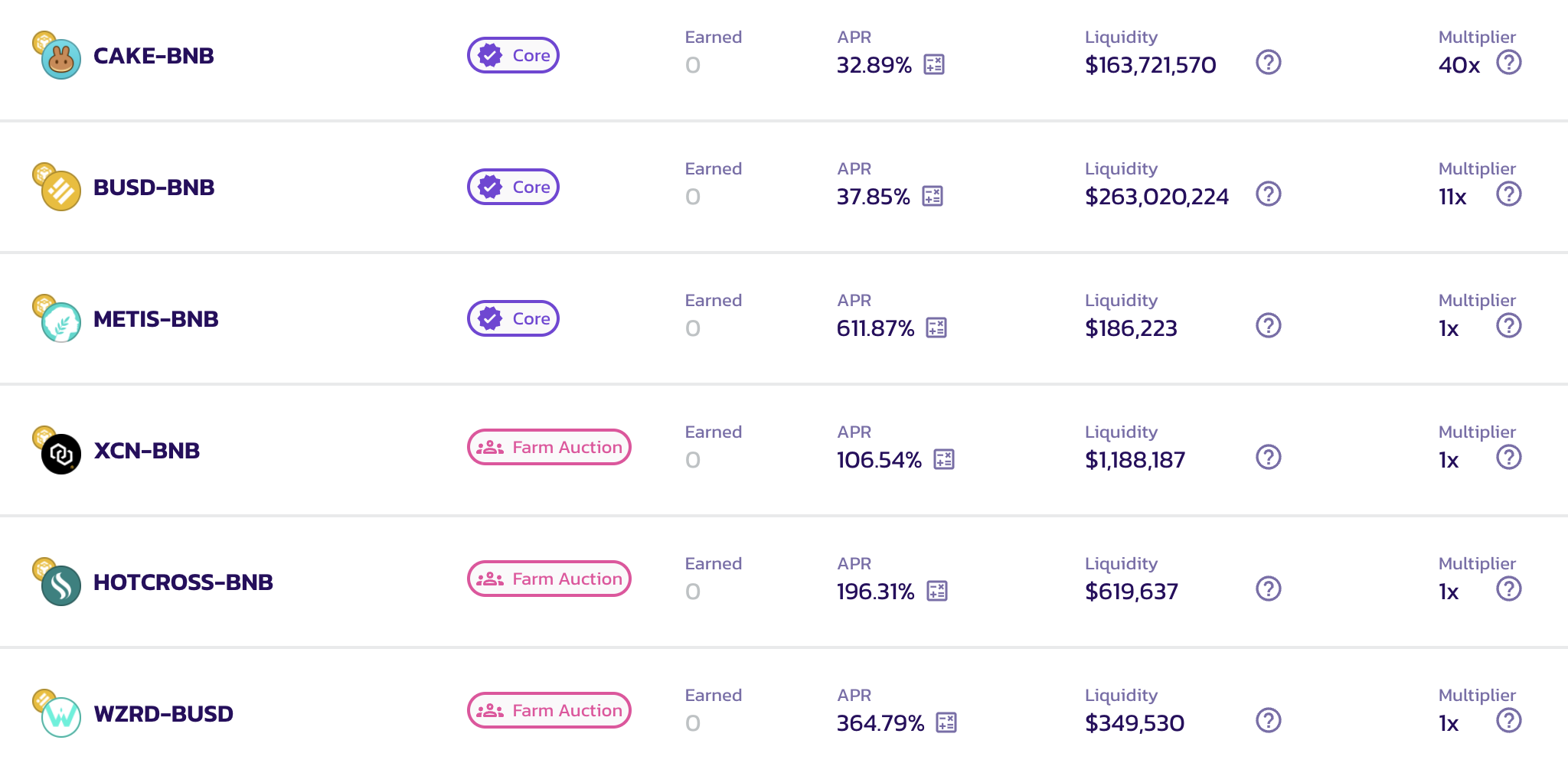

4. Pancakeswap – Great DeFi Yield Farming Site for BNB Pairs

Pancakeswap is a decentralized exchange that specializes exclusively in tokens listed on the Binance Smart Chain. As such, if you own BNB or any other BSC token, this platform might be for you.

The Pancakeswap exchange is very user-friendly and you can gain access to the platform via Trust Wallet or MetaMask. In terms of yield farming services, Pancakeswap offers both staking and liquidity pools.

High yields are on offer when you stake less liquid and/or volatile pairs. According to the platform itself, Pancakeswap is used by nearly 3 million traders and over $4.7 billion worth of tokens is currently locked in staked pools.

Pros

- Popular DEX that specializes in BSc tokens

- Staking and farming services

- High yields on volatile pairs

Cons

- No support for tokens outside of the Binance Smart Chain

- Most rewards are paid in CAKE

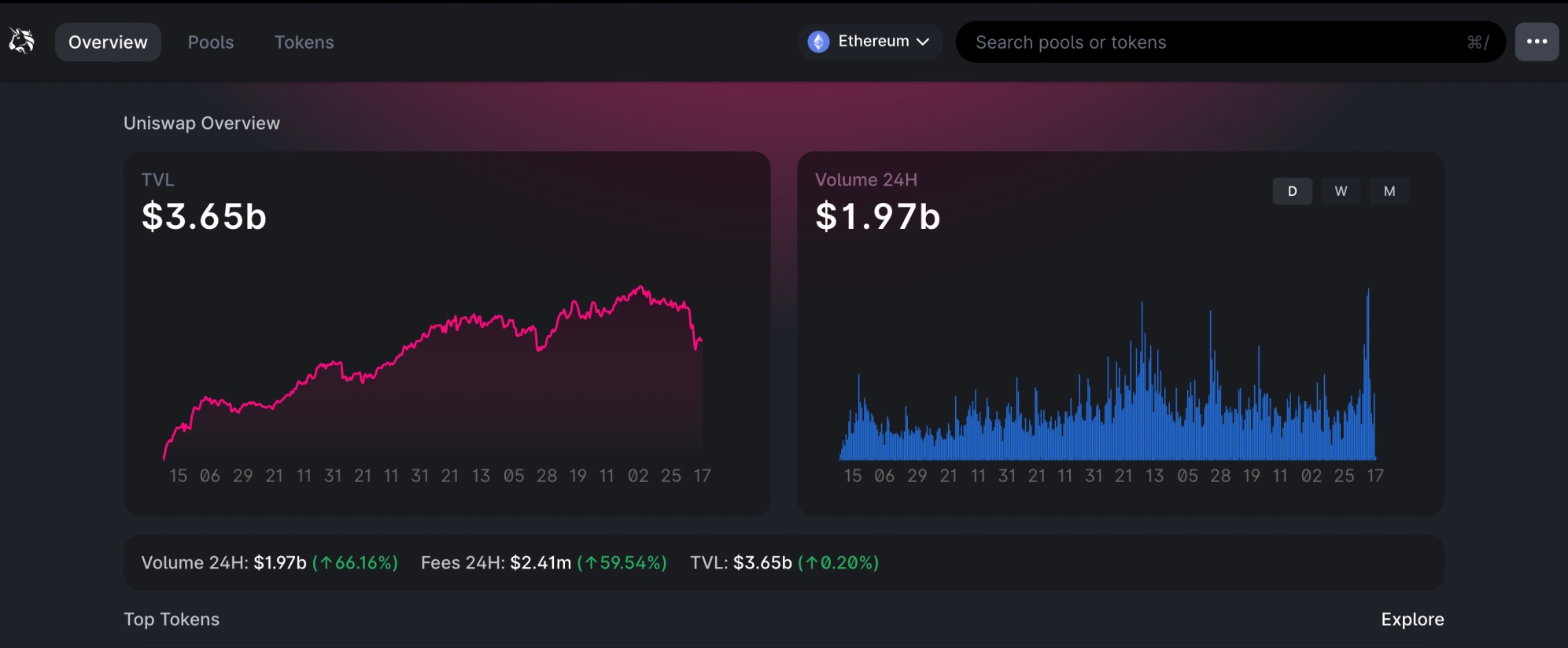

5. UniSwap – Leading DEX for Ethereum-Based Yield Farming Pools

UniSwap is perhaps the largest decentralized exchange in this space when it comes to trading volume. The platform specializes in tokens that operate on top of the Ethereum network.

As such, if you want to generate a yield on your idle ERC-20 tokens, Uniswap is worth considering. In addition to farming pools and swapping services, Uniswap also allows you to vote on governance decisions.

In order to participate in a vote, you simply need to hold the platform’s native digital token – UNI. The Uniswap DEX is relatively user-friendly and it supports Trust Wallet, MetaMask, WalletConnect, and more.

Pros

- Leading DEX for Ethereum-based pairs

- User-friendlyinterface

Cons

- Association with Ethereum blockchain means high trading fees (gas fees)

- Native token has performed poorly in comparison to other DeFi projects

DeFi Yield Farming Taxes

Taxation in the traditional cryptocurrency scene is now somewhat clear-cut. That is to say, if you buy a token and sell it at a profit, this will likely trigger capital gains tax in your jurisdiction.

However, there appears to be somewhat of a grey area when it comes to taxing DeFi yield farming gains. Moreover, the specifics will depend on your country of residence, tax band, annual income, and other core metrics.

Nonetheless, the general consensus is that any interest that you generate from DeFi farming tools will be subject to income tax. This is likely to be based on the income element alone.

- For example, let’s say that you deposit 1 ETH and 2,000 USDT into a farming pool.

- We’ll say that after three months of farming, you generate 10% interest on your holdings.

- This means that you will have generated 0.1 ETH and 200 USDT in interest – which in theory, would be liable for income tax.

You are, however, advised to speak with a qualified specialist when it comes to matters surrounding DeFi taxation.

Is DeFi Yield Farming Safe?

DeFi yield farming services give you the opportunity to earn significantly more interest than you will get with traditional financial providers. However, this also means that you will be taking on additional risk.

Before you proceed with a DeFi farming investment, be sure to consider the risks outlined below:

Impairment Loss Risk

To recap this refers to the opportunity cost that you will face if you make less from a yield farming pool than you would have done simply by holding the tokens in an exchange or wallet.

For example, if you make gains of $300 from yield farming but the respective tokens have increased by $500 during the same period, then your impairment loss amounts to $200.

Volatility and Price Risk

It goes without saying that unless you are farming a stablecoin, you will need to factor in the risks associated with volatile and market pricing. After all, crypto tokens will go up and down in value throughout the day.

This means that while your tokens are locked in a farming pool, their market value could decline. If this happens, there is every chance that you lose money.

- For example, let’s suppose that when you deposit BNB into a farming pool it is worth $500 per token.

- Over the course of three months, you generate 5% in interest.

- However, BNB has since declined by 20%.

- As such, although you have made 5% in interest, your overall BNB portfolio is now valued at a lower amount.

This is why you need to consider the reputation of the tokens that you are looking to farm. In other words, while large-cap tokens are less prone to huge volatility spikes, up-and-coming projects are a lot riskier.

Platform Risk

You also need to consider the risk associated with the DeFi platform itself. Crucially, in order to generate a yield, you will be required to deposit funds into the platform’s liquidity pool.

And in doing so, you need to trust that the platform is legitimate. If you end up depositing funds into a shady DeFi platform, you might never see your tokens again.

Smart Contract Risk

Smart contracts are billed as being immutable. This means that once the smart contract has executed your yield farming transaction, the underlying terms cannot be amended or manipulated.

However, we often hear about smart contracts that have poorly designed. If this is the case and somebody finds a flaw in the smart contract, they might be able to steal your tokens remotely.

Conclusion

In summary, yield farming DeFi platforms give you the opportunity to generate an attractive APY on your crypto holdings. After all, why leave your crypto tokens sitting idle in a private wallet when you can earn income on them?

If you’re looking to make your crypto investments work for you, consider getting started with DeFi Swap right now. Not only does this decentralized platform offer high-yield farming and staking tools, but you can instantly swap tokens at the click of a button.

Best of all, DeFi Swap requires no personal information from you. Instead, you can simply connect your wallet to the platform to start generating a yield on your tokens.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney