- Bitcoin’s dominance is slightly up over the last 24 hours.

- The majority of altcoins in the top 10 list have seen their prices drop.

- Traders may be losing interest in the crypto market leader.

Bitcoin’s dominance is slightly up over the last 24 hours according to CoinMarketCap. At press time, the market dominance of Bitcoin (BTC) has risen 0.20% — taking the market leader’s dominance to 39.71%.

This comes after the majority of the top 10 biggest cryptos all saw their prices drop over the last 24 hours. Currently, the largest altcoin by market cap, Ethereum (ETH), has seen its price drop 0.11% over the last 24 hours. As a result, the price of ETH now stands at $1,247.81.

Meanwhile, Binance Coin (BNB) and Ripple (XRP) experienced respective price drops of 0.27% and 3%. The prices of Dogecoin (DOGE) and Polygon (MATIC) are also down 3.58% and 2.82%. Cardano (ADA) is the only altcoin on the top 10 list that has posted a gain over the last 24 hours and is now 2.39% up to trade at $0.2722.

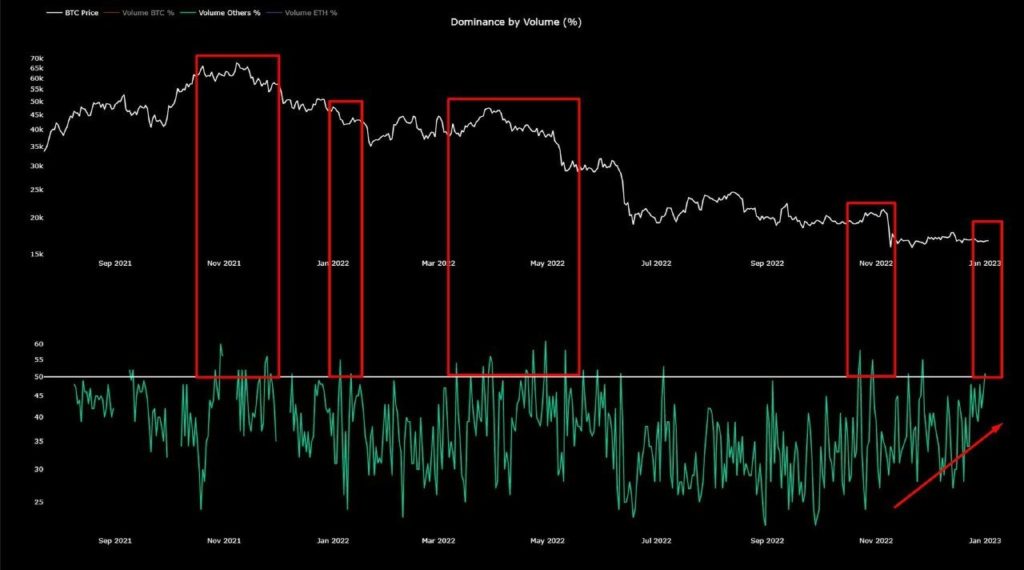

The market intelligence firm, Cryptoquant, posted a tweet today regarding the trading dominance of altcoins compared to that of Bitcoin (BTC). According to the tweet, altcoin trading dominance is above 50%. The analytics provider reached the conclusion that this statistic is “very concerning.”

Altcoin trading dominance (Source: Santiment)

Altcoin trading dominance (Source: Santiment)

The reason that Cryptoquant believes that this is concerning is that the historical crypto market trend for the last 6 years shows that the only way to have sustainable price movement in the market is to first have an upward move in BTC’s price. This price move by the market leader is then followed by price movements by Ethereum (ETH) and other altcoins.

With this not currently happening, traders are likely trading altcoins which are considered riskier. This, according to a Cryptoquant Quick Take, “makes them very fragile and easy to squeeze.”

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.