- The global crypto market has continued to rise over the last 24 hours.

- All of the altcoins in the top 10 cryptos list have printed weekly gains.

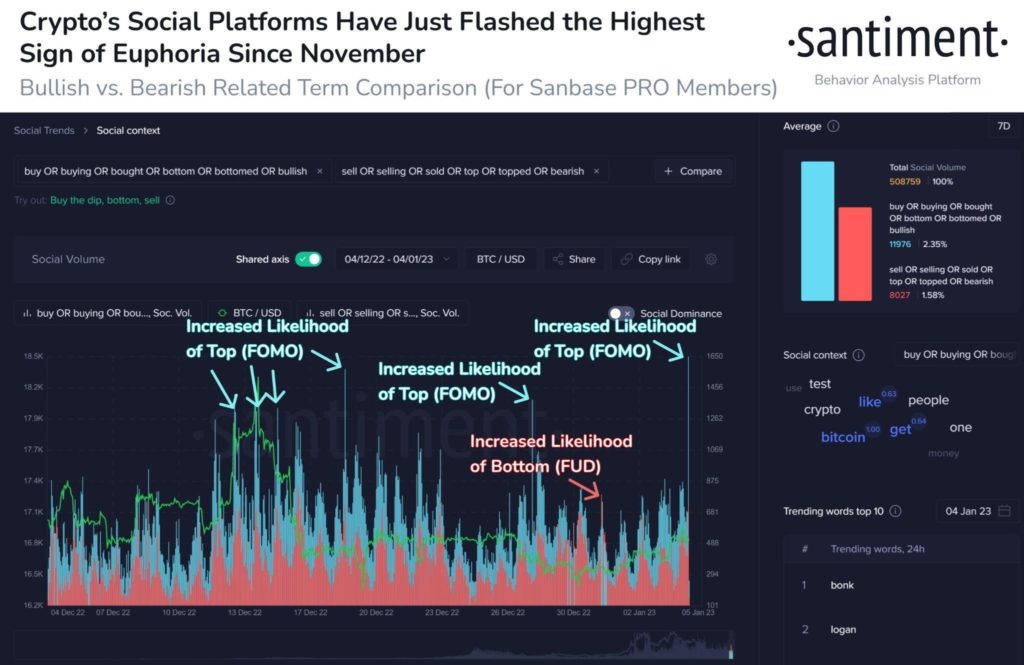

- Santiment tweeted a warning regarding the high levels of FOMO currently in the market.

The global crypto market cap has continued to rise over the last 24 hours according to CoinMarketCap. At press time, the global crypto market cap is up 0.35% — taking the total to $821.30 billion.

Altcoins have been in a mini-relief rally over the last week as the year gets into gear. Looking at just the altcoins in the top 10 cryptos on CoinMarketCap’s list, Ethereum (ETH), Dogecoin (DOGE), Binance Coin (BNB), Ripple (XRP), Cardano (ADA) and Polygon (MATIC) have all printed weekly gains.

Currently, the largest altcoin by market cap, ETH, is up 4.96% over the last 7 days. ETH’s price has also risen 0.52% over the last 24 hours. As a result, the price of the altcoin leader stands at $1,253.97 at press time.

Meanwhile, BNB and XRP are up 5.46% and 0.23% in the same time period, respectively. DOGE, ADA, and MATIC are up 5.23%, 9.34%, and 3.13%.

The mini altcoin rally may not be a sign of the overall trend in the crypto market changing just yet. Santiment, the blockchain analysis firm, tweeted this morning that this “modest crypto rally” has led to a spike in social media terms such as “buy, buying, bottom and bullish.”

Santiment’s tweet did, however, add that these positive terms are “signs of euphoria and FOMO,” and concluded by warning crypto investors and traders to tread carefully.

Crypto euphoria levels (Source: Santiment)

Crypto euphoria levels (Source: Santiment) The chart shared by Santiment in today’s tweet showed that the amount of Euphoria present on crypto’s social platforms has recently reached its highest levels since November of last year.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.