- Cardano has been facing a severe drop in its network activity.

- The transaction volume of the network is also too low.

- The volatile price action of ADA might have resulted in the drop in its network activity.

The public blockchain platform, Cardano, had been reportedly facing a severe drop in its network activity as well as in its transaction volume. The lowest level of transaction volume that hadn’t been seen since January 2022 might have resulted from the recent price action of ADA.

Over a year ago, Cardano had its all-time high price of $3.09. However, the coin is closer to its minimal price now since the winter started ruining the crypto industry in November 2021.

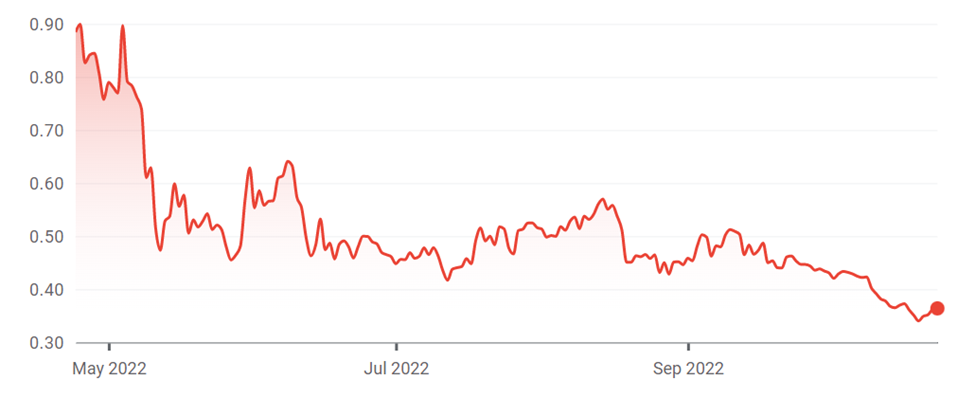

ADA Six Months’ Price

ADA Six Months’ Price

As Cardano remains one of the least profitable cryptocurrencies, the downtrend on Cardano is not that surprising for crypto traders. Still, the recent price action of ADA that began in October wasn’t expected by the crypto members.

It could be estimated that a major reason for the crash in the coin is the spike in its volatility. Since last year, there had been significant changes in the price of the Cardano coin, turning the investors highly strung, and causing the biggest volume spike since the middle of September.

Notably, the colossal plunge in transactional volume on the Cardano network could be a result of reluctant investors and the inactive ecosystem as a whole. As the highly volatile price action of the coin negatively affected the investors, they were hesitant to invest or to make transactions.

However, in the last four days, Cardano had been exhibiting a potential bounce by gaining 9% in value. Significantly, the currency’s bounce could be a positive signal that the bulls would still provide enough buying volume to retrieve the initial position of Cardano.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.