- Market update: BTC and ETH consolidate. Today’s biggest gainer and loser

- Ethereum staking speeds up, Ethereum Classic hashrate hits all-time high

- Australia will use “token mapping” as a framework to regulate crypto

- Ronin hackers convert stolen ETH funds into BTC using sanctioned mixers

- Charles Hoskinson apologizes to the operators of Cardano stake pools

Market Update: BTC and ETH Consolidate. Today’s Biggest Gainer and Loser

The crypto market’s strong performance in August abruptly ended last week after the United States Treasury Department released its FOMC minutes. However, cryptos, led by Bitcoin, are now looking to stabilize.

After falling from a high of $24k to as low as $20,800 over the weekend, the price of Bitcoin is now back above the $21k mark. Bitcoin now trades at $21,300, after peaking at an interday high of $21,668.

The 24-hour price chart for Bitcoin (BTC). Source: CoinMarketCap

Unlike Bitcoin, Ethereum attempted to reclaim the $1,600 level, peaking above $1,640. However, unsustained bullish pressure has seen ETH plunge by 3.6% today to fall to its current price of $1,570.

The 24-hour price chart for Ethereum (ETH). Source: CoinMarketCap

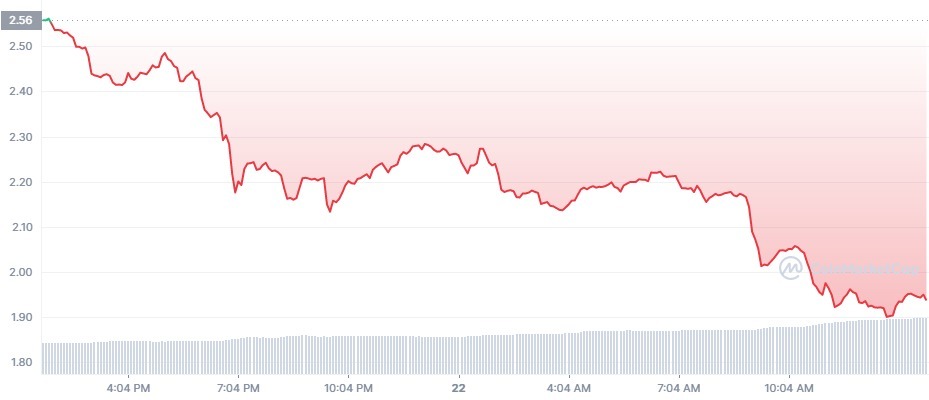

While the majority of the crypto market is bearish, the award for the biggest loser goes to Celsius (CEL). The price of CEL has plunged by 25% in the last 24 hours and 40.2% in the last 7 days to fall to a new low of $1.5.

The 24-hour price chart for Celsius (CEL). Source: CoinMarketCap

Flipsider:

- EOS is the biggest gainer over the last 24 hours, raking in gains of up to 10% to trade as high as $1.58 while the broader crypto market plunges.

- The gains, which make EOS today’s biggest gainer, are the continuation of a rally sparked by the rebrand of the project.

The 24-hour price chart for EOS (EOS). Source: CoinMarketCap

Ethereum Staking Speeds Up, Ethereum Classic Hashrate Hits All-Time High

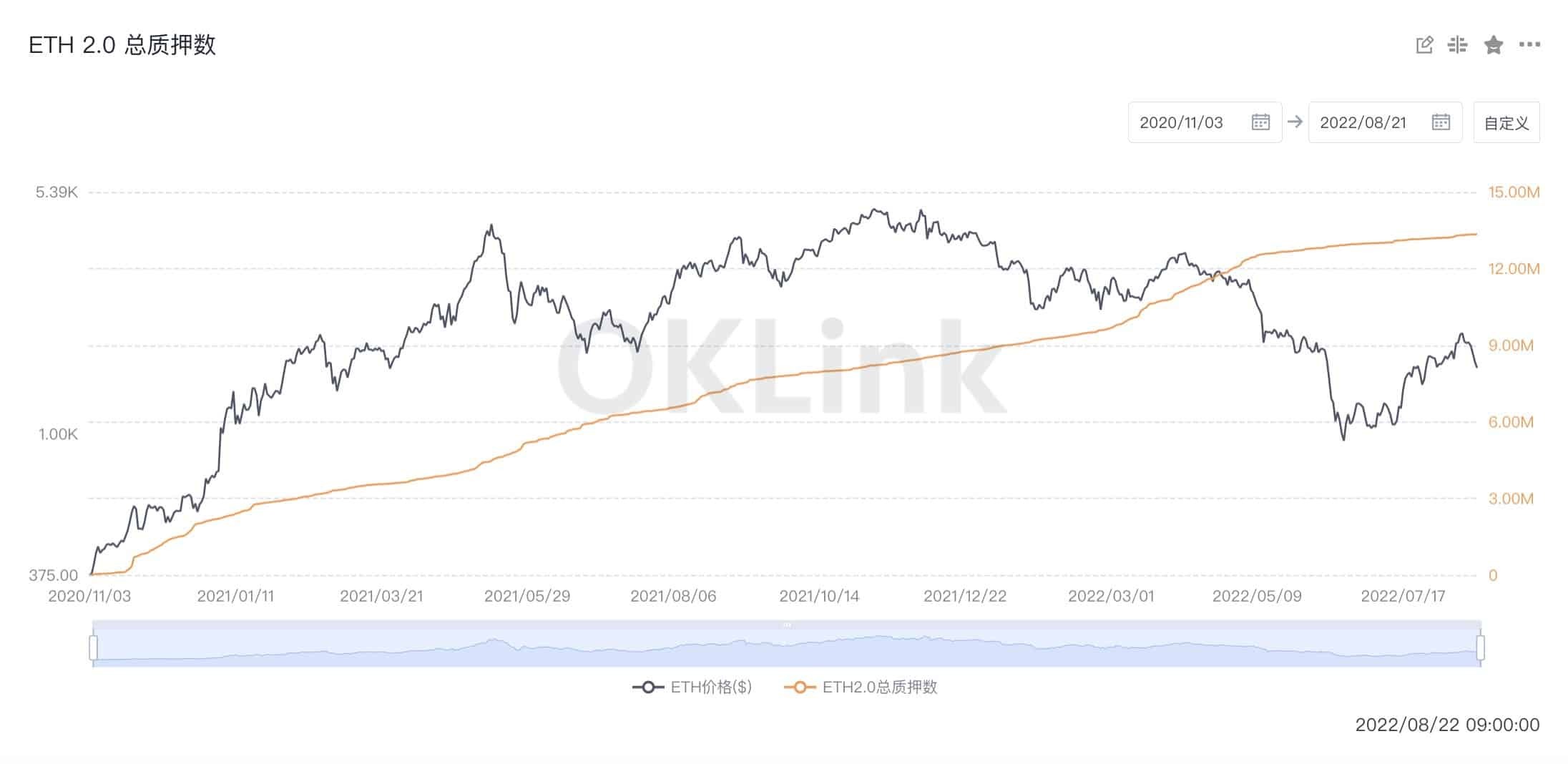

The plunging crypto prices have not stopped the staking of Ethereum (ETH) from accelerating. On-chain data shows that ETH 2.0 deposit contract addresses have surpassed 14,063,279 ETH.

Already more than 11.5% of ETH’s circulating supply has been staked. Further data show that about 36,000 ETHs have been added every week as investors anticipate the Ethereum mainnet merge scheduled for September 15.

While stakers are increasing the number of ETH staked on the ETH 2.0 deposit contract addresses, investors who favor proof-of-work (PoW) are migrating to Ethereum’s original framework, Ethereum Classic to continue mining.

The exodus of miners to Ethereum Classic caused the network’s hashrate to hit an all-time high of 38.37 terahash per second (TH/s) on August 20. The hashrate of Ethereum Classic now stands at 36.48 TH/S.

Flipsider:

- Despite the bullish sentiment for the mainnet merge, Ethereum’s on-chain activity has declined over the last three months as investors lose interest in DeFi and NFTs.

Why You Should Care

Analysts believe that Ethereum’s long-awaited “merge” will improve the network and drive bigger yields and draw in new investors.

Australia Will Use “Token Mapping” as a Framework to Regulate Cryptos

The Australian government announced on Monday that it is set to debut the world’s first token mapping of digital assets, from Dogecoin to Bitcoin. The move is the first step in the government’s efforts to regulate the country’s crypto ecosystem.

Token mapping will enable the government to determine the characteristics of all digital tokens available in the country and form a better regulatory approach. The tax office says over a million have interacted since 2018.

According to Treasurer Jim Chalmers, token mapping aims to “identify notable gaps in the regulatory framework, progress work on a licensing framework .. look at custody obligations for third-party custodians, and provide additional consumer safeguards.”

In addition to prioritizing crypto mapping this year, the government will also ensure users’ safety by reviewing the custody requirements for crypto custodians. Australia will also review the regulatory and licensing frameworks guiding crypto service providers.

Flipsider:

- Chalmers said that before “token mapping” is completed, the government will release a consultation paper with the sector about a regulatory framework.

Why You Should Care

The crypto-friendly approach of the Australian government has led to an increase in digital assets ownership in the country by over 56% between 2022 and 2021.

Ronin Hackers Convert Stolen ETH Funds into BTC Using Sanctioned Mixers

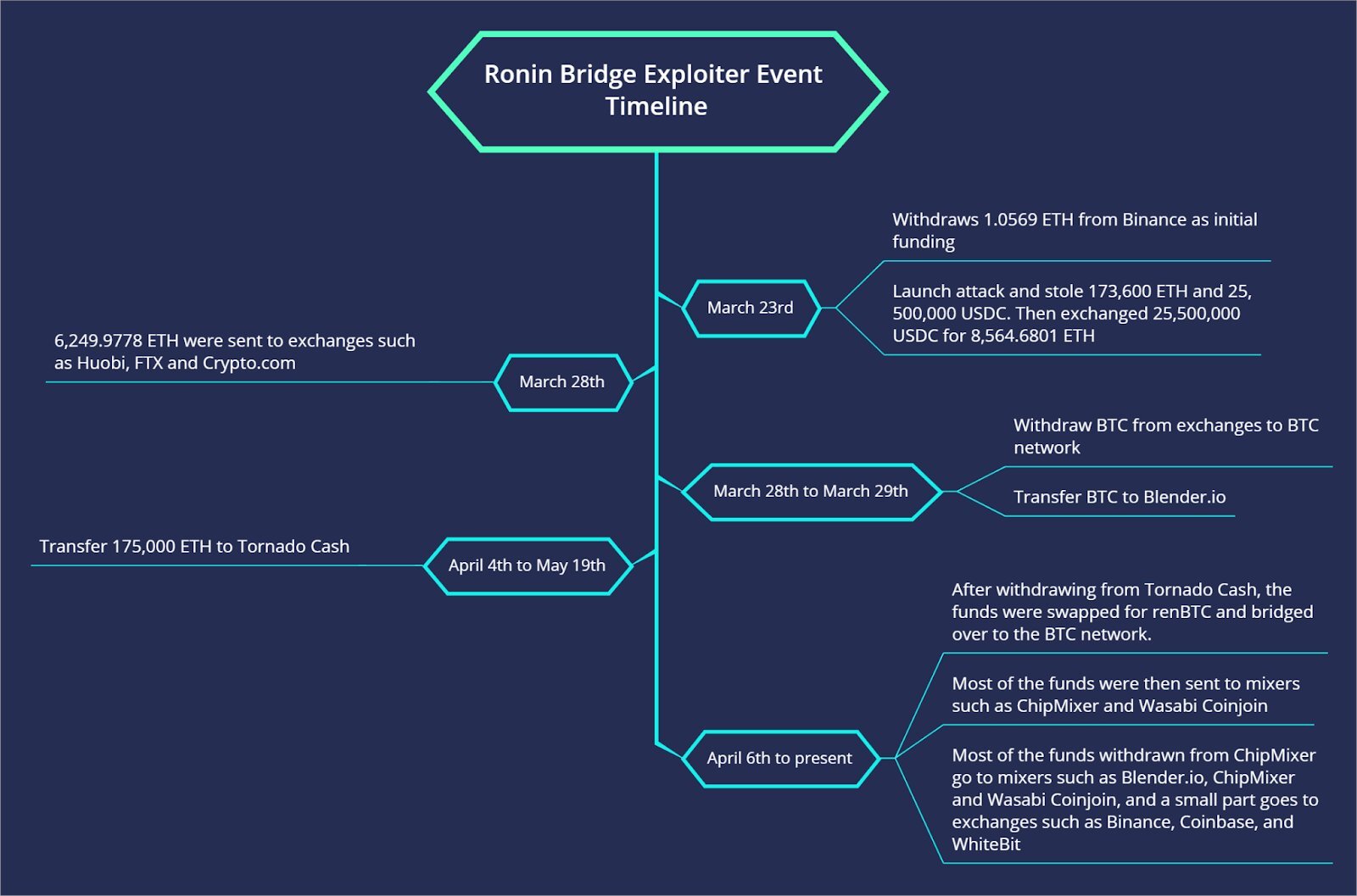

The hackers who stole $610 million worth of crypto from Axie Infinity’s Ronin bridge in March have since transferred most funds from ETH into BTC using renBTC. They also used privacy mixers to mask their identities.

SlowMist’s researcher, “₿litezero,” who has been tracking the stolen crypto since the attack, reported that the hackers have now moved all the funds to the Bitcoin network using some centralized crypto exchanges and privacy crypto mixers.

According to “₿litezero,” the hackers used the recently sanctioned Tornado Cash, in addition to Blender and ChipMixer, to hide their identities.

In addition, he reported that the hackers have transferred most of the funds stolen from the Ronin bridge attack to Tornado Cash. Currently, 6,250 ETH have been deposited on exchanges, including Huobi, FTX, and Crypto.com.

Flipsider:

- Three months after the hack, Axie Infinity relaunched the Ronin Bridge, promising better security features.

Why You Should Care

Although the theft has been attributed to North Korea, ₿litezero said he looks forward to putting in more time to “finding the money.”

Charles Hoskinson Apologizes to the Operators of Cardano Stake Pools

The founder of Cardano, Charles Hoskinson, has tendered an apology to the Cardano Stake Pool Community for his approach to refuting critics’ claims that the Cardano testnet was broken.

He described the stake pool operation (SPO) community as Cardano’s backbone while acknowledging the flaws in Cardano’s infrastructure. However, he adds that the coding issue found on that node version had been removed in the 1.35.3 update.

In reaction to reports from a top Cardano ecosystem developer that the testnet was “Catastrophically Broken,” the SPO earlier called out Hoskinson for rushing the hard fork launch. Hoskinson reacted by calling the claims bizarre.

Hoskinson’s approach to the claims sparked different reactions, which made him apologize over a tweet. According to him, for the past few years, the community has put in a lot of effort to balance the user experience with good security and fast delivery.

Flipsider:

- While addressing the testnet controversy during an Ask-Me-Anything on Friday, Hoskinson said that the anticipated Vasil hard fork will be deployed “imminently.”

Why You Should Care

Hoskinson, identifying the lack of governance on Cardano, said that the era after Vasil will include a more inclusive structure, new governance processes, faster development, and other positives.