- Bitcoin bounces back above $21k after $7.3 billion losses over the weekend.

- ProShares to launch first ETF allowing U.S. investors to bet against Bitcoin.

- Tether to undergo audit by top 12 accounting firm – 6.6 billion USDT burned.

- Cardano’s Vasil hard fork delayed – IOG announces new launch date.

- The U.K. goes back on plan to monitor unhosted digital wallets.

Bitcoin Bounces Back Above $21k After $7.3 Billion Losses Over the Weekend

Bitcoin was hit with an unexpected sell-off over the weekend, sending shockwaves through the entire crypto market. Investors took a major hit on June 18th, as the price of Bitcoin fell to an 18-month low of $17,700.

Data from blockchain analytics firm Glassnode reveals that Bitcoin hit its largest USD-denominated realized loss in Bitcoin history between June 16th and 19th. Across those three consecutive days, investors exited bitcoin positions worth a record $7.3 billion.

The intense sell-off, which drove the price of Bitcoin as low as $17,000, is beginning to ease, giving Bitcoin room for recovery. Just three days after sinking to long unseen lows, Bitcoin has bounced back, reclaiming the $21k level.

The 3 day price chart for Bitcoin (BTC). Source: CoinMarketCap

As of this writing, Bitcoin trades at $21,070 after setting an interday high of $21,387.65, marking a 25% increase from its June 18th low.

The 24 hour price chart for Bitcoin (BTC). Source: CoinMarketCap

Flipsider:

- Despite Bitcoin gaining some ground after a tumultuous week, former BitMEX CEO Arthur Hayes believes that BTC will experience more losses, and asserts that the correction is not yet over.

ProShares to Launch first ETF Allowing U.S. Investors to Bet Against Bitcoin

ProShares, the firm behind the first Bitcoin exchange-traded fund (ETF) launched in the U.S, has announced the launch of a new type of ETF that would allow investors to bet against Bitcoin.

The ProShares ‘Short Bitcoin Strategy’ (BITI), which opens for trade on the New York Stock Exchange on June 21st, will allow investors to bet against Bitcoin. This means investors could potentially stand to profit from the continued sell-off of Bitcoin.

As the first of its kind, the BITI option gives investors an extra option to either profit from the downtrend, or hedge their cryptocurrency holdings. This could make BITI a favorite for permabears who strongly believe that Bitcoin will hit zero.

ProShares’ move comes amidst a six-month-long bloodbath that has wiped nearly 70% of Bitcoins value. However, ProShares CEO Michael Sapir asserts that the move will help investors earn regardless of the direction of the Bitcoin Market.

Flipsider:

- BITI stands in sharp contrast to the earlier launched ETF, BITO, which came at a time when investors only saw the price of Bitcoin heading north.

Why You Should Care

ProShares’ BITI is the first of its kind in the U.S. market, and be the catalyst for alternative investment groups to consider the creation of short Bitcoin ETFs.

Tether to Undergo Audit by Top 12 Accounting Firm – 6.6 Billion USDT Burned

Since the crash of Terra USD (UST), many stablecoin operations have been called into question. With Tether receiving the scorn of critics, the issuer of the USDT has turned to auditing the project in a transparent manner.

Paolo Ardoino, the CTO of Tether, said in an interview that the company is preparing to conduct a thorough audit through MHA, one of the world’s top 12 accounting firms. Going forward, MHA will attest to Tether’s assets every quarter.

Providing more insight into the USDT reserves, Ardoino claims that Tether (USDT) is mostly backed by fiat, and only consists of a small proportion of digital assets. On-chain data reveals that Tether has burned 6.6 billion USDT (amounting to $6.6 billion in the last 24 hours).

First reported by Whale Alert, the burn represents the largest the stablecoin issuer has destroyed in a single action. Over the last seven days, as per data from CoinMarketCap, Tether’s market cap has dropped from $71.52 billion, to $67.43 billion.

The 7 day market cap chart for Tether (USDT). Source: CoinMarketCap

Flipsider:

- The market cap of Circle’s USDC has been steadily rising, as the asset seems more stable than USDT, which depegged as a result of the latest market crash.

Why You Should Care

Tether providing much-needed transparency into its reserves could quell the fears surrounding the USDT stablecoin.

Cardano’s Vasil Hard Fork Delayed – IOG Announces New Launch Date

The Cardano community will need to wait longer than expected for the Vasil hard fork as Input-Output Global (IOG) announced that the much-anticipated network upgrade will not be shipped to live until next month.

In announcing the postponement, the IOG revealed that there were seven bugs in the Vasil hard fork, although none of them were severe. The time extension will “allow more time for testing” and for the appropriate bug fixes.

According to Nigel Hemsley, IOG’s head of delivery and products, the time will give the development team ample opportunity to make sure that everything works at capacity when Vasil goes live.

The team will also be able to give paramount importance to the quality and security of the network. The Vasil hardfork, which was initially slated to launch on June 29th, is now expected to launch on the Cardano mainnet by the last week of July.

Flipsider:

- Despite news of the delay, Cardano (ADA) managed to break through the $0.5 level, and now trades at $0.5063 at press time.

The 24 hour price chart for Cardano (ADA). Source: CoinMarketCap

Why You Should Care

The Vasil hardfork is Cardano’s biggest upgrade, and with the stakes higher than ever, IOG is determined to ensure that the deployment of Vasil is done right.

The U.K. Goes Back on Plans to Monitor Unhosted Digital Wallets

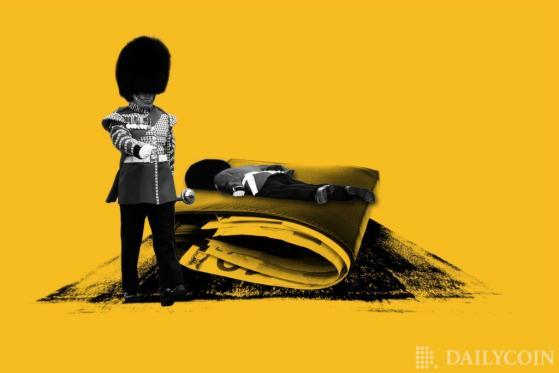

The government of the United Kingdom has decided against enforcing the controversial proposal that would have required senders of funds to collect the personal information of recipients for every transaction made, as explined in a document released by Her Majesty’s Treasury on June 20th.

The decision of HM Treasury was based on feedback it received from the publishing of its consultation document. The Treasury reasoned that the implementation of a data collection rule for unhosted and confidential wallets could be seen as unreasonable.

The Treasury had originally proposed to include crypto transfers in the standards outlined by the Financial Action Task Force (FATF), meaning that crypto firms would be required to identify both the originator and recipient of any transferred funds.

According to the document, “rather than requiring the collection of beneficiary and originator information for all unhosted wallet transfers, crypto-asset businesses will only be required to gather this information for transactions identified as posing a high risk of illicit finance.”

Flipsider:

- The UK’s stance differs to that of the EU, which elected to outlaw transfers to anonymous wallets in March.

Why You Should Care

The recommendations made in the Treasury’s report will be implemented in September 2022, following parliamentary approval.