Looking to buy Curve? You are not alone. With over 150,000 followers on top broker eToro, Curve (CRV) is a popular DeFi crypto. And, as a challenger to traditional finance, the $120bn Decentralised Finance (DeFi) sector is a hot investment area. Curve, which plays a part in what is known as liquidity farming, is right in the thick of the action.

Anybody can buy Curve as purely an investment asset (no DeFi experience required!). Below we explore how to invest in Curve, with brief reviews of four top crypto vendors. If you are looking for the lowest fees and the highest levels of safety, find out more below.

How to Buy Curve – Quick Guide

Looking for the best crypto to invest in 2022? You can buy Curve safely and quickly by signing up with top broker eToro:

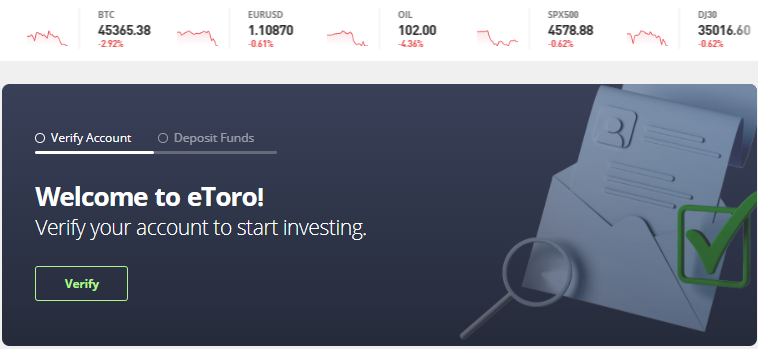

- ✅Step 1: Open an account with eToro – First you need to get registered. Fill in some basic personal information on the eToro sign-up page or use your Google/Facebook account.

- 🔑Step 2: Verify – As a regulated broker, eToro must verify your identity. Have your valid passport or ID card handy, as well as proof of address.

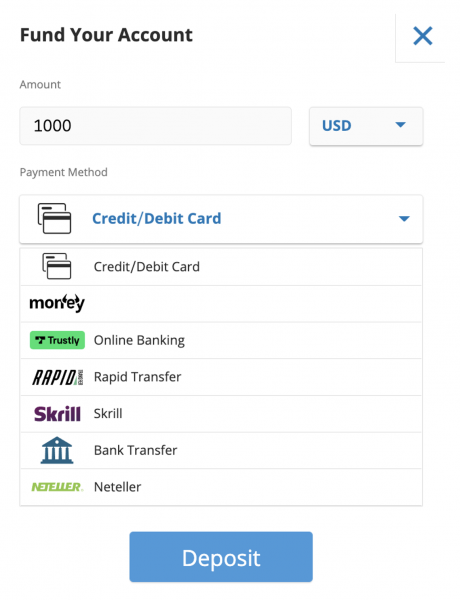

- 💳 Step 3: Deposit – You can deposit as little as $10 with eToro if you are from the US. US clients pay no deposit fees. Choose from bank transfer, e-wallet or credit/debit card deposit.

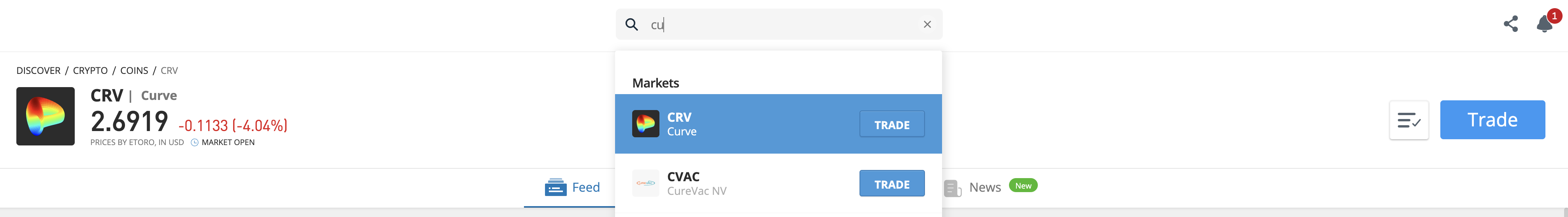

- 🔎 Step 4: Search for Curve – Enter ‘Curve’ or ‘CRV’ in eToro’s top toolbar. You can review the Curve homepage on eToro, or head straight to your buying options.

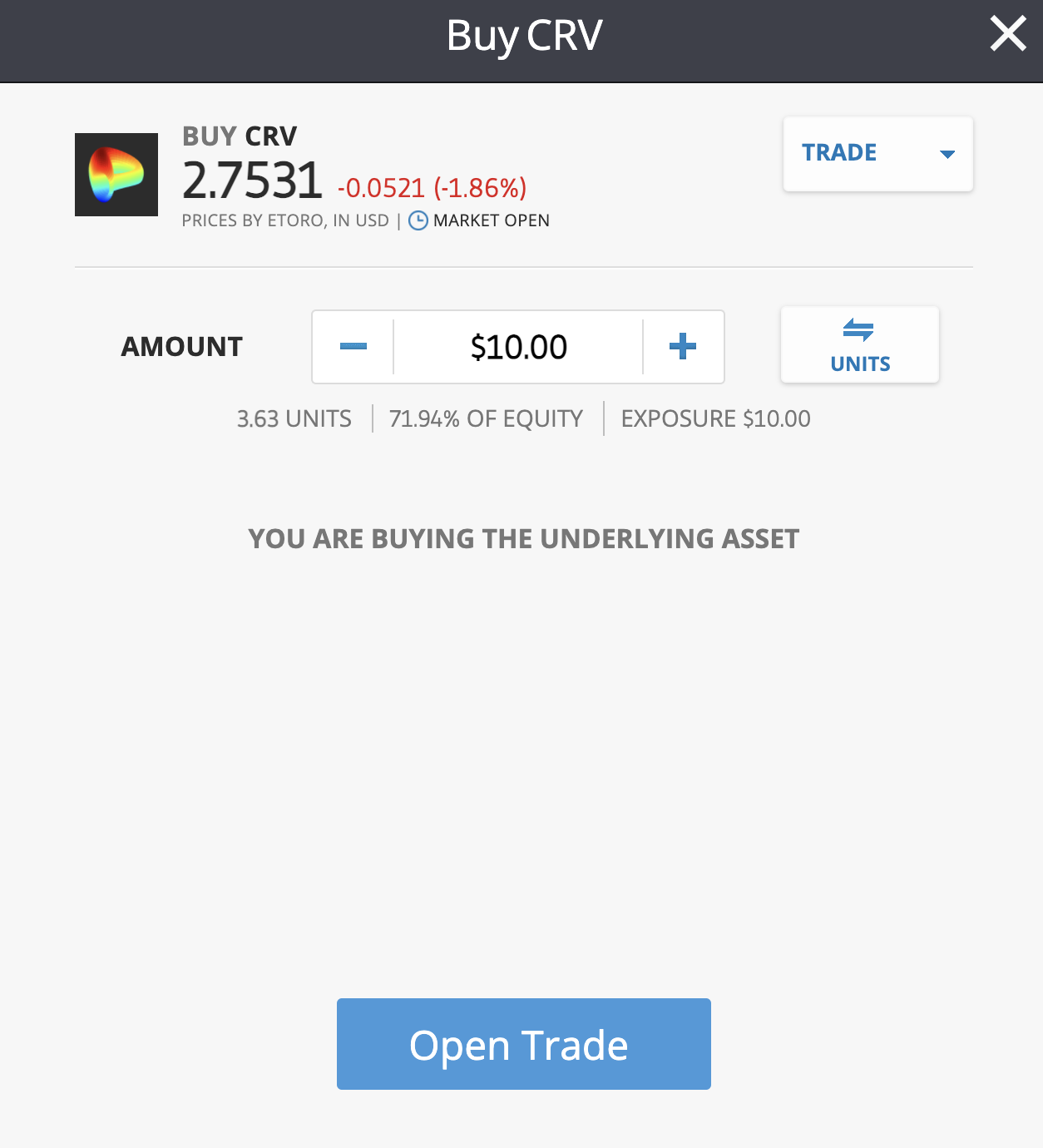

- 🛒 Step 5: Buy – Invest in Curve with as little as $10. eToro will hold your crypto until you want to sell.

Cryptoassets are a highly volatile unregulated investment product.

Where to Buy Curve

First you need to decide what your priorities are. How to buy Curve tokens in a way that suits you depends on your level of experience.

Are you looking to explore powerful trading and crypto financing options? If so, we recommend checking out one of the top crypto exchanges: Crypto.com, Coinbase and Binance.

If you are a beginner — or want to balance your crypto investment with stocks and ETFs — we suggest you begin with top global broker eToro.

1. eToro – Best Broker to Buy Curve with Low Fees

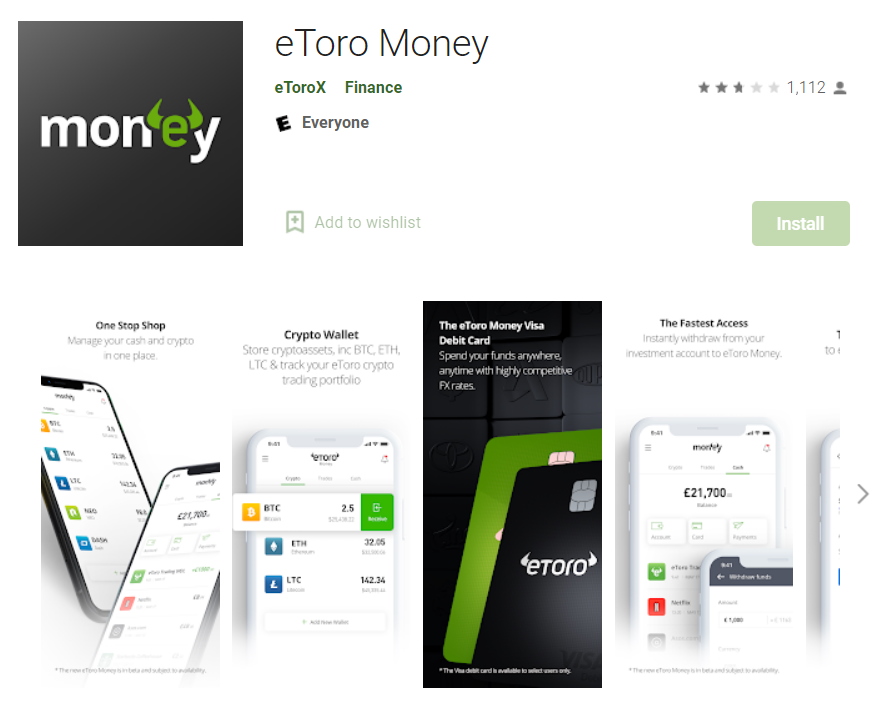

Founded in 2006, broker eToro has attracted 23m investors. Boasting a super-slick interface and low fees, this broker puts a lot of emphasis on making crypto easy. What’s more, alongside its crypto, eToro has a selection of 500 conventional stocks, 250 ETFs, indices and commodities to invest in.

eToro has stood the test of time because it is powerfully regulated. Regulation means that investors can be assured that they are dealing with a business that does things by the book. In the US, eToro is regulated by FinCEN and registered with FINRA. The broker is also regulated in the UK (by the FCA), Europe (CySEC) and Australia (ASIC).

US investors will appreciate the fact that eToro runs all its accounts in US dollars. You can deposit as little as $10 using bank transfer, e-wallets and credit/debit card. There are no deposit fees and — for US investors — no currency conversion fees.

You can buy CRV with eToro, as well as browse a top-quality selection of 127+ crypto. The major blockchains are all represented (Bitcoin, Ethereum, Solana, Cardano, Ripple, Tron and more). Metaverse coins like MANA feature, meme coins like Dogecoin and Shiba Inu and, of course, a wide range of DeFi coins including Curve, Aave, Algorand, Uniswap and Maker. eToro is no slouch when it comes to keeping up with the fast-moving crypto sector: new coins are generally released for sale every few months, with NFT coin APE being the latest hot property.

With so many crypto available, the crypto newbie can get overwhelmed. But not with eToro and its pioneering social trading. Social trading means supporting the crypto newcomer.

With eToro’s CopyTrader, beginners and experts alike can copy other traders’ activity for free! And with eToro’s crypto Smart Portfolios, you can buy into a pre-made strategic crypto position without having to figure it all out yourself.

Pros

- Buy CRV at low commission (1% on purchase, 1% on sale)

- Free eToro Money crypto wallet & eToro smartphone app

- 127 crypto, 500+ stocks & 250 ETFs to choose from

- 23m verified users

- Global financial regulation

- Social trading: Smart Portfolios and CopyTrader

Cons

- $5 flat withdrawal fee

- No crypto financing options like crypto staking/crypto loans

- No phone help (but, to be fair, the ticketing system works just fine)

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Modern Crypto Exchange with Beginner-Friendly Mobile App

Unlike broker eToro, Crypto.com is a crypto exchange. Whereas eToro has 23m customers, Crypto.com has 10m. The exchange handles a hefty $3bn of crypto business every day and offers a heap of options suitable for beginners and experts alike.

With Crypto.com, you can buy Curve in three ways. The standard way is to get verified, deposit funds and buy TRX. Or, if you already own some stablecoin crypto, you can deposit them with Crypto.com and use them to trade on the Crypto.com exchange. The third option is to buy CRV direct with credit card (which comes with a 2.99% fee after your first month of trading).

Crypto.com boasts a growing selection of 250+ crypto, so you will not be stuck for choice when it comes to investing in crypto. Where the exchange comes into its own, though, is in crypto financing. Crypto financing is where you use crypto you own to earn interest and rewards:

- Stake crypto for up to 14.5% interest

- Use a Crypto.com Visa Card to spend your crypto in the real-world, as well as earn every time you spend.

- Secure a crypto loan using your own crypto as collateral: just 8% p.a. interest charged.

Pros

- Sign-up & referral bonus

- Instantly buy CRV with credit/debit card

- 100% of client crypto held in cold storage

- Trade over 250 crypto

- Free crypto wallet app

- Accessible crypto financing options

Cons

- 2.99% credit card fee

- Not transparent about fees in general

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Popular and Reputable US Cryptocurrency Exchange

Coinbase is the second-biggest crypto exchange in the world with over 20m users. US investors will be glad to hear that Coinbase is based in San Francisco, California, giving the operation a friendly US feel. You may have heard of Coinbase already, as it was the first crypto exchange to join the NASDAQ stock exchange (in 2021). If you want to back Coinbase stock, head over to eToro and search under the ticker COIN.

Coinbase offers Curve (CRV) as well as almost 170 other crypto. The exchange is phasing out credit card purchases over regulatory concerns, but you can buy crypto simply by getting verified and depositing funds in your account just as you would with broker eToro.

Coinbase does not offer the powerful social tradings of eToro. But generally it is welcoming to the beginner. You can earn free crypto by simply completing online learning modules. And in pride of place is a giant register of all crypto on the market, which beginners can browse to get a feel for the sector. Some crypto financing options are also available, but they are not as wide-ranging as those offered by fellow exchanges Crypto.com and Binance.

Pros

- 98% of client crypto held in cold storage

- Joining bonus with referral link

- Range of 169+ crypto to trade

- Free Coinbase crypto wallet

- Free crypto trading app

- Free crypto incentives

- Regulated in all US states where it operates

Cons

- Dual fee structure – can be confusing

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Giant Exchange to Buy Curve

As the biggest exchange in the world, Binance is the place to come if you really want to explore the outer limits of investing in Curve. Binance has over 90m registered users and lists over 600 crypto.

Binance offers a giant range of trading tools and crypto financing options. The sheer scope of possibilities can be overwhelming for the beginner. So our first tip would be to ensure that you choose the ‘classic’ view on the desktop app, and ‘Binance Lite’ on the smartphone app. This will keep things simple.

How to buy Curve token with Binance? You are spoilt for choice. You can deposit USD in your account and buy direct from Binance. You can convert from crypto you already own. You can engage in P2P trading and buy crypto from fellow users. You can go on the exchange and trade Curve in pairs for other crypto. You can also buy Curve direct with credit card (which you can no longer do with Coinbase generally).

Binance is hot on security. Two-factor-authentication is mandatory. Binance also runs an in-house insurance fund. Crypto financing options — like staking, crypto loans and interest accounts — are plentiful. As with Crypto.com and Coinbase, you can apply for a credit card too.

Pros

- Sign-up bonus

- Buy Curve instantly with credit card

- 600+ crypto to choose from

- Free crypto wallet

- Great financing options

Cons

- Unregulated by financial authorities

- Takes a while to get tuned into the possibilities

Cryptoassets are a highly volatile unregulated investment product.

What is Curve?

CRV is the governance token for the Curve.fi liquidity exchange. You can buy CRV and stake it with Curve to have a say in the running of the exchange. Or you can do what most investors do and buy CRV simply as a speculative asset. With a broker like eToro or an exchange like Crypto.com, Coinbase or Binance, you can buy CRV and it will be held for you until you want to sell.

CRV is an ERC-20 token. This means that it is based on the Ethereum network. It has a market capitalisation of $1.2bn, with roughly $250m CRV traded every day on crypto exchanges.

Is Curve a Good Investment?

CRV offers five positives when it comes to investing in this new cryptocurrency. As with all investments you need to conduct enough research so that you’re making an informed decision.

1. CRV is Linked to Legitimate Crypto Business

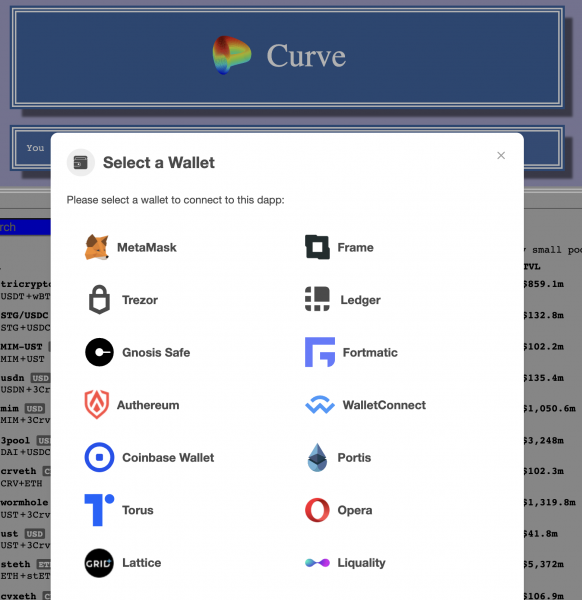

As the governance token for the Curve.fi exchange, CRV is part of an established DeFi sector. Curve.fi is the biggest Decentralised Exchange (DEX) based on Ethereum. It centres on liquidity pools. Liquidity pools and are used widely in the crypto world as part of borrowing and lending systems as well as gaming sites. These are basically pools of different crypto where users can earn yield on the crypto they put in.

Users go to liquidity pools, link up their crypto wallet, deposit funds and get trading (this is a risky business, and not recommended for beginners).

2. DeFi is a Booming Sector

Curve is an established part of the DeFi (Decentralised Finance) sector. All crypto investors face a choice of where to invest, and DeFI is a sound option:

- Do you invest in a meme coin like Dogecoin or Shiba Inu? It might rocket in price. But meme coins are fun investments. Their price goes up and down because of sentiment and nothing else.

- Do you invest in a metaverse coin like the SAND used in metaverse Sandbox or the AXIS coin used with the popular Axie Infinity blockchain game? Ever since Facebook said last year that it was getting involved in the metaverse, metaverse coins have been popular.

- Or do you invest in DeFi? DeFi coins like Curve are part of working financial systems. There is real substance here: $200bn is locked into DeFi projects currently. But note that Curve has competitors in the field of liquidity pools like Uniswap and Sushiswap (both available on eToro).

3. Buy The Dip?

The crypto sector is emerging from a period of price slump going back to Q4 2021. The price of Curve is currently less than half its all-time-high and, since the beginning of March 2022, it has begun to rise steadily. Although the future behaviour of the price is impossible to predict accurately, it does seem like Curve has found a resistance platform. CRV was priced over $6 per token only three months ago, and now it is priced at less than $3.

4. Buy into DAOs

Founded by a Russian scientist called Michael Egorov, Curve.Fi is now a Decentralised Autonomous Organisation (DAO). This means that there is no central authority; decisions are taken by the community. DAOs are considered to be a central part of Web 3.0 and the way forward for people organising themselves on the internet so everybody benefits. Curve.Fi is positioned exactly on this curve!

5. Sound Tokenomics

Unlike some crypto (like Dogecoin for example), the circulating supply of CRV is capped (at just over 3bn coins). Just 14% of CRV tokens are currently in circulation. This capped supply means that the price of CRV will not fall in future due to over-supply — as happens with fiat currency when governments print more banknotes and inflation reduces the currency buying power.

Curve Price

The Curve price is currently $2.74. That means you can buy one CRV token for $2.74, and a hundred US dollars will currently buy you over 36 CRV tokens.

- The Curve price took an immediate tumble after its August 2020 launch. It fell from almost $7 to less than $1 by November 2020. This behaviour is not unusual for a newly-released crypto. But investors will be kicking themselves that they did not take advantage of that immediate price dip and buy in.

- 2021 saw the Curve price rising sharply to hit over $4 by the end of April.

- The price then found a stable platform of resistance just under $1.5, and began a steady rise until November 2021.

- Between November 2021 and January 2021, the price of Curve doubled from under $3 to over $6.

- Since January 2022, the price fell (in line with the rest of the crypto sector and Ethereum in particular) to hit a crunch point at $2.

- Since the first week of March, the CRV price has risen by over 40%, from under $2 to $2.74 today.

Curve Price Prediction

Reviewing the CRV price chart above, we can see that the price has not been under a dollar since 2020 (two years ago). It is unlikely to be that low again, having found, in the meantime, support around above $1 — hitting lows of $1.32 on May 23rd 2021 and $1.28 on July 20th 2021.

Technical charting does not give us many clues with this particular crypto. But what we do know about CRV is that its fundamentals are good:

- Top crypto sector? Yes: the DeFi sector.

- Top player in that sector? Yes: Curve.fi is the biggest Ethereum-based DEX.

- Offers customers a competitive deal? Yes: the Curve algorithm, designed by Russian scientist Michael Egorov, has proven itself to minimise slippage and impermanent loss in liquidity pools and act as an efficient automated market maker.

- Good backing as an investment asset? Yes: CRV is followed by 150,000+ investors on eToro and roughly a quarter of a billion USD worth of Curve is traded every day.

Based on its centrality to a growing sub-sector of crypto, a reasonable Curve price prediction would posit a target price of $4 for the end of 2022, and perhaps a target price of $6 for 2023.

Put it this way: if the bottom falls out of the crypto sector, it will not be the DeFi coins like CRV that fall hardest. And that is because (unlike meme coins and speculative metaverse coins) they are already involved in real, money-making ventures.

Ways of Buying Curve

The crypto sector is currently going through a sea-change in ways to pay. Regulation by US authorities mean that payment via credit card – despite its convenience – is falling from favour over fraud fears, and PayPal too is becoming less common.

Buy Curve with PayPal

Coinbase is the best place to use PayPal. US investors can link their PayPal account to their Coinbase account and use it to deposit and withdraw funds.

(After PayPal began to offer its own crypto buying options, it is no longer supported by eToro.)

Buy Curve with Credit Card or Debit Card

To buy CRV with credit card instantly, your best bet is to use on the exchanges Crypto.com or Binance. But watch out for fees! Neither exchange is crystal clear over what fees apply. If you want to use your credit card to credit your crypto account for free, we suggest you sign up with eToro.

Best Curve Wallet

As an ERC-20 token, Curve is based on the popular Ethereum network. Most of the best crypto wallets permit ERC-20 tokens.

We recommend the eToro Money crypto wallet for general crypto use. Not only can you use eToro’s wallet to send and receive crypto around the web, but it offers a rare level of reassurance in the form of regulation by the Gibraltar Financial Services Commission.

The eToro Money crypto wallet is what is called a ‘hot’ ‘custodial’ wallet. Just to get you up to speed on the jargon here:

- A ‘hot’ wallet is always connected to the internet. This makes it faster and easier to use than a ‘cold’ wallet. ‘Cold’ wallets are generally not connected to the internet apart from when transacting; this makes them safer, but more cumbersome to use.

- A ‘custodial’ wallet means that an authority oversees your wallet. With a regulated overseer (like broker eToro), this is no cause for concern from a security point of view and offers the advantage that, if you lose your private keys to your wallet, you will not lose your funds forever. ‘Non-custodial’ wallets are run solely by their owner: lose your private key or seed phrase, and you are toast!

How to Buy Curve – Tutorial

When it comes to where to buy Curve, you must choose between using a crypto exchange or a broker. Exchanges tend to offer a broader range of crypto, but are generally less well-regulated than brokers.

To keep things as safe as possible, we suggest you take advantage of regulated broker eToro’s minimum deposit of just $10 and see how you go.

With eToro, follow just 5 simple steps to buy Curve:

1. Sign up with eToro

Go to eToro.com. Fill out the simple form onscreen. Be sure to tick the boxes acknowledging that you have read the legal information. Press ‘Create Account’ to move on. To get started even faster, you can sign in via your Facebook or Google account.

2. Verify your ID with eToro

All regulated crypto vendors must check the identity of their investors. These KYC (Know Your Customer) procedures are a pain, but ultimately KYC aims to keep everybody safe from fraud. You will need to have proof of ID (passport/ID card) as well as proof of address (utility bill) handy.

3. Deposit Funds to Buy Curve

Once you are verified with eToro, you can deposit funds. Depositing with USD is easy. Find the blue ‘Deposit Funds’ button at the bottom left of your screen and press it. Then fill out in the box that shows up i) how much you want to deposit and ii) which means of deposit you want to use. Note that no deposit fees apply currently with eToro. But, if you are depositing in any of the 14 currencies permitted other than USD, a currency conversion fee does apply.

4. Buy Curve with eToro in Seconds

Find Curve on eToro. To do this, simply enter ‘Curve’ in the top toolbar:

Click on the colourful CRV logo to access the Curve homepage on eToro. Here you can get to grips with stats and charting options, as well as pick up on news and views on Curve from fellow eToro investors.

To proceed to your trading options, press the blue ‘Trade’ button at the top right.

As you can see from the image above, when it comes down to it, there is nothing complicating about buying crypto at all. Simply enter how much you want to spend and click the ‘Open Trade’ button.

With eToro, your trade will generally go through immediately. You will receive confirmation onscreen. You can then review your newly-purchased CRV in your eToro portfolio.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell Curve

Crypto newbies often quite rightly wonder how they will sell their crypto to make a profit. The good news is that you do not need to go trawling around the internet in search of a buyer. When it is time to take some profits on your crypto purchase, you can sell your crypto back to your broker (eToro) or exchange (Crypto.com, Coinbase, Binance).

Conclusion

As the biggest Ethereum-based Decentralised Exchange, Curve.fi is a central player in the DeFi sector. We are therefore not surprised that you may want to invest in its governance token CRV.

In exploring how to buy CRV, we have reviewed a number of online vendors and presented our top picks above: broker eToro, as well as exchanges Crypto.com, Coinbase and Binance.

More adventurous crypto traders might check out the trading and financing options offered by the exchanges. But none match broker eToro for depth of regulation and ease of use. And when it comes to supporting the newcomer, none come close to eToro with its pioneering Social Trading. You can invest in Curve with as little as $10 with eToro.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney