Looking to buy DocuSign stock? The future looked bright for DOCU shares during the Pandemic. With so many people forced to work from home, clients flocked to DocuSign’s pioneering e-signature technology that allows documents to be signed over the internet.

What’s more, we outline how to invest in DocuSign stock without paying commission. We review two regulated brokers with reputations for low non-trading fees.

How to Buy DocuSign Stock in 2022

- ✅Step 1: Open an account with a regulated broker – Get signed up with your preferred stock trading platform. Supply some simple personal details and set a username and password.

- 🔑Step 2: Verification – Supply some ID. Trustworthy brokers must ask for ID to follow KYC (Know Your Customer) regulations.

- 💳 Step 3: Deposit funds – Investors can deposit using credit/debit card, bank transfer or with a range of e-wallets.

- 🔎 Step 4: Search for DocuSign Stock – Investors can pinpoint the financial asset they are looking for instantly by entering its name or stock ticker (DOCU) in the search toolbar.

- 🛒 Step 5: Buy & Research DocuSign Stock – Users can invest in DocuSign after conducting thorough market research.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Ever wondered where to buy stocks? Investors researching where to buy DocuSign stock typically search for online brokers which offer:

- Regulation by sovereign authorities.

- No commission on stock transactions.

- Low spreads.

Other key factors for choosing a broker include: security, payment methods, range of assets, level of customer help and extra features.

1: eToro

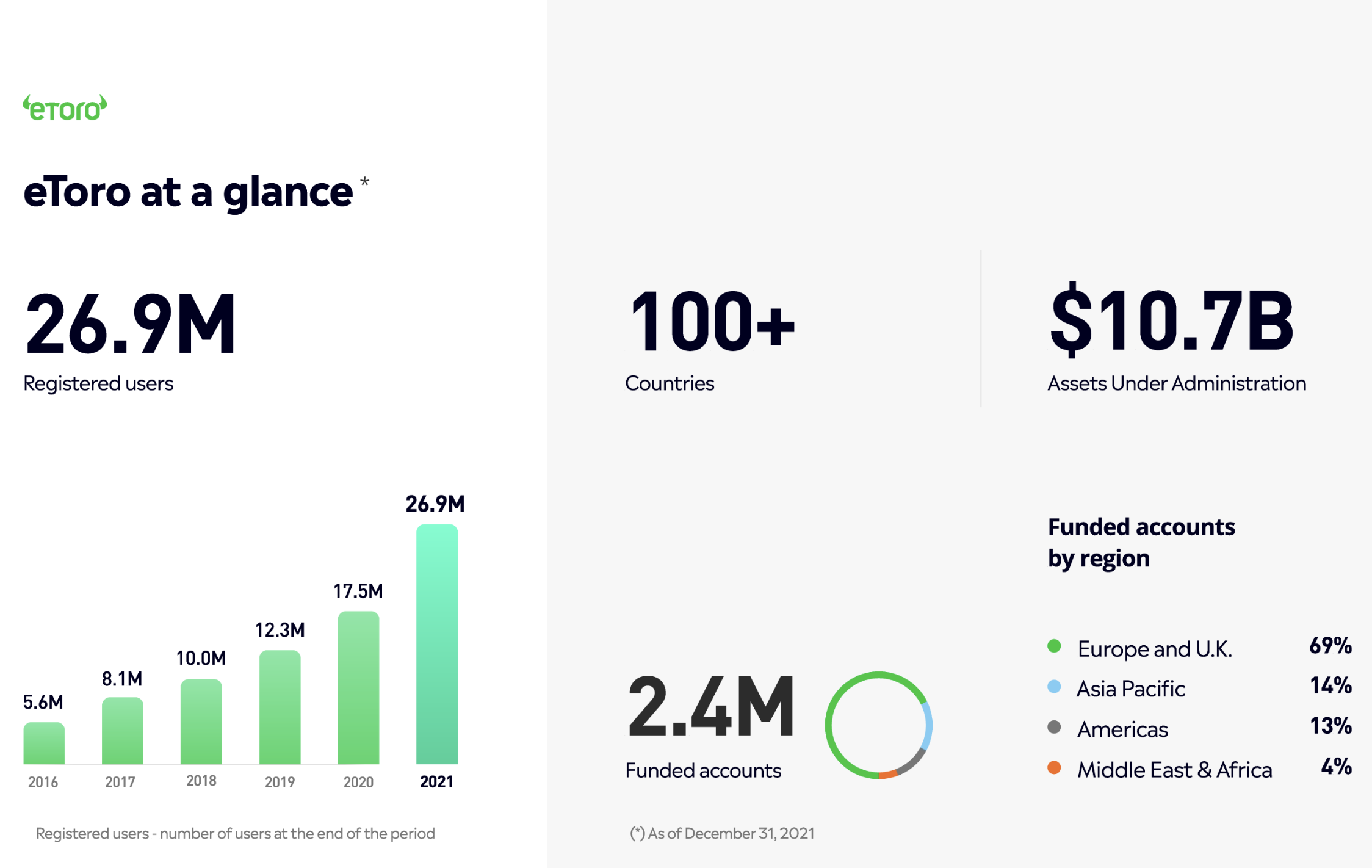

With almost 27m users, the social trading platform eToro has developed a reputation for itself as a leading broker since its launch in 2007.

With almost 27m users, the social trading platform eToro has developed a reputation for itself as a leading broker since its launch in 2007.

Investors wanting to buy stocks on eToro are struck by how simple it is to get around on eToro’s platform. eToro offers 3,000+ stocks from 15+ international stock exchanges — including tech stocks like DocuSign at tight spreads. A range of commodities, indices, forex pairs, 250+ ETFs and 70+ crypto coins are on offer too.

eToro charges zero commission on stock transactions. This applies to all stocks, from popular biotech stocks to the penny stocks. But, like all brokers, a spread fee applies. Investors wanting to buy DocuSign stock will be charged 0.27% on a ’round-trip’ buying and selling.

A minimum trade of just $10 applies on stock transactions. Funds can be deposited with credit/debit card, bank transfer and with a range of e-wallets. No deposit fee applies, but a flat fee of $5 is levied for any withdrawal.

Where this broker comes into its own is in its Social Trading tools. Social Trading means learning from other investors.

- CopyTrader. This allows investors to choose from thousands of other investors and copy their trades.

- Smart Portfolios. eToro provides 65+ portfolios that investors can buy into. Each represents a particular strategic take on a sector. Smart Portfolios offer a ready-made vehicle to diversify a portfolio.

The SEC oversees its operations in the US, as well as FINRA and FinCEN. eToro is also regulated by the FCA, CySEC and ASIC.

| Number of Stocks: | 3000+ |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying DocuSign: | Spread fee of just 0.27% |

| Deposit Fees: | NA (but currency conversion fee applies to non-USD deposits) |

| Withdrawal Fees: | $5 Flat fee |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Capital.com

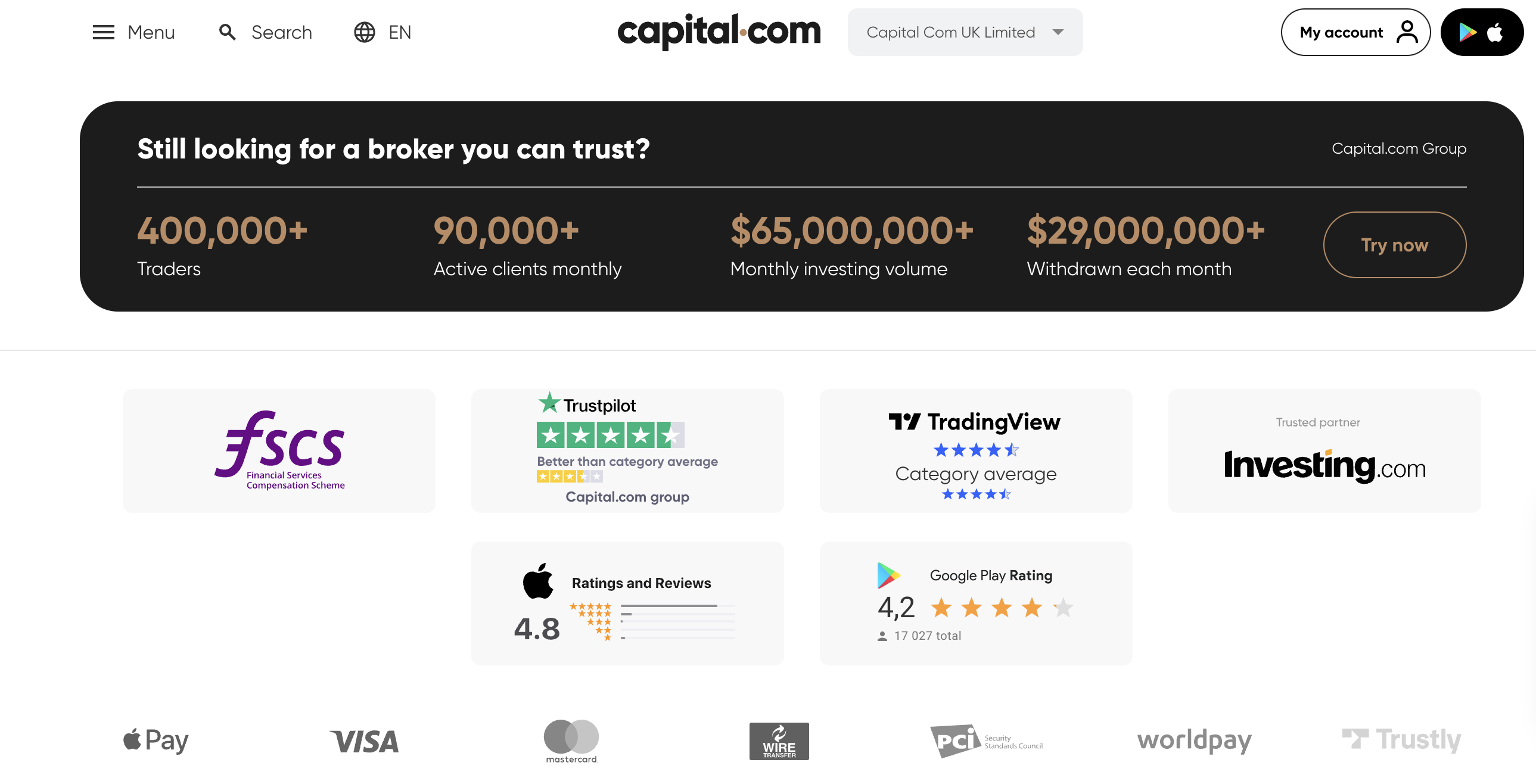

With 90,000 active clients every month, Capital.com supports around 5,600 markets. Capital.com specializes in CFDs (Contracts-For-Difference).

‘Scalping’ means getting in and out of trades quickly and using leverage to ‘scalp’ a profit from small movements in the asset price. CFDs empower traders to do this. CFDs allow traders to go short on stocks as well as leverage their trades.

Capital.com’s charting tools are abundant and the platform overflows with first-class market analysis. When it comes to fees, Capital.com matches eToro for zero commission and no deposit fee — and goes one better with zero withdrawal fees too. However, liquidity seems to be an issue with some stocks, which is reflected in spreads.

| Number of Stocks: | 5,000+ |

|---|---|

| Pricing System: | Spread fee + Overnight fees for CFDs, charged on borrowings |

| Cost of Buying DocuSign: | 1.95% Spread + 0.023% overnight fee Mandatory leverage of 5:1 |

| Deposit Fees: | NA |

| Withdrawal Fees: | NA |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research DocuSign Stock

Investors asking themselves this question would be well served by doing some research. This means getting an overview for what DocuSign does and how it generates revenues.

What is DocuSign?

![]()

Founded in 2003, this San Francisco-based firm pioneered e-signatures. This is the technology that allows electronic documents to be signed virtually and carry the same legal weight as if they had been signed by hand.

- The Docusign stock symbol is ‘DOCU’.

- DocuSign’s flagship product eSignature is set up to integrate with 350+ popular business apps.

- API technology means eSignature can be seamlessly integrated too into proprietary customer platforms and processes.

- DocuSign boasts more than a million clients.

- 13 of the 15 Fortune 500 tech companies use DocuSign.

- The firm has over a billion end-users worldwide.

DocuSign Stock Price — How Much is DocuSign Stock Worth?

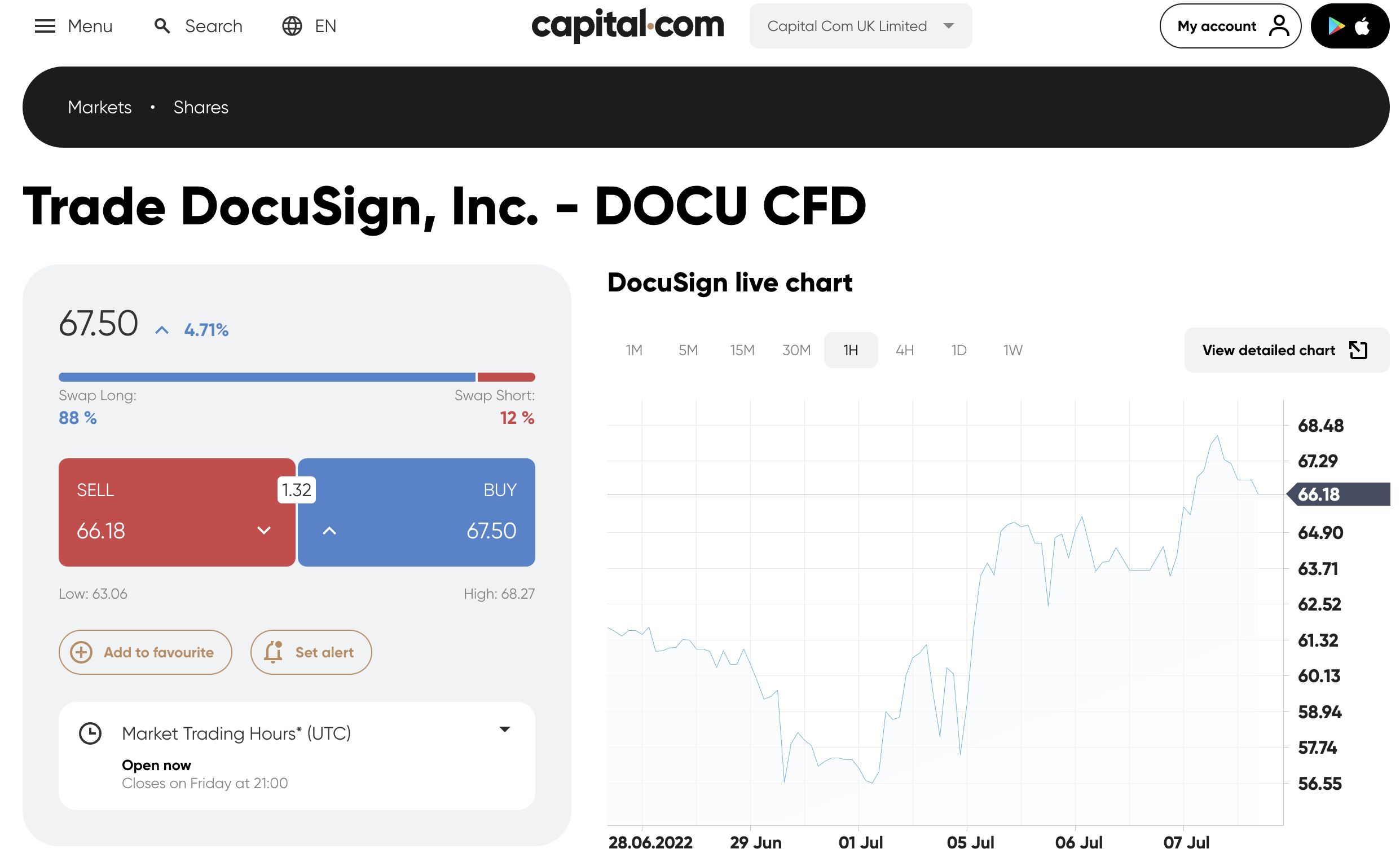

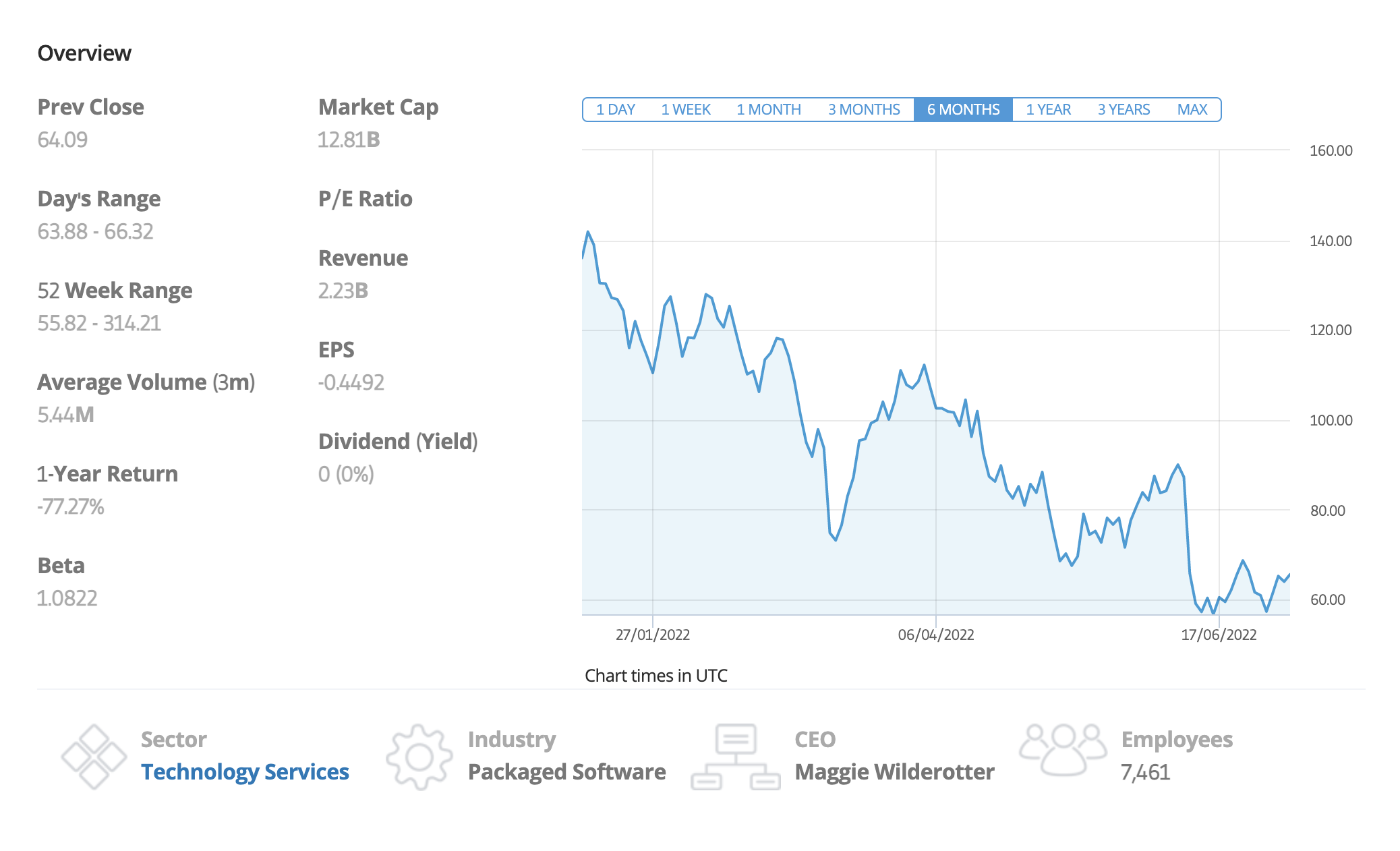

From the DocuSign stock chart below, we can see that the closing price on July 7th, 2022 was $67.45.

DocuSign Stock History

DocuSign stock is down 77% in the last year. Here we review the highlights of its price journey since rocketing upwards in 2020:

364% Rise in Value Down To Pandemic

Over 2020 and the first half of 2021, DocuSign was a stock market darling. The Pandemic had the share price rocket by 364% in 18 months.

Why? Because DocuSign’s key product facilitates remote signing of business documents. Businesses using DocuSign could therefore conduct business as normal even though employers were confined to their homes thanks to lockdowns.

- When the Pandemic first hit the markets, the DocuSign price fell slightly to open at $66.81 on March 18th, 2020.

- 18 months later, the price had soared to an all-time-high of $310.27 on September 7th, 2021.

Q3 2021 Revenues Forecast Disappointed the Market

Q3 2021 revenue and earnings topped analyst estimates. But the firm disappointed the market with revised revenue estimates for Q4 that were lower than expected. The price dropped by 34% overnight (as we can see from the prominent break in the price line shown in the chart above):

- On December 2nd, 2021, the price closed at $233.16.

- The next day, the opening price was $153.18.

Q1 2023 (Financial Year) Results Disappointed the Market

Q1 2023 (financial year) results on July 9th, 2022 disappointed the market (as we outline in more detail below). As a result, the DocuSign price plummeted overnight by just under 25%.

Early July 2022: Price Up on Positive Borrowing News

Very recently on July 5th, 2022, the DocuSign price was up by 8.7% over the course of the day. This was on the back of news that US Treasury yields were down.

When yields are down, it means that borrowing becomes less expensive. This has a positive implication for the discounted cashflow models on which valuations of growth stocks like DocuSign are based.

Two Key Financial Metrics

Few people wanting to invest in stocks want to read the entire balance sheet for any company.

On the DocuSign homepage on eToro, for example, we can view an overview for the last financial year.

Table: Two Key Financial Metrics to Assess Any Stock

| Metric | Definition | Shows? |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Q1 2022 DocuSign EPS (Earnings Per Share): $0.38

The EPS figure gives us one indication of how profitable a company is.

For Q1 2022, the firm announced an EPS figure of $0.38. This was down from $0.44 year-on-year. And, what’s worse, this was lower than the figure of $0.45 that analysts were hoping for.

The markets are looking for increasing revenues, rather than revenues per se. So when a company reports a decline in EPS, this is considered to be a red flag for investors.

Q1 2022 DocuSign P/E Ratio: 35.31

DocuSign’s P/E ratio using the EPS figure for the trailing 12 months (TTM) is 35.31. Compared to the Technology Services average P/E ratio of 23.10, this is quite expensive.

DocuSign Stock Dividends

DocuSign is not a dividend stock. The firm has never paid a dividend. As a growth stock – with a P/E ratio of over 20 – this is not surprising. Nor has DocuSign turned a positive net income between 2019 and 2022.

Step 3: Open a Trading Account and Research DocuSign Stock

Where to buy stocks is a decision that depends on personal preference. Ultimately, the investor needs to shop around. Fortunately, then, most online brokers offer a similar process to get started:

- Sign up

- Verify ID

- Deposit Funds

- Search for DocuSign Stock

- Buy DocuSign Stock

DocuSign Stock: Investor Sentiment

Hedge Funds Still Onboard With Almost 10m DocuSign Shares

We have noted above that the average recommendation for DocuSign stock of 15 analysts is ‘Hold’. This is far from a glowing recommendation, but only 13% were more negative with ‘Sell’ advice.

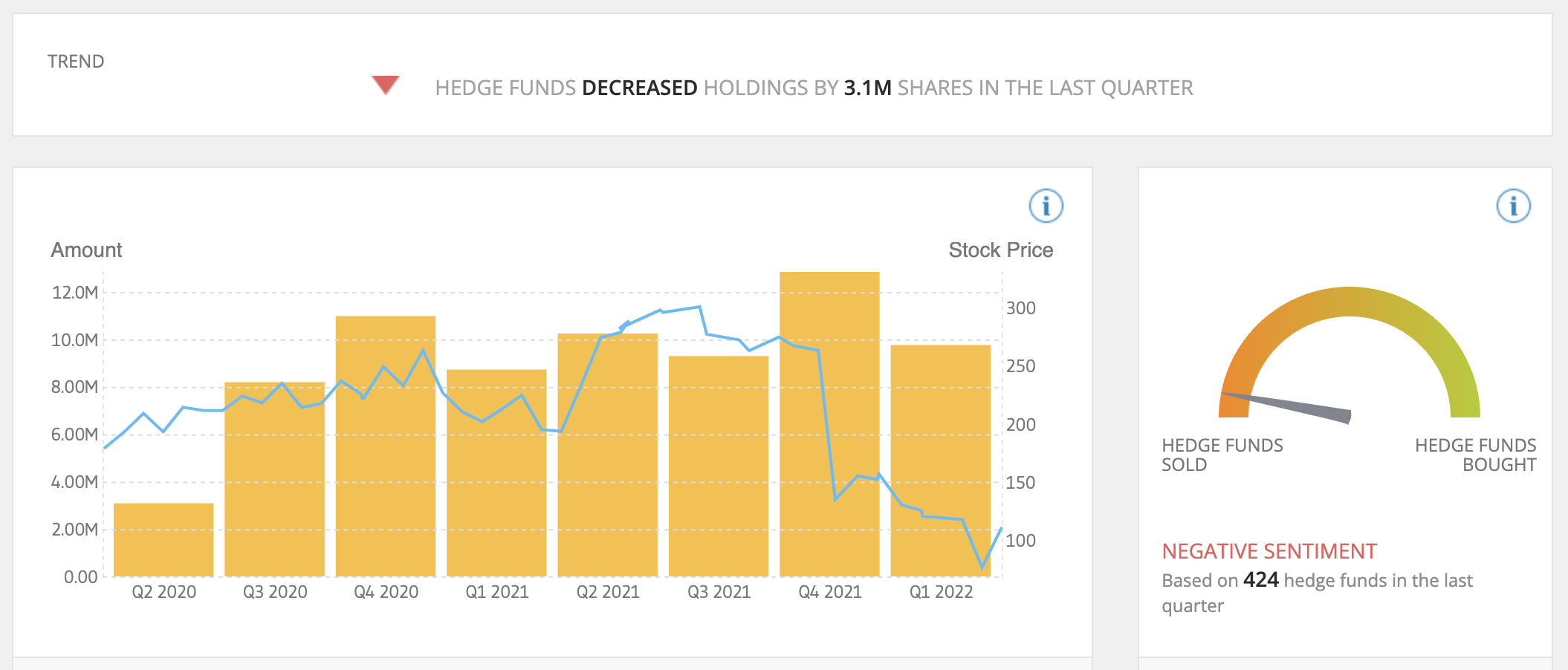

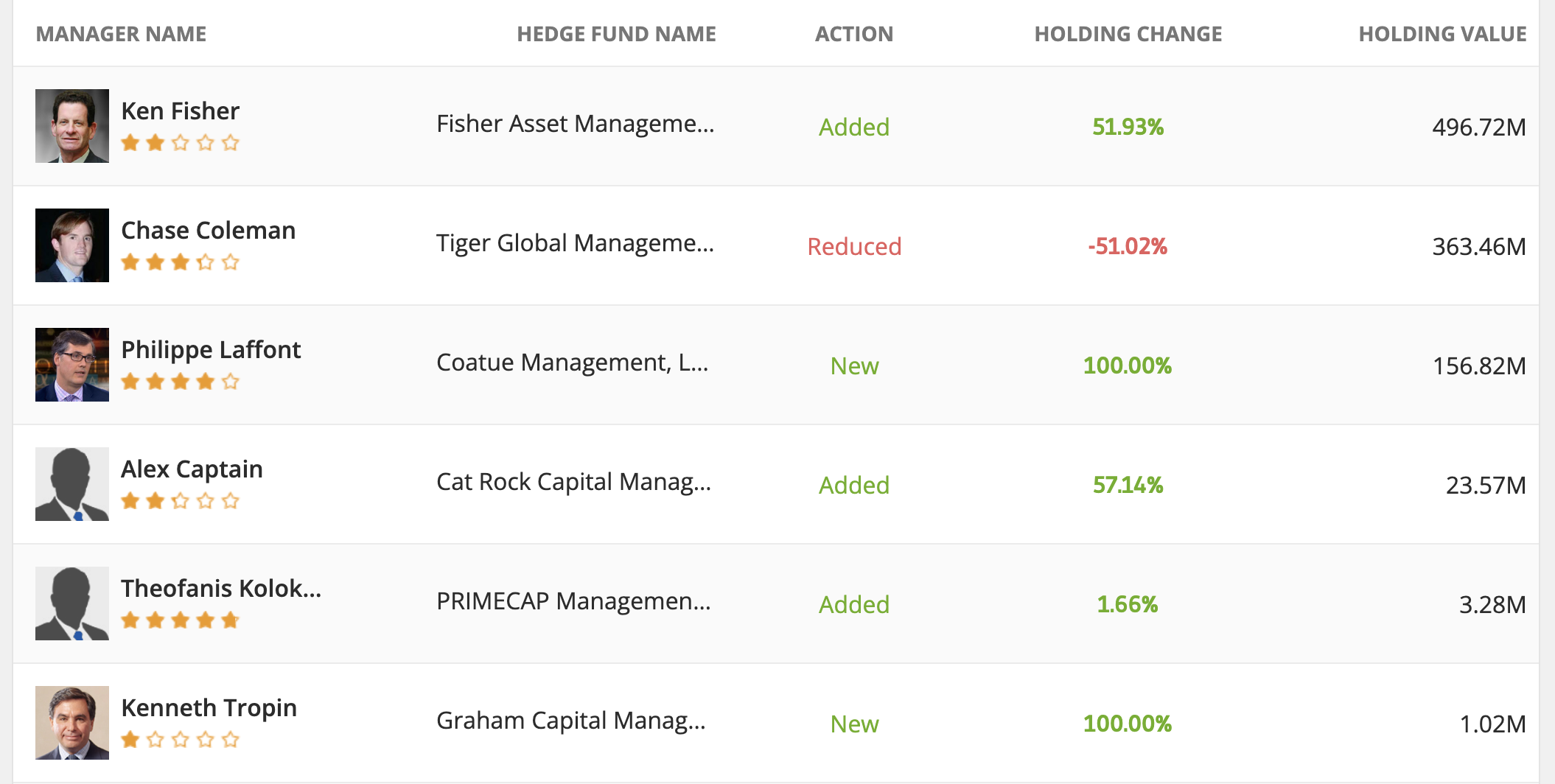

But what is the hedge fund situation? From DocuSign’s homepage on eToro shown below, we can see that hedge funds actually reduced their holdings in DocuSign by 3.1m shares in Q1 2022.

But let us also note that almost 10m DocuSign shares remain in hedge fund hands. What’s more, several hedge fund managers increased their holdings in the last quarter:

- K. Fisher of Fisher Asset Management doubled his firm’s holding to $496.7m.

- P. Laffont of Coatue Management doubled his holding too – to $156.8m.

- A. Captain of Cat Rock Capital Management upped his firm’s holding to $23.5m.

Let us turn to the pressures facing DocuSign stock over the coming year, as well as review some negative news from the options market.

The Work at Home Bonanza is Over

During the Pandemic, it looked like working at home was going to become the new normal.

But it also fair to observe that the 20202-2021 valuations of DocuSign – which drove its share price up by 360+% – were made in uncertain times.

Wedbush Securities analyst Daniel Ives points out that the company has effectively downgraded its billing guidance for the coming financial year by $200m. He concludes dramatically that, ‘DOCU’s core growth story is now essentially over with the clock striking midnight.’

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire