DWAC stands for Digital World Acquisition Corp. With this firm being a SPAC (Special Purpose Acquisition Vehicle), the DWAC stock forecast depends entirely on whether its planned merger with Trump Media & Technology Group goes through. But the merger is in jeopardy. Below we investigate why, and probe whether this high-risk stock retains some potential upside.

To buy DWAC stock, investors will need to sign up with an online broker. We show how this works. With the spotlight on two reputable brokers, we highlight where to buy DWAC stock at zero commission.

Buying DWAC Stock — An Overview

- ✅Step 1: Open an account with a regulated broker – Select a regulated, trusted broker then enter a few personal details to kick off.

- 🔑Step 2: Verification – Onboarding with any online broker involves providing some ID. Most will take the investor through the process with onscreen instructions.

- 💳 Step 3: Deposit – A range of payment methods are available, bank transfer, credit/debit card and a range of e-wallets are available.

- 🔎 Step 4: Search for DWAC Stock – Pinpoint DWAC from among the brokers stocks by using the simple but powerful search function.

- 🛒 Step 5: Buy DWAC Stock – Time to take the plunge. With fractional share investing, broker’s allow investors to stake as little as $10 on any stock or ETF.

Step 1: Choose a Stock Broker

Whichever companies stand out as potential investments, the question of where to buy stocks is key. Investors need to get started somewhere.

There are a few areas to consider:

- Thorough Regulation

- Zero Commission on Stock Transactions

- Tight Spread Fees

1: Thorough Regulation

Regulation by a financial authority means that a broker is overseen by experts as it conducts its business. The idea is to keep investors safe from fraud and company collapse.

In the US, brokers like eToro and Webull are regulated by the Securities and Exchange Commission (SEC). Both these brokers are also signed up to the Securities Investor Protection Corporation. This gives investors compensation coverage of up to $500,000.

2: Zero Commission on Stock Transactions

Commission is a fee that some online brokers charge on stock transactions. It works on a percentage basis. So if an investor were to spend $100 on one of the most popular oil stocks — for example — and the commission charged was 2%, the investor would be charged $2 to make the transaction.

3: Tight Spread Fees

Spread fees are a trading fee (like commission). They are charged by all brokers. They are not charged, though, as a separate fee. The spread fee is rather a difference in the list price of a stock and the prices it may be bought and sold at by the investor.

Hence, the investor can only buy a stock at a slightly higher price than the list price. And the stock may then only be sold back to the broker at a price slightly lower than the list price.

The difference between this buy (bid) price and sell (ask) price is called the spread or spread fee. This is how the broker makes money on the trade.

The tighter the spread fee, the less difference there is between the bid and ask price. Thus, the tighter the spread fee, the less money the investor loses on a ‘return’ trip of buying and selling the stock.

1: eToro

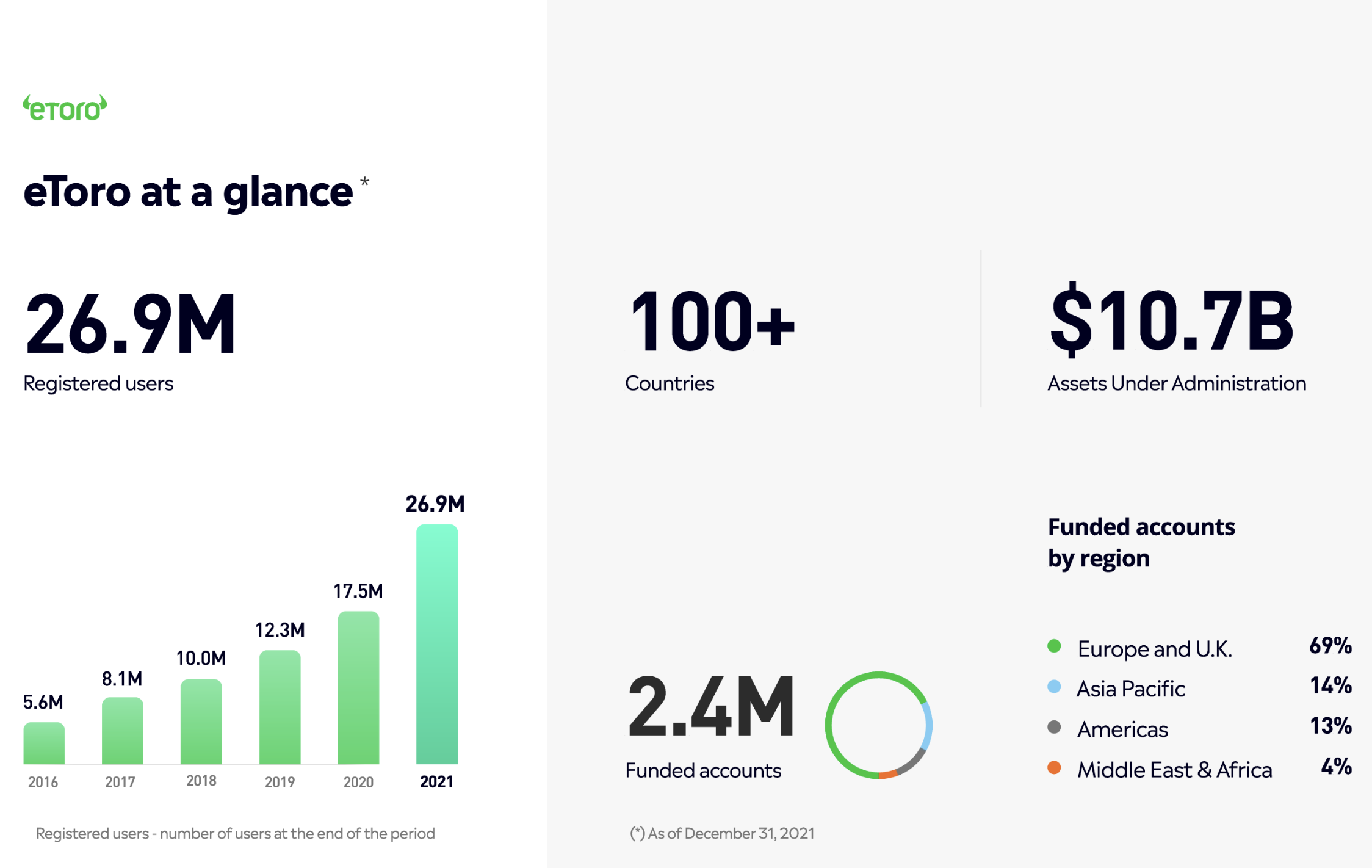

Launched in 2007, eToro has attracted almost 27 million users across 100 countries. Well-established and well-regulated, this broker has over $10bn of assets on its books and a solid reputation for safe and simple trading.

Launched in 2007, eToro has attracted almost 27 million users across 100 countries. Well-established and well-regulated, this broker has over $10bn of assets on its books and a solid reputation for safe and simple trading.

A total of 3,000 stocks are available to trade with eToro. This includes a robust complement of 900+ that are traded outside the US across 15 international exchanges. A total of 17 sectors are covered, spanning high-risk stocks (like cannabis stocks and Metaverse stocks) to low-risk stocks in consumer durables and utilities for example. Investors can pick from a further 250+ ETFs as well as indices, forex, commodities and 70+ crypto coins.

As a one-stop-shop for all sorts of financial assets, eToro impresses. But users looking to invest in stocks in particular will be especially impressed for three reasons:

Zero Commission on Stock Trades

Investors who buy stocks on eToro pay no commission. That applies to selling too. The only trading fee that eToro charges is the spread fee. Spread fees vary across brokers. They also vary according to market volatility. Investors wanting to buy stock in DWAC with eToro can enjoy a tight spread fee of just 0.44%.

Social Trading

eToro is committed to helping investors to help themselves. As well as a raft of free features like stock homepages and a handy personal watchlist, two powerful Social Trading tools stand out: CopyTrader and Smart Portfolios:

- CopyTrader allows the investor to pick from 4,000+ other eToro investors and copy their trades with real money, in real-time.

- Smart Portfolios are strategic holdings designed by eToro experts. There are 65+ to choose from. Each numbers a basket of shares that represents a particular take on a sector. Investors may buy into Smart Portfolios with a minimum investment of $1,000.

Impressive Regulation

The mighty Securities and Exchange Commission (SEC) regulates eToro in the US, as well as FinCEN and FINRA. eToro is also signed up to the SIPC. In Europe, CySEC is eToro’s regulator. The FCA oversees its operations in the UK, and ASIC in Australia.

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Etsy: | Spread fee of just 0.44% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Webull

Webull is an online broker headquartered in New York. It has been in business for a decade less than eToro, yet manages to compete on a number of key levels.

Webull is an online broker headquartered in New York. It has been in business for a decade less than eToro, yet manages to compete on a number of key levels.

Investors exploring buying DWAC stock will be pleased, first and foremost, that Webull offers (like eToro) zero commission on share transactions. (But watch out for a withdrawal fee for bank transfers of $25).

What’s more, Webull offers more shares to trade than eToro, with a selection of 5,000+. A slight issue here, though, is that the vast majority of Webull shares are US-only. Adventurous investors may find this limiting.

Certainly when it comes to the range of other financial assets on offer, Webull is not limiting. ETFs are available, as well as options trading and OTC (Over-The-Counter) trading for investors wanting to browse penny stocks and more. IRA accounts are available too. But — whereas eToro allows investors to gear trades and trade on margin automatically — Webull limits margin trading to special accounts (minimum holding: $2,000).

A key perk available with Webull is its extended hours trading. This means investors wanting to buy stock in DWAC can do so before the market opens and after it closes. More sophisticated market ordering is available than on eToro. And another standout feature of Webull is the positive reception it has received for its cellphone trading app. Android users rate this on average 4.4/5 on Google Play. And Apple users on the App Store have given it an impressive average rating of 4.7/5.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying DWAC: | Spread fee: not available |

Your capital is at risk.

Step 2: Research DWAC Stock

Research is important with any stock. This is particularly the case with DWAC. Because DWAC is currently linked to the Trump Media and Technology Group, it has a political element. This can be distracting. Smart investors would do well to ignore the politics and get down to the financial nitty-gritty.

What is DWAC

DWAC stands for Digital World Acquisition Corp.

DWAC stands for Digital World Acquisition Corp.- The company was incorporated in 2020.

- DWAC is based in Miami, Florida.

DWAC: A SPAC

![]() DWAC is a Special Purpose Acquisition Company (SPAC) — otherwise known as a ‘blank cheque company’. This means that it was specifically founded with the purpose of finding another established company and reverse merging with it in order to take the combined companies public.

DWAC is a Special Purpose Acquisition Company (SPAC) — otherwise known as a ‘blank cheque company’. This means that it was specifically founded with the purpose of finding another established company and reverse merging with it in order to take the combined companies public.

In October 20, 2021, DWAC announced that it planned to merge with the Trump Media And Technology Group (TMTG).

The deal was expected to be concluded by the end of 2022. But, thanks to an ongoing SEC probe, the reverse merger is in doubt.

DWAC Stock Price — How Much is DWAC Stock Worth

From the DWAC stock chart below, we can see that the DWAC stock price closed on 29th July 2022 at $22.57. It opened the next day lower at $21.97.

- The DWAC stock symbol (otherwise known as the DWAC stock ticker) is ‘DWAC’.

DWAC Stock History

- All SPACs are listed initially at $10 a share. DWAC came to market in late September 2021.

- On news of a possible merger with TMTG, DWAC stock peaked intra-day at $170 per share on 25th October, 2021.

- The price then fell to below $40 by late November, 2021.

- The planned launch of TMTG’s Truth Social network inspired investors to pile into the stock. The price rose to a 2022 high of $98.02 by the end of February.

- With the flopped launch of Truth Social on the App Store on February 28th, 2022, the DWAC stock price fell sharply.

- Apparently finding some support around the $37 mark over the course of April and May, the stock then tanked on news that the DWAC board had been issued subpoenas by a Federal Grand Jury.

DWAC Stock: Two Key Financial Metrics

Broker eToro provides detailed financial stats on each company that it features. DWAC is no exception. On the DWAC homepage we can find a financial overview as well as income statements and a balance sheet summary.

From this selection, investors can pick out two financial metrics: EPS and P/E Ratio.

For most stocks, these two metrics are among many key indicators of the financial health of a company. But SPACs (like DWAC) are different. Investors figuring out buying DWAC stock should be clear that, with SPACs, financial fundamentals are nowhere near as important as merger news.

Table: 3 Key Financial Metrics to Assess Any Stock

| Metric | Definition | Shows |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

DWAC EPS (Earnings Per Share): NA

As a SPAC stock, DWAC has generated no earnings. A SPAC stock is a financial vehicle only. It is not expected to generate revenues.

DWAC P/E Ratio: NA

With no earnings and no intention of making any until post-merger, DWAC has no P/E ratio.

DWAC Stock Dividends

DWAC does not qualify as a dividend stock because it never has paid dividends.

If the merger with TMTG goes through, the resulting stock (likely to bear the ticker ‘TMTG’) may or may not issue dividend payments.

Investors wanting to check out dividend stocks will need to look elsewhere. An example of a dividend stock is AT&T, the leading telecoms provider in the US. Arguably one of the most popular tech stocks, AT&T has saddled itself with a staggering $180bn in debt but has managed nonetheless to increase its annual dividend payout every year since its IPO in 1984.

Factors Affecting DWAC Stock

Buying DWAC stock is a moot question unless the investor is convinced that the stock is worth buying.

On the plus side, DWAC is well-funded and is set to benefit from global recognition for its senior management should it merge with its chosen target, TMTG:

DWAC is Well Funded

- DWAC has $293m in the bank ready to invest in the company formed when it merges with its target.

- On December 04, 2021, DWAC and TMTG announced $1bn in PIPE investment from institutional investors. PIPE investment means ‘Private Investment in Public Equity.’

Should a merged company arise, it will have at least the beginnings of a war chest.

Global Recognition for Management

Love him or hate him, everybody knows who Donald Trump is.

- Ex-US President Trump is the founder of the Trump Media & Technology Group which DWAC aims to merge with and thus take onto the public stock markets.

- Putting politics to one side (which is always sensible when making investment decisions), the DWAC stock price has always benefitted from its link to ex-US president Donald Trump. Wider public awareness has led to the DWAC stock being pumped at various points on key DWAC stock news.

- The current DWAC CEO, Patrick Orlando, has no public profile.

On the negative side, two key questions need to be answered regarding the planned DWAC/TMTG merger and TMTG’s flagship product, Truth Social.

Will DWAC survive the ongoing SEC enquiry

Potentially damning DWAC to the status of a dog stock is the current SEC investigation. The suspicion is that DWAC spoke to TMTG about a possible merger before raising funding for DWAC. For a SPAC stock to explore possible merger targets before launching is a crime.

Potentially damning DWAC to the status of a dog stock is the current SEC investigation. The suspicion is that DWAC spoke to TMTG about a possible merger before raising funding for DWAC. For a SPAC stock to explore possible merger targets before launching is a crime.

- In a December, 2021 SEC filing, DWAC announced that the SEC had launched an investigation into DWAC stock trades and communications prior to the merger being declared in October 2021.

- In a June 2022 SEC filing, DWAC announced that a Federal Grand Jury of the Southern District of New York had issued subpoenas to each member of DWAC’s Board of Directors. The request was for further information relating to the SEC probe started in 2021.

- On Friday 24th June, DWAC issued an acknowledgement of this legal action. The firm warned the market that the planned merger with TMTG was under threat: ‘These subpoenas, and the underlying investigations by the Department of Justice and the SEC, can be expected to delay effectiveness of the Registration Statement, which could materially delay, materially impede, or prevent the consummation of the Business Combination.’

- DWAC shares fell by 9.6% on the following Monday 27th June. This indicates that the market has a gloomy outlook for DWAC’s chances of surviving the SEC probe with the merger intact.

Will Truth Social Achieve its Targets

![]() TMTG’s flagship product is the social network Truth Social which launched in February, 2022. Similar to Twitter in format (but not political emphasis), Truth Social is widely-thought to be a rallying point for Trump supporters in the US, rather than the ‘Big Tent’ of diverse political opinions that it professes to be.

TMTG’s flagship product is the social network Truth Social which launched in February, 2022. Similar to Twitter in format (but not political emphasis), Truth Social is widely-thought to be a rallying point for Trump supporters in the US, rather than the ‘Big Tent’ of diverse political opinions that it professes to be.

Truth Social is part of a threefold roll-out by TMTG. After Truth Social will come a subscription video-on-demand service, followed by a podcast network.

The social network started out with some ambitious targets:

- A total of 16 million users in 2022.

- 81 million users (with 40 million paying subscribers) plus an average revenue per user of $13.50 by 2026.

But the Truth Social launch has been plagued with technical difficulties:

- The social media app was only available to Apple users until May 2022.

- Since then, it has been made available via browser.

- An Android app for Google Play has yet to be released.

As a result, would-be users were placed on a registration wait queue numbering over a million applicants. And Truth Social has thus failed to impress so far in terms of consumer take-up:

- In late April 2022, Truth Social was reported to have just 513,000 active daily users. This compares unfavorably to market leader Twitter’s daily user base of 271 million. Business Insider said that Truth Social was ‘like a conservative ghost town that had been overrun by bots.’

Step 3: Open an Account and Buy DWAC Stock

Signing up with an online broker and buying stock (or other financial assets) generally follows the same format:

- Sign up

- Verify ID

- Deposit Funds

- Search for DWAC Stock

- Buy DWAC Stock

Below we outline how this onboarding process works with an online broker.

1: Sign up

- Head online and go to the broker’s website.

- Supply a few personal details.

- Set a password and user name.

- Tick the boxes when happy with the related information.

- Press the blue ‘Create Account’ button.

2: Verify ID

Regulated brokers can give investors a protected investment experience because they follow KYC (Know Your Customer) regulations.

This means that investors must provide scanned ID proving who they are and where they live.

Investors complain with some brokers that this process, which is usually automated, can be tiresome.

3: Deposit Funds

Once verified, investors can sign into their new account.

- Press the blue ‘Deposit Funds’ button at the bottom left of the screen. This brings up the box below:

Here investors can choose their deposit method and simply enter how much money they want to deposit.

- Deposit times vary according to the method used.

- Investors should use credit/debit card for fastest deposit times.

4: Search for DWAC Stock

Investors can pinpoint DWAC stock immediately from among the brokers stocks by entering the DWAC stock ticker ‘DWAC’ in the toolbar.

Press the DWAC logo to access the DWAC homepage. Here investors can access a newsfeed on DWAC as well as financial stats and charting options.

- Press the blue ‘TRADE’ button to head straight to buying DWAC stock.

5: Buy DWAC Stock

To execute their DWAC stock purchase, the investor need only enter how much DWAC stock they want to buy and press ‘Open Trade’.

- Most brokers provide onscreen confirmation of the successful trade.

- Investors may review their freshly-bought DWAC stock in their portfolio.

DWAC Stock Strengths and Weaknesses

In the case of DWAC, the stakes are high; given its inherent riskiness as a SPAC stock and the ongoing SEC investigation, investors should recognise that DWAC is certainly a high-risk stock. But, of course, high-risk stocks can potentially realize high rewards.

SELL: Danger of DWAC Default

DWAC faces a threat common to all SPAC stocks. If its stock price returns to the value it was issued at initially – which is $10 for all SPACs – the company is rolled up and investor funds returned. The DWAC stock price is currently barely above $20, and is down over 75% on its 2022 high.

What’s more, in the near future, DWAC stock is unlikely to rise above the established resistance level of $37 (shown on the DWAC stock chart below). As long as the SEC is investigating, the price is likely to stay beneath this level.

BUY: Three Reasons Why There is Hope for DWAC

Joel Baglole perhaps rather overstates the case when he writes in June, 2022 at investorplace.com that, ‘There’s no good news related to Digital World Acquisition Corp. or its planned reverse merger with Trump Media and Technology Group … The only thing worse than the headlines is the performance of DWAC stock.’

Stock App Rating

For one thing, TMTG’s Truth Social app has received a high average rating on the App Store of 4.5/5 from over 117,000 users. Despite the scalability issues plaguing the app, at least its existing users are happy.

The Musk Factor

Secondly, if Elon Musk’s Twitter mega-deal falls through, it is likely that DWAC stock will receive a boost. TMTG’s Truth Social was conceived as the right-wing antidote to the left-wing emphasis perceived to dominate on Twitter. Thus, with right-wing Musk planning to take over Twitter and presumed to be planning to moderate this emphasis, the whole raison d’etre of right-wing Truth Social came under question. So, if the Twitter deal fails, Truth Social may receive renewed positive focus as a right-wing mainstream alternative to Twitter.

DWAC SEC Probe: Companies Have Survived Worse

Thirdly, investors researching about buying DWAC stock should bear in mind that companies do recover from situations which, at the time, look impossible.

The stock of US rental firm Hertz, for example, hovered beneath the $2.50 mark for the second half of 2020 whilst it was in bankruptcy proceedings — but, having secured new investment, rebounded to an intra-day high above the $45 mark in late October 2021. Hertz’s stock chart below shows its dramatic reversal of fortunes:

(Investors can buy Hertz stock with eToro.)

DWAC’s current legal woes are fully priced into its share price. If the news improves, though, the stock price is likely to rise. And, if the planned merger actually goes through, it is likely to rocket.

Conclusion

When it comes to buying Digital World Acquisition Corp stock, we have shone the spotlight on two brokers: eToro vs. Webull.

Investors can always look forward to picking up new stocks with a large broker as well as benefitting from the powerful possibilities of advanced and unique features.

Investing in DWAC stock is ultimately down to the individual investor. We advise above all that a regulated broker is used to avoid the danger of fraud.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire