Filing an insurance claim will increase your rates, but you might not know that poor credit can lead to even higher insurance rates.

Having a bad credit score doesn’t automatically mean that you’re a risky driver or careless homeowner. However, insurers see your credit as a factor if they’re using a credit-based insurance score to determine car insurance or home insurance costs.

Insurers use credit scores to identify consumers who are consistent and reliable, such as paying their bills. Insurers say these people are less likely to file a claim on an insurance policy — thus costing the insurance company less money.

“A consumer’s credit history is one of the most, if not the most, accurate predictors of risk available to insurers,” said P.J. Smith, senior director, insurance, LexisNexis Risk Solutions.

Average Insurance Rates for Your Used Vehicle

- What are credit-based insurance scores?

- How credit score affects your insurance?

- How does credit score affect car insurance?

- How does credit score affect home insurance?

- Why does credit score affect insurance costs?

- Which states don’t allow insurers to take credit score into account?

- How often do insurance companies check credit history?

- How to lower insurance costs if you have poor credit

KEY TAKEAWAYS

- Your credit score shows how risky it is for an insurance company to offer you a policy. It’s one of the important factors that carriers consider to determine premiums.

- If you live in a state that lets car insurance companies use your credit score to set rates, you’ll pay more for insurance if you have bad credit.

- Drivers with fair credit pay 18% less for car insurance than someone with poor credit scores.

- In states like California and Massachusetts, insurance companies are not allowed to use credit history to determine car insurance premiums.

What are credit-based insurance scores?

“A person’s credit history is used in credit-based insurance scores to provide an objective and consistent tool that insurers use, along with other applicant information, to better predict a consumer’s risk and the likelihood of experiencing a future loss,” Smith said.

Smith said credit-based insurance scores gauge a customer’s risk. However, how the insurer weighs that information varies.

“Each insurance company makes underwriting decisions based on its own business requirements. Depending on a company’s own proprietary strategies, they are likely to evaluate credit-based insurance scores alongside many other variables to ascertain if a consumer has a higher risk of experiencing a loss,” Smith said.

What is the difference between a credit score and an insurance score?

Your credit history influences both your insurance risk scores and credit risk scores. However, consumers shouldn’t confuse the two.

“The biggest difference is that insurance risk scores look for stability, but credit risk scores look for a reliable pattern. Insurance scores are also more interested in how regularly you pay than in how much you already owe,” said Craig Watts, former public affairs director for Fair Isaac Corp. (FICO). Roughly 300 insurers use FICO’s insurance risk scores to calculate insurance quotes.

Insurance companies are adapting. Companies, such as State Farm and Allstate Insurance, have noted the correlation between credit scores and claims and have tailored their own insurance risk-scoring systems as part of their pricing.

How credit score affects your insurance

While Fair Isaac Corp. will not release the details of its insurance risk-scoring model to the public, your credit score can give you an idea of your insurance risk score.

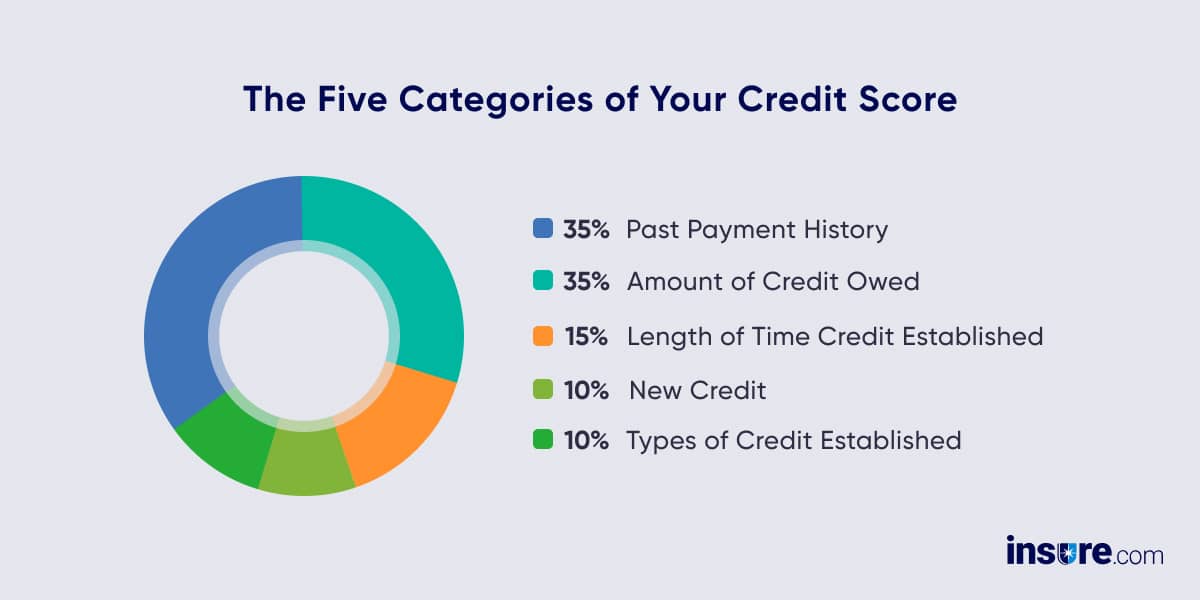

The five categories of your credit score are:

- Past payment history: how you’ve paid your credit bills in the past, if your bills have been paid on time, items in collection, the number of “adverse public records” (bankruptcy, wage attachments, liens), and the number and length of delinquencies or items in collection.

- Amount of credit owed: how many accounts have balances, what kind of accounts they are and how close you are to your credit limits.

- Length of time credit established: how long you have had credit accounts and how long you have had specific accounts.

- New credit: number and proportion of recently opened accounts, the number of credit inquiries, and the re-establishment of positive credit history after payment problems.

- Types of credit established: the number and activity of various types of credit accounts including credit cards, retail store accounts, installment loans, and mortgages.

Insurers place importance on the factors that show long-term stability, so by demonstrating responsible use of credit and keeping your balances low, you should be able to improve your insurance score. That could translate into lower insurance premiums if you’ve been impacted by a negative credit history in the past.

How does credit score affect car insurance?

Credit is a determining factor, but many other factors go into an auto insurance rate, including:

- Location

- Age and experience of drivers

- Make, model and age of vehicle

- Miles driven annually

- Your insurer

- Driving history

If you’re in a state that allows credit-based auto insurance scores to influence rates, you’ll pay more for car insurance if you have poor credit.

“Credit will increase the cost of auto insurance if you have not maintained good credit history,” said John Espenschied, agency owner, Insurance Brokers Group. “You can have a clean driving history with no driving violations or accidents, but still be penalized for poor credit, which means higher insurance premiums.

Credit is an accurate means for insurance companies to be able to predict adverse selection and adjust the premium based on potential claim risk. The same would apply when obtaining a credit card or home loan — your credit will determine what you will pay.”

How much can you save by having a better credit score?

- 71% — A person with good credit pays 71% less for car insurance than someone with poor credit.

- 18% — A person with fair credit pays 18% less for car insurance than someone with poor credit.

“You can ask your insurance company if a credit-based insurance score was used to underwrite and rate your policy and which risk category you were placed in after you receive a quote,” Worters said.

Rate increases vary by insurer and state. Michigan is worst for drivers with poor credit. Drivers in that state pay an increase of nearly $4,000 more than the state’s average. Drivers with poor credit in many states pay double what is charged to people with good credit.

State average auto insurance premium by credit score

Here are the differences by state for car insurance:

| State | Average rate | Rate with poor credit | % increase | $ increase |

|---|---|---|---|---|

| Michigan | $2,368 | $6,316 | 167% | $3,948 |

| New Jersey | $1,419 | $2,925 | 106% | $1,506 |

| Arizona | $1,399 | $2,711 | 94% | $1,312 |

| Texas | $1,644 | $3,170 | 93% | $1,526 |

| Utah | $1,212 | $2,316 | 91% | $1,104 |

| Nevada | $1,578 | $2,986 | 89% | $1,408 |

| Illinois | $1,176 | $2,198 | 87% | $1,022 |

| New York | $1,214 | $2,255 | 86% | $1,041 |

| Minnesota | $1,339 | $2,471 | 85% | $1,132 |

| Pennsylvania | $1,438 | $2,572 | 79% | $1,134 |

| Vermont | $1,166 | $2,070 | 78% | $904 |

| South Carolina | $1,353 | $2,386 | 76% | $1,033 |

| Alabama | $1,304 | $2,296 | 76% | $992 |

| Tennessee | $1,339 | $2,342 | 75% | $1,003 |

| Florida | $2,250 | $3,926 | 74% | $1,676 |

| Maine | $884 | $1,540 | 74% | $656 |

| Rhode Island | $2,011 | $3,496 | 74% | $1,485 |

| Montana | $1,589 | $2,756 | 73% | $1,167 |

| Colorado | $1,675 | $2,890 | 73% | $1,215 |

| Kentucky | $1,611 | $2,766 | 72% | $1,155 |

| Nebraska | $1,287 | $2,203 | 71% | $916 |

| Idaho | $1,019 | $1,742 | 71% | $723 |

| Indiana | $1,057 | $1,806 | 71% | $749 |

| Missouri | $1,288 | $2,197 | 71% | $909 |

| Louisiana | $2,228 | $3,797 | 70% | $1,569 |

| Delaware | $1,838 | $3,128 | 70% | $1,290 |

| South Dakota | $1,250 | $2,119 | 70% | $869 |

| Arkansas | $1,556 | $2,621 | 68% | $1,065 |

| Oklahoma | $1,469 | $2,468 | 68% | $999 |

| Ohio | $959 | $1,610 | 68% | $651 |

| Georgia | $1,815 | $3,040 | 67% | $1,225 |

| DC | $1,887 | $3,153 | 67% | $1,266 |

| North Dakota | $1,123 | $1,873 | 67% | $750 |

| Oregon | $1,325 | $2,193 | 66% | $868 |

| Kansas | $1,412 | $2,320 | 64% | $908 |

| Washington | $1,307 | $2,117 | 62% | $810 |

| Iowa | $1,073 | $1,728 | 61% | $655 |

| Virginia | $993 | $1,595 | 61% | $602 |

| New Mexico | $1,498 | $2,404 | 60% | $906 |

| Maryland | $1,541 | $2,464 | 60% | $923 |

| Wisconsin | $1,147 | $1,832 | 60% | $685 |

| New Hampshire | $1,156 | $1,846 | 60% | $690 |

| Mississippi | $1,504 | $2,358 | 57% | $854 |

| Connecticut | $1,980 | $3,095 | 56% | $1,115 |

| West Virginia | $1,467 | $2,167 | 48% | $700 |

| Alaska | $1,246 | $1,789 | 44% | $543 |

| Wyoming | $1,577 | $2,179 | 38% | $602 |

| North Carolina | $1,170 | $1,317 | 13% | $147 |

| California | $1,783 | $1,783 | 0% | $0 |

| Hawaii | $1,255 | $1,255 | 0% | $0 |

| Massachusetts | $1,616 | $1,616 | 0% | $0 |

QuickTake

How does credit score affect home insurance?

Credit history is one of many factors used by carriers to calculate the potential risks and price of a home insurance policy.

Other factors that play a part in home insurance costs are:

- The type of home

- Location

- Claims history

- The closeness of a fire hydrant

- Fire suppression and alert systems

“There is an insurer for every type of risk, and there is the right rate for every risk. Non-standard insurers are also an option for some consumers,” said Smith.

Of course, home insurance claims can increase your rate.

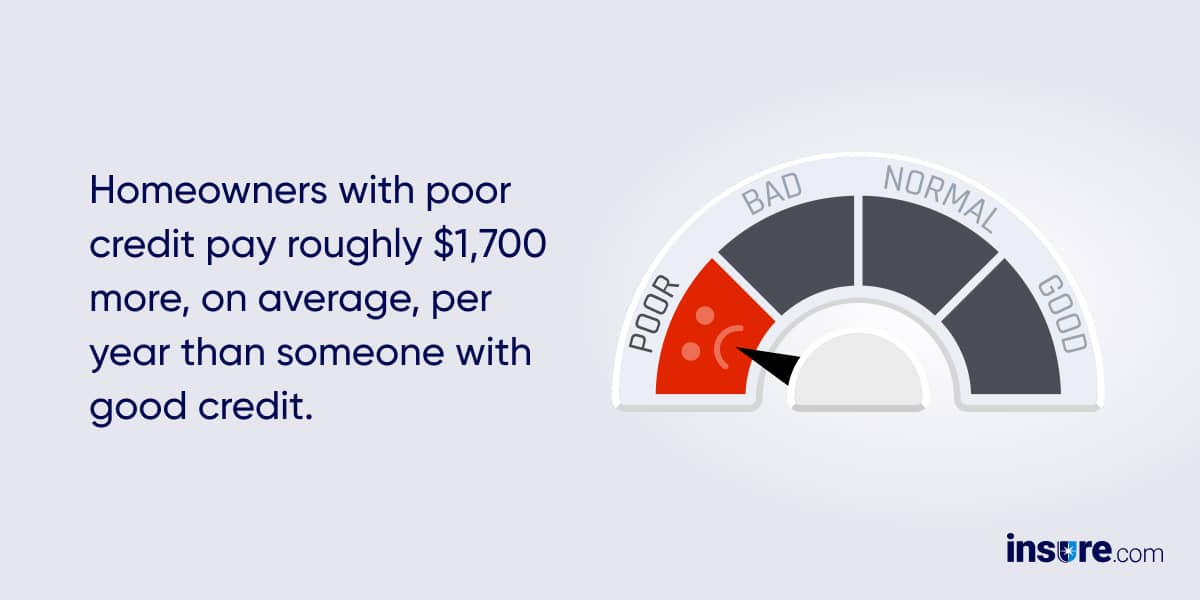

However, the only other thing that can increase your premium more is bad credit:

- Homeowners with poor credit pay an average of 127% more for home insurance than someone with excellent credit. That’s roughly $1,700 more annually.

- People with fair credit pay on average 34% more than those with excellent credit. That’s $425 on average.

State average home insurance premium by credit score

Here are the averages by state (note: California, Maryland and Massachusetts aren’t included since they don’t allow insurers to base home insurance rates on credit history).

| State | Avg. premium for excellent credit | Avg. premium for fair credit | Avg. premium for poor credit | Avg. difference between excellent and poor credit |

|---|---|---|---|---|

| Alaska | $837 | $1,168 | $2,133 | $1,296 |

| Alabama | $1,460 | $2,617 | $3,955 | $2,495 |

| Arkansas | $2,067 | $3,151 | $5,893 | $3,826 |

| Arizona | $1,145 | $1,775 | $2,779 | $1,634 |

| Colorado | $1,926 | $2,665 | $4,012 | $2,086 |

| Connecticut | $1,163 | $1,496 | $2,271 | $1,108 |

| Delaware | $694 | $924 | $1,547 | $853 |

| District of Columbia | $706 | $1,018 | $1,726 | $1,020 |

| Florida | $4,798 | $4,841 | $4,913 | $115 |

| Georgia | $995 | $1,833 | $3,105 | $2,110 |

| Idaho | $786 | $1,083 | $1,714 | $928 |

| Illinois | $919 | $1,428 | $2,582 | $1,663 |

| Indiana | $987 | $1,881 | $4,285 | $3,298 |

| Iowa | $1,135 | $1,911 | $2,754 | $1,619 |

| Kansas | $2,540 | $4,221 | $8,175 | $5,635 |

| Kentucky | $1,513 | $2,216 | $3,686 | $2,173 |

| Louisiana | $2,011 | $2,841 | $4,158 | $2,119 |

| Maine | $684 | $988 | $1,542 | $858 |

| Maryland | $1,166 | $1,244 | $1,379 | $213 |

| Michigan | $871 | $1,413 | $3,577 | $2,706 |

| Minnesota | $2,178 | $2,154 | $3,507 | $2,353 |

| Missouri | $1,556 | $2,343 | $4,083 | $2,527 |

| Mississippi | $1,057 | $2,957 | $4,631 | $2,453 |

| Montana | $1,610 | $2,614 | $5,266 | $3,656 |

| Nebraska | $1,525 | $2,283 | $4,201 | $2,676 |

| Nevada | $782 | $1,179 | $2,420 | $1,638 |

| New Hampshire | $607 | $949 | $1,673 | $1,066 |

| New Jersey | $1,003 | $1,274 | $1,751 | $748 |

| New Mexico | $1,560 | $2,192 | $3,531 | $508 |

| New York | $860 | $1,051 | $1,368 | $1,638 |

| North Carolina | $1,463 | $1,890 | $2,673 | $1,210 |

| North Dakota | $1,159 | $1,925 | $2,460 | $1,301 |

| Ohio | $923 | $1,630 | $3,943 | $3,020 |

| Oklahoma | $2,172 | $3,202 | $6,277 | $4,105 |

| Oregon | $591 | $1,163 | $2,460 | $1,869 |

| Pennsylvania | $663 | $1,157 | $2,515 | $1,852 |

| Rhode Island | $1,161 | $1,465 | $2,071 | $910 |

| South Carolina | $1,230 | $2,178 | $3,073 | $1,843 |

| South Dakota | $1,370 | $2,519 | $4,877 | $3,507 |

| Tennessee | $1,574 | $2.980 | $5,197 | $3,623 |

| Texas | $2,259 | $3,344 | $5,805 | $3,546 |

| Utah | $591 | $1,082 | $1,371 | $780 |

| Virginia | $855 | $1,255 | $2,040 | $1,185 |

| Vermont | $576 | $779 | $1,170 | $594 |

| Washington | $804 | $1,098 | $1,664 | $860 |

| Wisconsin | $668 | $984 | $1,621 | $953 |

| West Virginia | $1,191 | $1,762 | $3,679 | $2,488 |

| Wyoming | $1,021 | $1,306 | $1,747 | $726 |

Why does credit score affect insurance costs?

A 2013 study published by the Bureau of Business Research at the University of Texas showed that there is a strong correlation between credit history and filing auto insurance claims. Credit scores were matched with claim data in the study. It found that people with bad credit scores claimed losses 53% more than the average.

“People who manage their finances well tend to also manage other important aspects of their lives responsibly, such as driving a car,” said Loretta Worters from the III. “People who manage money carefully may be more likely to have their car serviced at appropriate times and may also more effectively manage the most important financial asset most Americans own — their house — making routine repairs before they become major insurance losses.”

Statistics show a correlation, but critics don’t believe a person’s credit should lead to a denial or higher rates. Birny Birnbaum, executive director of the Center for Economic Justice, has testified before Congress on insurance credit scoring and outlined reasons it should be prohibited.

He argues that credit-based insurance scores are arbitrary and unrelated to how well a consumer manages their finances. He said that scores penalize consumers due to lenders’ business decisions. He added that 87% of family bankruptcies result from job loss, major medical bills and divorce.

“It is only in the cloistered world of insurance actuaries and executives that charging higher auto and homeowners insurance rates to someone who has suffered an economic or medical catastrophe is considered fair,” he told Insure.com.

Which states don’t allow insurers to take credit score into account?

Most states allow credit scores to factor into insurance rates, but there are a few exceptions:

- California and Massachusetts don’t let insurers take credit history into account when determining insurance rates.

- Hawaii doesn’t allow its use for auto insurance.

- Maryland won’t allow insurers to take credit history into account when determining home insurance rates.

- Florida lets insurers only partially base rates on credit history. So, people with poor credit only pay an average of 3.6% more than those with excellent credit.

“Keep in mind, each insurer has to file its rates and have them approved by each state (Department of Insurance), who ensure they meet all actuarial and regulatory requirements working on behalf of consumers in these states,” said P.J. Smith.

How often do insurance companies check credit history?

When insurance companies check credit history varies. A majority of companies pull checks when quoting a new applicant and when a customer renews. Most carriers run another check if there are regulatory requirements. These requirements vary by state. Some companies implement a process to re-run your credit-based insurance score every few years.

It is important to note that insurance credit inquiries are soft inquiries that do not negatively affect your credit score like hard inquiries can.

“Credit history data is dynamic and can change over time,” said Smith. “Because of this, carriers will refresh the credit-based insurance score of a policyholder. A common practice is every two to three years at renewal. Also, some states have requirements for ‘at the insured’s request’ where a policyholder can ask to have their score re-run.”

How to lower insurance costs if you have poor credit

Since risk underwriting is the core point of differentiation between insurance companies, it’s important that those with a low credit score shop around and compare rates.

“Some will weigh credit information heavily while others may ignore it altogether,” said Kevin Haney, who owns A.S.K. Benefit Solutions and has more than a decade of experience with Experian. “Some companies even advertise that they do not check credit. Again, poor credit people should shop around and get multiple quotes to find the best rates.”

Don’t fret if you have a poor credit history. It will take some time and diligence, but you can improve your credit score. Here are some insider tips to improve your credit score:

- Always pay your bills on time.

- Keep your oldest credit card or cards, but do not use them unless you can pay them off monthly.

- Avoid opening numerous new credit accounts in a short period of time.

Credit history plays a vital part in your auto and home insurance rates. By improving on your credit, you can save hundreds on insurance each year. In the meantime, here are some tips on how to shop for high-risk car insurance.