Having the right insurance coverage plays a crucial role in your financial situation. Have you reviewed your policy or shopped around for insurance lately?

The idea of reviewing your insurance policies, much less shopping around for new ones, can seem overwhelming when there are so many other things going on in life.

That’s why the experts at Insure.com developed the Insurance Advisor.

Insurance Advisor quickly tells you whether you have enough auto, health, home and life insurance coverage with only a few clicks. This convenient and easy-to-use tool identifies holes or weak areas in your insurance portfolio.

If you’re looking for ways to save money on insurance, we have great news! Insurance Advisor gives personalized suggestions on ways you can lower the cost of insurance.

- What do you need to use the Insurance Advisor tool?

- How does Insurance Advisor work?

- How often should you review your insurance needs?

- How to review your car insurance

- How to review your home insurance

- How to review your health insurance

- How to review your life insurance

What do you need to use the Insurance Advisor tool?

All you need is five minutes and your insurance policies.

If you don’t currently have insurance but are interested in getting covered, Insurance Advisor will make recommendations for optimal coverage for your specific situation.

How does Insurance Advisor work?

After you answer a few easy questions, Insurance Advisor will analyze your information and give you a letter grade for each part of your insurance portfolio. You can then make the necessary changes so you’re adequately covered.

Suppose you are unfamiliar with your policies or feel unsure about limits and industry jargon. In that case, Insure.com senior consumer analyst Penny Gusner recommends pulling up your accounts online in multiple tabs in your browser. That way, as you complete the Insurance Advisor tool, you have everything you need just a few clicks away to help ensure the most accurate report possible.

How often should you review your insurance needs?

Gusner recommends using the Insurance Advisor tool annually or anytime you have a major life event. These events could include marriage, the addition of a child, buy or sell a home, divorce or death in the family. The goal is to protect your assets, family, and quality of life, no matter your life situation.

How to review your car insurance

We all care about cost, and it is often one of the driving factors in insurance decisions. But the cost is only one part of an auto insurance policy. A lower price tag might initially mean a smaller hit to your wallet, but it may mean a devastating blow to your wallet later if you are not covered when you need it most.

Other aspects to take into account are claims processing, customer service and financial rating. If you’re in the market for a new auto insurance policy, review Insure.com’s Best Auto Insurance Companies.

As you begin your insurance check-up, the Insurance Advisor will ask for information on your vehicle’s make, model and year. It will also review your auto insurance coverage: liability limits, comprehensive & collision, uninsured motorist coverage and PIP or MedPay coverage.

“If you’re not ready to use the Insurance Advisor yet, there are some faithful rules you can follow when evaluating coverage on your own,” explains Insure.com Editorial Director Michelle Megna. “You can make some basic calculations to ensure you’re not paying for unnecessary coverages.”

Auto insurance at a glance

Liability recommendations

If your net worth is:

- Less than $50,000, choose at least 50/100/50

- Between $50,000 and $100,000, choose at least 100/300/100

- More than $100,000, choose at least 250/500/100

Collision coverage recommendations

- If your car is less than ten years old, consider buying collision coverage to protect the vehicle’s value.

- If your car is more than ten years old, buy collision if your car is worth $3,000 or more.

- Buy collision if you can’t afford to replace the vehicle in the event of a total loss from an accident.

Comprehensive coverage recommendations

- If your car is less than ten years old, you should consider buying comprehensive.

- If your car is more than ten years old, buy comprehensive if your car is worth $3,000 or more.

- Buy comprehensive if you live in a region prone to flooding, hail or animal strikes.

Calculate your score now using our Auto Insurance Advisor tool.

How to review your home insurance

Homeowners often don’t give home insurance another thought after buying the initial policy. However, those policies quickly become outdated.

New furniture, a fancy flat-screen TV, laptop computer and remodeling your home are all times to increase your home insurance coverage.

Taking an inventory of your items is crucial to making sure you’re up-to-date so that you can protect your home and assets. Many companies even allow you to upload a video inventory — making the process as painless and straightforward as possible.

In this section, the Insurance Advisor tool looks at home insurance’s basic components, such as dwelling coverage, liability, and personal property.

Home insurance at a glance

- Dwelling refers to the amount needed to rebuild your home and replace the possessions inside.

- Liability is the amount of coverage to cover the cost of damages that you or other people covered by your insurance policy are responsible for causing.

- Personal property – items or collections of particularly high value items, usually over $2,500, are insured with a rider in your home insurance. Gun collections, antiques, jewelry and heirlooms are just a few examples of items that might benefit from having a rider in place.

Dwelling coverage recommendations

Gusner recommends buying enough dwelling coverage to rebuild or repair your home with equitable materials in today’s market. It’s also preferable to select replacement cost instead of actual cash value. That means, if your items need to be replaced, you will receive the dollar amount required to buy the same or comparable item, rather than the value of the item at the time of loss

Liability coverage recommendations

Standard homeowners insurance policies will include $100,000 to $300,000 in liability coverage. Gusner suggests $300,000 or more, and here’s why:

“If someone suffers an injury on your property, they may have no other choice but to file a claim to pay their medical bills,” says Gusner. “A dog bite, a trip hazard, even food poisoning leaves you vulnerable to holding the bill for an injury that occurs on your property.”

Shop around yearly for home insurance when yours is up for renewal. Make sure to look into bundling your auto coverage with the same provider to see if the company can give you a good price on great coverages.

Calculate your score now using our Home Insurance Advisor tool.

How to review your health insurance

When buying a health plan, it’s vital to think about your health, your family’s health, your financial situation and what you want out of a health plan. Once you’ve done that, you can dig into the copay, coinsurance, deductible and provider network.

You also may want to figure out the type of plan that works best for you if you have a choice. Plans vary based on costs and provider networks.

The most common types of health plans at a glance:

- PPO – PPO stands for preferred provider organization. Premiums are usually much higher for a PPO than an HMO, but that comes with greater flexibility to choose your service providers and locations.

- High-deductible – HDHP stands for high-deductible health plan. While the deductible is high, plans usually attach a Health Savings Account (HSA). An HSA allows you and your employer to save for your health care.

- HMO – HMO stands for health maintenance organization and is known for its lower premiums and restricted network of doctors and hospitals. What you sacrifice in flexibility, you gain in lower upfront costs.

- POS – POS stands for point of service plan and isn’t nearly as common as PPOs, HDHPs and HMOs. POS plans are a hybrid of PPO and HMOs, meaning the health care consumer gets to choose whether to use HMO or PPO services each time a provider is seen.

- Catastrophic – A catastrophic plan protects you in worst-case scenarios only, like accidents or serious illnesses. These have low premiums but can have substantial out-of-pocket costs.

The Insurance Advisor reviews your current medical plan in comparison to your medical needs at this time.

Health insurance recommendations

Gusner’s advice when it comes to health insurance: Take time to work through different scenarios.

“Your cheapest option is nearly always workplace health insurance. Even then, if your partner also has health insurance through an employer, be sure to crunch the numbers to see if it’s more cost-effective to be on one plan or if it’s cheaper to use each employer’s health insurance separately,” she says. “This step is even more important when you have kids; the premiums for a family can vary by hundreds of dollars per year.”

Calculate your score now using our Health Insurance Advisor tool.

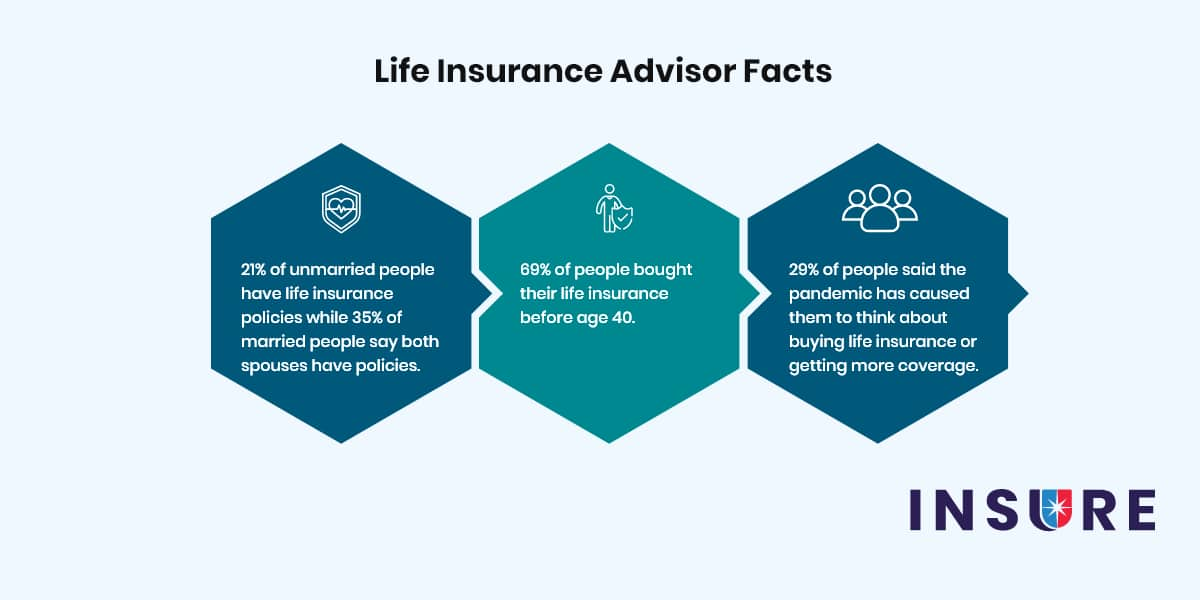

How to review your life insurance

Life insurance isn’t required, unlike many other types of insurance. For that reason, it’s often overlooked in the insurance portfolio; however, life insurance is crucial to help ensure the quality of life for your family in the event of your death when you are a major financial contributor.

The Insurance Advisor breaks down term and permanent life insurance. It looks at your dependents’ needs and your final requests to strategize the best kind of policy and coverage levels to ensure your family’s quality of life.

Life insurance is meant to help pay off expenses like a mortgage, provide funds for funeral expenses, offer your partner a supplemented income for a certain amount of time and even help fund education for your children.

Your mortgage, debts, income and additional expenses, like childcare or education, should influence which life insurance policy is best for you.

Life insurance at a glance

- Term life – provides death benefit protection without any savings, investment or cash-value components. Term life insurance is available for set periods, such as 10, 15, 20 or 30 years. Term life is a popular choice because of the significantly lower cost. However, if you outlive the policy, you may find yourself in a challenging situation to try to buy another life insurance policy.

- Permanent life – provides a death benefit and lets you tap into the policy while you’re alive as part of the cash-value account. As the name implies, the policy doesn’t have an expiration date. Rates are significantly higher than term coverage. Whole life is the most popular type of permanent life policy.

“One of the biggest mistakes you can make concerning life insurance is not telling the beneficiary about the policy and how to access it,” says Megna. “Life insurance companies are under no obligation to reach out to beneficiaries. Most often, the company isn’t even aware the policyholder has died, and it’s a family member who reports the death of a person to the insurance company.”

Calculate your score now using our Life Insurance Advisor tool.

Start your insurance check-up now

When you’ve finished the four sections of the Insurance Advisor, you’ll have a comprehensive review of your auto, health, home and life insurance coverage.

“Our tool is an excellent way to get a complete snapshot of your insurance portfolio. This process could easily take two hours with an in-person insurance advisor, but with this tool, the same guidance will take a fraction of the time.

With this information, you’ll be prepared to have conversations with agents that can help you reduce costs, eliminate useless coverage and raise coverage as your net worth grows,” says Gusner.

After completing your assessment, if you find that you are now in the market to supplement or change your insurance, review the annual Best Insurance Companies to discover the best company and the best value for your insurance needs.