Looking to buy Etsy stock? Shares in the online crafts marketplace have taken a 77% tumble in value over the last seven months— thanks to investor fears over global consumer discretionary spending. But with three acquisitions under its belt and a global brand name, some market analysts have speculated that Etsy stock could be well-placed to weather an economic storm.

Below, we delve into some key Etsy financials and key metrics. What’s more, we outline how to buy stock in Etsy using a popular and regulated broker. We compare established brokerages eToro and Webull, where investors can buy Etsy stock at zero commission.

How to Buy Etsy Stock in 2022

- ✅Step 1: Open a trading account with a regulated broker – Head to the online platform of your preferred broker. Fill in a few details to get started.

- 🔑Step 2: Verification – Supply some proof of ID and address to get verified.

- 💳 Step 3: Deposit – US investors can deposit funds into their account via credit/debit card, bank transfer and a range of e-wallets.

- 🔎 Step 4: Search for Etsy Stock – Locate Etsy stock via the search bar. Users need only enter the Etsy ticker ‘ETSY’.

- 🛒 Step 5: Buy Etsy Stock – Experienced investors conduct their own market research prior to investing any capital in the stock markets.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Ever wondered where to buy stocks in 2022?

Step 1: Choose a Stock Broker

There are many online brokerages where investors can buy Etsy stock. But few offer zero commission on stock transactions as well as a reassuringly high level of regulation.

Below we compare eToro with Webull.

1: eToro

Founded in 2007, eToro has built a user-base of 25m+ investors.

Founded in 2007, eToro has built a user-base of 25m+ investors.

Investors can choose from 3,000+ stocks (with 900+ stocks trading on 15 exchanges internationally), 250+ ETFs, indices, forex, commodities and 70+ crypto coins.

What makes eToro stand out are three factors:

eToro: Zero Commission on Stock Trades

Investors wanting to buy stocks on eToro can do so with no commission fees. The only trading fee to worry about is the spread fee. This is the difference between the price an investor can buy at and the price they can sell at — at any given time. Spread fees tend to move around according to market volatility. But, at the time of writing, the spread fee for Etsy with eToro is just 0.27%.

eToro: Security and Regulation

Trading with a regulated broker simply makes sense. Regulation will not protect the investor from unfavorable market conditions. But it does offer some peace of mind that the brokerage is run correctly.

eToro is regulated in the US by the SEC and FINRA and registered with FinCEN. SIPC provides insurance coverage of up to $500,000 per investor. Regulation further afield is provided by the stringent FCA in the UK, CySEC in Europe, and ASIC in Australia.

eToro: Social Trading

Whether an investor is in search of popular new stocks or old favorites, it always makes sense to get some help with investing. eToro’s Social Trading tools help investors to benefit from the experience of others:

- With CopyTrader, investors can copy other trader’s activity for free. The software works automatically, using allocated funds to match trades in real-time.

- eToro users can also invest in one of 65+ eToro Smart Portfolios, with each comprising a unique strategic position on a particular sector.

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Etsy: | Spread fee of just 0.27% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Webull

Webull is a similar broker to eToro. Based in New York, Webull offers a high level of regulation as well as zero commission on share trading.

Webull is a similar broker to eToro. Based in New York, Webull offers a high level of regulation as well as zero commission on share trading.

Webull actually offers more stocks than eToro, with a fantastic range of 5,000+. The only downside here is that, unlike eToro, very few of Webull’s stocks are based outside of the US.

On top of stocks, Webull allows users to trade via an Individual Retirement Account (IRA), which eToro does not. Webull also offers options trading (which eToro does not either) and a special margin account for traders who want to go short on assets. eToro provides margin trading as standard.

Webull further offers:

- Level 2 Advance (Nasdaq TotalView) charting tools.

- Extended hours trading (pre-market and after-hours).

- 24/7 customer service.

Where Webull really stands out is in customer ratings of its smartphone app. The Webull app has gained an average review score of 4.4/5 on Google Play and an excellent average score of 4.7/5 on the App Store.

Where Webull does not score so highly is in spelling out what spread fees can be expected for each stock. Likewise, investors must handle fractional share trading by entering the fraction of the share they want to buy. With eToro, users need only enter how much they want to spend.

Overall, private individuals wanting to invest in stocks are spoilt for choice when it comes to Webull and eToro.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying Etsy: | Spread fee: not available |

Your capital is at risk.

Step 2: Research Etsy Stock

Investors figuring out how to buy Etsy stock would be well-served by doing some research first.

Below we give an overview of what Etsy is, and how its financials stand up.

What is Etsy?

Etsy is a global e-commerce platform. It specializes in creative goods (often hand-made) like furniture, jewelry, arts, clothing and décor. Founded in 2005, Etsy is headquartered in Brooklyn, New York, US.

Described as a ‘crafty cross between Amazon and eBay’, Etsy acts as a virtual shopping mall, connecting buyers with sellers.

- Sellers each host their own virtual shop.

- Sellers include individuals and professional manufacturers.

Etsy Facts And Figures: 2021

- 120m items for sale on the platform.

- 7.5m sellers.

- 96m buyers.

- 2,402 staff.

Etsy Stock Price — How Much is Etsy Stock Worth?

Investors wanting to buy stock in Etsy can find it on the US NASDAQ Exchange. The Etsy stock symbol is ‘ETSY’.

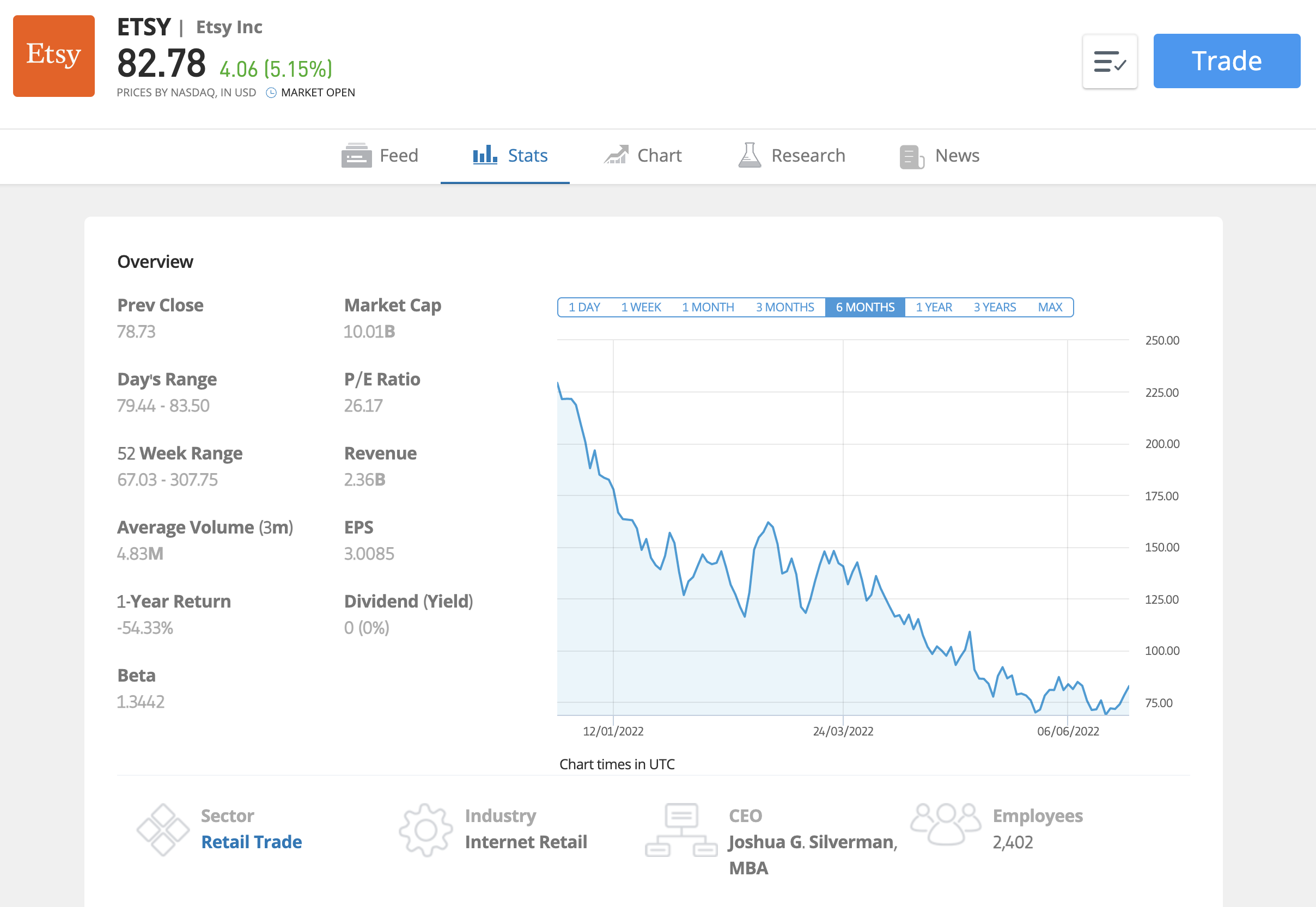

From the Etsy stock chart below we can see that the Etsy stock price today is $82.78.

$96.32

-3.29

(-3.3%)

At close: 12 Oct, 4:00PM EDT - Delayed Price

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Stock Rating

Wall St Analyst RatingN/A

99.61

9530278

3517027

2.18

0.00%

13.68B

39.72x

266.55

N/A (0.00%)

N/A

N/A

| Date | Transactions | Shares |

|---|---|---|

| Last 3 Months | | |

Etsy Stock: Three Key Financial Metrics

From Etsy’s homepage on eToro, we can access a financial overview, income statement, balance sheet and cashflow statement.

Investors considering whether to buy Etsy stock will not want to get overwhelmed by data.

Table: 3 Key Financial Metrics to Assess Any Stock

| Metric | Definition | Shows? |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Quick Ratio | Assets (that can be liquidated in 90 days) plus cash divided by liabilities | The ability of the company to pay off all its debts in 90 days from now |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Etsy EPS (Earnings Per Share): 3.0085

For every share outstanding, Etsy has earned just over $3 in the last financial year. This compares favorably, for example, with eBay’s currently negative EPS of -6.6278.

However, Etsy’s EPS for Q1 2022 is just $0.60. Etsy put this down to their increased staff headcount: ‘the decline in net income was primarily due to increased employee compensation-related expenses, as total employee headcount increased approximately 71% year-over-year, which includes increased headcount from the acquisitions of Depop and Elo7.’

Etsy P/E Ratio: 26.17

Etsy’s relatively high P/E ratio reflects investor belief in its potential to generate revenues over the long-term.

But let us be clear: Etsy is not one of these companies with a high P/E ratio that is not currently making any money.

- The Etsy marketplace attracted Gross Merchandise Sales of $2.8bn in Q1 2022. This was down 2% compared to Q1 2021, but up 177% compared to Q1 2019.

- Etsy says that, ‘GMS performance was impacted by headwinds related to consumer discretionary spending, continued reopenings, and geopolitical events.’ That is fair enough.

Consolidated revenue for Q1 2022 was $579m, up 5.2% year-on-year. But net income — which shows how much money Etsy got through the door after all expenses were paid off — was down 40.1% year-on-year at just $86.1m. Etsy put this decline down to the cost of employing new staff as part of their 2021 acquisitions of Depop and Elo7.

Etsy Quick Ratio: 2.68

Some analysts call the ‘Quick Ratio’ the acid test of a company’s finances. It shows the proportion of assets to debts. Specifically, it shows a company’s capacity to pay off all its debts in 90 days if it needed to by liquidating everything it can.

Etsy’s Quick Ratio of 2.68 shows that, roughly, it has 2.68 times as many assets as debts.

Etsy Financials Summary:

- 2021 Gross Merchandise Sales: $13.5bn.

- 2021 revenues: $2.3bn.

- 2021 net income: $493.5m.

Etsy Stock Dividends

Dividends are payments to shareholders that companies sometimes make.

Dividend stocks are companies which can be relied upon to pay dividends each quarter.

One example of a dividend stock is one of the most popular tech stocks, AT&T, which has increased its dividend payment every year since its IPO in 1984.

But, if an investor is pondering how to buy Etsy dividend stock, they are on the wrong track. Etsy does not currently pay dividends. This is not surprising, given its relative youth as a company and its recent acquisitions. Etsy may pay dividends in the future. Investors should keep an eye out for announcements on the Etsy investor relations page (accessible via its eToro homepage).

Etsy Stock – Fundamentals

From Etsy’s recent stock history, we could be forgiven for thinking that this is a company on the way out. The stock price has fallen by almost 80% in the last 7 months.

But this decline is down to tough economic conditions and a fall in investor confidence in the markets generally.

1: Unique Market Positioning

There are other successful online marketplaces like Etsy where individuals, rather than companies, are particularly welcome. Two in particular are Craigslist and eBay.

- Craigslist

Active across 700 local sites spread across 70 countries, Craigslist hosts classified ads across diverse product categories. Craigslist attracts 60m+ monthly users in the US alone. - eBay

Founded in 1995, eBay is the first successful global online marketplace. eBay hosts a diverse product range from private sellers across 190 global markets, with 142m active buyers.

Etsy differentiates itself from these global names by specializing in crafts and arts goods.

Etsy, though, has several competitors which offer a similar business model of being an online marketplace for (often hand-made) crafts and arts goods.

- Amazon Handmade

Founded in 2015, this is the artisan sales area of global e-commerce platform Amazon. Amazon Handmade charges a 15% fee for sellers, but no listing fee. - Druzza

Founded in 2020 and based in Sri Lanka, Druzza is an online marketplace featuring crafts, electronics and other more mainstream product categories. - Bonanza

Founded in 2008, this is a US-based marketplace for fashion, health and beauty, home and garden goods. Bonanza features 25,000 sellers and a basic selling fee of 3.5%.

But Etsy beats them it all when it comes down to global reach and brand recognition. Etsy says that, since 2019, it has become a ‘household’ name in its core regions and increased in size by 2.5x. Etsy’s core markets are the US, the UK, Germany, Canada, Australia, France and India.

Whereas eBay is the general online marketplace to beat, Etsy is the specialist crafts marketplace to beat. But no other company is close when it comes to global reach.

2: The Etsy Marketplace has Three Revenue Streams

The main Etsy marketplace has three revenue streams:

- The firm takes a 6.5% cut of all sales plus a listing fee of $0.20 per item. We can compare this 6.5% cut from sellers to Amazon Marketplace’s figure of 15%. Maybe Etsy will push it up to increase profitability?

- Seller Services: these are targeted at Etsy sellers and include on-site advertising, payment processing, and shipping label printing. Seller services are Etsy’s fastest-growing revenue stream.

- Third-party payment processor fees.

3: Etsy Pro-active in Making Strategic Acquisitions

In addition to its core craft/art e-commerce business, Etsy has made three acquisitions since 2019.

- Reverb, a musical goods e-commerce platform

Reverb specialises in the trade of musical instruments. Etsy acquired Reverb in 2019. -

depop, the British online second-hand fashion resale app

Etsy acquired depop in 2021 specifically to appeal to Generation Z consumers. Vox.com reported of the $1.65bn acquisition that, ‘Etsy is staking its claim on a much younger generation of sellers and shoppers with the Depop purchase, rather than trying to reach those buyers on its own platform.’ - elo7, an online handmade goods marketplace

Etsy acquired elo7, the ‘Etsy’ of Brazil, in 2021.

In Q2 2022, Etsy plans to increase its Gross Merchandise Sales by $300m from Q1’s figure of $2.9bn. The firm also expects revenues to increase by $50m from $540m to $590m. Etsy must achieve these predictions, or the share price will suffer.

These targets, though, are not as impressive as they sound. Even if Etsy hits its mark, Gross Merchandise Sales will still be down 10% year-on-year. That is the price Etsy has paid as investors worry about global price inflation.

CEO Josh Silverman says, ‘Despite the near-term uncertainty, we have ample reason to remain very optimistic for the long-term … We truly believe we offer something different – across every brand in our house – and that the size of the prize for Etsy is enormous.’

Step 3: Open a Trading Account

Wherever an investor chooses to buy Etsy stock, the onboarding process with an online broker tends to follow the same 5 steps:

- Sign up

- Verify ID

- Deposit Funds

- Search for Etsy Stock

- Buy Etsy Stock

Etsy Stock – Investment Sentiment

In concluding our outline of Etsy as a stock, we present one key pro and one key con.

BUY: Analysts suggest ‘Moderate Buy’

From Etsy’s homepage on eToro, we can see that analysts are fairly bullish on the stock.

The Etsy stock forecast for the next 12 months is a target price of $129.24. That is the average of 17 price predictions by professional analysts polled by Tipranks on behalf of eToro.

SELL: Consumer Discretionary Income Under Pressure

With price inflation the worst it has been for 40 years in the US, consumers are projected to have less money to spend on the type of items that Etsy sells. This does not bode well for revenues over the long-term — although Etsy confidently plans to increase revenues by $50m by Q2 2022.

Etsy is not alone in seeing its value to investors under pressure thanks to global economic woes. The value of online marketplaces in general has been hit.

- In the second week of June, eBay stock fell 5% on news that investment bank Goldman Sachs had downgraded it from ‘neutral’ to ‘sell’. Goldmans said that there was a risk that revenues would not grow given the pressures on global consumer spending.

Investors considering whether to buy Etsy stock should not, though, be too discouraged. It is quite possible that fears over price inflation have been fully priced into the stock, which we have witnessed fall by almost 80% in 7 months.

Conclusion

Above we have outlined a few key essentials about Etsy as an investor stock. On the one hand, we note that the share price has been tumbling down to fears over the global economy. On the other hand, we note that professional analysts are bullish on Etsy, and expect its share price to be up 55% in 12 months time.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor