I nsure.com’s ninth annual Mother’s Day Index shows our appreciation for all that moms do for our families.

nsure.com’s ninth annual Mother’s Day Index shows our appreciation for all that moms do for our families.

This year, mom gets a well-deserved raise.

Our annual Mother’s Day Index assigns an annual salary to the total value of common family duties. That value is based on the most recent Bureau of Labor Statistics salary data and reflects the most reasonable job titles for the many hats that moms wear.

This year, Mom received a modest increase of 3.5 percent, taking her annual salary to $71,297 — the highest mom has ever received in our survey. And since inflation is projected at 2 percent for 2019, there’s a chance that she might have a little cash on hand for some quality quiet time. A spa day? A weekend getaway with friends? Maybe. But who are we kidding? She’ll probably put it into the kids’ college funds.

When does school start?

Mom’s highest wage increase this year came from her role as a summer activity planner, up 11 percent. Swim lessons, arts and crafts, reading time, games in the backyard… trying to coordinate ways to keep the kids out of trouble all day long is, well, a lot of work — and this year, some of that hard work is actually paying off.

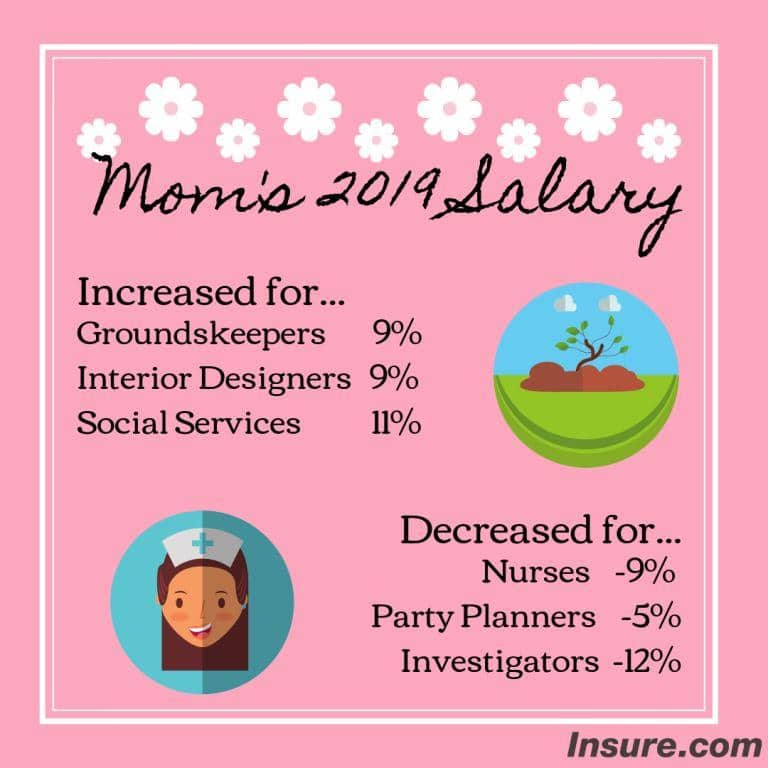

The jobs with the highest increase in payable terms are:

- 11% – Summer activity planner

- 9% – Yard work

- 9% – Fixing up the house

The jobs with the largest decline in payable terms are:

- -12% – Private detective/investigator

- -9% – Licensed vocational nurses

- -5% – Party planner

Mother’s Day job values index 2019

| BLS occupation title | Mother’s job description | Hours per week | Weeks per year | Mean Hourly Wage | Change from 2018 | Annual earnings |

|---|---|---|---|---|---|---|

| Cook | Cooking | 14 | 52 | $10.93 | 0.2% | $7,953 |

| Taxi drivers and chauffeurs | Driving | 9 | 52 | $11.25 | -0.7% | $5,265 |

| Other teachers and instructors | Helping with homework | 10 | 40 | $21.00 | 2.4% | $8,400 |

| Childcare worker | Taking care of the kids | 40 | 52 | $12.30 | 3.8% | $25,584 |

| Licensed practical and licensed vocational nurses | Nursing wounds | 2 | 12 | $18.58 | -8.7% | $446 |

| Maids and housekeeping cleaners | Cleaning up | 10 | 52 | $11.43 | 4.1% | $5,941 |

| Meeting & convention planners | Planning parties | 8 | 8 | $25.15 | -5.5% | $1610 |

| Miscellaneous community and social service specialists | Summer activity planner | 40 | 12 | $22.03 | 11.4% | $10,572 |

| Hairdressers, hairstylists, and cosmetologists | Haircuts | 0.5 | 52 | $13.70 | 5.2% | $356 |

| Personal care aides | Shopping for the family | 3 | 52 | $12.33 | 2.9% | $1923 |

| Accountants and auditors | Family finances | 0.5 | 52 | $27.70 | 4.0% | $720 |

| Grounds maintenance workers | Yard work | 1 | 52 | $14.30 | 9.0% | $744 |

| Interior designers | Fixing up the house | 5 | 8 | $23.30 | 8.8% | $932 |

| Private detectives and investigators | Finding out what the kids are up to | 5 | 8 | $21.28 | -11.6% | $851 |

| TOTAL | 148 | 3.5% | $71,297 |

Multitasking like a mother

As if this list of tasks wasn’t enough, Insure.com received feedback over the years from readers who say there’s more work that should be added to mom’s list. Where does mom find the time? Well, Insure.com believes that Mom can handle a few different tasks at the same time. Talking to the kids about their friends and what happened when a BFF sat next to someone else at lunch is something that can be discussed while making dinner and rotating laundry.

| BLS occupation title | Mother’s job description | Hours per week | Weeks per year | Mean hourly wage | Annual earnings |

|---|---|---|---|---|---|

| Baker | Making baked goodies for bake sale, Girl Scouts meetings, Cub Scout meetings, birthdays, etc. | 3 | 8 | $13.33 | $320 |

| Counselor | Talking to kids about relationship problems | 5 | 40 | $21.46 | $4291 |

| Judge | Breaking apart fighting kids and deciding who did what and the punishment | 3 | 50 | $40.05 | $6,008 |

| Laundry | Washing and folding family laundry | 4 | 50 | $10.40 | $2080 |

| TOTAL | 15 | $12,379 |

These additional tasks take Mom’s salary to a whopping $83,676. But before we get too excited, let’s remember it’s an imaginary salary for a very real amount of hard work — frequently coming after an already full day of work.

This year for Mother’s Day, maybe give her the gift of some time not spent on family chores. Many have heard the expression, “Happy wife, happy life.” But perhaps even more true could be, “Happy mom, life is the bomb.”

The myth of Mom and the reality of family

While it comes out in time for Mother’s Day, Insure.com’s Mother’s Day Index should be considered as “The Primary Caregiver Index.” We know as well as you do that families come in all shapes and sizes. Maybe Dad is the primary caregiver. Maybe it’s a grandparent. Whoever it is in your family, we want to celebrate that person’s role by acknowledging all he or she does, and by reminding you that having a financial safety net is paramount to your family’s future.

Insure.com finds a light-hearted way to show families the value of the primary giver — whoever it may be. Stop and think about the person who does all these tasks on a daily basis. And now, imagine if that person were no longer there. Thinking about loss can be uncomfortable and emotional, but being prepared with a life insurance policy that would help protect the quality of life for your loved ones should the worst happen is certainly worth a little discomfort.

Life insurance protects your quality of life

There are many reasons why people go without life insurance: they believe it’s too expensive, they think their employer-paid policy is sufficient, or they think it’s just “extra” money received if a loved one dies.

The goal of the Mother’s Day Index is to show that losing this critical role in your family can be financially devastating — even if you didn’t have financial problems previously. If your primary caregiver watched the children, can you now afford to put the children into daycare? If both you and your partner worked, can you afford your mortgage and monthly bills without that income? Can you afford to hire help with the recurring chores while you take on additional family responsibilities?

Consider these findings from the 2018 Insurance Barometer survey report by LIMRA and the non-profit life insurance awareness association, LifeHappens.org:

- Almost half of respondents would feel the financial adversity from the loss of their primary wage earner in just six months, and more than a third would feel adversity in a month or less.

- Among married/partnered respondents, one-third wish that their spouse or partner would purchase more life insurance, while an additional 16 percent are not sure how much life insurance protection their spouse or partner has.

- At least 41 percent say they don’t have any life insurance.

- Approximately 63 percent have put off buying life insurance based on the belief that it costs too much, but consumers tend to overestimate the price. For instance, when asked how much a $250,000 term life policy would be for a healthy 30-year-old, which is about $160 a year, most estimate it was more than three times the actual cost.

If you’re not sure how much life insurance coverage you would need, simply visit Insure.com’s life insurance calculator to input some basic answers about your coverage needs and get an immediate estimate of the recommended policy amount.

But maybe that’s not you. Maybe you dialed in your insurance policies a long time ago. You checked that adulting box and never looked back. Unfortunately, insurance policies aren’t a “set-it-and-forget-it” kind of checkbox. Maybe you didn’t own a home at the time. Perhaps you’ve added another child to the household since then. You haven’t stayed the same over all that time, and neither have your assets.

That’s why Insure.com created the Insurance Advisor, a tool designed to help you measure your current assets and understand any holes in coverage (life, health, auto or home insurance) you might have. Think of it like a checkup on the health of your insurance coverage.

Celebrating everyone who is busy putting family first

Insure.com wants to be sure that in between the soccer practices and movie nights, the homework help and breaking up of sibling fights that you can rest a little easier knowing your family, and everything you’re working for, is protected. This Mother’s Day, be sure to give thanks to that special mom in your life — or whoever it is that is putting family first.