Carbon credits are a market worth exploring for those who wish to make their portfolio more sustainable. However, buying and selling carbon credits directly might invite uncomfortable risk for some investors.

That being said, it is also possible to gain exposure to this market by investing in companies that trade carbon credits.

Therefore, in this guide, we explore the best carbon credits stocks for 2022 – considering their performance history as well as how they contribute to protecting the environment.

11 Popular Carbon Credits Stocks to Watch in 2022

The following list represents some of the best stocks that are involved in the carbon credits market:

- IMPT – Gain Exposure to Carbon Credits via Digital Tokens

- Tesla – Most Popular Carbon Credit Stock on Wall Street

- Microsoft – Tech Stock With Strong Carbon Offset Program

- Nike – Sports Company With Zero Carbon Initiatives

- Equinor – Energy Company With Carbon Capture Technology

- Plug Power – Carbon Credit Stock Producing Green Hydrogen

- Amazon – Carbon Stock Focusing on Nature-Based Solutions

- Schlumberger – Leader in Carbon Capture and Storage

- Shell – Energy Company Aiming to Become Carbon Neutral

- Occidental – Petroleum Company Capturing Carbon

- Carbon Streaming Corp – First Publicly Traded Carbon Credit-Focused Company

For beginners, we have prepared a guide on how to invest in stocks that will offer more insight into this marketplace.

A Closer Look at Carbon Credits Stocks

As countries across the world are taking the threat of climate change more seriously, carbon credits are quickly emerging as a popular investment concept.

However, at this moment in time, other than climate change stocks there are relatively few ways to get into this market as a retail client.

One way to approach a carbon credits investment is by trading stocks of companies that are related to this field. Below, we discuss some of the best carbon credits stocks in the market right now – some of which might appeal to socially responsible investors.

1. IMPT – Gain Exposure to Carbon Credits via Digital Tokens

We have already established that stocks are one of the most effective ways to invest in the carbon credits market – at least for retail clients. With that said, there is another to consider that offers direct exposure to carbon credits – without having to go through any compliance market.

In particular, IMPT offers carbon credits in the form of digital tokens, or more precisely, NFTs. This crypto project is set to launch in November 2022 with an attractive proposition for socially responsible investors. The project plans to partner with carbon offset programs from across the world, offering an easy way for companies to purchase carbon credits.

In effect, companies can choose which project they want to invest in and buy carbon credits. These will be offered as NFTs, which they can burn to offset their emissions. In return, firms will be offered an additional NFT that they can hold on to with the aim of generating capital gains in the future – if the value increases.

Individual investors on the other hand can also purchase carbon credits directly. The only difference is that they need not burn their NFTs. Instead, they can adopt a HODL strategy to cash out later, if and when the price of carbon credits goes up in the market.

However, to buy these carbon credits, investors will need to purchase IMPT digital tokens. The token’s presale is set to take place in several stages – with the price gradually increasing at each phase. This means that early investors will be able to obtain tokens at a discounted price.

To find out more about the project, visit the IMPT website and check out the whitepaper.

Another way to get more information about this green project is by subscribing to the IMPT Telegram channel.

2. Tesla – Most Popular Carbon Credit Stock on Wall Street

Tesla is a popular tech stock and one of the best renewable energy companies that needs no introduction. This company is best known as a manufacturer of electric vehicles, although it is also involved in renewable energy generation and storage. Apart from EVs and solar panels, Tesla also makes money by selling carbon credits.

As an EV manufacturing company, Tesla receives carbon credits from various regulatory authorities, such as the California ZEV program making it one of the best climate change stocks in 2022. Since the company produces fewer emissions than its allowance, Tesla is able to sell its excess carbon credits to other entities and in particular – other automakers.

In fact, Tesla’s profits over the years are partly fueled by the sales of carbon credits. To offer some insight, regulatory credit sales went from $986 million in 2019 to $1.46 billion in 2021. During the first two quarters of 2022, this segment brought in sales worth $679 million and $344 million, respectively.

Apart from its carbon credits segment, Tesla continues to dominate the EV sector. The company reported a revenue of $16 billion for the third quarter of 2022, translating to year-over-year growth of more than 40%. It also has a healthy balance sheet that boasts nearly $19 billion in cash and short-term investments.

Given these factors, it is no surprise that the price of Tesla stock has enjoyed tremendous growth in recent years. In the past five years alone, Tesla stock has increased by nearly 1,200% in value. In addition to this, Tesla’s energy business is also growing rapidly. All things considered, some investors will consider Tesla as one of the best carbon credits stocks for ESG investing.

ESG rating: A

3. Microsoft – Tech Stock With Strong Carbon Offset Program

Unlike Tesla, Microsoft does not have any spare carbon credits to trade. Instead, it has implemented a low-carbon program in order to offset its emissions. The company plans to become carbon-negative by the end of 2030 and even aims to remove its historical emissions by 2050.

To accomplish this, Microsoft is already investing heavily in global carbon offset programs. In 2021, the company purchased 1.3 billion carbon credits, most of which were linked to forestry projects. It is also focusing on becoming a net-water-positive and zero-waste company by 2030.

In addition to this, Microsoft has announced that it will invest $1 billion over the next few users to develop carbon removal technologies. This tech firm continues to report attractive revenues and net profits, which is another reason why investors might want to buy Microsoft stock.

Over the past five years, the stock has returned over 220% to its investors – which is far and beyond the market average. It is worth considering that among popular tech stocks, Microsoft is one of the few companies to offer dividends. However, the running yield at the time of writing is just 1%.

ESG rating: AAA

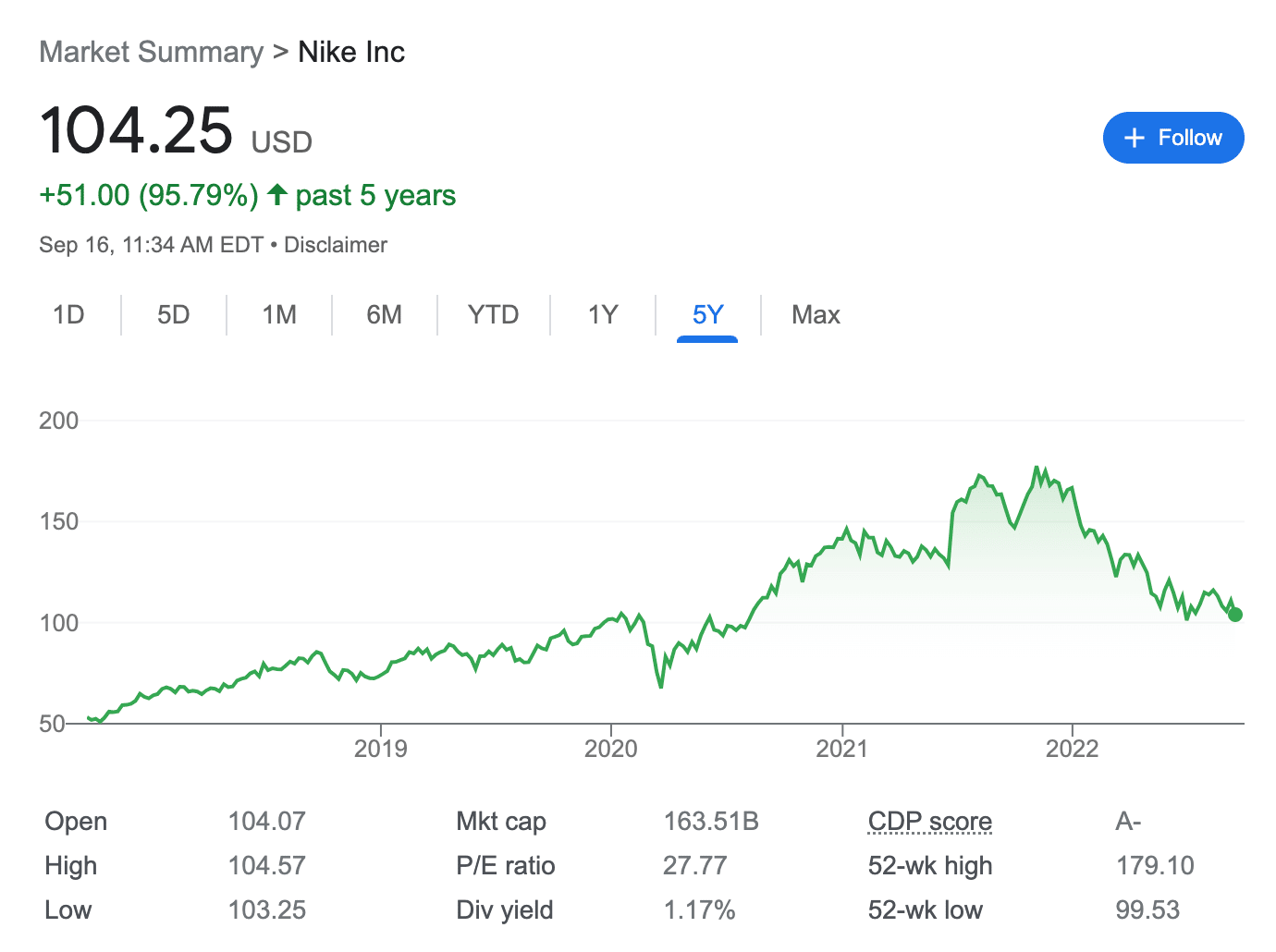

4. Nike – Sports Company With Zero Carbon Initiatives

When researching the best carbon neutral stocks, Nike is not likely to be the obvious choice. However, the company has adopted a serious stance toward tackling climate change. Its ‘Move to Zero’ venture represents its commitment to sustainability.

Under this program, Nike aims to minimize its environmental footprint not only as a business but also as a brand. For instance, the company has plans to power all of its owned and operated facilities with 100% renewable energy by 2025. It also aims to reduce its carbon emissions by 30% in the lead-up to 2030.

The company will also divert footwear manufacturing waste and upcycle them as are materials for shows and new jerseys. Nike has also set up programs to covert waste into playgrounds, running tracks, and courts.

In a nutshell, investors can buy Nike stock knowing that the company has undertaken serious measures to reduce its carbon footprint. In addition to its carbon-cutting endeavors, Nike is also a successful business with strong dominance in the sports appeal market.

The company boasts almost 50% of the athletic footwear market in North America alone and nearly one-third of the rest of the world. Nike stock has gained nearly 100% in value over the past five years. However, the company has faced some supply disruptions since the pandemic came to fruition – which has slowed its stock price momentum.

As of writing, Nike is trading at around $100 – around 40% less than its 52-week high back in November 2021.

ESG rating: A

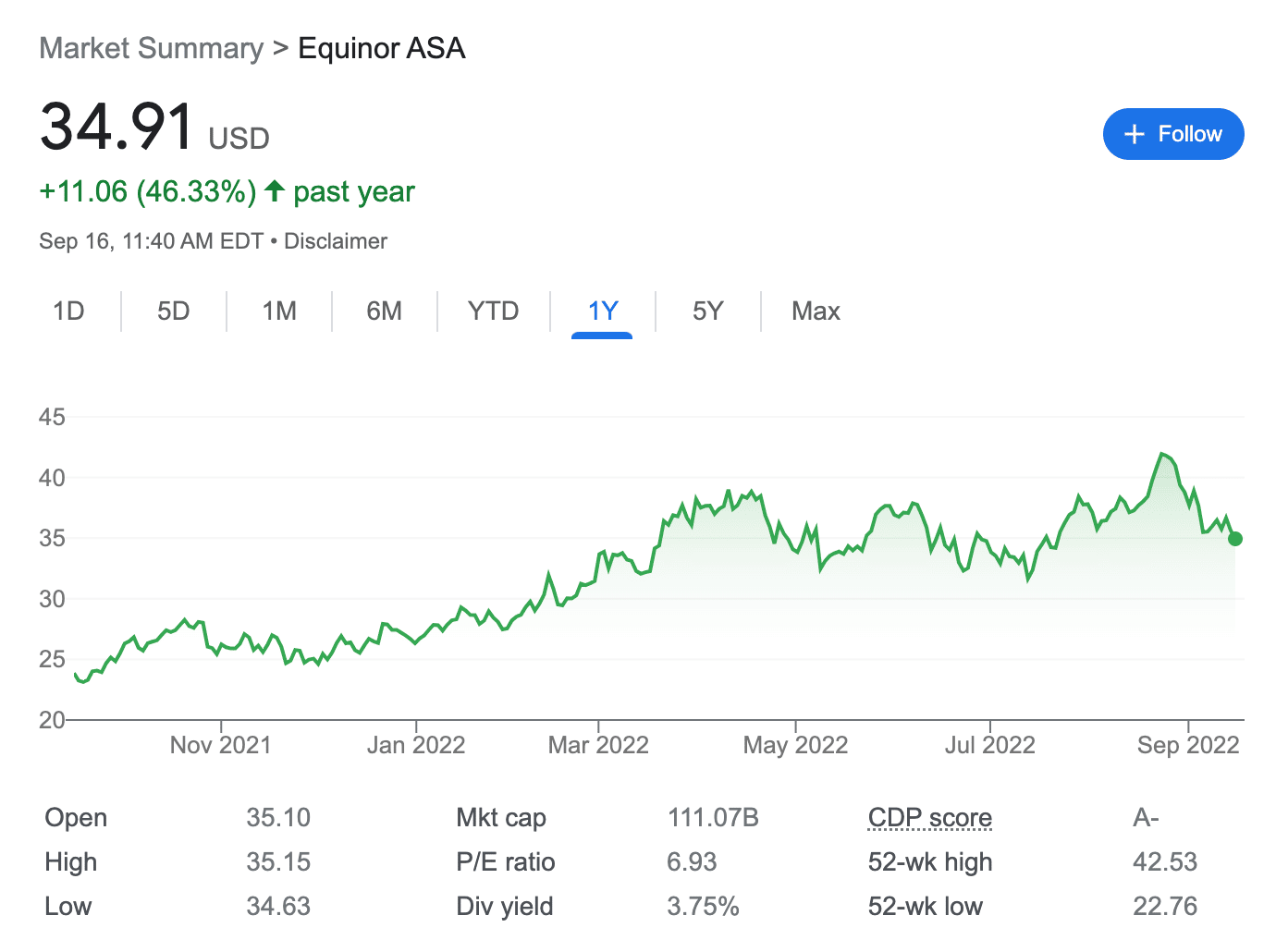

5. Equinor – Energy Company With Carbon Capture Technology

Equinor is primarily an energy company specializing in the exploration of petrol. It is the second-largest producer of natural gas in Europe. Headquartered in Norway, the firm has operations within its home country as well as in other parts of the world. In line with other prominent oil companies, Equinor has also shifted its focus to clean energy solutions.

It has an active carbon capture program, which has expanded to 30 countries. At the time of writing, Equinor is involved in the research and development of the ‘Northern Light’ project – which aims to facilitate storing of carbon dioxide in the seabeds off the coast of Norway.

Moreover, Equinor’s growth is also fueled by the economic unrest in Europe. As Russia threatened to cut off Europe, the EU is turning to companies such as Equinor for its energy needs. This has driven the growth of this stock over the past few months.

The value of Equinor stock has increased by 30% since the beginning of January 2022. This carbon stock also pays a dividend – at a running yield of nearly 4% as of writing.

ESG rating: AAA

6. Plug Power – Carbon Credit Stock Producing Green Hydrogen

Plug Power is an American company that develops hydrogen fuel cell systems. Although this clean energy technology might not be as popular as solar or hydropower, many speculate that it has the potential to grow in the coming years. Moreover, Plug Power is also focused on producing green hydrogen – which emits a low or zero carbon footprint.

This makes Plug Power one of the top players in the green energy market. Moreover, Plug Power has already committed to producing up to 12,500 tons of liquid and gaseous green hydrogen for the European market annually.

This firm is also helping other multinational companies meet their energy goals. In August 2022, Amazon announced that it would buy thousands of tons of carbon-free green hydrogen from Plug Power per year. This deal includes Amazon acquiring a stake in Plug Power, worth over $2 billion.

By 2028, Plug Power hopes to produce 1,000 tons of hydrogen per day. The company has also demonstrated enormous growth over the past few years. For instance, in the prior five years alone, the price of this carbon credit stock has increased by over 1,000%.

ESG rating: A

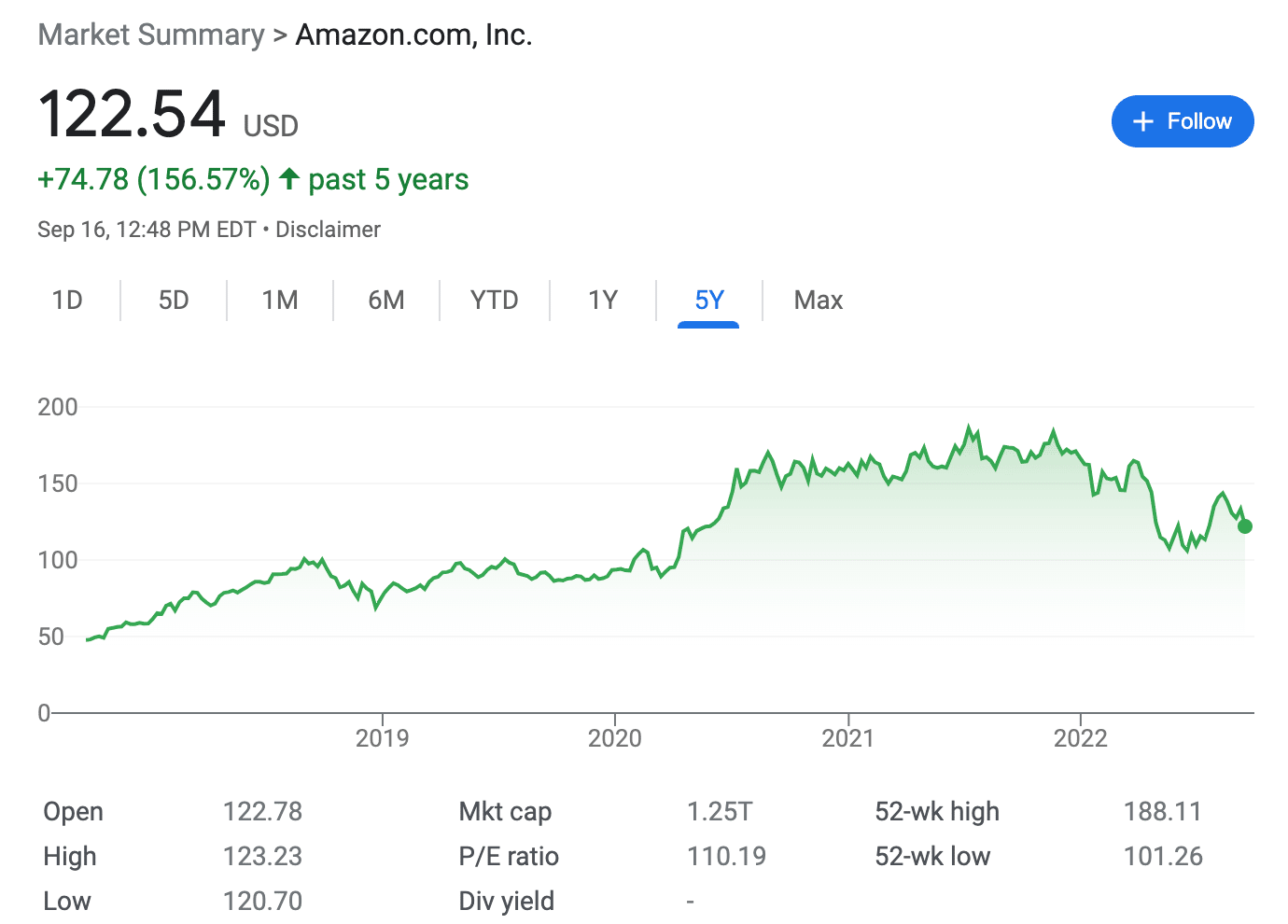

7. Amazon – Carbon Stock Focusing on Nature-Based Solutions

Not all investors who buy Amazon stock will be aware of the company’s carbon offset initiatives. Amazon has taken a two-fold approach to achieve its commitment to the Climate Pledge and attain net-zero carbon by 2040. First, the company is investing to eliminate emissions within its businesses’ value chain.

For instance, as we pointed out above, Amazon has signed up for a deal with Plug Power to buy green hydrogen, which will power a range of its vehicles used in delivery operations. Second, Amazon is investing in nature-based and technological solutions to produce carbon credits and help other companies neutralize their emissions.

One example of this includes the company’s partnership with The Nature Conservancy to remove up to 10 million metric tons of carbon dioxide emissions.

Needless to say, this is only one of the many reasons why investors might want to consider Amazon. After all, Amazon is the world leader in e-commerce, and its cloud-computing and advertisement segments are also increasing their respective market shares. In terms of historical performance, Amazon stock has recorded a growth of more than 150% over the past five years.

ESG rating: BBB

8. Schlumberger – Leader in Carbon Capture and Storage

Since 2005, Schlumberger has led over 60 carbon capture projects across the world. This makes Schlumberger one of the earliest players to enter the space of carbon capture and storage. In fact, Schlumberger’s DELFI cognitive E&P environment is used across the world by carbon capture companies.

Schlumberger will also deploy this software for the ‘Northern Lights’ carbon capture program that is underway in Norway. As is evident, this company plays an important role in removing carbon emissions from across the world. That being said, Schlumberger is primarily an oil stock.

However, its diversified portfolio and focus on green energy are factors that might make this stock appealing to socially responsible investors.

The stock price of Schlumberger has increased by 30% over the past 12 months. The company also pays a running dividend yield of nearly 2% as of writing.

ESG rating: AA

9. Shell – Energy Company Aiming to Become Carbon Neutral

Although Shell operates in the shale industry, it has already announced that it will cut down its oil production to focus on green energy. Shell is also investing in carbon capture technologies which might make be a positive indicator for ethical investors to consider this stock.

It is also invested in the ‘Northern Light’ carbon capture program, along with Equinor and Schlumberger. Looking at Shell’s performance history, the stock has gone through some serious volatility in recent years.

Over the past five years, the stock has lost nearly 12% in value – largely due to the bear market associated with the pandemic. However, the stock has recovered since then, gaining about 30% in the previous year. This is a result of record oil prices in 2022. Shell is paying a running dividend yield of 3.5% as of writing.

ESG rating: AA

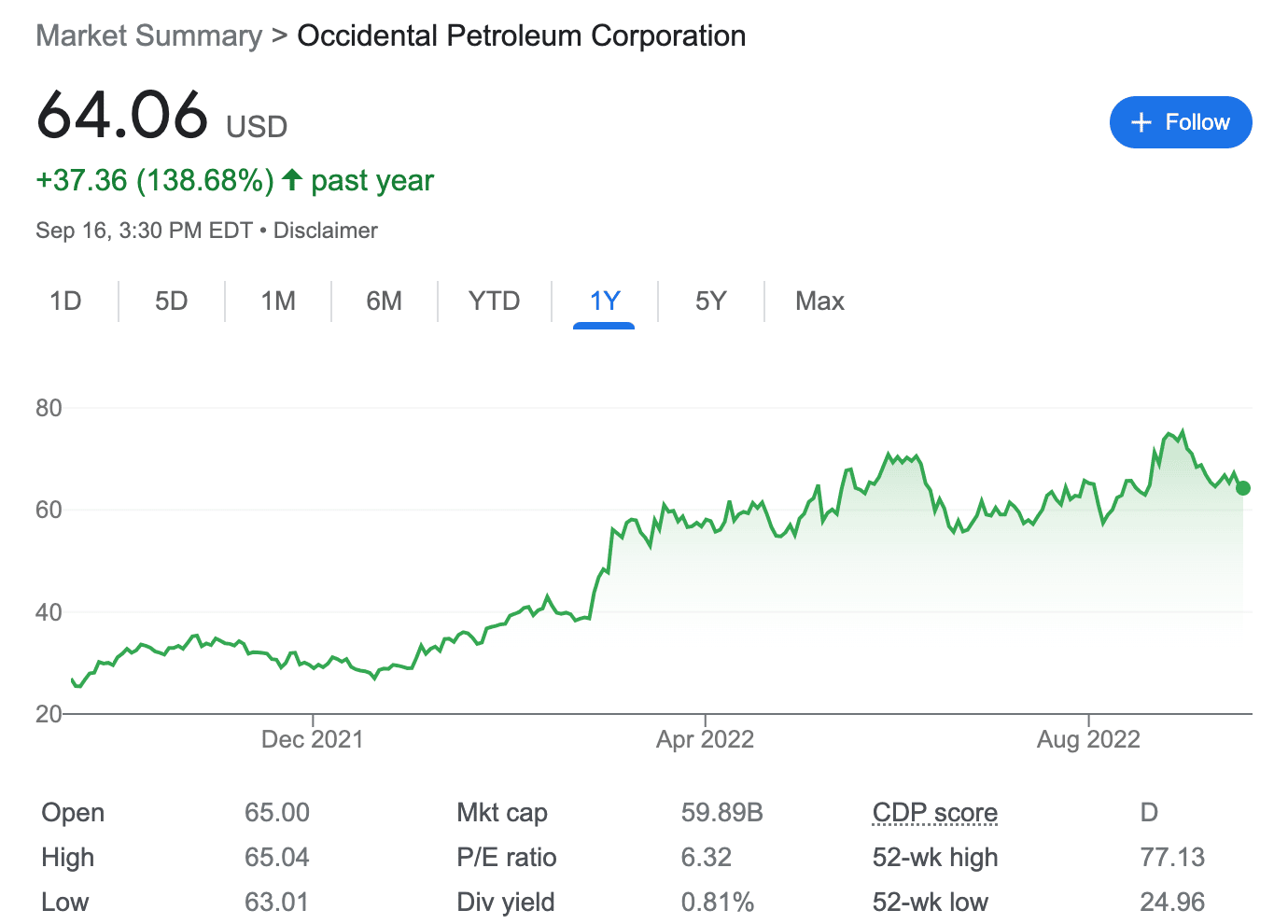

10. Occidental – Petroleum Company Capturing Carbon

Occidental Petroleum is one of the biggest shale companies in the North American region, Like the other oil stocks discussed here, Occidental is also looking to make progress towards a clean energy future. By doing so, this company is positioning itself as a key player in the industry of carbon capture.

It is not only attempting to reduce greenhouse gas emissions from its operations but also to capture and retiree more carbon than it emits. The company’s stock has gained nearly 140% in value over the past year. While the stock has historically performed well, potential investors should also note that the firm is carrying a net debt of around $26 billion.

More pertinently, cash in hand is only around $2 billion – which makes the debt-to-cash ratio a concerning figure. Therefore, debt reduction is one of the prime objectives of the company’s management at the moment – which might affect how much money Occidental invests into carbon capture in the near future.

ESG rating: BBB

11. Carbon Streaming Corporation – First Publicly Traded Carbon Credit-Focused Company

Carnon Streaming is a Canadian company that has a unique proposition to investors. This company offers its investors direct exposure to the carbon credits space. It plans to enter into streaming agreements with companies, governments, and individuals to sell carbon credits in the financial markets.

It will also be purchasing carbon credits and hold them for long-term appreciation. In addition to this, Carbon Streaming will also invest in or acquire companies involved in the carbon credits industry.

In other words, investors looking for a stock with direct exposure to this market might find that Carbon Streaming is an ideal fit. The company started trading on Canada’s NEO exchange in June 2021. Carbon Streaming is currently focusing on building a diversified portfolio of carbon credits projects.

ESG rating: N/A

What are Carbon Credits Stocks?

In simple terms, carbon credits are permits to emit greenhouse gases. Typically, it allows the owner to emit one ton of carbon dioxide – although the volume can vary between different gases.

Carbon credit trading refers to the buying and selling of these permits in the financial markets.

Here is a simple explanation of how this works:

- Countries across the world have set up their own emission trading systems.

- Under these schemes, companies are offered an allowance of carbon credits.

- If companies struggle to stay within this allocated amount of carbon credits, they will have to either cut off emissions or buy more.

- On the other hand, if a company does well at reducing emissions, it can sell spare carbon credits to other entities.

Most of these exchanges happen under the ‘cap and trade’ system set up by the governments. However, there is also a voluntary market where participants can buy and sell carbon credits without having to follow compliance guidelines.

Nevertheless, both these systems apply to countries or entities producing or emitting carbon dioxide. In other words, there is very little room for individual investors to gain exposure to conventional carbon credits markets.

This has led to the emergence of other financial instruments that offer access to this market – such as ETFs, futures, and of course, stocks.

That is, investors can look for companies that sell carbon credit surpluses or have set up programs to reduce their greenhouse gas emissions. This is one of the simpler ways for investors to participate in the carbon credits markets.

That said, there are indeed other ways to invest in carbon credits – read our full guide on the topic to know more.

Why do People Invest in Carbon Credits Stocks?

Before we jump into the finer details of how to buy carbon credits stocks, let’s talk about why investors should consider this market.

Those who wish to gain exposure to the carbon credits industry might find the following factors beneficial to their portfolio:

- Financial Return – Apart from the ethical appeal, many investors are looking to buy carbon credit companies stock to generate a financial return. Given the rate of climate change, it is possible that the demand for carbon credits will go up in the future, which might fare well for companies aligning themselves to a low-emission strategy.

- Socially Responsible Investing- Individuals are increasingly looking for ways to invest their money in a way that aligns best with their values. For some, this might mean buying ethical stocks that make a positive impact on the environment. By investing in carbon stocks, investors are supporting companies that seek to reduce their greenhouse gas emissions.

- Accessibility – There are indeed several ways to invest in carbon credits – via ETFs, futures, commodities, and more. However, the easiest and perhaps, most accessible option would be to invest in individual companies.

At the same time, investing in a carbon credits stock can also be risky. Investors need to consider not only the carbon credits market but also other factors that can impact the value of the stock itself.

For instance, even if the price of carbon credits goes up, if the demand for EV vehicles goes down, Tesla stock will likely decline in value.

In other words, investors should be cautious when choosing carbon credits stocks for their portfolio.

Regulated Stock Brokers Offering Carbon Credits Stocks

When contemplating investing in a carbon credit stock, it is crucial to make sure that trades are executed via a regulated brokerage platform. Preferably, this broker should also offer access to multiple markets and international stock exchanges.

eToro is a popular option to consider that lists nine out of the 10 carbon credits stocks that we discussed above making it one of the leading carbon credit brokers in 2022. It charges no commissions for stock trading, making it an ideal choice for those looking to minimize brokerage fees. Furthermore, eToro is a multi-asset broker.

is a popular option to consider that lists nine out of the 10 carbon credits stocks that we discussed above making it one of the leading carbon credit brokers in 2022. It charges no commissions for stock trading, making it an ideal choice for those looking to minimize brokerage fees. Furthermore, eToro is a multi-asset broker.

More specifically, this provider lists some of the best carbon credits ETFs and commodities. Users of this broker can also gain access to the forex and cryptocurrency market at competitive fees. It also processes deposits in US dollars for free and supports multiple payment methods.

eToro users have the option to fund their accounts with credit/debit cards, e-wallets, and bank transfers. Moreover, users also have access to other innovative features – such as Copy Trading. For instance, eToro users can copy the trades of another investor who has an ethical portfolio.

This means that the trades placed by the chosen investor will be repeated in the user’s portfolio. In addition to this, eToro also offers professionally managed Smart Portfolios that allow investors to diversify into specific niches with one click. What’s more, investors can buy carbon credits stock from just $10 via fractional trading.

And finally, eToro is regulated by several governing bodies – including the SEC from the US, FCA in the UK, ASIC in Australia, and CySEC in Cyprus.

How to Invest in Carbon Credits Stocks

Before concluding this guide, we have prepared an in-depth explanation of how to invest in IMPT – one of the best carbon credit stocks in the market.

Step 1: Open a Cryptocurrency Wallet

To join the IMPT token presale, investors must create a cryptocurrency wallet which supports Ethereum-based assets. For example, MetaMask is one of the most popular crypto wallets which is compatible with the IMPT token presale.

Download a browser extension or mobile app which MetaMask supports, and follow the steps displayed on the screen to continue.

Step 2: Buy ETH/USDT Tokens

IMPT tokens can be swapped with either Ethereum (ETH) or Tether (USDT) tokens. If you do not hold any of these assets then head over to a suitable cryptocurrency exchange, buy ETH/USDT and transfer the tokens to your MetaMask wallet.

Step 3: Connect MetaMask with the IMPT Presale

Head over to the IMPT.io platform to link your MetaMask wallet to access the presale.

On the website, click on ‘Connect Wallet’, choose MetaMask as your crypto wallet option and connect the wallet with the presale.

Step 4: Buy IMPT Tokens

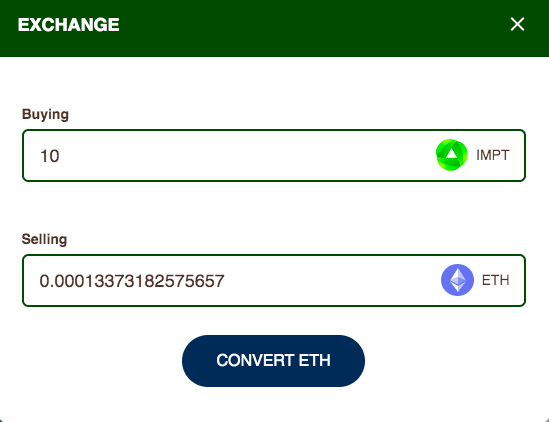

After connecting your wallet, you can choose to purchase IMPT with either ETH or USDT. Select your preferred asset and enter the amount of IMPT you wish to purchase.

To continue, a minimum amount of 10 IMPT/ 0.000133 ETH must be purchased. Click on ‘Convert ETH’ to confirm the buy order. Alternatively, ETH can be purchased directly with a VISA card, Apple Pay or a bank transfer.

Conclusion

This comprehensive guide has reviewed the best carbon credits stocks for investors to consider in 2022. We have also explained how companies involved in the carbon credits industry are working towards making the planet a more environmentally-friendly place.

However, the carbon credits markets can be extremely risky. Therefore, investors should do their due diligence and gain a good understanding of how the carbon credits sector works before risking any capital.

We rank IMPT as the best carbon credit investment right now – click below to learn more.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor