Since the Medifast stock price surged 586% higher during the pandemic, interest in learning how to buy Medifast stock has dramatically increased.

In this article we research the company’s fundamentals, and go through how to buy Medifast stock with a fully regulated stock trading platform.

How to Buy Medifast Stock in 2022

If you are ready to research Medifast stock using a regulated broker then follow the quick four-step guide below.

- Open an account with a regulated broker. Head over to your preferred broker’s website and register for a new trading account.

- Upload ID. Most regulated brokers comply with KYC standards which means traders will have to upload proof of ID and address.

- Deposit. Deposit methods such as credit/debit cards, bank wire transfers and e-wallets such as PayPal are typically supported by most trading platforms nowadays.

- Research Medifast Stock. Before making any investments it’s widely accepted that adequate market research is crucial as stocks are volatile financial assets.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

To buy Medifast stock it is important to use a safe, regulated broker that also provides fast execution and low trading fees. Additional features such as a web platform or mobile app and stock research tools should also be considered.

Below are two options on where to buy Medifast stock that fit these criteria.

1. eToro

eToro launched in 2007 and now boasts a 20 million member investing community. One reason why eToro is one of the most popular stock market trading platforms around is the fact that it is fully regulated. It is licensed by the UK FCA, ASIC, CySEC, FINRA and other regulators around the world.

With eToro, you can invest in more than 2,000+ stocks from 17 of the world’s largest stock exchanges around the world. Another feature of the platform is the fact you can invest in stocks with 0% commission making eToro one of the most popular places to buy Medifast stock.

Because of eToro’s popularity, it is now considered to be the world’s largest social trading and copy trading platform in the world. This means investors can build a passive income stream by copying the trades of other successful investors, allowing you to buy stocks on eToro in an active or passive way.

For passive investors, eToro also provides access to its Smart Portfolios. These are ready made investment portfolios that track certain themes. This means investors can buy the biotech stocks or metaverse stocks at the click of a button.

From the eToro platform, investors can also access other markets such as foreign exchange, indices, commodities, cryptocurrencies and exchange traded funds (ETFs). There are also a range of research tools available to aid in investment decisions.

| Number of Stocks: | 2,000+ globally |

| Pricing System: | 0% commission + Spread |

| Cost of Buying Medifast: | Only spread fee from $0.17 cents |

| Non-Trading Fees: | Zero |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com

Capital.com is another stock broker that provides margin trading via CFDs.

With this low margin rate broker, you can trade stock, currency, index, commodity, crypto and ETF CFDs with 0% commission and tight spreads. Depending on your geographical region you can also purchase stocks using leverage.

Capital.com is authorized and regulated by the UK FCA, ASIC, CySEC and the FSA.

The web platform and mobile trading app are simple to use and come packed with extra features such as live charts, drawing tools, trading ideas, news, indicators such as a moving average and much more.

Deposit and withdrawals are also fee-free and you can open a free demo trading account to test Capital.com services with zero risk.

| Number of Stocks: | 5,000+ globally |

| Pricing System: | 0% commission + Spread |

| Non-Trading Fees: | Zero |

Your capital is at risk. 78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research Medifast Stock

Medifast stock to buy or not? To answer this question, it is important to analyse the Medifast stock price history and real-time company fundamentals. This can help to provide a Medifast stock forecast based on sound investment principles.

What is Medifast Inc?

Medifast Inc (MED) is a global health and wellness company behind the billion dollar brand OPTAVIA which provides clinically proven plans and scientifically developed health products. Based in Baltimore, the company prides itself on impacting more than 2 million lives through its Lifelong Transformation and One Healthy Habit at a Time plans and through its network of wellness coaches.

The Medifast stock ticker is MED which trades on the New York Stock Exchange (NYSE) but not on the NASDAQ like most other health and wellness technology companies. The company was founded in 1980 and is the current leader – by revenue – in the weight management industry with more than 984 employees.

In 2022, Forbes recognised Medifast as one of America’s Mid-Sized Companies, The company also made the Fortune 100 Fastest Growing Companies list in 2020 and 2021. Medifast is the world‘s 3372nd most valuable company based on its current $2.16 billion market cap.

Medifast Stock Price – How Much is Medifast Stock Worth?

Analysing the Medifast stock price history and how it has developed over time can give useful insights into how much the company is currently worth and whether or not it is growing.

$118.45

+0.98

(+0.83%)

At close: 12 Oct, 4:00PM EDT - Delayed Price

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Stock Rating

Wall St Analyst Rating$117.94

117.47

132641

166410

10.70

5.51%

1.31B

8.82x

348.00

6.56 (5.51%)

Nov 08, 2022

Sep 19, 2022

| Date | Transactions | Shares |

|---|---|---|

| Last 3 Months | | |

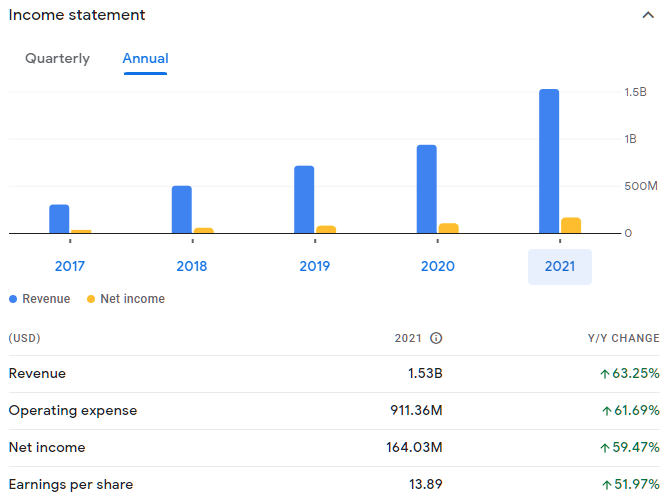

The Medifast stock price history shows rising revenue and income from 2017. In 2021, the company recorded revenues of 1.53 billion US dollars which was up 63.25% from the prior year. Both operating expenses and net income values also rose to provide earnings per share (EPS) value of 13.89 USD which is up 51.97% from the prior year.

Currently, Medifast’s price to earnings ratio (P/E ratio) is 13.1, providing a return on equity of 84.29% based on the last 12 months’ trailing return. The Medifast stock ticker has a beta value of 0.71 which means that the stock price is correlated to the border market.

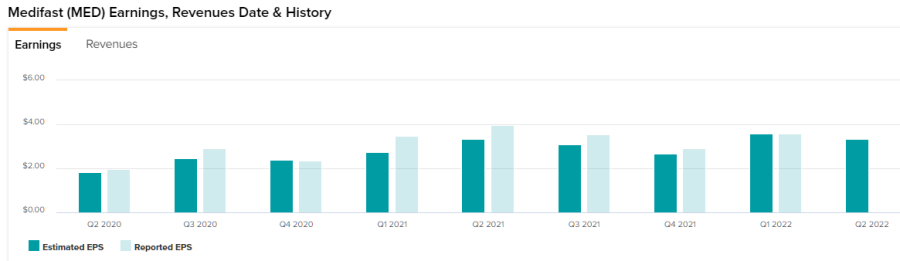

Medifast’s earnings per share has been rising year on year but did have a dip in the last few quarters of 2021. However, earnings per share for the first quarter of 2022 rose sharply back to record levels with more growth expected in the long term according to some market analysts.

In fact, in the first quarter of 2022, Medifast beat analyst expectations of 3.57 USD earnings per share with a result of 3.59 USD earnings per share.

Medifast Stock Dividends

A dividend is a quarterly payment to shareholders that represents a share in the profit of a company.

In June 2022, the Medifast Board of Directors announced a $1.64 quarterly cash dividend to its shareholders. This means shareholders will receive $6.56 every year for every share that they own. The last ex-dividend date was 27 June 2022.

At the Medifast stock price today, this represents a very healthy 3.56% dividend yield.

Business Model Provides In-Demand Solutions for Everyone

The core fundamental of any business is to have a product that people want. Since the pandemic and remote working, more and more people are investing in their health and wellbeing. While this space is competitive Medifast is the biggest player in the field.

Medifast has been providing health and wellness solutions for more than 40 years. Its flagship weight loss management product OPTAVIA has been the primary driver of growth at Medifast. This is essentially a community of people committed to a healthy lifestyle and particularly focused on those who have struggled with weight loss and diets in the past.

The product provides clinically proven plans for diet products and meal replacements that are supported by regular interaction with independent coaches. Of the more than 60,000 coaches in OPTAVIA, more than 92% were clients first highlighting the strength of their product and potential growth opportunities.

As Medifast’s clients often become its coaches, the business model is scalable and fits into the current trend of working habits – remote working at home. It’s also free marketing as people trust the product more when its users then work for the company and become their ambassadors.

Historical Growth Rates Expected to Continue

Medifast is a company that is growing fast. It has won various awards as a testament to this fact. Forbes recognized Medifast as one of America’s Mid-Sized Companies in 2022 and the company also made the Fortune 100 Fastest Growing Companies list in 2020 and 2021.

Over the past five years, revenue has grown 455% with year on year growth rates also growing above 22%. This has provided Medifast with an impressive gross profit margin of more than 70%. Perhaps more importantly, nearly all of Medifast’s growth metrics are higher than those of its competitors.

Balance Sheet is Debt Free in a Time of Higher Interest Rates

One of the factors that led to the global stock market sell-off at the beginning of 2022 is the threat rising interest rates have on businesses. For many businesses, their growth is linked to their level of debt.

In a time of rising interest rates, the debt load becomes more expensive to manage which affects overall profitability and margins. As tech stocks tend to borrow the most they were hit the hardest at the beginning of the 2022 interest rate hikes.

Fortunately, Medifast has a debt free balance sheet which is uncommon in growth stocks. So far, the company’s business model is supporting the spending to grow the business. There is also more than $120 million cash in the bank to financially support the company.

Medifast Stock – The Fundamentals

While you can buy Medifast stock from the eToro platform for as little as $10, it is still worthwhile performing a deep and thorough analysis of the stock.

Navigating the ups and downs of any investment is a key skill required for any successful investor. The more belief there is in a company’s fundamentals and future projections the more likely an investor can sit through the ups and downs in performance.

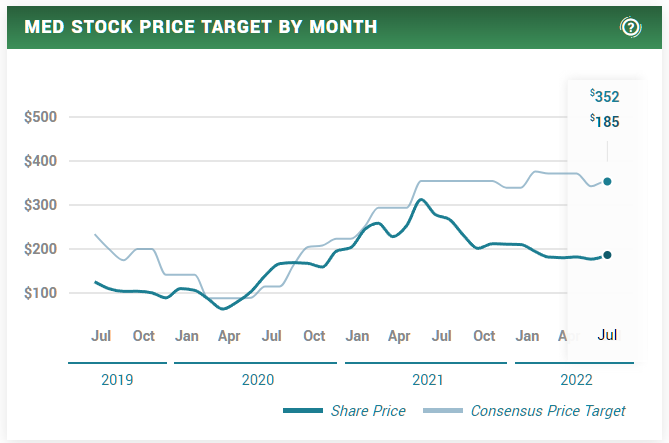

Identifying what institutional analysts and insiders have to say about a stock and its future projections is a way to find out more about the company in question. Currently, the Med stock price today ($185.00) is trading well below the consensus price target from different analysts ($352.00).

As already discussed above, Medifast has won multiple awards for how fast the company is growing. The fundamentals also support Medifast’s growth story. The share price has risen more than 750% over the past 10 years which has provided a more than 26% compound annual growth rate which is exceptional.

The return on equity, return on income invested and price to earnings ratio metrics are also exceptional and the highest among its competitors. The debt load is very low as well which is important in a world of higher interest rates and borrowing costs.

The standout metric for Medifast is its dividend payout. Shareholders will receive a quarterly dividend of 1.64 USD for every share owned which results in $6.56 every year.

Conclusion

The value and growth story of Medifast is unquestionable. Not only is the management team, led by Chief Executive Officer Daniel R.Chard, offering an in-demand product in a trending sector of health and wellness.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire