If you’re between jobs or have a gap in your health insurance coverage, you might want to consider purchasing short-term health insurance. Short-term health insurance is a temporary plan that provides coverage when you don’t have a standard policy.

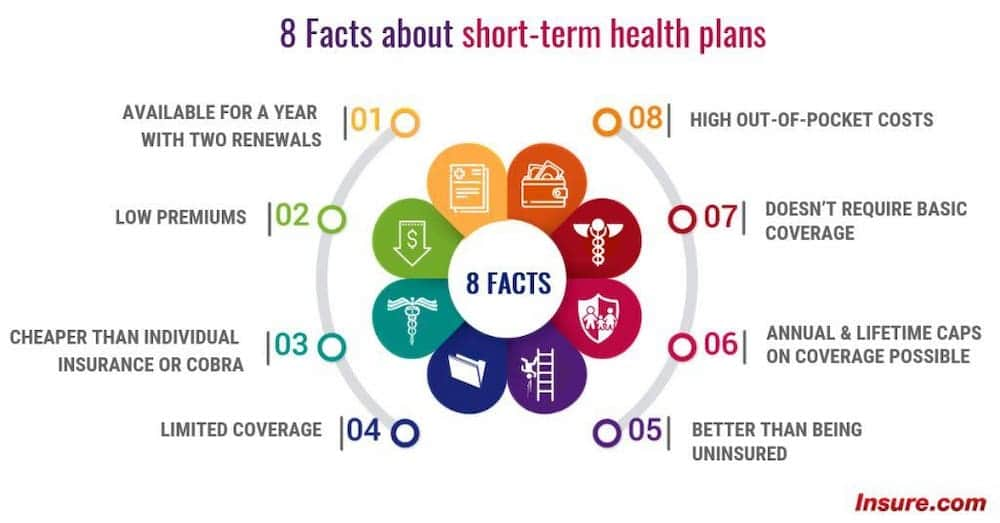

One of the biggest benefits of a short-term health insurance plan is that it’s typically cheaper than a regular plan. If you need temporary coverage and are in good health, short-term coverage is a good option.

However, short-term health insurance has its limitations and shouldn’t be a long-term solution. These plans usually have restricted benefits, leading to high out-of-pocket costs when you need certain types of medical care. Also, if you have pre-existing conditions, you may not qualify for short-term health insurance.

If you’re considering short-term health insurance, it’s important to first weigh the pros and cons. What follows is some key information about short-term health insurance coverage, how much it costs, and what alternatives are available.

KEY TAKEAWAYS

- Short-term health insurance is generally affordable for people who are healthy and don’t need frequent medical care.

- Compared to standard plans, short-term health insurance provides less coverage, which can lead to higher out-of-pocket costs.

- Temporary health insurance is not available in every state, and not all health insurance companies offer this type of plan.

- You can usually extend an annual short-term health plan twice, but you’ll need to purchase a standard policy after that.

- A short term health insurance plan costs less than $100 a month.

What is short-term health insurance?

Short-term health plans are low-cost, low-coverage plans.

These plans are available in most states for up to one year with the option to extend the plans twice. In effect, you could have a short-term plan for three years. That’s unlike regular health insurance, which has an annual renewal period.

A good way to think of short-term plans is that they’re temporary health insurance with lower premiums, higher out-of-pocket costs and less coverage than a standard health plan.

How does short-term health insurance work?

Short-term health insurance plans are designed to cover individuals for a limited period. These plans do not have an open enrollment period like ACA plans. You can enroll in a short-term health insurance plan anytime during the year if you need coverage.

Short-term or temporary health insurance plans are often used by people who are between jobs or waiting for their employer-sponsored health insurance to begin.

Unlike traditional health insurance plans, which generally offer comprehensive benefits, short-term plans provide less coverage. They do not cover pre-existing conditions, routine medical needs or maternity coverage. As a result, these plans are less robust than traditional health insurance.

Individuals considering a short-term health insurance plan should carefully examine their needs and consider all of their options before enrolling in a plan.

What does a short-term health plan cover?

Short-term health plans generally include:

- Hospitalizations

- Outpatient surgeries

- Emergency room and urgent care visits

- Doctor visits

- Prescription drugs

“In many cases, short-term health insurance plans cover the same services as major medical plans,” says Chris Foley, a licensed health insurance broker with Abbot Benefits Group. “However, you need to be careful when comparing policies. Some short-term health insurance plans exclude certain preventive care services, which can be very limiting.”

What doesn’t a short-term health plan cover?

When shopping for temporary health plans, you should also find out what is not covered. This will differ with every plan, but here are several services that usually are not part of short-term health plans:

- Mental health care

- Routine medical needs

- Maternity care

- Many plans do not offer coverage for preventative, vision and dental care

Because maternity care is not automatically covered under a short-term plan, short-term health insurance might not be the best option for people who are looking to start a family. However, it’s possible that some plans will cover pregnancy and postpartum care — it just depends on your specific plan. You can also look into ACA plans that cover pregnancy and maternity care as essential health benefits.

How much does a short-term health plan cost?

You can find a short-term health insurance plan for less than $100 a month, which is significantly less than the average of more than $400 for unsubsidized ACA-compliant health plans.

“Short-term health insurance is almost always cheaper than a standard plan,” Foley says.

However, Betsy Imholz, special projects director at Consumers Union, says that premiums are just one piece of a financial puzzle. You must also look at a plan’s deductibles, copays, coinsurance and dollar limits and exclusions of services that aren’t covered in short-term plans.

You may find that a low-cost, short-term medical plan may actually cost you more than an individual health insurance plan in the long run.

How long will my short-term coverage last?

Most states allow you to have a short-term health plan anywhere from a month to two years.

States that forbid the sale of short-term plans include:

- California

- Hawaii

- Massachusetts

- New Jersey

- New York

Other states have regulations that restrict short-term plans beyond the federal rules:

- Colorado and Illinois limit short-term plans to six months.

- Delaware, the District of Columbia, Maryland, New Mexico, Vermont and Washington only allow short-term plans for three months with no renewals.

Also, some states allow short-term plans, but no companies offer short-term plans in those states. Rhode Island is one state that allows short-term health insurance, but no companies currently offer plans there.

What is the best short-term health insurance?

The best short-term health insurance for you depends on your specific needs.

Major health insurance companies like UnitedHealthcare offer short-term plans. Other short-term plans come from smaller insurers like Everest, Pivot Health and National General.

Companies don’t offer short-term health plans in all states, so dig into the fine print to see what’s covered and what’s not covered by each plan.

Make sure to compare policies from different insurers. Not all companies offer the same coverage, so it’s important to shop around to get the best deal on your short-term health insurance plan.

How to get short-term health insurance

Some major health insurers, such as UnitedHealthcare, offer short-term plans, but that coverage differs from regular health insurance. Just because a big-name insurer offers a short-term plan doesn’t mean that the plan provides full health insurance coverage. It’s not always easy to distinguish between plans, so reading the fine print is critical.

“One thing consumers can do is to ask the agent or company for a Summary of Benefits and Coverage, which is a standardized form required for (Affordable Care Act) plans to help people compare plans. If there is not one available, that’s an indicator that it’s not an ACA-protected plan,” Imholz says.

Who qualifies for short-term health insurance?

Most states allow short-term health plans, but some states ban the plans while others limit the length of the coverage.

However, even if your state allows short-term plans, an insurance company can still reject you based on your health. “If you have been diagnosed with a major medical condition or are currently pregnant, you may not qualify for short-term health insurance,” Foley says.

Here’s who may benefit from a short-term health plan:

- A young person who is healthy and doesn’t expect to need many health care services.

- A person who missed open enrollment for other health insurance and doesn’t qualify for a special enrollment.

- Someone who’s out of work and can’t afford COBRA or an ACA plan but wants some level of insurance.

- Someone who will soon qualify for Medicare and does not want to enroll in another year-long plan.

People with pre-existing conditions like asthma or diabetes should avoid short-term plans because they will pay significantly higher premiums. However, this isn’t always an option if you need medicine. If you are denied coverage because of a pre-existing condition, you can get a pre-existing condition insurance plan under ACA, which covers primary and specialty care, hospital care and prescription drugs. Check out the Centers for Medicare & Medicaid Services site for more details.

However, a short-term plan is better than no plan at all.

Pros and cons of short-term health insurance

There are a number of factors to consider when deciding whether or not to purchase short-term health insurance.

These plans help bridge a gap between standard health insurance, such as if you’re between jobs and don’t want to pay the high costs of COBRA.

Here are the pros and cons of short-term health insurance:

| Pros | Cons |

|---|---|

| Low premiums | Limited coverage |

| No open enrollment period, so you can buy any time | Large out-of-pocket costs if you need care |

| May have a wider network than some Affordable Care Act plans | You can only keep coverage for a limited time |

| Short-term plans can cover you internationally | May not cover pre-existing conditions |

Alternatives to short-term health insurance

An indemnity plan is an alternative to a standard health insurance plan with a network of providers, such as preferred provider organization (PPO) and health maintenance organization (HMO) plans.

With an indemnity plan, you as the member decide on which doctors and hospitals to visit. The health insurance company pays part of the total cost.

How does an indemnity plan compare to a short-term health plan? Let’s look at how they’re similar and how they’re different.