It’s finally time for you to move on from your current auto insurance company.

Maybe the customer service just isn’t what it used to be, or your premiums increased a little too much for your liking. Or maybe you just want to test out a more digital option like a usage-based insurance policy.

Whatever the reason is to cancel your current policy, you’ll need to follow your insurance provider ’s rules for cancellation. Each insurance company has its own policy in place for the timing, fees, and even method of cancellation. In some cases, you’ll have to write and send a cancellation letter to close the matter for good.

If writing isn’t your thing, we’ve got you covered with a cancellation letter template. We’ll take a look at how auto insurance cancellations work and exactly how to write that letter so you can move on to your new insurance company once and for all.

But even if you think you found a great new car insurance company, take some time to comparison shop to make sure you’re getting the best deal around.

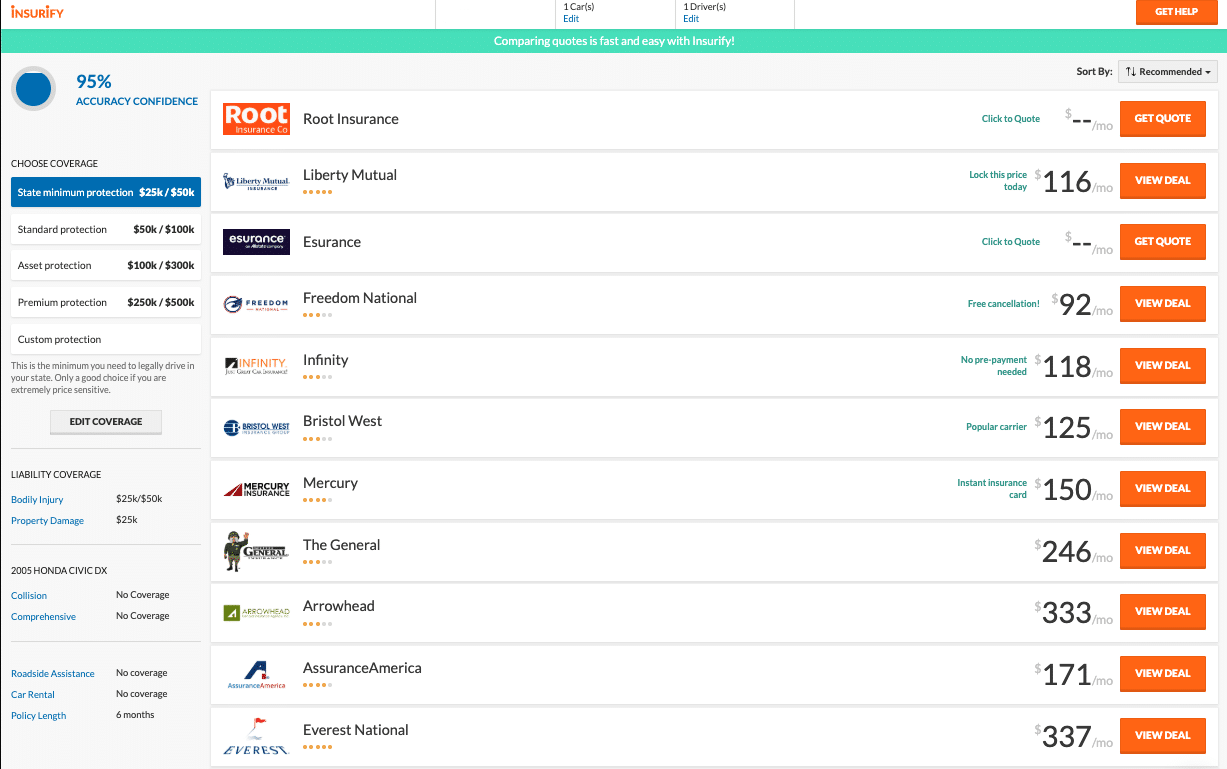

Insurify makes this process a little easier by showing you personalized, affordable quotes based on one simple profile. It’s totally free without any commitment required so you can make the best decision for you without any risk.

Table of contents

- Canceling Your Auto Insurance

- How to Write a Cancellation Letter to Your Auto Insurance Company

- Things to Consider Before You Cancel Your Policy

- Auto Insurance Cancellation Letter Template

- How to Buy Affordable Car Insurance Within Minutes

Canceling Your Auto Insurance

Each insurance company has its own rules to follow when it comes to canceling auto insurance policies. To make sure your cancellation and refund are handled promptly, you need to understand exactly how the process works with your current insurance provider.

To start, it’s worth finding out if there are any fees for canceling your policy before your term is up. Some companies charge a flat fee, while others keep a portion of your unused premium. If you can’t find this information online, check your policy documents or contact your insurer directly to find out. It’s never a nice surprise to get hit with a cancellation fee you weren’t expecting.

You’ll also want to keep your policy period end date in mind. If you don’t switch companies mid-period, you want this date in mind so you can make sure your new coverage starts before your old policy ends. We advise letting your coverage overlap by a few days so that you’re always protected on the road.

Finally, there’s the logistics of actually canceling your existing policy. There are more rules to check to make sure you get the outcome you want. Look out for rules like a minimum number of days’ notice you need to provide your company to cancel and what method is accepted. Some car insurance companies let you cancel online or by phone, but others require all cancellation requests to be submitted in writing with a formal letter.

How to Write a Cancellation Letter to Your Auto Insurance Company

Your current insurer may have a template of their own to use for a cancellation letter, but these letters typically require the same information:

-

Old policy number

-

Requested cancellation date

-

New insurance company name

-

New insurance policy effective date

-

Your mailing address

-

Your contact information

Many insurance companies require a formal request for policy cancellation in writing. However, it’s not a one-sided conversation. Make sure you request a written confirmation of receipt in return for your own records. This way, if there are ever any issues with the effective cancellation date or refund processing, you have a record to reference.

It’s important to check where your cancellation request needs to end up. Larger companies may have a dedicated cancellations department, while others might request letters to be sent to your local office instead. You can usually find a mailing address on your insurance company ’s website, but if you have any doubt, a quick phone call to your insurance agent can clarify.

Once you know all the ins and outs of canceling your policy and where to send your letter, use this template to write your request:

Car Insurance Cancellation Letter Template

[Date]

To whom it may concern:

Please accept this letter as written notice of cancellation for my auto insurance policy [Policy number], effective [Date new policy begins] At that time, I will be enrolled in a new policy with another company.

Please stop any automatic premium payments prior to [Date new policy begins] and refund any unused portion of my remaining premium promptly.

I am requesting a written confirmation of the cancellation and refund to the following address:

[Your full name]

[Your street address]

[Your city, state, and ZIP code]

Thank you,

[Your signature]

[Your full name]

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesThings to Consider Before You Cancel Your Policy

Before you put a stamp on your insurance cancellation letter, you need to have another car insurance policy ready to go. In most states, it’s illegal to drive while uninsured, so it’s best to purchase a new policy before you even start the cancellation process.

If you’re seeing your current policy through to the end of the policy period, you’ll want to make your new policy effective before that one ends. And if you cut your current policy short, just make sure you request a cancellation date after your new policy kicks in.

Protecting yourself on the road is the number one priority, but there’s another benefit, too. Some insurance companies reward you for maintaining continuous coverage, so avoiding a gap of even a few days can pay off in the long run.

Just don’t make the switch until you compare all of your options.

Auto Insurance Cancellation Letter Template

The best way to get an affordable rate on car insurance is to compare personalized quotes. Insurify takes your personal information and finds the best deals on car insurance for you so you can make sure you’re getting an affordable rate on the policy you need.

How to Buy Affordable Car Insurance Within Minutes

Looking for better rates on car insurance used to take a lot of time and energy. But you don’t have to go hopping from company to company to try to get the best deal anymore.

Instead, Insurify gathers personalized car insurance quotes in one place so you can see all your options. In less than 10 minutes, you can get up to 20 car insurance quotes tailored to your driver’s profile and auto insurance coverage needs. It’s totally free, so give it a try today to discover the right insurance company for you.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesMethodology

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.