If you’ve let your coverage lapse, you may be wondering what to do next. Read on. Your options are wide open!

If paying your car insurance bill is the least of your monthly spending concerns, you aren’t alone. When it comes to keeping your auto policy coverage intact, however, letting your coverage lapse can lead to even more significant financial hardship. Luckily, you can reinstate your canceled car insurance policy or even get a new policy in place with another insurance provider. The important thing is getting your car insurance back on track quickly.

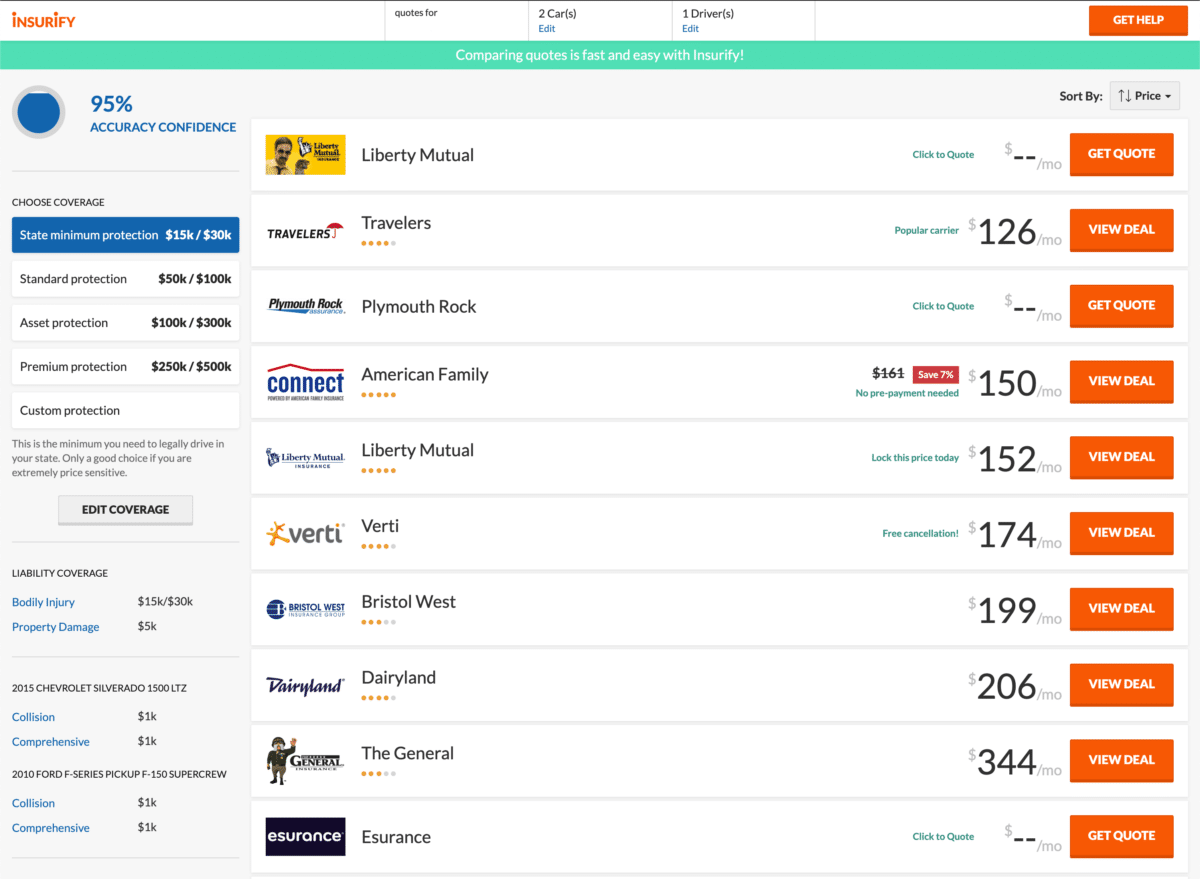

If you are on the verge of letting your insurance lapse, visit Insurify today to learn more about your coverage options and get quick, affordable car insurance quotes that will keep you on the road and out of even more financial trouble.

Table of contents

- My Coverage Expired. What Are My Options Right Now?

- What Happens If I Let Insurance Lapse?

- State Laws Concerning Coverage Lapse Penalties

- You May Still Have Time to Pay Your Car Insurance

- FAQ: Car Insurance Reinstatement

- Conclusion: How to get the best and cheapest car insurance quotes

My Coverage Expired. What Are My Options Right Now?

Here are our top tips.

Ask your current insurance company to reinstate your policy

Insurance companies genuinely want your business—even if you’ve missed one or more insurance premium payments. Unfortunately, reinstating your policy sometimes means paying a penalty or having a higher monthly insurance rate than you expected.

Still, it’s less expensive than getting caught (or worse, yet, having an accident) without any insurance at all. All you have to do is call your insurance provider and talk to them about your situation. Ask them what they can do for you in extending the payment date or putting you on a payment plan. And if you are considering another insurer, make sure you know the cost of reinstating with your current insurer first.

Switch to another insurance provider

Whether you’ve let your coverage lapse or not, this may be the opportune time to consider a new policy with another insurance carrier. Every insurance company is different in terms of rates and what products they have to offer. They may be able to reduce your rate by bundling other insurance you have (such as home or life) within one tidy package. Or you may find a lower rate on auto insurance alone. Car insurance is a highly competitive business, and with so many options, you are sure to find a carrier that suits your needs—perhaps in an even more customized way than ever before.

Surrender your plates

If you’ve let your coverage lapse (or have decided you may have to soon), surrendering your plates to your local department of motor vehicles ( DMV ) will ensure that you don’t get financially penalized even further. In some states, lack of insurance voids your registration. Now you are looking at reinstating both your insurance and paying new registration fees.

Chances are, however, that in a marketplace teeming with so many options, you’ll find something that can fit your budget.

What Happens If I Let Insurance Lapse?

You definitely don’t want a lapse in your insurance history. This momentary lack of coverage could come back to haunt you for years to come.

Consequences on the road

It’s never a good idea to let coverage lapse. If you ever get pulled over, officers have real-time systems that know whether your coverage is good or not, regardless of what’s written on your insurance card. Depending on any offenses you may already have, consequences can include fines, revocation of your driver’s license, license suspension, and impounding your vehicle. The time and money involved in wiggling your way out of those issues can compound your financial problems quickly, depending on the state you live in.

Take the state of Idaho, for example. Their DMV computer systems recognize when a registered vehicle is uninsured. After two consecutive months of being uninsured, the vehicle owner is notified that their registration will be canceled within the next 30 days unless proof of insurance is submitted. After the proof is provided, the vehicle registrant must pay $75 to reinstate their registration.

Consequences from your current insurer

Insurance companies are willing to work with you, but they aren’t simply going to look the other way if you fail to pay your auto insurance policy on time. Clients looking to reinstate their coverage with the same company may be charged a reinstatement fee or charged a higher monthly premium. If you have a habit of letting coverage lapse often with your current or other providers, you may even be refused coverage completely. And poor marks on your driving record or from your insurance agent can reflect poorly on your credit score as well. Remember, just like your driving record, your coverage history follows you from provider to provider.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesState Laws Concerning Coverage Lapse Penalties

As of a new law enacted on July 2, 2020, uninsured Michigan drivers can purchase car insurance without non-payment penalties during an 18-month amnesty period starting July 2, 2020. After that, penalties include fines of up to $500, a year in jail, or both.

You May Still Have Time to Pay Your Car Insurance

Your car insurance provider may have some built-in policies or best practices that offer some relief or forgiveness to financially strapped policyholders.

Find out about grace periods

When we can’t pay a bill, it’s easy to ignore it or bury our head in the sand.

However, there are better options. Most insurance companies have what’s called a “ grace period,” which means they will give you some additional days after your payment is due to pay or make other arrangements before your coverage lapses.

Your insurance agent may even be able to reverse late payment fees if you explain your situation. Above all, speak to your insurance provider about your inability to pay—quickly. Providers look more favorably upon those who communicate, as it saves the company the time and hassle of recovering debt from someone who simply ignores the problem.

Get a payment date extension

You’ll never know what someone will do for you if you don’t ask. Car insurance companies would much rather you own up to your inability to pay on time than to let it lapse and have them come looking for you. After explaining your situation to them, you may find that many insurers are prepared to extend payment dates a few days to a few weeks so you can catch up.

FAQ: Car Insurance Reinstatement

-

How many times can I reinstate car insurance after cancellation?

The answer varies by insurance provider, but insurers don’t look favorably on those who habitually let their insurance policy lapse. They may charge you additional fees and increase the amount of your coverage each time. Additionally, they can eventually refuse you coverage altogether.

-

Can an insurance company cancel my coverage?

Yes, an insurance company does have the right to cancel coverage within what is called the “binding period.” Policy cancellation happens when an insurance company finds that a policyholder has additional risks they weren’t aware of when they originally wrote the policy. Insurance companies can also cancel a policy outside of the binding period if they find that you fraudulently received your policy, including giving false answers…or if you receive a DUI.

-

Where can I compare cheap car insurance quotes online for free?

Instead of wasting your time looking up quote after quote or placing call after call, you can visit Insurify and get a complete, ready-to-buy quote from up to 20 top insurance companies based on your driver profile in less than five minutes.

Conclusion: How to get the best and cheapest car insurance quotes

If today’s the day you are looking to reinstate your insurance policy, you owe it to yourself to find out what you may be missing cost-wise in terms of other providers.

Insurify allows you to compare car insurance policies from top-rated national and regional companies quickly and with no obligation. Turn uncertainty into opportunity by turning to Insurify for your next cheap car insurance quote.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesMethodology

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.